How to trade options with the Algo function

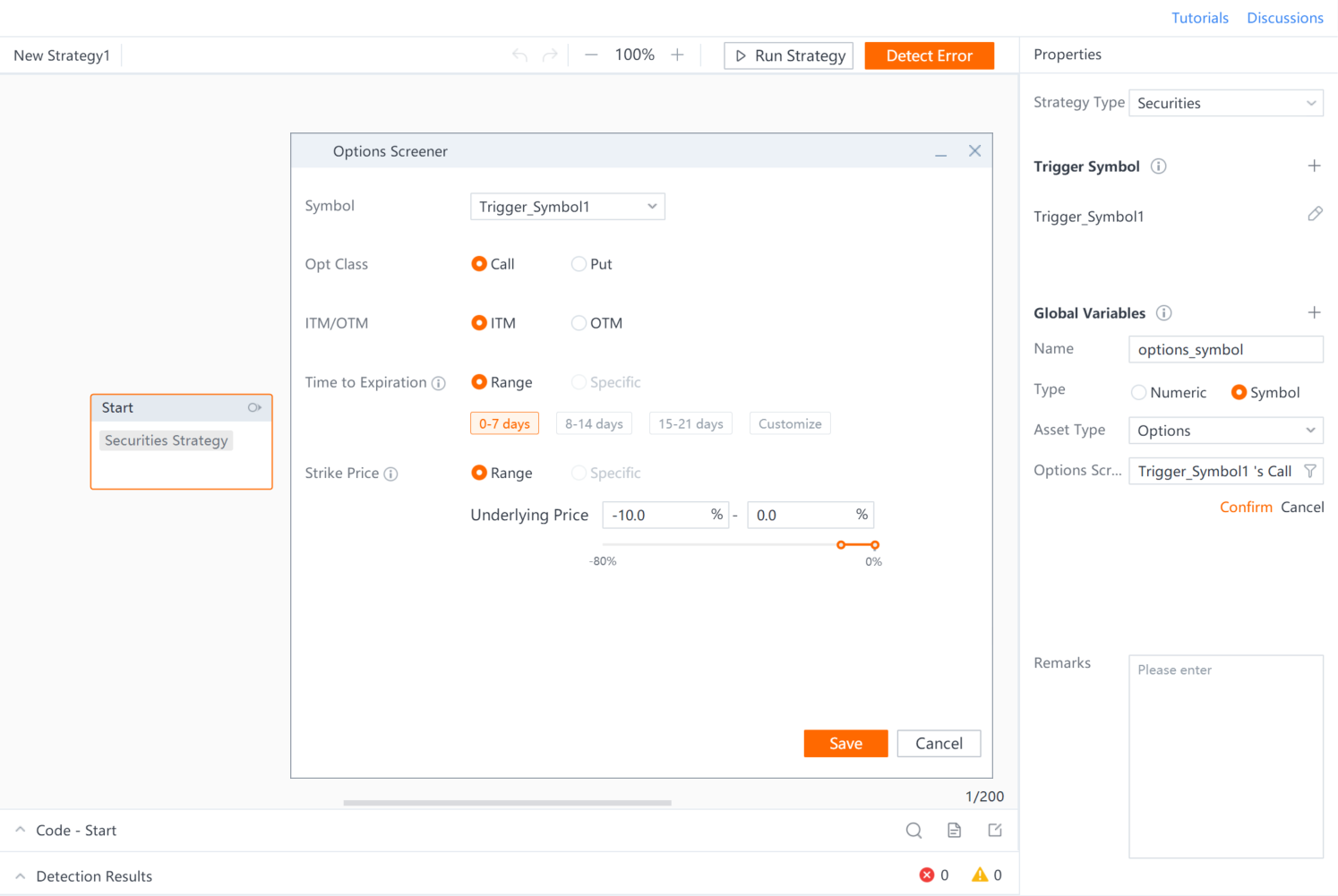

1. Set the underlying stock as a variable

-

Drag the Start card onto the canvas

-

Create a new global variable on the Properties panel

-

Select Symbol, and then select Options as the asset type

-

Set the filter conditions for options

Any images provided are not current and any securities or inputs shown are for illustrative purposes only and are not recommendations.

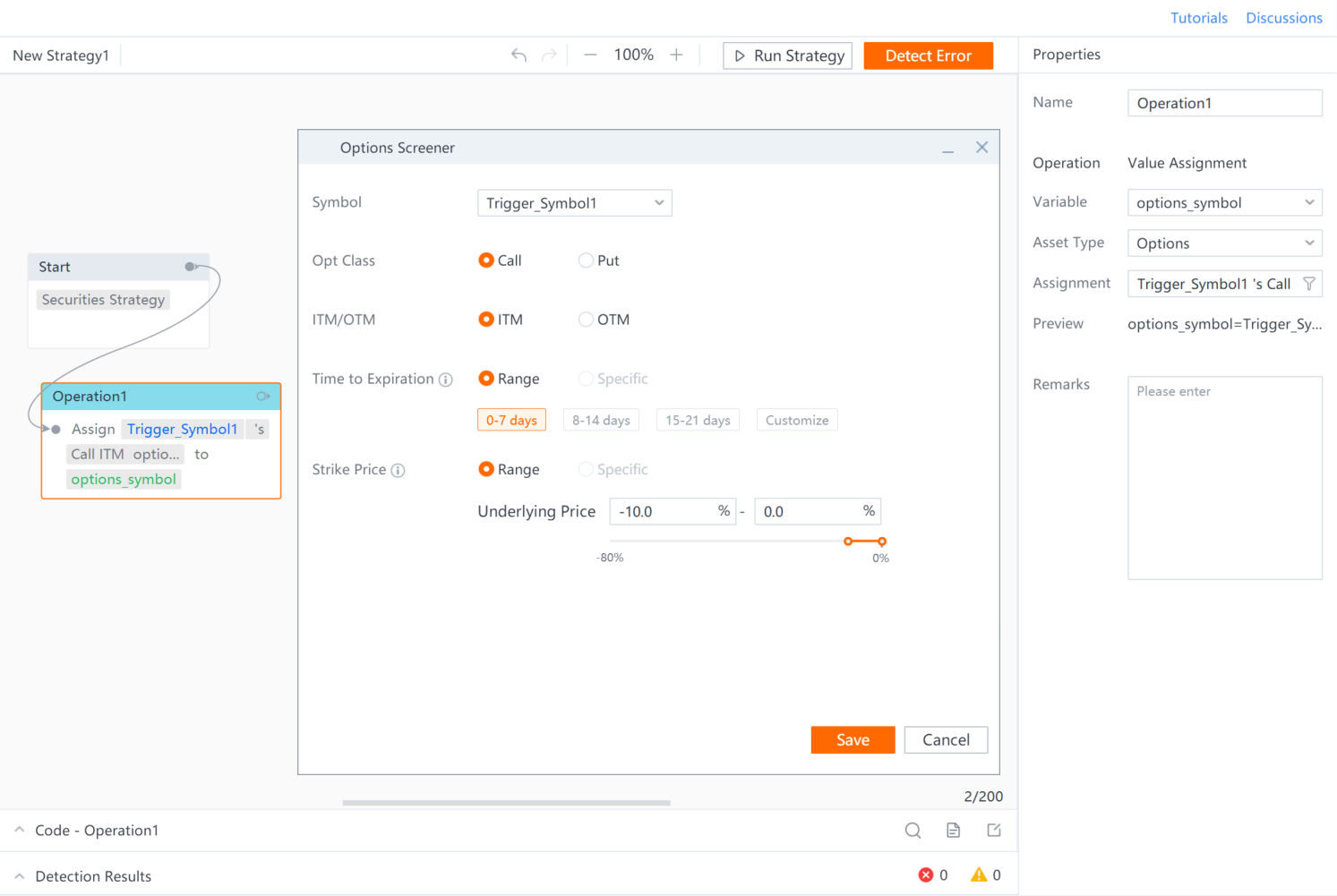

2. Filter options during strategy execution

Any images provided are not current and any securities or inputs shown are for illustrative purposes only and are not recommendations.

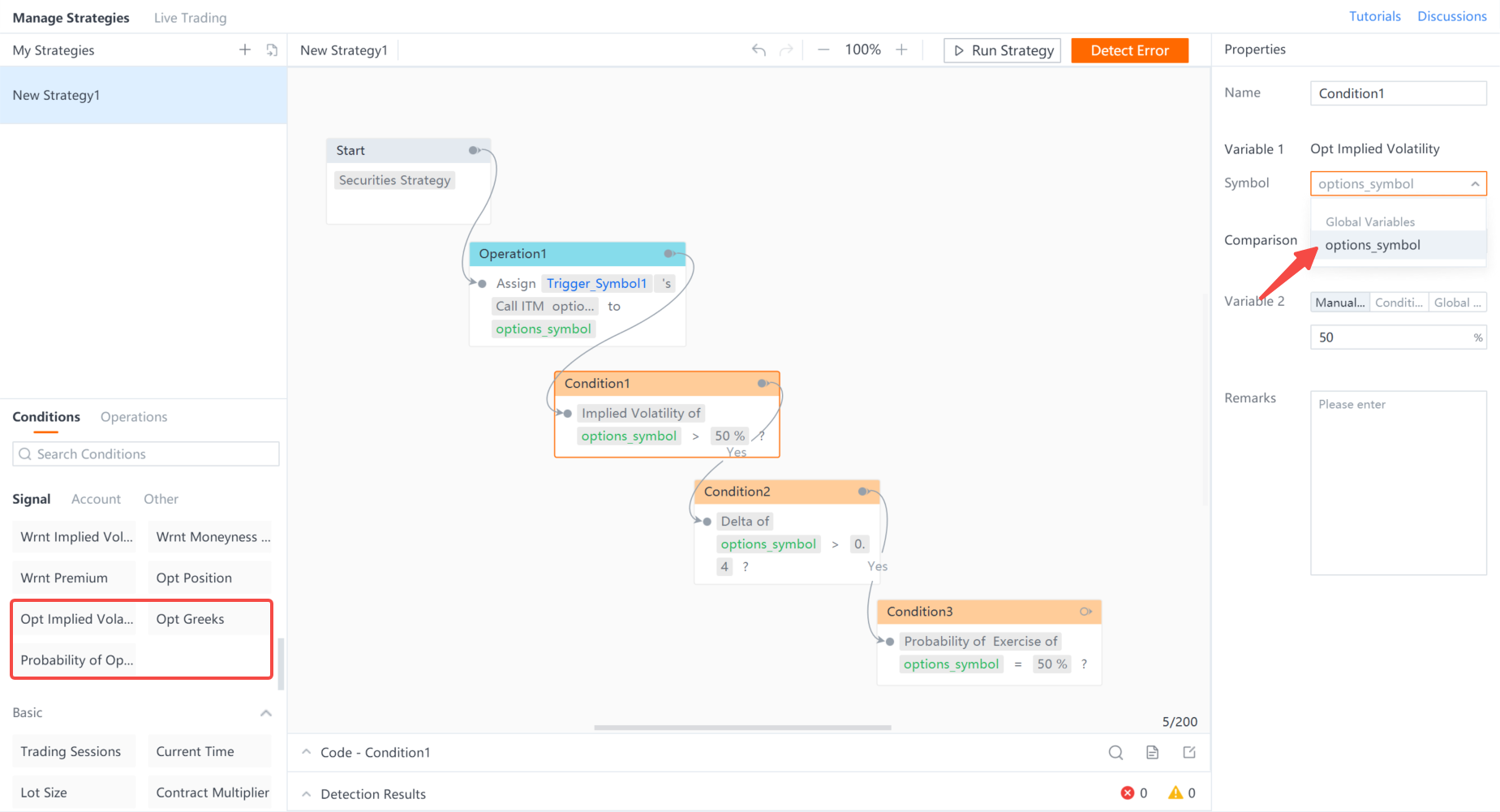

3. Set the conditions

Any images provided are not current and any securities or inputs shown are for illustrative purposes only and are not recommendations.

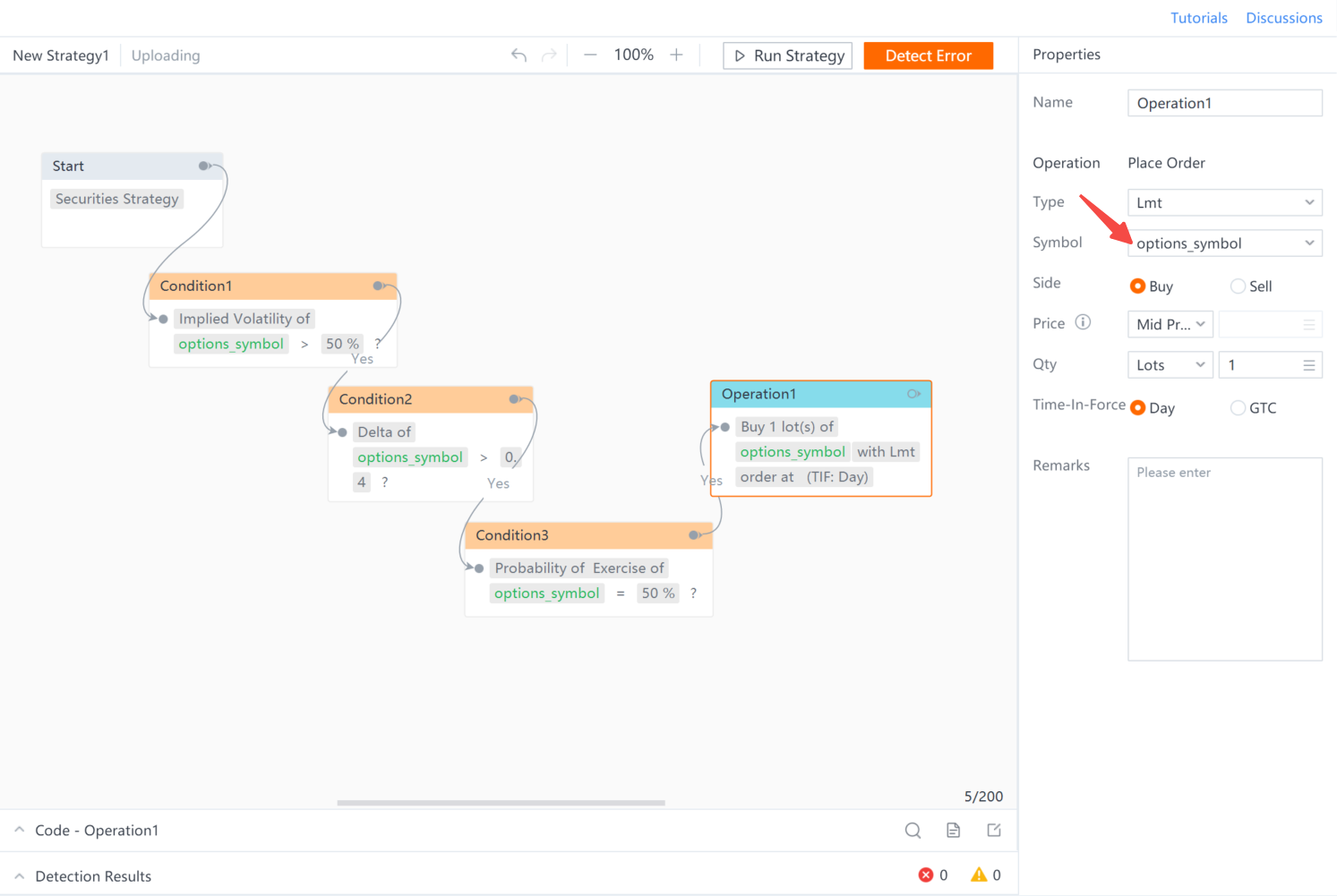

4. Trade options

Any images provided are not current and any securities or inputs shown are for illustrative purposes only and are not recommendations.

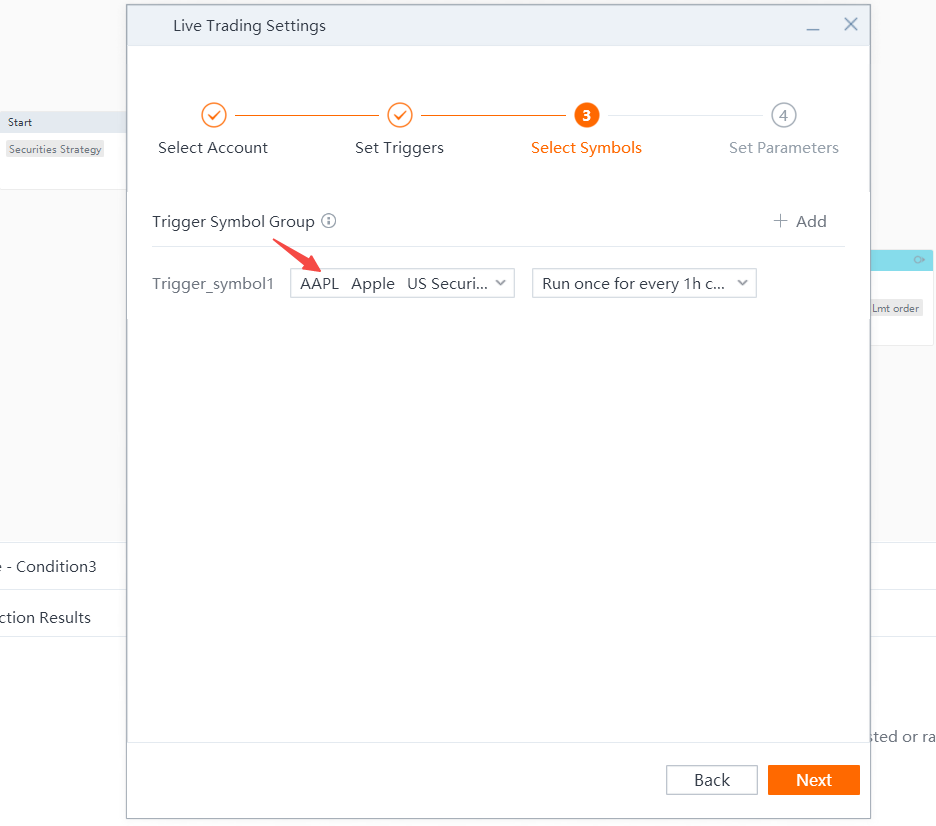

5. Live trading

Any images provided are not current and any securities or inputs shown are for illustrative purposes only and are not recommendations.

Options trading entails significant risk and is not appropriate for all customers. It is important that investors read Characteristics and Risks of Standardized Options before engaging in any options trading strategies. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including the potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request.Our platform does not guarantee favorable investment outcomes. The past performance of a security or financial product does not guarantee future results or returns. Customers should consider their investment objectives and risks carefully before investing in options. Because of the importance of tax considerations to all options transactions, the customer considering options should consult their tax advisor as to how taxes affect the outcome of each options strategy.

Losses can happen more quickly with quant and algorithmic trading compared to other forms of trading. Trading in financial markets carries inherent risks, making effective risk management a crucial aspect of quantitative trading systems. These risks encompass various factors that can disrupt the performance of such systems, including market volatility leading to losses.Moreover, quants face additional risks such as capital allocation, technology, and broker-related uncertainties. It's important to note that automated investment strategies do not guarantee profits or protect against losses.The responsiveness of the trading system or app may vary due to market conditions, system performance, and other factors. Account access, real-time data, and trade execution may be affected by factors such as market volatility.

This presentation is for informational and educational use only and is not a recommendation or endorsement of any particular investment or investment strategy. Investment information provided in this content is general in nature, strictly for illustrative purposes, and may not be appropriate for all investors. It is provided without respect to individual investors’ financial sophistication, financial situation, investment objectives, investing time horizon, or risk tolerance. You should consider the appropriateness of this information having regard to your relevant personal circumstances before making any investment decisions. Past investment performance does not indicate or guarantee future success. Returns will vary, and all investments carry risks, including loss of principal. Moomoo makes no representation or warranty as to its adequacy, completeness, accuracy or timeliness for any particular purpose of the above content.