Z9Gwqc14JU

赞并评论了

金融科技蚂蚁集团旗下的 $阿里巴巴(BABA.US$ 据说主要投资者华平将估值下调了15%,至2000亿美元以下。

路透社援引消息人士的话说,私募股权投资公司华平是蚂蚁金服2018年筹款的大型投资者,该公司估值从6月底的2240亿美元下调至9月底的1910亿美元。报告还称,有迹象表明,蚂蚁金服计划中的首次公开募股不会在短期内实现。

据路透社报道,华堡以 “监管发展和正在进行的重组的影响” 为由改变了对这家金融科技巨头的估值方法。

中国监管机构命令蚂蚁集团重组为一家金融控股公司,而持有蚂蚁集团股份的阿里巴巴不得不在4月份支付创纪录的27.5亿美元的反垄断罚款。

去年,蚂蚁金服在轰动一时的IPO双重上市之前的估值为3150亿美元,监管机构在11月的最后一刻撤回了首次公开募股。5月,富达将蚂蚁集团的估值从3000亿美元的高位下调至1440亿美元。

另外,《华尔街日报》早些时候报道说,作为蚂蚁金服旨在安抚中国当局的重组工作的一部分,蚂蚁已经成立了一家新的消费金融公司,并将其信贷业务并入了新实体。

蚂蚁集团董事弗雷德·胡在7月告诉日经指数,他预计该公司将能够 “不久之后” 恢复暂停的首次公开募股。

本周早些时候,阿里巴巴、百度等因中国政府处以罚款而下跌。

路透社援引消息人士的话说,私募股权投资公司华平是蚂蚁金服2018年筹款的大型投资者,该公司估值从6月底的2240亿美元下调至9月底的1910亿美元。报告还称,有迹象表明,蚂蚁金服计划中的首次公开募股不会在短期内实现。

据路透社报道,华堡以 “监管发展和正在进行的重组的影响” 为由改变了对这家金融科技巨头的估值方法。

中国监管机构命令蚂蚁集团重组为一家金融控股公司,而持有蚂蚁集团股份的阿里巴巴不得不在4月份支付创纪录的27.5亿美元的反垄断罚款。

去年,蚂蚁金服在轰动一时的IPO双重上市之前的估值为3150亿美元,监管机构在11月的最后一刻撤回了首次公开募股。5月,富达将蚂蚁集团的估值从3000亿美元的高位下调至1440亿美元。

另外,《华尔街日报》早些时候报道说,作为蚂蚁金服旨在安抚中国当局的重组工作的一部分,蚂蚁已经成立了一家新的消费金融公司,并将其信贷业务并入了新实体。

蚂蚁集团董事弗雷德·胡在7月告诉日经指数,他预计该公司将能够 “不久之后” 恢复暂停的首次公开募股。

本周早些时候,阿里巴巴、百度等因中国政府处以罚款而下跌。

已翻译

38

13

Z9Gwqc14JU

赞并评论了

$特斯拉(TSLA.US$ Tesla first introduced personal auto insurance in California in 2019 through State National Insurance. More recently, the company took the next step forward in its insurance journey by offering personal auto insurance in Texas through the underwriting company Redpoint County Mutual Insurance. It's important to note that Tesla isn't an underwriting company, it is partnering with underwriting companies to offer its product under the Tesla Insurance name.

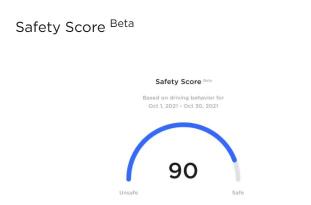

The premium is determined based on what vehicle you drive, your provided address, how much you drive, and what coverage you select. The company is not using traditional variables like credit, age, gender, and claim history to price their insurance. With Texas, Tesla also introduced their UBI program called the Safety Score as an additional factor in determining premium.

The Safety Score is based on driving behavior and assigns the driver a score from 0 to 100 based on five safety factors:

1. Forward Collision Warnings per 1,000 Miles: Audible and visual alerts provided to the driver in situations where a possible collision could occur due to an object in front of the vehicle. Maintaining a safe distance and paying attention to the traffic around you helps improve your score.

2. Hard Braking*: Defined as a decrease in the vehicle’s speed larger than 6.7 mph, in one second. Despite the definition, I think we all know what hard braking is. The Safety score can be improved by engaging the brake pedal early when slowing down, coming to a stop, or reacting to a change in the environment.

3. Aggressive Turning*: Defined as an increase in vehicle’s speed to the left/right greater than 8.9 mph, in one second. Again, we all know aggressive turning when we see it. The Safety Score can be improved by turning, changing lanes, or rounding a corner gradually instead of aggressively.

4. Unsafe Following*: Tesla vehicles measure their own speed, the speed of the vehicle in front of them and the distance between the two vehicles. Based on these measurements, Tesla calculates Headway, or the number of seconds you would have to react and stop if the vehicle in front of you came to a sudden stop. Unsafe following is the proportion of time where your vehicle’s headway is less than 1.0 seconds relative to the time that your vehicle’s headway is less than 3.0 seconds. Unsafe following is only measured when your vehicle is traveling at least 50 mph. The Safety Score can be improved by not tailgating or driving close to the vehicle in front of you so you have enough time to react.

5. Forced Autopilot Disengagement: If you remove your hands from the steering wheel during Autopilot, an audio and visual warning is sent to the driver. Three of these warnings result in Autopilot system disengagement for the remainder of a trip.

*Not factored into the Safety Score formula when on Autopilot

These factors are measured directly by the Tesla models using various sensors on the vehicle and Autopilot software. Although this is a significant step forward in Tesla’s insurance journey, The Safety Score isn’t something that’s new.

Many major U.S personal auto insurers have introduced optional UBI programs that assign a score to the driver. Nonetheless, there are a couple of meaningful items that differentiate Tesla.

Some of the factors introduced by Tesla in Texas are different to what other insurance carriers have. For example, Progressive doesn’t have forward collision warnings or unsafe following as factors. On the other hand, Progressive includes late night driving and driving less overall as factors within their UBI program. Tesla is likely to introduce new factors and tweak existing factors within the Safety Score as more data becomes available.

Unlike other major carriers, Tesla doesn't require and additional device to be installed in the vehicle to capture driving behavior. Tesla uses specific features within the vehicle to evaluate premium based on actual driving.

The Safety Score is updated daily to provide real-time feedback on driving safety. The daily Safety Scores are combined (up to 30 days) to provide a premium based on the months’ driving activity. Below is an example of how the premium could change based on the score by month. Traditional insurance carriers don’t offer daily updates and change in premiums by month. Instead, it’s typical to have a monitoring period of 6 months before receiving a score and change in premium.

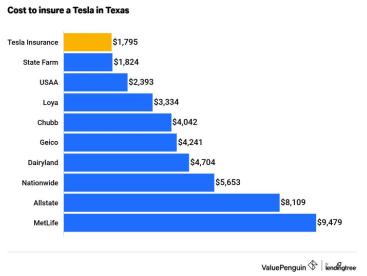

Based on the introduction of the Safety Score and partnership with Repoint Insurance, Tesla Insurance is the cheapest option for full coverage in Texas.

Lastly, and most importantly, the company will be able to leverage first party data to predict collision frequency due to the technology within Tesla cars. Other insurance carriers will likely have to partner with different manufacturers to capture data within cars at the point of sale, Tesla already has first party data.

CFO, Zachary Kirkhorn, explained:

At Tesla, because our cars are connected, because they are essentially computers on wheels, there's enormous amounts of data that we have available to us to be able to assess the attributes of a driver who's operating that car, and whether those attributes correlate with safety.

We've been able to go back and analyze that data and we've learned 2 things coming from that. The first is that the probability of collision for a customer using safety score versus not is 30% lower. That's a pretty big difference.

It means that the product is working and customers are responding to it. The second thing that we've looked at is what is the probability of collision based upon actual data as a function of a driver safety score. And that is aligning with our models. Most notably, if you're in the top tier of safety compared to lower tiers, there's multiplex difference in probability of collision based upon actual data.

Tesla is looking at hundreds of different variables and billions of miles of driving history to predict loss frequency and price each risk individually. The dataset will continue to grow and get better as Tesla sells more cars and as people drive more. Tesla is planning to launch personal auto insurance in every major market in which they have cars.

The premium is determined based on what vehicle you drive, your provided address, how much you drive, and what coverage you select. The company is not using traditional variables like credit, age, gender, and claim history to price their insurance. With Texas, Tesla also introduced their UBI program called the Safety Score as an additional factor in determining premium.

The Safety Score is based on driving behavior and assigns the driver a score from 0 to 100 based on five safety factors:

1. Forward Collision Warnings per 1,000 Miles: Audible and visual alerts provided to the driver in situations where a possible collision could occur due to an object in front of the vehicle. Maintaining a safe distance and paying attention to the traffic around you helps improve your score.

2. Hard Braking*: Defined as a decrease in the vehicle’s speed larger than 6.7 mph, in one second. Despite the definition, I think we all know what hard braking is. The Safety score can be improved by engaging the brake pedal early when slowing down, coming to a stop, or reacting to a change in the environment.

3. Aggressive Turning*: Defined as an increase in vehicle’s speed to the left/right greater than 8.9 mph, in one second. Again, we all know aggressive turning when we see it. The Safety Score can be improved by turning, changing lanes, or rounding a corner gradually instead of aggressively.

4. Unsafe Following*: Tesla vehicles measure their own speed, the speed of the vehicle in front of them and the distance between the two vehicles. Based on these measurements, Tesla calculates Headway, or the number of seconds you would have to react and stop if the vehicle in front of you came to a sudden stop. Unsafe following is the proportion of time where your vehicle’s headway is less than 1.0 seconds relative to the time that your vehicle’s headway is less than 3.0 seconds. Unsafe following is only measured when your vehicle is traveling at least 50 mph. The Safety Score can be improved by not tailgating or driving close to the vehicle in front of you so you have enough time to react.

5. Forced Autopilot Disengagement: If you remove your hands from the steering wheel during Autopilot, an audio and visual warning is sent to the driver. Three of these warnings result in Autopilot system disengagement for the remainder of a trip.

*Not factored into the Safety Score formula when on Autopilot

These factors are measured directly by the Tesla models using various sensors on the vehicle and Autopilot software. Although this is a significant step forward in Tesla’s insurance journey, The Safety Score isn’t something that’s new.

Many major U.S personal auto insurers have introduced optional UBI programs that assign a score to the driver. Nonetheless, there are a couple of meaningful items that differentiate Tesla.

Some of the factors introduced by Tesla in Texas are different to what other insurance carriers have. For example, Progressive doesn’t have forward collision warnings or unsafe following as factors. On the other hand, Progressive includes late night driving and driving less overall as factors within their UBI program. Tesla is likely to introduce new factors and tweak existing factors within the Safety Score as more data becomes available.

Unlike other major carriers, Tesla doesn't require and additional device to be installed in the vehicle to capture driving behavior. Tesla uses specific features within the vehicle to evaluate premium based on actual driving.

The Safety Score is updated daily to provide real-time feedback on driving safety. The daily Safety Scores are combined (up to 30 days) to provide a premium based on the months’ driving activity. Below is an example of how the premium could change based on the score by month. Traditional insurance carriers don’t offer daily updates and change in premiums by month. Instead, it’s typical to have a monitoring period of 6 months before receiving a score and change in premium.

Based on the introduction of the Safety Score and partnership with Repoint Insurance, Tesla Insurance is the cheapest option for full coverage in Texas.

Lastly, and most importantly, the company will be able to leverage first party data to predict collision frequency due to the technology within Tesla cars. Other insurance carriers will likely have to partner with different manufacturers to capture data within cars at the point of sale, Tesla already has first party data.

CFO, Zachary Kirkhorn, explained:

At Tesla, because our cars are connected, because they are essentially computers on wheels, there's enormous amounts of data that we have available to us to be able to assess the attributes of a driver who's operating that car, and whether those attributes correlate with safety.

We've been able to go back and analyze that data and we've learned 2 things coming from that. The first is that the probability of collision for a customer using safety score versus not is 30% lower. That's a pretty big difference.

It means that the product is working and customers are responding to it. The second thing that we've looked at is what is the probability of collision based upon actual data as a function of a driver safety score. And that is aligning with our models. Most notably, if you're in the top tier of safety compared to lower tiers, there's multiplex difference in probability of collision based upon actual data.

Tesla is looking at hundreds of different variables and billions of miles of driving history to predict loss frequency and price each risk individually. The dataset will continue to grow and get better as Tesla sells more cars and as people drive more. Tesla is planning to launch personal auto insurance in every major market in which they have cars.

15

9

Z9Gwqc14JU

赞并评论了

罗森布拉特分析师肖恩·霍根在一份总结该公司与前市场监管机构的前两次讨论的报告中写道:“监管即将进入加密市场,但这将是一个缓慢而谨慎的过程。”

Brett Redfearn,美国证券交易委员会交易与市场部前主管、美国证券交易委员会前资本市场主管 $Coinbase(COIN.US$,美国商品期货交易委员会市场监督部前主任、Coinbase业务线和市场前副总裁兼总法律顾问多萝西·德威特是加密货币监管系列文章的前两位演讲者。

双方都认为,政府不太可能像Coinbase所建议的那样为加密货币设立新的联邦监管机构,因为这将是最昂贵的选择。雷德费恩预计,由于美国证券交易委员会在国会山的影响力及其对投资者保护的关注,美国证券交易委员会可能会获得该授权。

德威特认为财政部和银行监管机构有可能监督稳定币,而美国证券交易委员会或美国商品期货交易委员会可能会对非稳定币领域进行监督。

她预计,鉴于总统金融市场工作组本月早些时候的提议,稳定币发行人将像银行一样受到严格监管。

霍根说,雷德费恩认为,大型银行需要深入研究采用加密资产,因为去中心化金融应用程序会将资金从银行转移到试图去中间化银行的个人手中,从而构成威胁。

他说,根据霍根的报告,抵制监管变革的公司可能 “在短期内获得更多的市场份额,但那些按预期监管积极主动的公司将在长期内受益”。分析师认为这是有益的 $Robinhood(HOOD.US$ 对于 Coinbase 来说是不利的, $泰达币(USDT.CC$,还有 BlockFi。

两位前监管机构还讨论了对订单流支付(PFOF)进行更严格的监管的可能性,这将影响Robinhood和Robinhood等股票 $Virtu金融(VIRT.US$。

Redfearn预计,加密PFOF将与股票和期权PFOF分开处理。霍根说,目前大多数焦点似乎都集中在股票PFOF上;这对Robinhood来说是一个积极因素,因为其股权PFOF收入占其PFOF收入的百分比正在萎缩。

8月,美国证券交易委员会主席加里·根斯勒表示,对PFOF的全面禁令已经摆在桌面上。

在今天的加密新闻中,美国银行监管机构将在加密冲刺中重点关注托管、交易、稳定币

$比特币(BTC.CC$ $狗狗币(DOGE.CC$ $以太坊(ETH.CC$

Brett Redfearn,美国证券交易委员会交易与市场部前主管、美国证券交易委员会前资本市场主管 $Coinbase(COIN.US$,美国商品期货交易委员会市场监督部前主任、Coinbase业务线和市场前副总裁兼总法律顾问多萝西·德威特是加密货币监管系列文章的前两位演讲者。

双方都认为,政府不太可能像Coinbase所建议的那样为加密货币设立新的联邦监管机构,因为这将是最昂贵的选择。雷德费恩预计,由于美国证券交易委员会在国会山的影响力及其对投资者保护的关注,美国证券交易委员会可能会获得该授权。

德威特认为财政部和银行监管机构有可能监督稳定币,而美国证券交易委员会或美国商品期货交易委员会可能会对非稳定币领域进行监督。

她预计,鉴于总统金融市场工作组本月早些时候的提议,稳定币发行人将像银行一样受到严格监管。

霍根说,雷德费恩认为,大型银行需要深入研究采用加密资产,因为去中心化金融应用程序会将资金从银行转移到试图去中间化银行的个人手中,从而构成威胁。

他说,根据霍根的报告,抵制监管变革的公司可能 “在短期内获得更多的市场份额,但那些按预期监管积极主动的公司将在长期内受益”。分析师认为这是有益的 $Robinhood(HOOD.US$ 对于 Coinbase 来说是不利的, $泰达币(USDT.CC$,还有 BlockFi。

两位前监管机构还讨论了对订单流支付(PFOF)进行更严格的监管的可能性,这将影响Robinhood和Robinhood等股票 $Virtu金融(VIRT.US$。

Redfearn预计,加密PFOF将与股票和期权PFOF分开处理。霍根说,目前大多数焦点似乎都集中在股票PFOF上;这对Robinhood来说是一个积极因素,因为其股权PFOF收入占其PFOF收入的百分比正在萎缩。

8月,美国证券交易委员会主席加里·根斯勒表示,对PFOF的全面禁令已经摆在桌面上。

在今天的加密新闻中,美国银行监管机构将在加密冲刺中重点关注托管、交易、稳定币

$比特币(BTC.CC$ $狗狗币(DOGE.CC$ $以太坊(ETH.CC$

已翻译

32

12

Z9Gwqc14JU

赞了

$Palantir(PLTR.US$ 2.5 billion + in cash

Virtually zero debt (under 15 million)

FCF positive

Not profitable by choice and at that, net losses are just barely there.

Net income has always hovered between -100 million to -200 million.

^^ that is by choice.

Virtually zero debt (under 15 million)

FCF positive

Not profitable by choice and at that, net losses are just barely there.

Net income has always hovered between -100 million to -200 million.

^^ that is by choice.

15

4

Z9Gwqc14JU

赞并评论了

$阿里巴巴(BABA.US$ In 1980 the PE on the S&P got down to 7 when the market crashed. The PE of Alibaba is now about 16.

Food for thought. Maybe value is not as much protection as we perhaps think.

Food for thought. Maybe value is not as much protection as we perhaps think.

10

4

Z9Gwqc14JU

赞了

In 2016-2017, the WS have criple $京东(JD.US$ with story of CEO and some women…..i was in JD from 40 to 23$

Ju must know with who you play this game….

Just time, time is everything, in this case, $阿里巴巴(BABA.US$ in 2025 is 300$ stock….they will do just 75 bill$ stock buyback in that time

WS is ruthles, but playing same story for years

Also Chipotle and food poising….😂😂😂😂😂😂🔝

Ju must know with who you play this game….

Just time, time is everything, in this case, $阿里巴巴(BABA.US$ in 2025 is 300$ stock….they will do just 75 bill$ stock buyback in that time

WS is ruthles, but playing same story for years

Also Chipotle and food poising….😂😂😂😂😂😂🔝

25

12

Z9Gwqc14JU

赞了

$英伟达(NVDA.US$ 从技术上讲,在过去的5年中(至少如此),它的估值一直被高估了。因此,过高的估值不足以宣布退出。真正的问题是:NVDA是否会在不久的将来成为一家价值万亿美元的公司?如果不是,那么其他地方就有有利条件。如果是这样,价值万亿美元的公司往往会走得更高。市场允许某些素质的公司加入这个梦寐以求的万亿美元俱乐部,而且它们往往更注重创新,而不是利润。另外,如果首席执行官在过去的某个时候穿过摩托车夹克,那会有所帮助...我不确定到底为什么,但是那件摩托车夹克的价值似乎约为3亿美元。奇怪。很奇怪...

已翻译

11

3

Z9Gwqc14JU

赞并评论了

$比特币(BTC.CC$ Can’t fault the president for trying here. He’s thinking outside the box. Sounds like he’s taking a page out of Iceland’s playbook. Iceland capitalized on their own natural resources (also geothermal energy) to build aluminum production and farming. Yes, farming. Like massive greenhouses using geothermal energy. I’ve visited the,. Pretty impressive what they accomplished. Oh yeah, Iceland mines a lot of cryptocurrency too. You folks don’t laugh at Iceland, do you? They’re a pretty wealthy nation.

Meanwhile, our country increasingly prints cash and politicizes our monetary policy, playing games with what should be a more objective, partisan institution. This could also turn ugly. Maybe BTC could offer us all some schmuck insurance. Maybe in the comments section of the El Salvador version of SA, they are laughing at us.

Meanwhile, our country increasingly prints cash and politicizes our monetary policy, playing games with what should be a more objective, partisan institution. This could also turn ugly. Maybe BTC could offer us all some schmuck insurance. Maybe in the comments section of the El Salvador version of SA, they are laughing at us.

10

6

Z9Gwqc14JU

赞了

$ARK Innovation ETF(ARKK.US$ $特斯拉(TSLA.US$ the problem is she could be right on everything.. probably is...yet she will still underperform. she does not understand investing. it isn't a charity for the future. people want to invest to live well today and near future.

13

5

Z9Gwqc14JU

赞并评论了

Cathie Wood 的旗舰 $ARK Innovation ETF(ARKK.US$继续承受压力,该基金周一收盘下跌-4.19%,在过去十个交易日中的八个交易日中现已收于下行。

在过去的十天里,ARKK下跌了12.44%,今年迄今为止的交易价格为-13.86%。

该交易所交易基金盘中触及107.59美元的低点,这是自10月5日以来一个多月以来一直没有出现的低点。

此外,投资者似乎正在逃离ARKK。根据etfdb.com的数据,自11月1日以来,该ETF还见证了总额为3.5994亿美元的资本流出。

助长ARKK最近的抛售的是上涨 $美国10年期国债收益率(US10Y.BD$收益率,同期攀升了16个基点。传统上,随着收益率的上升,它们会给ARKK持有的以科技股为主的公司施加压力。

以下是ARKK的两个月图表,突显了其最近十天的跌幅。反对ARKK的投资者可能会将目光投向 $Tradr Short Innovation Daily ETF(SARK.US$,这是ARKK的反向竞争对手基金,在ARKK下滑的同一十天内,该基金的回报率为+12.56%。

$特斯拉(TSLA.US$

在过去的十天里,ARKK下跌了12.44%,今年迄今为止的交易价格为-13.86%。

该交易所交易基金盘中触及107.59美元的低点,这是自10月5日以来一个多月以来一直没有出现的低点。

此外,投资者似乎正在逃离ARKK。根据etfdb.com的数据,自11月1日以来,该ETF还见证了总额为3.5994亿美元的资本流出。

助长ARKK最近的抛售的是上涨 $美国10年期国债收益率(US10Y.BD$收益率,同期攀升了16个基点。传统上,随着收益率的上升,它们会给ARKK持有的以科技股为主的公司施加压力。

以下是ARKK的两个月图表,突显了其最近十天的跌幅。反对ARKK的投资者可能会将目光投向 $Tradr Short Innovation Daily ETF(SARK.US$,这是ARKK的反向竞争对手基金,在ARKK下滑的同一十天内,该基金的回报率为+12.56%。

$特斯拉(TSLA.US$

已翻译

39

14

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)

Z9Gwqc14JU : 购买 pypl