跟踪南北向资金最新动态

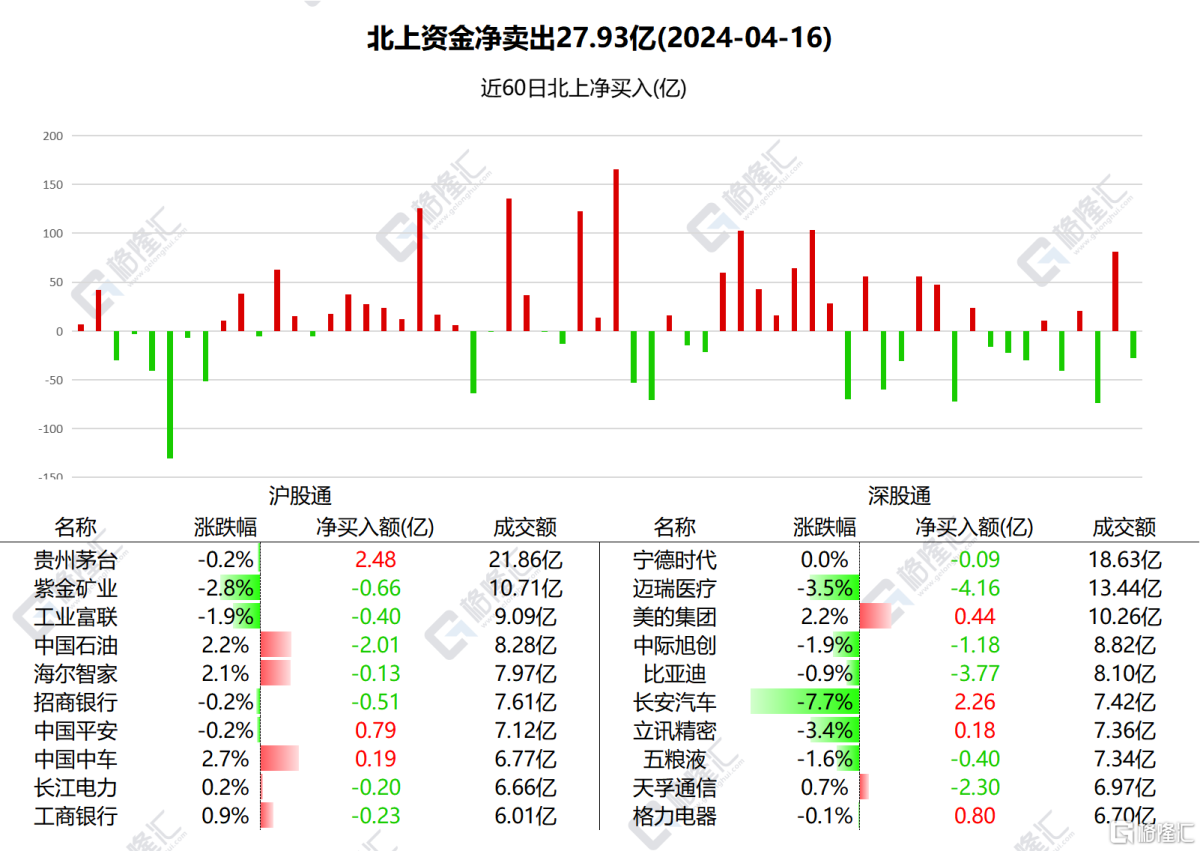

4月16日,北上资金今日净卖出A股27.93亿元。其中,沪股通净卖出13.6亿元,深股通净卖出14.32亿元。

前十大成交股中,净买入额居前三的迈瑞医疗、比亚迪、天孚通信,分别获净卖出4.16亿元、3.77亿元、2.3亿元。

贵州茅台净买入额居首,金额为2.48亿元,长安汽车获净买入2.26亿元。

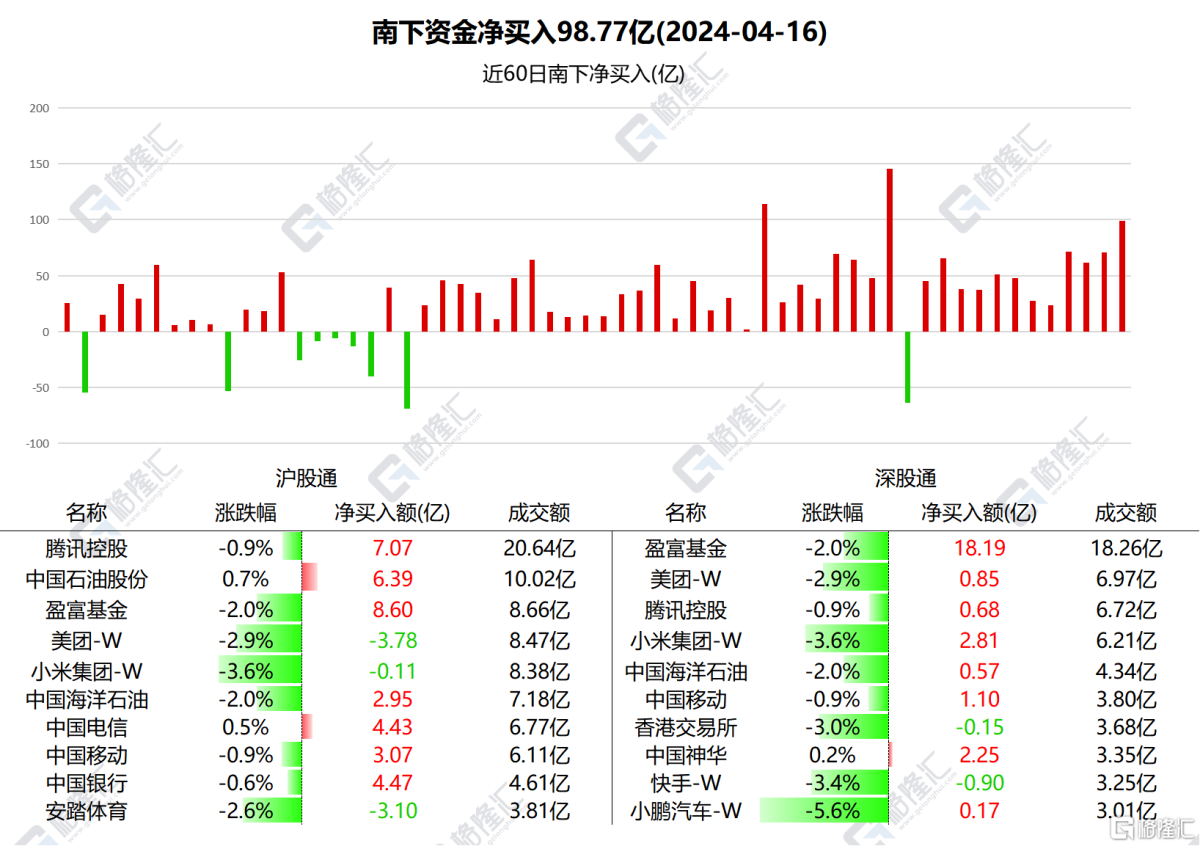

南向资金净买入98.77亿港元,其中,港股通(沪)净买入56.24亿港元,港股通(深)净买入42.53亿港元。

其中,净买入盈富基金26.78亿、腾讯7.74亿、中石油6.39亿、中国银行4.47亿、中国电信4.42亿、中国移动4.17亿、中海油3.51亿、小米2.7亿、中国神华2.24亿。

安踏体育、美团-W、快手-W 分别遭净卖出3.1亿港元、2.93亿港元、9005万港元。

据统计,南下资金已连续9日加仓中国移动,共计31.6729亿港元;连续6日加仓中国银行,共计23.5658亿港元;连续5日加仓中石油,共计14.5839亿港元;连续5日加仓中海油,共计10.9878亿港元。

南水关注个股

迈瑞医疗:今日跌3.5%。消息面上,欧盟拟对中国医疗器械采购在新工具《国际采购工具》(International Procurement Instrument, 或IPI)下展开首个调查,最早可能于4月中旬宣布。4月16日,迈瑞医疗对此回应称,“一向积极践行自由贸易理念,严格遵守世界各国法律法规及监管要求,依法合规参与市场竞争”。

天孚通信:今日收涨0.65%。国信证券发布研报称,AI改变算力集群网络架构,一方面单一训练集群规模持续扩大,互联需求和加速单元的比例关系有望进一步提升;另一方面,分布式的算力集群有望促进10-20km的DCI互联需要,加速“相关下沉”。综合来看,Marvell认为光互联需求的增长弹性有望超越加速单元,光互联市场有望维持高景气。

贵州茅台:今日跌0.18%报1670元。中国银河证券指出,上周茅台批价下跌引起白酒板块震荡,但周内企稳反弹, 更多是短期供给影响;且茅台批价下降并未传导至千元价格带,因此判断并非板块基本面的系统性走弱,预计上周下跌较多的白酒标的在本周有反弹机会

北水关注个股

腾讯控股:今日收跌0.85%。招银国际发布研究报告称,维持腾讯控股“买入”评级,将2024至2026年度总收入预测轻微下调1%至2%,主要反映游戏业务相对较弱,目标价由450.5港元下调至445港元。该行认为,腾讯游戏业务短期仍然面对压力,估计首季收入同比跌2%,第二季在新游戏推出下有望恢复正面增长。

中国石油股份:今日盘中一度大涨超3%,收涨0.67%。东吴期货指出,在原油基本面较强,美国二次通胀预期逐渐增强的背景下,预计油价总体走势偏强。周一,摩根士丹利将中国石油H股纳入了重点关注股票名单。美银证券也维持对中石油“买入”评级。基于油价及天然气增长支持稳定盈利,0.8倍市账率的吸引估值,7厘的高股息及资本管理行动计划的潜在惊喜。该行予中石油H股目标价为9元。

安踏体育:今日跌2.58%。不过海通证券研报指出,安踏体育高质量运营,盈利能力显著提升。23 年收入623.6 亿元(+16.2%),归母净利润102.4 亿元(+34.9%),如剔除合营公司损益影响为109.5 亿元(+44.9%),股东应占溢利率(剔除合营公司)17.6%(+3.5pct),盈利能力回到19 年水平。经营利润率24.6%(+3.7pct),主因:①收入增长带动经营杠杆提升,②DTC 及直营零售占比增加,③集团持续的严格成本控制。