暂无数据

沪深市场个股详情

000016 上证50

- 2461.86

- +30.23+1.24%

休市中 04/26 15:00 (北京)

2467.27最高价2432.76最低价

2432.76今开2431.62昨收4783.80万手成交量1.42%振幅37上涨797.29亿成交额2751.4452周最高11下跌2450.02平均价2163.8752周最低2平盘

分时

- 5日

- 日K

- 周K

- 月K

- 季K

- 年K

新闻

开源证券:给予长城汽车买入评级

开源证券股份有限公司任浪,徐剑峰近期对长城汽车进行研究并发布了研究报告《公司信息更新报告:重磅车型北京车展齐亮相,直营新引擎提升用户体验》,本报告对长城汽车给出买入评级,当前股价为26.32元。长城汽车(601633)2024Q1营收同比+47.6%,归母净利同比+1752.6%公司发布2024年一季报,实现营收428.6亿元,同比+47.6%;归母净利32.3亿元,同比+1752.6%;扣非归母

东吴证券:给予天合光能买入评级

东吴证券股份有限公司曾朵红,郭亚男,徐铖嵘近期对天合光能进行研究并发布了研究报告《2023年年报及2024年一季报点评:竞争加剧组件盈利下降,业务协同支撑发展》,本报告对天合光能给出买入评级,当前股价为20.58元。天合光能(688599)投资要点事件:公司2023年营收1133.92亿元,同增33.32%;归母净利润55.31亿元,同增50.26%,扣非净利润57.55亿元,同增66.02%;Q

中国电信(辽宁)智算集群上线

嘉兴工行科创贷款加速

农业银行天津市分行助推科创小微企业发展

山西汾酒去年营收站上300亿,今年一季度实现营收153亿元同比增长21%

2024 年 4 月 25 日,山西汾酒发布 2023 年年报及 2024 年一季报。 2023年公司实现营业收入 319.28 亿元,同比+21.80%;实现归母净利润104.38 亿元,同比+28.93%。这是公司营收首次突破300亿元。 产品层面,2023 年公司产品结构继续升级,中高端产品引领公司整体增长。2023 年中高价酒类营收 232.03 亿元,同比+22.56%;其中核心产品

评论

专栏铁矿石与A股市场周报与全球资金市场周报

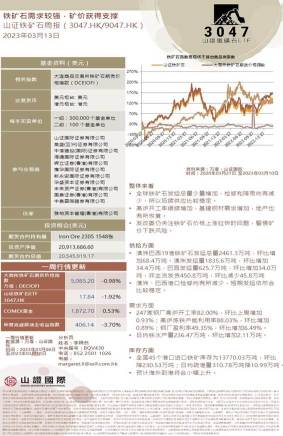

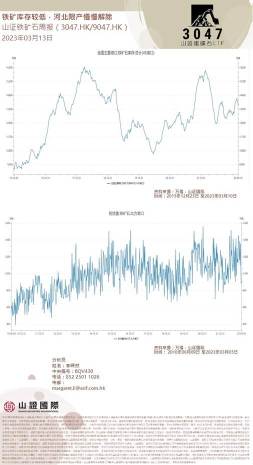

整体来看

• 全球铁矿石发运总量少量增加,检修和降雨均有减少,所以后续供应比较稳定。$F山证铁矿石(03047.HK$

• 高炉开工率继续增加,基建钢材需求增加,地产也有所恢复。

• 发改委仍关注铁矿石价格上涨过快的问题,警惕矿价下跌风险。

供给方面

• 澳洲巴西19港铁矿石发运总量2461.3万吨,环比增加68.4万吨。澳洲发运量1835.6万吨,环比增加34.4万吨,巴西发运量625.7万吨,环比增加34.0万吨,非主流发货450.8万吨,环比减少45.8万吨

• 澳洲、巴西港口检修均有所减少,短期发运依然会比较稳定。

需求方面

• 247家钢厂高炉开工率82.00%,环比上周增加0.93%;高炉炼铁产能利用率88.03%,环比增加0.89%;钢厂盈利率49.35%,环比增加6.49%。

• 日均铁水产量236.47万吨,环比增加2.11万吨。

库存方面

• 全国45个港口进口铁矿库存为13770.03万吨,环比降230.53万吨;日均疏港量310.78万吨降...

• 全球铁矿石发运总量少量增加,检修和降雨均有减少,所以后续供应比较稳定。$F山证铁矿石(03047.HK$

• 高炉开工率继续增加,基建钢材需求增加,地产也有所恢复。

• 发改委仍关注铁矿石价格上涨过快的问题,警惕矿价下跌风险。

供给方面

• 澳洲巴西19港铁矿石发运总量2461.3万吨,环比增加68.4万吨。澳洲发运量1835.6万吨,环比增加34.4万吨,巴西发运量625.7万吨,环比增加34.0万吨,非主流发货450.8万吨,环比减少45.8万吨

• 澳洲、巴西港口检修均有所减少,短期发运依然会比较稳定。

需求方面

• 247家钢厂高炉开工率82.00%,环比上周增加0.93%;高炉炼铁产能利用率88.03%,环比增加0.89%;钢厂盈利率49.35%,环比增加6.49%。

• 日均铁水产量236.47万吨,环比增加2.11万吨。

库存方面

• 全国45个港口进口铁矿库存为13770.03万吨,环比降230.53万吨;日均疏港量310.78万吨降...

+2

专栏This Week's Possible Plays 5/16 - 5/20

There are some good looking charts to play next week. Especially after then end of last week where we had a very green day on friday. Most of these are bullish plays and most of these plays are short term. Remember there are thousands of potential plays. There is money to be made all over the markets every day. Here are a few I will be watching for some short term momentum. The US futures opened on the green side so these short term bullish plays are loo...

+11

8

6

专栏Bullish or Bearish?

$比特币(BTC.CC$

Bitcoin has been stuck in a massive range with swings as low as $28,800 up to as high as about $71,000. Currently the price is approaching this long term range’s support level it has not dropped below since the beginning of 2021. If you were bullish on BTC then this support level might be a good place to enter. If you were bearish on BTC then you might want to wait to see if this level gets broken before entering into any short positions on bitcoin relat...

Bitcoin has been stuck in a massive range with swings as low as $28,800 up to as high as about $71,000. Currently the price is approaching this long term range’s support level it has not dropped below since the beginning of 2021. If you were bullish on BTC then this support level might be a good place to enter. If you were bearish on BTC then you might want to wait to see if this level gets broken before entering into any short positions on bitcoin relat...

+1

13

66

专栏Monday's Earnings 5/2

It is not a major day for earnings. Many small banks reporting again. There are some good names reporting earnings and may be worth a look.

$美高梅(MGM.US$

This travel and leisure company may have performed well. Based off of airline companies earnings we have seen a lift in airline ticket sales. Also booking for cruise liners has been high as well. This could very well point to increased revenues in other companies in this sector. This is not ...

$美高梅(MGM.US$

This travel and leisure company may have performed well. Based off of airline companies earnings we have seen a lift in airline ticket sales. Also booking for cruise liners has been high as well. This could very well point to increased revenues in other companies in this sector. This is not ...

4

13

专栏Monday Outlook 5/2

The main event for the week will be Jerome Powell's rate hike on wednesday this week. The Fed increasing interest rates is the main reason for the market correction these past months. A 50 basis point hike is expected. Anything different will surely move markets. we might even possibly get a big move in the markets off of the expected 50 point move as well.

Many world markets will be closed for some time this week. Most importantly Chinese mainland markets will be cl...

Many world markets will be closed for some time this week. Most importantly Chinese mainland markets will be cl...

+8

8

2

阅读更多