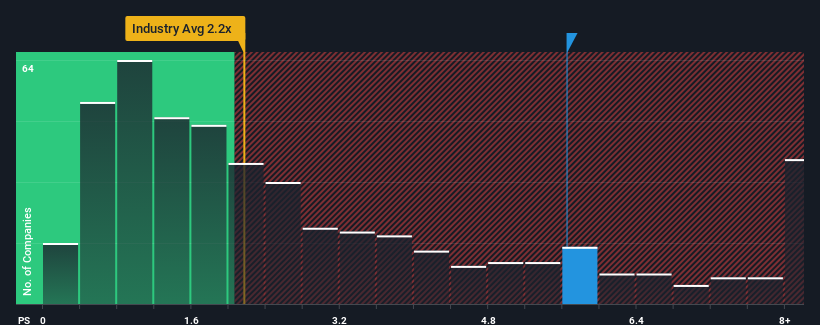

When you see that almost half of the companies in the Chemicals industry in China have price-to-sales ratios (or "P/S") below 2.2x, Crystal Clear Electronic Material Co.,Ltd (SZSE:300655) looks to be giving off strong sell signals with its 5.6x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

How Has Crystal Clear Electronic MaterialLtd Performed Recently?

Crystal Clear Electronic MaterialLtd has been struggling lately as its revenue has declined faster than most other companies. Perhaps the market is predicting a change in fortunes for the company and is expecting them to blow past the rest of the industry, elevating the P/S ratio. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Crystal Clear Electronic MaterialLtd will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For Crystal Clear Electronic MaterialLtd?

In order to justify its P/S ratio, Crystal Clear Electronic MaterialLtd would need to produce outstanding growth that's well in excess of the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 16%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 6.4% overall rise in revenue. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Looking ahead now, revenue is anticipated to climb by 37% during the coming year according to the two analysts following the company. With the industry only predicted to deliver 23%, the company is positioned for a stronger revenue result.

With this in mind, it's not hard to understand why Crystal Clear Electronic MaterialLtd's P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What Does Crystal Clear Electronic MaterialLtd's P/S Mean For Investors?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Crystal Clear Electronic MaterialLtd's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

Before you take the next step, you should know about the 1 warning sign for Crystal Clear Electronic MaterialLtd that we have uncovered.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.