Is It Too Late to Buy Costco Stock?

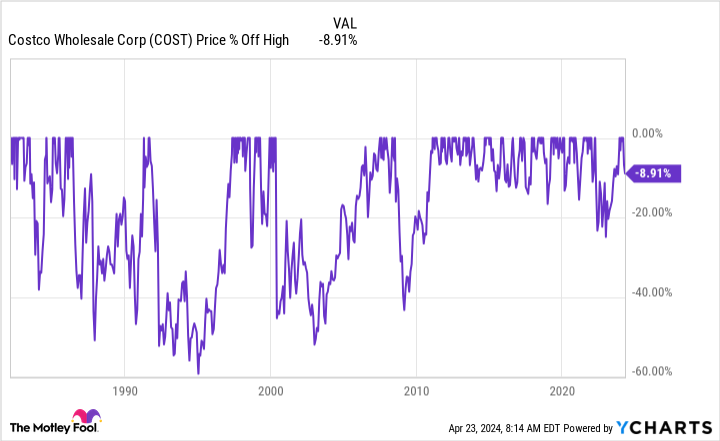

Costco Wholesale (NASDAQ: COST) stock is down around 8% from its all-time highs. A normal drawdown would be around 20%, with a really big one touching the 40% mark. Both have happened multiple times in the past. So now may not be the best time to buy Costco if you have a value bent. But if you are a growth-oriented investor, history suggests that this growing retailer might still be attractive.

Costco keeps its customers happy

Costco is a club store, which changes the dynamics of the retail sector a great deal. In effect, its customers pay it a membership fee for the privilege of shopping in a Costco store. In order to justify that fee Costco works very hard to keep its customers happy. That includes having low prices on desirable products, but it also means having responsive and happy employees and ensuring that the stores are well stocked, even during difficult times. On that last point, Costco actually chartered its own boats during the coronavirus pandemic so it would have goods to sell while other stores had empty shelves. It was an expensive decision, but it kept Costco customers paying those membership fees.

Why is that so important? The answer is pretty simple when you look at the company's earnings statement. Costco breaks revenue down into sales and membership fees. In the fiscal second quarter of 2024, ended Feb. 18, product sales totaled $57.3 billion while membership fees were just $1.1 billion. But membership fees don't actually come with material costs; Costco has to buy the goods it sells. The company's operating income, which takes into account operating costs that are mostly associated with product sales, was just under $2.1 billion. So the membership fees make up over half of the company's operating income. Membership fees are incredibly important to Costco's business.

But here's the interesting thing: The company's heavy emphasis on customers has been a huge success. It has 150 locations in the United States that generate over $300 million in sales and 40 that do over $400 million in business. These are very large numbers, which means traffic at its stores is huge. Maybe too huge -- some customers choose not to shop at Costcos because they are too crowded. Although that could be viewed as Costco being a victim of its own success, there's a positive here because it means Costco has room to keep adding new locations. And those locations can be near older stores specifically with the intent of cannibalizing the customer base.

Growth is still in the cards at Costco

This is where things get interesting for growth investors. With more than $300 billion market cap, Costco is a long way from being a fast-growing start-up. But that doesn't mean it can't continue to grow. In fact, as the U.S. business shows, it still has to grow its store base if it wants to keep its customers as happy as possible. Meanwhile, it operates in countries around the world. So there's growth to be had in those markets, as well. If Costco can achieve similar success abroad as it has in the United States, it probably has more room to grow internationally than it may at first seem.

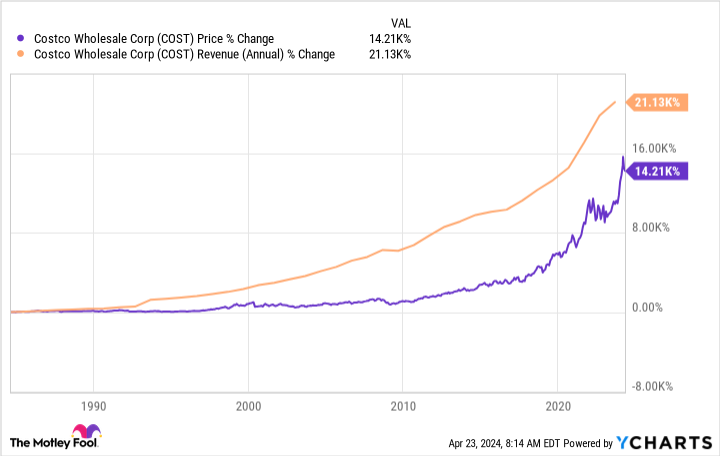

Would it be better if Costco's stock were down 20% or even 40%? Of course, that would be a much better entry point. But the company's growth has, over time, led to a higher and higher stock price. That's driven by results, not Wall Street hype. As the chart below shows, the stock continues to track the top line higher over time.

So is now a great time to buy Costco? Probably not. If you have a value bent you might want to wait for a deeper pullback. But is now a bad time to buy Costco? Given the company's growth prospects as it opens new stores (some by what appears to be necessity), the top line should continue to expand and the stock, if history is any guide, will increase along with the business expansion. If you are a growth investor looking to buy and hold for a long time, perhaps forever, you should probably give Costco a close look.

Costco is a great company and it's rarely cheap

At the end of the day, Wall Street clearly recognizes the strength of Costco's business model. It seldom trades at discounted prices. Yes, you could try to wait until it looks historically cheap before buying. But given the steady march higher for revenue and the stock price, that could mean missing out on years of growth. So, if you are a long-term growth investor, it might make sense to just get on board now instead of trying to find the perfect entry point. And if the stock does fall materially for some reason, consider it an opportunity to add to your position.

Should you invest $1,000 in Costco Wholesale right now?

Before you buy stock in Costco Wholesale, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Costco Wholesale wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $537,557!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 22, 2024

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Costco Wholesale. The Motley Fool has a disclosure policy.

Is It Too Late to Buy Costco Stock? was originally published by The Motley Fool