美股周三收低,道指下跌逾420点。美国3月CPI数据超预期,显示通胀压力仍然高企,使市场降低了对美联储降息的押注。美联储会议纪要显示央行希望对通胀率向2%目标迈进更有信心。

道指跌422.16点,跌幅为1.09%,报38461.51点;纳指跌136.28点,跌幅为0.84%,报16170.36点;标普500指数跌49.27点,跌幅为0.95%,报5160.64点。

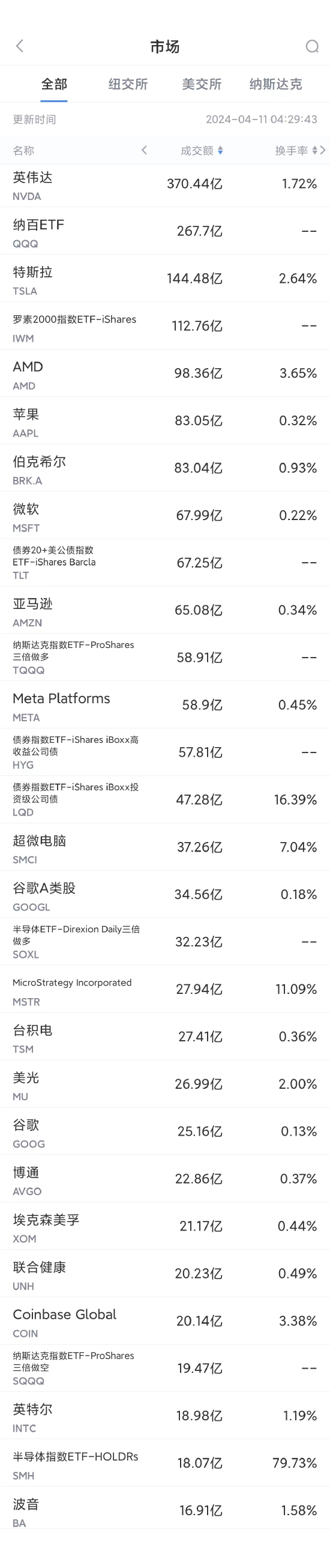

周三美股成交额第1名英伟达收高1.97%,成交370.44亿美元。摩根士丹利周三将英伟达目标价从795美元上调至1000美元。该行表示,对企业确定长期投资计划感到高度鼓舞,大型企业计划未来3至4年扩建数据中心预示需求持久性,当中包括微软的千亿美元星门项目(Stargate Project)。英伟达指数据中心已有四成使用推理技术,意味市场仍过于集中芯片在大语言模型的应用,忽视其他人工智能应用。

第2名特斯拉收跌2.89%,成交144.48亿美元。《印度商业在线》当地时间10日援引消息人士的话披露,美国电动汽车制造商特斯拉正与印度信实工业公司洽谈,讨论成立合资企业、在印建厂事宜。

此外有知情人士称,马斯克将于当地时间4月22日访问印度,会见印度总理莫迪。据悉,马斯克预计将宣布与特斯拉投资计划和在印度建厂有关的消息。

特斯拉一直在北美大幅下调Model Y价格,由此引发市场对该款车型试图在更新之前清理库存的猜测。4月10日,特斯拉相关负责人向上证报记者表示,北美地区今年不会推出改款Model Y。

另有报道称,特斯拉正在开发一款代号为“Project Juniper”的Model Y项目,亦有传闻称,上海超级工厂将在2024年年中开始生产改款Model Y。特斯拉同样明确表示,针对中国市场,今年并没有Model Y的改款计划。

第3名AMD收跌2.13%,成交98.36亿美元。黑莓公司周二宣布与AMD合作,两家公司将共同推出一款平台,为工业和医疗保健领域的机器人系统提供更强的性能、可靠性和可扩展性。该平台将黑莓的实时软件工具与由AMD架构提供支持的硬件相结合。

第4名苹果收跌1.11%,成交83.05亿美元。据媒体周三(4月10日)报道,苹果公司在印度的iPhone组装业务在过去一年取得了显著增长。根据数据,苹果公司去年在印度组装了140亿美元(约1013.6亿元人民币)的iPhone,同比增长了一倍。目前,在印度制造的iPhone中,富士康和和硕各占近67%和约17%,而塔塔集团负责运营剩余的印度产iPhone。

为了进一步加大在印度市场的投资,苹果公司计划在未来五年内将“印度制造”的iPhone产量增加五倍。供应链中的富士康科技集团已经向其在印度设立的一家工厂追加至少10亿美元(约72.4亿元人民币)的投资。富士康还计划为其印度工厂拨出约27亿美元(约195.48亿元人民币)预算,以加强该地区的组装产业链并扩充iPhone产能。

第7名亚马逊收高0.15%,成交65.08亿美元。据报道,亚马逊允许公司中下层员工自行决定自己未来的薪酬在多大程度上与公司的股票表现挂钩。

据媒体看到的一份内部备忘录显示,今年5月,亚马逊将给许多美国企业员工一项选择——将明年获得的股票数量减少四分之一,以换取更多现金。

亚马逊加入了越来越多的包括特斯拉和Shopify在内的科技公司的行列,这些公司不那么重视股权薪酬作为激励员工的一种方式。这代表着科技公司支付员工薪酬的方式发生了巨大变化。

第8名Meta Platforms收高0.57%,成交58.9亿美元。该公司周三宣布将部署一种新的自研芯片来用于其人工智能服务,旨在降低对英伟达和其他外部公司半导体的依赖。

周三宣布的芯片是Meta训练和推理加速器(MTIA)的最新版本,将帮助对Facebook和Instagram上的内容进行排名和推荐。Meta去年发布了首款MTIA产品。

第10名谷歌A类股(GOOGL)收跌0.29%,成交34.56亿美元。在Google Cloud Next 2024活动中,科技巨头谷歌宣布了一项重大进展:推出其首款专为数据中心设计的基于Arm架构的CPU,命名为Axion。这一新型处理器标志着谷歌在云计算硬件领域的最新突破,意在提升数据中心的性能和能效。

第11名比特币概念股MicroStrategy收高8.67%,成交27.49亿美元。

第12名台积电收高0.56%,成交27.41亿美元。台积电2024年3月合并营收约为新台币1952.11亿元,较上月增加7.5%,较去年同期增加34.3%。2024年1至3月累计营收约为新台币5926.44亿元,较去年同期增加16.5%。

第17名联合健康收跌2.10%,成交20.23亿美元。

第19名英特尔收跌2.95%,成交18.98亿美元。周二英特尔推出了Gaudi 3 AI芯片,其成本仅为英伟达H100芯片成本的“一小部分”,并宣布赢得了戴尔、惠普和联想等企业公司的一些合同。英伟达称Gaudi 3与英伟达H100相比训练性能提高了170%,推理能力提高了50%,效率提高了40%,但成本却低得多。

(截图来自新浪财经APP 行情-美股-市场板块 左滑更多数据)下载新浪财经APP