By Julianna

Investors appear to be losing patience with Ark Investment Management's genomics fund.

![]()

![]() $ARK生物基因科技革新主动型ETF(ARKG.US)$

$ARK生物基因科技革新主动型ETF(ARKG.US)$ is an actively managed ETF that focus on health care, information technology, materials, energy, and consumer discretionary.

Companies within ARKG are focused on and are expected to substantially benefit from extending and enhancing the quality of human and other life by incorporating technological and scientific developments and advancements in genomics into their business.

- according to ARKG fund description.

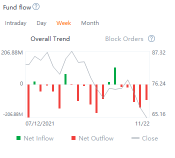

However, ARKG is down 30% this year as investors shun health-care stocks in favor for more cyclical names that perform well during an economic recovery. Even so, this ETF is faring far worse than the broader biotech sector, with the

$道琼斯美国生物技术指数(.DJUSBT.US)$up 11.35% this year.

![]()

![]()

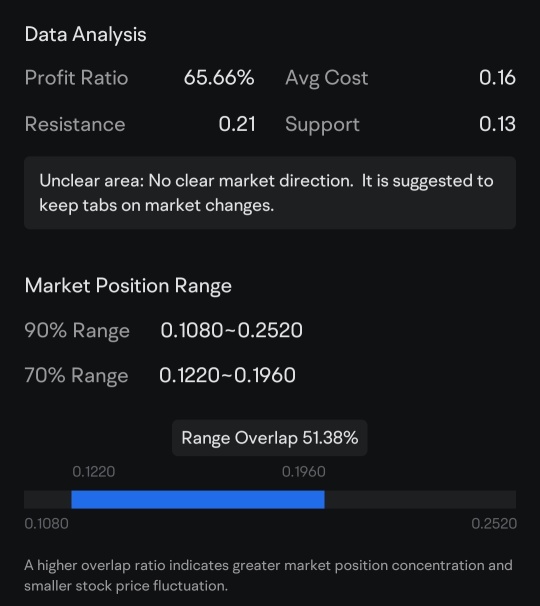

ARKG is currently trading at $65.16 a share, 43% lower from its peak in this February. The genomics fund has also seen the largest outflows among Ark's ETFs this year.

![]()

![]()

It's interesting that typically loyal Ark investors have been bailing on the ETF.

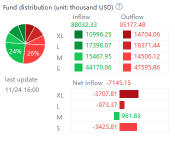

The fund's assets have been chopped in half since February. While I don't believe the ETF is experiencing some of sort of 'doom loop,' clearly the outflows are putting downward price pressure on the underlying holdings and testing the will of remaining fund owners.

- said Nate Geraci, president of The ETF Store, an advisory firm.

![]()

![]()

FOLLOW ME to know more about ETFs

PLZ leave your comments and likes below

![]()

ARKG's top two holdings,

$Teladoc Health(TDOC.US)$and

$精密科学(EXAS.US)$, heavily impact its performance, with drops of 47% and 33.5% this year, respectively.

![]()

![]()

![]()

The recent outflows may be due to investors looking for shorter-term opportunities into the year-end and freeing up cash.

- said Sylvia Jablonski, chief investment officer at Defiance ETFs.

Ark Chief Executive Officer Cathie Wood is well-known for prioritizing longer term investments over short-term gains.

![]()

![]()

This is a 5-10 year hold. AI in health care is going to change the way that we can predict, treat and manage the most difficult diseases like cancer, and the Ark fund gives investors access to the companies who are on the cutting edge of that research.

- Jablonski added.

Have you ever invested in the Biotechnology sector? Do you agree with Jablonski's opinion?

![]()

![]()

Source: Bloomberg

lightfoot : junk, hook, line and sinker

Clueless Noob : great post. thank you for sharing

Christopher Flint197 : like to learn what a swing trade looks like and when to get in and out.