Fountain Set (Holdings) Limited (HKG:420) shares have continued their recent momentum with a 28% gain in the last month alone. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 16% over that time.

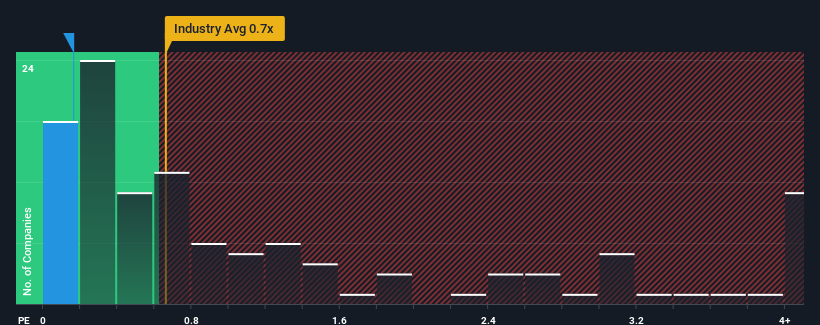

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about Fountain Set (Holdings)'s P/S ratio of 0.2x, since the median price-to-sales (or "P/S") ratio for the Luxury industry in Hong Kong is also close to 0.7x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

How Has Fountain Set (Holdings) Performed Recently?

As an illustration, revenue has deteriorated at Fountain Set (Holdings) over the last year, which is not ideal at all. Perhaps investors believe the recent revenue performance is enough to keep in line with the industry, which is keeping the P/S from dropping off. If not, then existing shareholders may be a little nervous about the viability of the share price.

Although there are no analyst estimates available for Fountain Set (Holdings), take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Fountain Set (Holdings)'s Revenue Growth Trending?

In order to justify its P/S ratio, Fountain Set (Holdings) would need to produce growth that's similar to the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 27%. As a result, revenue from three years ago have also fallen 10% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 13% shows it's an unpleasant look.

In light of this, it's somewhat alarming that Fountain Set (Holdings)'s P/S sits in line with the majority of other companies. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh on the share price eventually.

The Bottom Line On Fountain Set (Holdings)'s P/S

Fountain Set (Holdings) appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our look at Fountain Set (Holdings) revealed its shrinking revenues over the medium-term haven't impacted the P/S as much as we anticipated, given the industry is set to grow. Even though it matches the industry, we're uncomfortable with the current P/S ratio, as this dismal revenue performance is unlikely to support a more positive sentiment for long. Unless the the circumstances surrounding the recent medium-term improve, it wouldn't be wrong to expect a a difficult period ahead for the company's shareholders.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Fountain Set (Holdings) (1 can't be ignored) you should be aware of.

If these risks are making you reconsider your opinion on Fountain Set (Holdings), explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.