美股市场个股详情

.DJUSUT 道琼斯美国公用事业指数

- 358.570

- +6.100+1.73%

收盘价 05/31 16:00 (美东)

358.950最高价352.120最低价

353.190今开352.470昨收2.26亿股成交量360.29052周最高--上涨1.94%振幅270.72052周最低--下跌355.535平均价--平盘

嘿 mooer们![]()

![]()

![]() 星期五快乐! 每周行业基金流向板 来了~

星期五快乐! 每周行业基金流向板 来了~![]()

![]()

从这张图表中,您将能够找出哪些行业的ETF的资金流入最多。资金流入通常被视为该行业和相关ETF的看涨信号!

^每周行业基金流向板:基于行业ETF3个月资金流总额的行业排名。

^3 个月资金流量:该指标可用于衡量不同领域投资者对投资者的感知受欢迎程度。

^董事会包括以下信息:排名变化、3个月资金流量、该行业有多少ETF以及相关的ETF。

本周,我报道了ESG最高的两个分数 与行业相关的交易所买卖基金 !现在,让我们来看看棋盘吧~你可能会找到一些东西 使您的投资组合多样化![]()

![]()

* 关注我,了解市场上有哪些热门商品![]()

![]()

![]()

行业动态:

*科技![]()

![]()

科技股在尾盘交易中大多走高, $科技行业精选指数ETF-SPDR(XLK.US$ 周四上涨了1%, $费城半导体指数(.SOX.US$ 持平,逆转了中午的下滑。

在公司新闻中, $The Glimpse(VRAR.US$ 这家虚拟和增强现实公司宣布计划以800万美元的价格收购营销机构Sector 5 Digital,并在未来三年内再收购多达1900万美元,下跌了8%,回吐了上午中旬的小幅涨幅。

从好的方面来看, $Snowflake(SNOW.US$ 这家数据平台公司周三晚间公布了强劲的报告后,上涨了15%以上。与去年同期相比,收入翻了一番多,增长了109%,达到3.344亿美元,也超过了3.061亿美元的街景。

$Okta(OKTA.US$ 周四上涨近13%,此前这家云身份公司隔夜公布了高于预期的第三季度业绩,还缩小了预计的22财年净亏损,并上调了截至1月31日的12个月的收入预期。

*鳍![]()

![]()

金融股收盘时接近周四涨幅的峰值, $SPDR金融行业ETF(XLF.US$ 上涨了3%。

比特币下跌0.3%,至57,116美元,而10年期美国国债收益率上涨1.4个基点,至1.448%。

在公司新闻中, $Coastal Financial(CCB.US$ 上涨4.8%,此前周四宣布与金融技术平台LendingPoint建立新的合作伙伴关系,该公司预计该协议将降低该银行的贷款风险和成本并扩大其地理覆盖范围。财务条款未披露。

*房地产![]()

![]()

费城住房指数上涨了4.3%, $The Real Estate Select Sector SPDR Fund(XLRE.US$ 上涨了2.7%。

$Brixmor Property Group(BRX.US$ 在Truist Securities将房地产投资信托的目标股价上调3美元至每股26美元并重申其对该股的持有评级后,上涨了6%。

$Medallion Financial(MFIN.US$ 上涨11.6%,此前这家专业贷款机构表示已完成以1,910万美元的价格向Warp Speed出售其Richard Petty Motorsports NASCAR赛车队。该公司表示,该交易从其资产负债表中删除了2600万美元的无形资产,并将其有形账面价值增加了每股1美元以上。

*医疗保健

医疗保健股结束了周四的涨势,纽约证券交易所医疗保健指数今天下午上涨了0.5%,而 $医疗保健精选行业指数ETF-SPDR(XLV.US$ 也上涨了0.5%。

$Biofrontera(BFRI.US$ 这家生物制药公司表示,其将Ameluz药物与RhodoLED灯结合的减痛照明方案获得了美国专利,此后,该生物制药公司飙升了21%。

$奥麦罗制药(OMER.US$ 这家生物制药公司表示将以价值超过10亿美元的交易将其OMIDRIA特许经营权出售给雷纳外科集团,上涨7.3%。

*消费者

消费股在周四晚些时候的交易中增加了先前的涨幅, $日常消费品精选行业指数ETF-SPDR(XLP.US$ 上涨了1%,而 $非必需消费类ETF-SPDR(XLY.US$ 上涨了1.5%。

在公司新闻中, $Duluth Holdings(DLTH.US$ 上涨18%,此前这家服装商公布截至10月31日的第三季度每股净收益为0.09美元,是去年每股0.03美元利润的三倍,超过了预计每股0.30美元的GAAP亏损的单一分析师电话会议。净销售额增加,该公司还上调了2021财年的收益预期。

$克罗格(KR.US$ 这家杂货连锁店的第三财季业绩超过了华尔街的预期,并提高了22财年的收益预期,上涨了11%以上。

*能源

能源股今天下午飙升,纽约证券交易所能源板块指数上涨3.2%,而 $能源指数ETF-SPDR(XLE.US$ 上涨了3%。这个 $PHLX石油服务类股指数(.OSX.US$ 还公布了3.4%的涨幅, $道琼斯美国公用事业指数(.DJUSUT.US$ 上涨了1.2%。

前月西德克萨斯中质原油收高0.93美元,至每桶66.50美元,扭转了早盘的跌势,而全球基准布伦特原油合约上涨1.49美元,至每桶70.36美元。

来源:MT Newswires

从这张图表中,您将能够找出哪些行业的ETF的资金流入最多。资金流入通常被视为该行业和相关ETF的看涨信号!

^每周行业基金流向板:基于行业ETF3个月资金流总额的行业排名。

^3 个月资金流量:该指标可用于衡量不同领域投资者对投资者的感知受欢迎程度。

^董事会包括以下信息:排名变化、3个月资金流量、该行业有多少ETF以及相关的ETF。

本周,我报道了ESG最高的两个分数 与行业相关的交易所买卖基金 !现在,让我们来看看棋盘吧~你可能会找到一些东西 使您的投资组合多样化

* 关注我,了解市场上有哪些热门商品

行业动态:

*科技

科技股在尾盘交易中大多走高, $科技行业精选指数ETF-SPDR(XLK.US$ 周四上涨了1%, $费城半导体指数(.SOX.US$ 持平,逆转了中午的下滑。

在公司新闻中, $The Glimpse(VRAR.US$ 这家虚拟和增强现实公司宣布计划以800万美元的价格收购营销机构Sector 5 Digital,并在未来三年内再收购多达1900万美元,下跌了8%,回吐了上午中旬的小幅涨幅。

从好的方面来看, $Snowflake(SNOW.US$ 这家数据平台公司周三晚间公布了强劲的报告后,上涨了15%以上。与去年同期相比,收入翻了一番多,增长了109%,达到3.344亿美元,也超过了3.061亿美元的街景。

$Okta(OKTA.US$ 周四上涨近13%,此前这家云身份公司隔夜公布了高于预期的第三季度业绩,还缩小了预计的22财年净亏损,并上调了截至1月31日的12个月的收入预期。

*鳍

金融股收盘时接近周四涨幅的峰值, $SPDR金融行业ETF(XLF.US$ 上涨了3%。

比特币下跌0.3%,至57,116美元,而10年期美国国债收益率上涨1.4个基点,至1.448%。

在公司新闻中, $Coastal Financial(CCB.US$ 上涨4.8%,此前周四宣布与金融技术平台LendingPoint建立新的合作伙伴关系,该公司预计该协议将降低该银行的贷款风险和成本并扩大其地理覆盖范围。财务条款未披露。

*房地产

费城住房指数上涨了4.3%, $The Real Estate Select Sector SPDR Fund(XLRE.US$ 上涨了2.7%。

$Brixmor Property Group(BRX.US$ 在Truist Securities将房地产投资信托的目标股价上调3美元至每股26美元并重申其对该股的持有评级后,上涨了6%。

$Medallion Financial(MFIN.US$ 上涨11.6%,此前这家专业贷款机构表示已完成以1,910万美元的价格向Warp Speed出售其Richard Petty Motorsports NASCAR赛车队。该公司表示,该交易从其资产负债表中删除了2600万美元的无形资产,并将其有形账面价值增加了每股1美元以上。

*医疗保健

医疗保健股结束了周四的涨势,纽约证券交易所医疗保健指数今天下午上涨了0.5%,而 $医疗保健精选行业指数ETF-SPDR(XLV.US$ 也上涨了0.5%。

$Biofrontera(BFRI.US$ 这家生物制药公司表示,其将Ameluz药物与RhodoLED灯结合的减痛照明方案获得了美国专利,此后,该生物制药公司飙升了21%。

$奥麦罗制药(OMER.US$ 这家生物制药公司表示将以价值超过10亿美元的交易将其OMIDRIA特许经营权出售给雷纳外科集团,上涨7.3%。

*消费者

消费股在周四晚些时候的交易中增加了先前的涨幅, $日常消费品精选行业指数ETF-SPDR(XLP.US$ 上涨了1%,而 $非必需消费类ETF-SPDR(XLY.US$ 上涨了1.5%。

在公司新闻中, $Duluth Holdings(DLTH.US$ 上涨18%,此前这家服装商公布截至10月31日的第三季度每股净收益为0.09美元,是去年每股0.03美元利润的三倍,超过了预计每股0.30美元的GAAP亏损的单一分析师电话会议。净销售额增加,该公司还上调了2021财年的收益预期。

$克罗格(KR.US$ 这家杂货连锁店的第三财季业绩超过了华尔街的预期,并提高了22财年的收益预期,上涨了11%以上。

*能源

能源股今天下午飙升,纽约证券交易所能源板块指数上涨3.2%,而 $能源指数ETF-SPDR(XLE.US$ 上涨了3%。这个 $PHLX石油服务类股指数(.OSX.US$ 还公布了3.4%的涨幅, $道琼斯美国公用事业指数(.DJUSUT.US$ 上涨了1.2%。

前月西德克萨斯中质原油收高0.93美元,至每桶66.50美元,扭转了早盘的跌势,而全球基准布伦特原油合约上涨1.49美元,至每桶70.36美元。

来源:MT Newswires

已翻译

58

4

Hey mooers![]()

![]()

Happy Friday! Weekly Sectors Fund Flow Board is here~

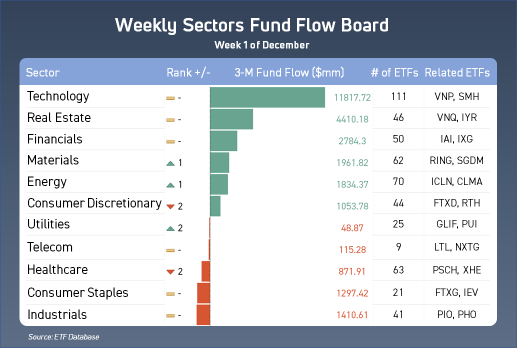

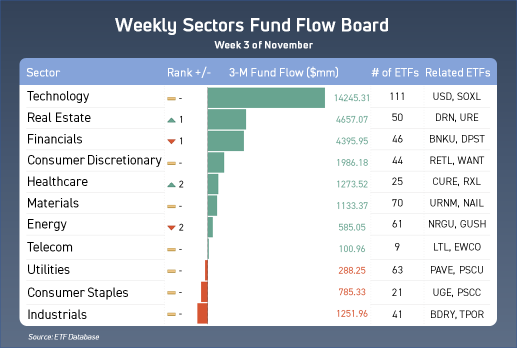

From this chart, you will be able to find out what sector ETFs have most fund inflow. Fund inflow is often considered as a bullish sign of the sector and related ETFs!

^Weekly Sectors Fund Flow Board: a sector ranking based on sector ETFs aggregate 3-month fund flows.

^3-month fund flows: a metric that can be used to gaugethe perceived popularity amongst investors of different sectors.

^The board includes the following information: change of rankings, 3-month fund flows, how many ETFs are in the sectors, and the related ETFs.

For this week, I covered the top two YTD sector-realted ETFs. Now, let's take a look at the board~You may find something to diversify your porfolio

* Follow me to know what is hot on the market![]()

![]()

Sectors Updates:

REITs, FIN, Healthcare, and Energy changed in ranks of 3-month fund flow.

*Tech

Technology stocks extended their Thursday gains, with the $科技行业精选指数ETF-SPDR(XLK.US$Thursday rising 1.0%, while the $费城半导体指数(.SOX.US$was advancing 1.6% this afternoon.

$Zscaler(ZS.US$was 2.6% higher late in Thursday trading after the cloud security company said it is powering its offices and more than 150 data centers running its Zscaler Zero Trust Exchange using either directly purchased renewable energy or renewable energy credits.

$英伟达(NVDA.US$shares briefly rose more than 8% Thursday after the company beat earnings and sales expectations for the third quarter.

Read more:If Nvidia rises another 26%, its market cap will exceed trillions!

*FIN

Financial stocks continued to lose ground Thursday afternoon, with the NYSE Financial Index and $SPDR金融行业ETF(XLF.US$both close off 0.5%.

$i3 Verticals(IIIV.US$added 4.7% after the payments processor reported non-GAAP net income of $0.33 per share for its fiscal Q4 ended Sept. 30, from $0.20 per share a year earlier, beating analysts' consensus by $0.04 per share.

$Patria Investments(PAX.US$climbed 5.7% after the asset manager reported distributable Q3 net income of $0.165 per share, up from $0.149 a year ago and beating the single-analyst estimate expecting $0.13 per share.

*Real Estate

The Philadelphia Housing Sector Index fell 0.5% while the $The Real Estate Select Sector SPDR Fund(XLRE.US$slipped 0.1%.

*Consumer

Consumer stocks were ending broadly mixed late in Thursday trading, close with the $日常消费品精选行业指数ETF-SPDR(XLP.US$dropping 0.3% while the $非必需消费类ETF-SPDR(XLY.US$was rising 1.1%.

*Health Care

Health care stocks were little changed this afternoon, with the NYSE Health Care Index falling 0.1% while the $医疗保健精选行业指数ETF-SPDR(XLV.US$also was up 0.04%. The Nasdaq Biotechnology index was slipping 0.1%.

*Energy

Energy stocks were ending moderately lower Thursday afternoon, with the NYSE Energy Sector Index falling 0.3% while the $能源指数ETF-SPDR(XLE.US$was down 0.4%. The $PHLX石油服务类股指数(.OSX.US$was declining 2.9% and the $道琼斯美国公用事业指数(.DJUSUT.US$was sinking 0.6%.

Source: MT Newswires

Happy Friday! Weekly Sectors Fund Flow Board is here~

From this chart, you will be able to find out what sector ETFs have most fund inflow. Fund inflow is often considered as a bullish sign of the sector and related ETFs!

^Weekly Sectors Fund Flow Board: a sector ranking based on sector ETFs aggregate 3-month fund flows.

^3-month fund flows: a metric that can be used to gaugethe perceived popularity amongst investors of different sectors.

^The board includes the following information: change of rankings, 3-month fund flows, how many ETFs are in the sectors, and the related ETFs.

For this week, I covered the top two YTD sector-realted ETFs. Now, let's take a look at the board~You may find something to diversify your porfolio

* Follow me to know what is hot on the market

Sectors Updates:

REITs, FIN, Healthcare, and Energy changed in ranks of 3-month fund flow.

*Tech

Technology stocks extended their Thursday gains, with the $科技行业精选指数ETF-SPDR(XLK.US$Thursday rising 1.0%, while the $费城半导体指数(.SOX.US$was advancing 1.6% this afternoon.

$Zscaler(ZS.US$was 2.6% higher late in Thursday trading after the cloud security company said it is powering its offices and more than 150 data centers running its Zscaler Zero Trust Exchange using either directly purchased renewable energy or renewable energy credits.

$英伟达(NVDA.US$shares briefly rose more than 8% Thursday after the company beat earnings and sales expectations for the third quarter.

Read more:If Nvidia rises another 26%, its market cap will exceed trillions!

*FIN

Financial stocks continued to lose ground Thursday afternoon, with the NYSE Financial Index and $SPDR金融行业ETF(XLF.US$both close off 0.5%.

$i3 Verticals(IIIV.US$added 4.7% after the payments processor reported non-GAAP net income of $0.33 per share for its fiscal Q4 ended Sept. 30, from $0.20 per share a year earlier, beating analysts' consensus by $0.04 per share.

$Patria Investments(PAX.US$climbed 5.7% after the asset manager reported distributable Q3 net income of $0.165 per share, up from $0.149 a year ago and beating the single-analyst estimate expecting $0.13 per share.

*Real Estate

The Philadelphia Housing Sector Index fell 0.5% while the $The Real Estate Select Sector SPDR Fund(XLRE.US$slipped 0.1%.

*Consumer

Consumer stocks were ending broadly mixed late in Thursday trading, close with the $日常消费品精选行业指数ETF-SPDR(XLP.US$dropping 0.3% while the $非必需消费类ETF-SPDR(XLY.US$was rising 1.1%.

*Health Care

Health care stocks were little changed this afternoon, with the NYSE Health Care Index falling 0.1% while the $医疗保健精选行业指数ETF-SPDR(XLV.US$also was up 0.04%. The Nasdaq Biotechnology index was slipping 0.1%.

*Energy

Energy stocks were ending moderately lower Thursday afternoon, with the NYSE Energy Sector Index falling 0.3% while the $能源指数ETF-SPDR(XLE.US$was down 0.4%. The $PHLX石油服务类股指数(.OSX.US$was declining 2.9% and the $道琼斯美国公用事业指数(.DJUSUT.US$was sinking 0.6%.

Source: MT Newswires

59

4

暂无评论

darikus : 读得不错

Isidro Fernandez : 太棒了,谢谢

一买就跌一卖就涨 : 不错

Tiggerpepper : 我们全部购买。