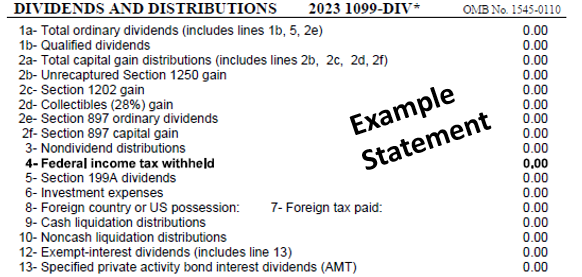

Tax Form 1099-DIV

1. What is 1099-DIV

Form 1099-DIV is used to report dividends and other distributions paid to clients and to the IRS.

2. Key Terms for 1099-DIV Dividends and Distributions

2.1 Ordinary dividends vs. Qualified dividends

Ordinary dividends means the payment is not qualified for a lower tax rate and gets taxed at an ordinary income tax rate

Qualified dividends means the payment qualifies for a lower dividend tax rate

○ A dividend is considered qualified if the stock is held for more than 60 days in the 121-day period, that begins 60 days before the ex-dividend date (one market day before the dividend's record date). It is an ordinary dividend if held it for less than that amount of time.

2.2 Total Capital Gain Distributions

are payments (usually paid at year end) made by an exchange-traded fund (ETF) on a portion of the proceeds from the fund's sales of stocks and other assets from within its portfolio.

2.3 Dividend Distribution Vs Non-Dividend Distribution

Dividends distributions are a share of corporate profits paid out to shareholders and are usually taxable

Non-Dividend distributions are a portion of a distribution to shareholders and is a nontaxable return of capital

2.4 Cash Liquidation Distributions vs Non-Cash Liquidation Distributions

Cash liquidation distributions are a type of non-dividend distribution paid in cash by a corporation or a partnership to its shareholders during its partial or complete liquidation.

Non-Cash Liquidation Distributions are assets (other than cash) that the taxpayer received when the entity they invested in was partially or completely liquidated.

Disclaimer: We do not provide tax advice and any tax-related information provided is general in nature and should not be considered tax advice. Consult a tax professional regarding your specific tax situation.