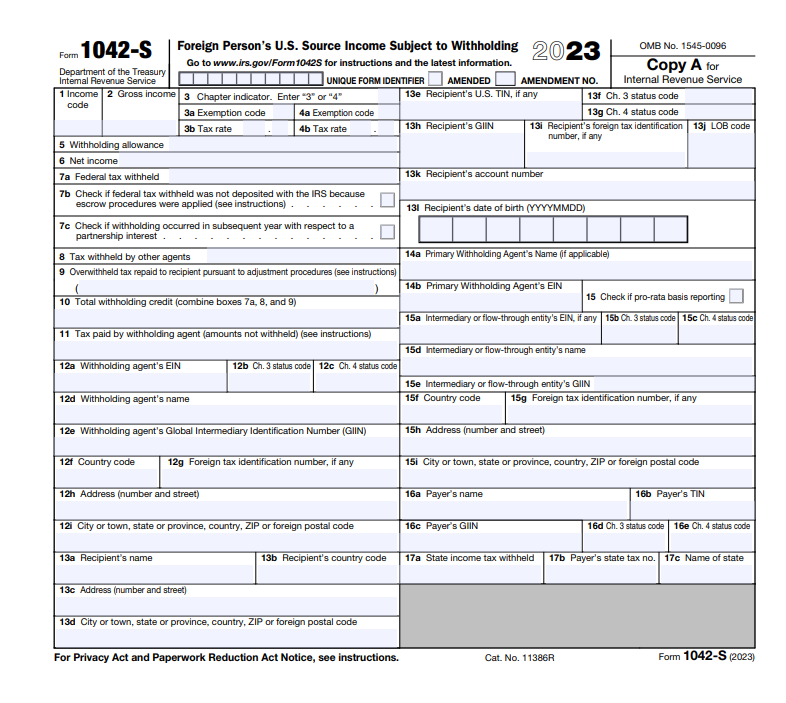

Key Terms for Tax Form 1042-S

Key Terms for 1042-S Foreign Person’s US Source Income Subject to Withholding:

-

Income Code

This two-digit income code identifies the appropriate income source.

-

Gross Income

The total amount of all income paid as specific to the income code. This includes dividends, interest and other income sources.

-

Chapter Indicator 3 or 4

Applies to non-U.S. beneficial owners of U.S. source FDAP income under Chapter 3 and to non-U.S. payees who receive U.S. source withholdable payments under Chapter 4.

-

Tax Rate

The rate of withholding applied.

-

Withholding allowance

The personal exemption amount.

-

Net Income

The amount after withholding and other deductions have been applied.

-

Federal Tax Withheld

The amount of taxes withheld based on the tax rate.

-

Tax Withholding Credit

The amount of taxes already paid to the IRS.