-

市场

-

产品

-

资讯

-

Moo社区

-

课堂

-

查看更多

-

功能介绍

-

费用费用透明,无最低余额限制

投资选择、功能介绍、费用相关信息由Moomoo Financial Inc.提供

- English

- 中文繁體

- 中文简体

- 深色

- 浅色

Options Corner: Pfizer's Options Market Sees Big Money Take Bullish Stance

Options Corner: Pfizer's Options Market Sees Big Money Take Bullish Stance

Deep-pocketed investors have adopted a bullish approach towards $Pfizer (PFE.US)$, and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in PFE usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 9 extraordinary options activities for Pfizer. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 44% leaning bullish and 44% bearish. Among these notable options, 5 are puts, totaling $273,893, and 4 are calls, amounting to $302,325.

Predicted Price Range

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $17.5 to $35.0 for Pfizer over the last 3 months.

Analyzing Volume & Open Interest

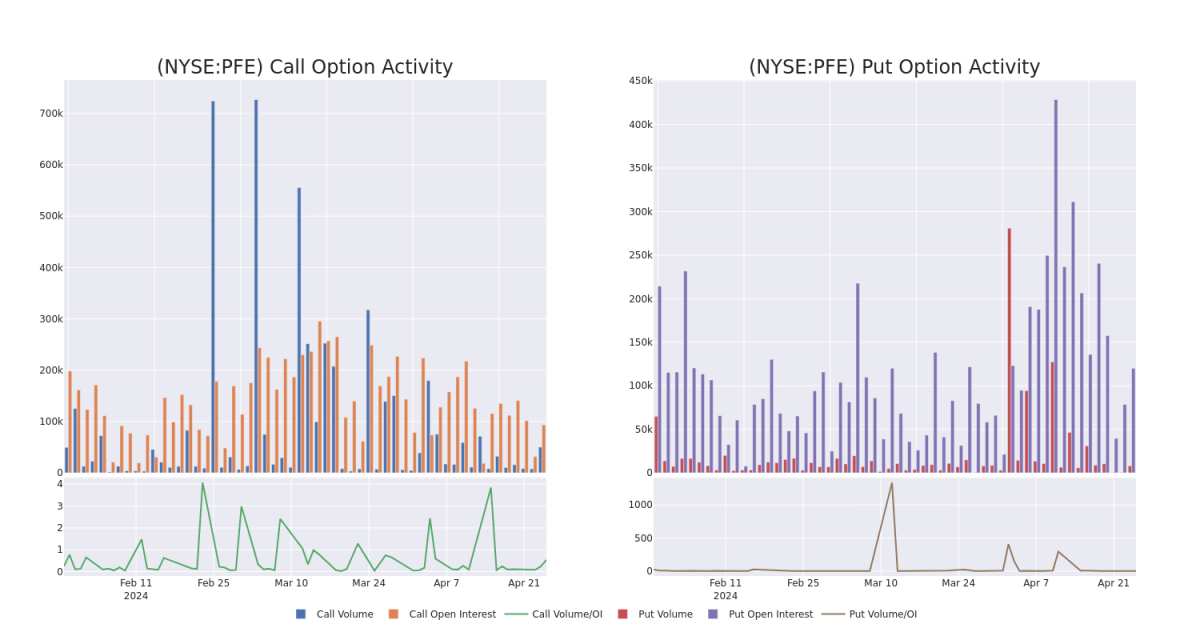

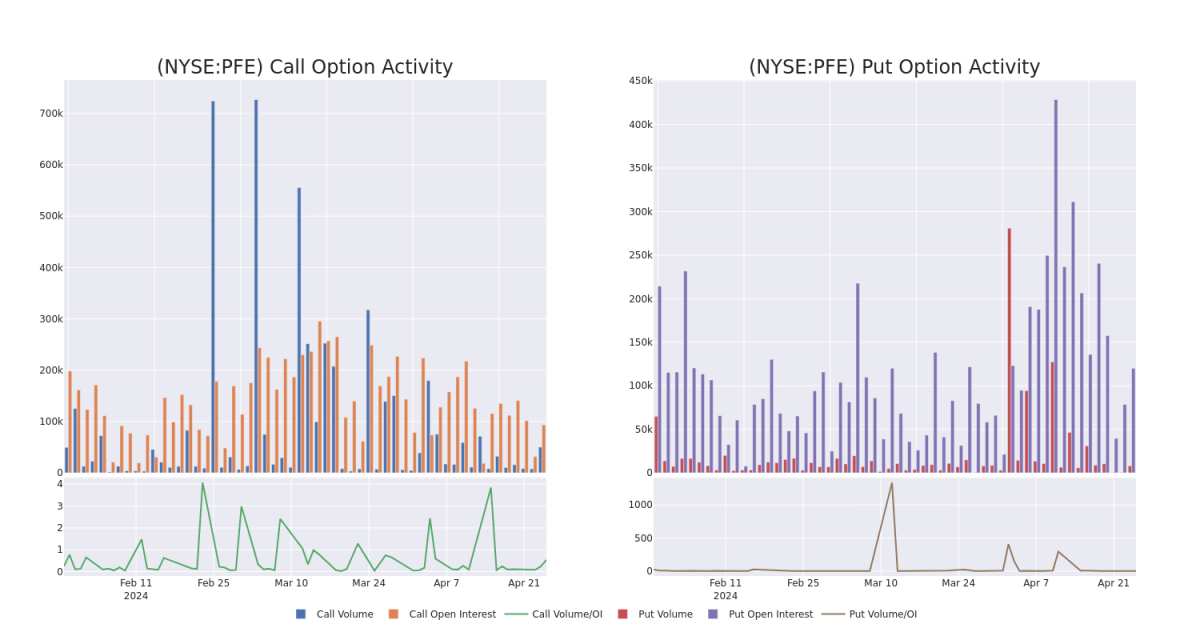

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Pfizer's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Pfizer's substantial trades, within a strike price spectrum from $17.5 to $35.0 over the preceding 30 days.

Pfizer Option Volume And Open Interest Over Last 30 Days

Biggest Options Spotted:

Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

PFE | CALL | SWEEP | BULLISH | 01/16/26 | $8.25 | $8.1 | $8.25 | $17.50 | $150.1K | 443 | 182 |

PFE | PUT | SWEEP | BEARISH | 06/20/25 | $10.2 | $10.1 | $10.2 | $35.00 | $136.6K | 343 | 0 |

PFE | CALL | SWEEP | BEARISH | 01/16/26 | $6.65 | $6.45 | $6.45 | $20.00 | $70.9K | 8.2K | 10 |

PFE | CALL | SWEEP | BULLISH | 12/20/24 | $4.15 | $4.05 | $4.15 | $22.00 | $47.7K | 2 | 5 |

PFE | PUT | SWEEP | BULLISH | 01/17/25 | $2.4 | $2.07 | $2.07 | $25.00 | $41.3K | 59.0K | 0 |

About Pfizer

Pfizer is one of the world's largest pharmaceutical firms, with annual sales close to $50 billion (excluding COVID-19 product sales). While it historically sold many types of healthcare products and chemicals, now prescription drugs and vaccines account for the majority of sales. Top sellers include pneumococcal vaccine Prevnar 13, cancer drug Ibrance, and cardiovascular treatment Eliquis. Pfizer sells these products globally, with international sales representing close to 50% of total sales. Within international sales, emerging markets are a major contributor.

Where Is Pfizer Standing Right Now?

Currently trading with a volume of 3,549,737, the PFE's price is up by 0.57%, now at $25.41.

RSI readings suggest the stock is currently may be oversold.

Anticipated earnings release is in 5 days.

Expert Opinions on Pfizer

4 market experts have recently issued ratings for this stock, with a consensus target price of $45.0.

In a cautious move, an analyst from Cantor Fitzgerald downgraded its rating to Overweight, setting a price target of $45.

Reflecting concerns, an analyst from Cantor Fitzgerald lowers its rating to Overweight with a new price target of $45.

In a cautious move, an analyst from Cantor Fitzgerald downgraded its rating to Overweight, setting a price target of $45.

In a cautious move, an analyst from Cantor Fitzgerald downgraded its rating to Overweight, setting a price target of $45.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Pfizer with Benzinga Pro for real-time alerts.

Deep-pocketed investors have adopted a bullish approach towards $Pfizer (PFE.US)$, and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in PFE usually suggests something big is about to happen.

财力雄厚的投资者对以下方面采取了看涨态度 $辉瑞 (PFE.US)$,这是市场参与者不应该忽视的事情。我们对本辛加公开期权记录的追踪今天揭示了这一重大举措。这些投资者的身份仍然未知,但是PFE的如此重大变动通常表明即将发生重大事件。

We gleaned this information from our observations today when Benzinga's options scanner highlighted 9 extraordinary options activities for Pfizer. This level of activity is out of the ordinary.

我们今天从观察中收集了这些信息,当时Benzinga的期权扫描仪重点介绍了辉瑞的9项非同寻常的期权活动。这种活动水平与众不同。

The general mood among these heavyweight investors is divided, with 44% leaning bullish and 44% bearish. Among these notable options, 5 are puts, totaling $273,893, and 4 are calls, amounting to $302,325.

这些重量级投资者的总体情绪存在分歧,44%的人倾向于看涨,44%的人倾向于看跌。在这些值得注意的期权中,有5个是看跌期权,总额为273,893美元,4个是看涨期权,总额为302,325美元。

Predicted Price Range

预测的价格区间

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $17.5 to $35.0 for Pfizer over the last 3 months.

考虑到这些合约的交易量和未平仓合约,在过去的3个月中,鲸鱼似乎一直将辉瑞的价格定在17.5美元至35.0美元之间。

Analyzing Volume & Open Interest

分析交易量和未平仓合约

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Pfizer's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Pfizer's substantial trades, within a strike price spectrum from $17.5 to $35.0 over the preceding 30 days.

评估交易量和未平仓合约是期权交易的战略步骤。这些指标揭示了辉瑞期权在指定行使价下的流动性和投资者对辉瑞期权的兴趣。即将发布的数据可视化了与辉瑞大量交易相关的看涨期权和看跌期权的交易量和未平仓合约的波动,在过去30天内,行使价范围从17.5美元到35.0美元不等。

Pfizer Option Volume And Open Interest Over Last 30 Days

辉瑞过去30天的期权交易量和未平仓合约

Biggest Options Spotted:

发现的最大选择:

Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

PFE |

CALL |

SWEEP |

BULLISH |

01/16/26 |

$8.25 |

$8.1 |

$8.25 |

$17.50 |

$150.1K |

443 |

182 |

PFE |

PUT |

SWEEP |

BEARISH |

06/20/25 |

$10.2 |

$10.1 |

$10.2 |

$35.00 |

$136.6K |

343 |

0 |

PFE |

CALL |

SWEEP |

BEARISH |

01/16/26 |

$6.65 |

$6.45 |

$6.45 |

$20.00 |

$70.9K |

8.2K |

10 |

PFE |

CALL |

SWEEP |

BULLISH |

12/20/24 |

$4.15 |

$4.05 |

$4.15 |

$22.00 |

$47.7K |

2 |

5 |

PFE |

PUT |

SWEEP |

BULLISH |

01/17/25 |

$2.4 |

$2.07 |

$2.07 |

$25.00 |

$41.3K |

59.0K |

0 |

符号 |

看跌/看涨 |

交易类型 |

情绪 |

Exp。日期 |

问 |

出价 |

价格 |

行使价 |

总交易价格 |

未平仓合约 |

音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

PFE |

打电话 |

扫 |

看涨 |

01/16/26 |

8.25 美元 |

8.1 美元 |

8.25 美元 |

17.50 美元 |

150.1 万美元 |

443 |

182 |

PFE |

放 |

扫 |

粗鲁的 |

06/20/25 |

10.2 美元 |

10.1 |

10.2 美元 |

35.00 美元 |

136.6K |

343 |

0 |

PFE |

打电话 |

扫 |

粗鲁的 |

01/16/26 |

6.65 美元 |

6.45 美元 |

6.45 美元 |

20.00 美元 |

70.9 万美元 |

8.2K |

10 |

PFE |

打电话 |

扫 |

看涨 |

12/20/24 |

4.15 美元 |

4.05 美元 |

4.15 美元 |

22.00 美元 |

47.7 万美元 |

2 |

5 |

PFE |

放 |

扫 |

看涨 |

01/17/25 |

2.4 美元 |

2.07 美元 |

2.07 美元 |

25.00 美元 |

41.3 万美元 |

59.0K |

0 |

About Pfizer

关于辉瑞

Pfizer is one of the world's largest pharmaceutical firms, with annual sales close to $50 billion (excluding COVID-19 product sales). While it historically sold many types of healthcare products and chemicals, now prescription drugs and vaccines account for the majority of sales. Top sellers include pneumococcal vaccine Prevnar 13, cancer drug Ibrance, and cardiovascular treatment Eliquis. Pfizer sells these products globally, with international sales representing close to 50% of total sales. Within international sales, emerging markets are a major contributor.

辉瑞是全球最大的制药公司之一,年销售额接近 500 亿美元(不包括 COVID-19 产品的销售额)。尽管它历来销售许多类型的医疗保健产品和化学品,但现在处方药和疫苗占销售额的大部分。最畅销的产品包括肺炎球菌疫苗Prevnar 13、抗癌药物Ibrance和心血管治疗药物Eliquis。辉瑞在全球销售这些产品,国际销售额占总销售额的近50%。在国际销售中,新兴市场是主要贡献者。

Where Is Pfizer Standing Right Now?

辉瑞现在在哪里?

Currently trading with a volume of 3,549,737, the PFE's price is up by 0.57%, now at $25.41.

RSI readings suggest the stock is currently may be oversold.

Anticipated earnings release is in 5 days.

PFE目前的交易量为3549,737美元,价格上涨了0.57%,目前为25.41美元。

RSI读数表明该股目前可能已超卖。

预计财报将在5天后发布。

Expert Opinions on Pfizer

关于辉瑞的专家意见

4 market experts have recently issued ratings for this stock, with a consensus target price of $45.0.

4位市场专家最近发布了该股的评级,共识目标价为45.0美元。

In a cautious move, an analyst from Cantor Fitzgerald downgraded its rating to Overweight, setting a price target of $45.

Reflecting concerns, an analyst from Cantor Fitzgerald lowers its rating to Overweight with a new price target of $45.

In a cautious move, an analyst from Cantor Fitzgerald downgraded its rating to Overweight, setting a price target of $45.

In a cautious move, an analyst from Cantor Fitzgerald downgraded its rating to Overweight, setting a price target of $45.

坎托·菲茨杰拉德的一位分析师谨慎地将其评级下调至增持,将目标股价定为45美元。

坎托·菲茨杰拉德的一位分析师将其评级下调至增持,新的目标股价为45美元,这反映了人们的担忧。

坎托·菲茨杰拉德的一位分析师谨慎地将其评级下调至增持,将目标股价定为45美元。

坎托·菲茨杰拉德的一位分析师谨慎地将其评级下调至增持,将目标股价定为45美元。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Pfizer with Benzinga Pro for real-time alerts.

交易期权涉及更大的风险,但也提供了更高利润的潜力。精明的交易者通过持续的教育、战略贸易调整、利用各种指标以及随时关注市场动态来降低这些风险。使用Benzinga Pro了解辉瑞的最新期权交易,以获取实时警报。

moomoo是Moomoo Technologies Inc.公司提供的金融信息和交易应用程序。

在美国,moomoo上的投资产品和服务由Moomoo Financial Inc.提供,一家受美国证券交易委员会(SEC)监管的持牌主体。 Moomoo Financial Inc.是金融业监管局(FINRA)和证券投资者保护公司(SIPC)的成员。

在新加坡,moomoo上的投资产品和服务是通过Moomoo Financial Singapore Pte. Ltd.提供,该公司受新加坡金融管理局(MAS)监管(牌照号码︰CMS101000) ,持有资本市场服务牌照 (CMS) ,持有财务顾问豁免(Exempt Financial Adviser)资质。本内容未经新加坡金融管理局的审查。

在澳大利亚,moomoo上的金融产品和服务是通过Futu Securities (Australia) Ltd提供,该公司是受澳大利亚证券和投资委员会(ASIC)监管的澳大利亚金融服务许可机构(AFSL No. 224663)。请阅读并理解我们的《金融服务指南》、《条款与条件》、《隐私政策》和其他披露文件,这些文件可在我们的网站 https://www.moomoo.com/au中获取。

在加拿大,通过moomoo应用提供的仅限订单执行的券商服务由Moomoo Financial Canada Inc.提供,并受加拿大投资监管机构(CIRO)监管。

在马来西亚,moomoo上的投资产品和服务是通过Moomoo Securities Malaysia Sdn. Bhd. 提供,该公司受马来西亚证券监督委员会(SC)监管(牌照号码︰eCMSL/A0397/2024) ,持有资本市场服务牌照 (CMSL) 。本内容未经马来西亚证券监督委员会的审查。

Moomoo Technologies Inc., Moomoo Financial Inc., Moomoo Financial Singapore Pte. Ltd., Futu Securities (Australia) Ltd, Moomoo Financial Canada Inc.,和Moomoo Securities Malaysia Sdn. Bhd.是关联公司。

风险及免责提示

moomoo是Moomoo Technologies Inc.公司提供的金融信息和交易应用程序。

在美国,moomoo上的投资产品和服务由Moomoo Financial Inc.提供,一家受美国证券交易委员会(SEC)监管的持牌主体。 Moomoo Financial Inc.是金融业监管局(FINRA)和证券投资者保护公司(SIPC)的成员。

在新加坡,moomoo上的投资产品和服务是通过Moomoo Financial Singapore Pte. Ltd.提供,该公司受新加坡金融管理局(MAS)监管(牌照号码︰CMS101000) ,持有资本市场服务牌照 (CMS) ,持有财务顾问豁免(Exempt Financial Adviser)资质。本内容未经新加坡金融管理局的审查。

在澳大利亚,moomoo上的金融产品和服务是通过Futu Securities (Australia) Ltd提供,该公司是受澳大利亚证券和投资委员会(ASIC)监管的澳大利亚金融服务许可机构(AFSL No. 224663)。请阅读并理解我们的《金融服务指南》、《条款与条件》、《隐私政策》和其他披露文件,这些文件可在我们的网站 https://www.moomoo.com/au中获取。

在加拿大,通过moomoo应用提供的仅限订单执行的券商服务由Moomoo Financial Canada Inc.提供,并受加拿大投资监管机构(CIRO)监管。

在马来西亚,moomoo上的投资产品和服务是通过Moomoo Securities Malaysia Sdn. Bhd. 提供,该公司受马来西亚证券监督委员会(SC)监管(牌照号码︰eCMSL/A0397/2024) ,持有资本市场服务牌照 (CMSL) 。本内容未经马来西亚证券监督委员会的审查。

Moomoo Technologies Inc., Moomoo Financial Inc., Moomoo Financial Singapore Pte. Ltd., Futu Securities (Australia) Ltd, Moomoo Financial Canada Inc.,和Moomoo Securities Malaysia Sdn. Bhd.是关联公司。

- 分享到weixin

- 分享到qq

- 分享到facebook

- 分享到twitter

- 分享到微博

- 粘贴板

使用浏览器的分享功能,分享给你的好友吧