To Moon

赞了

$西方石油(OXY.US$

【核心摘要:1.这些美国证券市场的知识和法规必须要知道和了解,因为涉及到缴税的问题。现在尤其是为自己做交易,必须控制税务的风险。美国是成熟法治国家,法规很细腻,为的就是防止洗钱,所以别不当回事。我以后也不会做大量的日内交易和短线交易,所以也不会每天写盘后复盘图表解析报告了。以前为金融机构工作,就只管套利交易就行,现在为自己做交易不得不照顾到税务方面的问题 。】

【核心摘要:2.为了适应税务方面的情况,将由原来的短线和波段级别的博弈性操作交易改为中长线波段级别的博弈性交易(非价值投资),具体时间将暂定为2个月(61天)以上。特此通知。】

免责声明:该文章是私人操盘日志,不是观点和个股推荐,博主是以建数理模型定量分析的短线操作风格(常规大众的基本面分析和技术面分析,看图形做交易在我看来早已落伍,失效,使用的人太多,与赌博无异,有惊喜更多的是沮丧和绝望,赌博永远是高消费。),持股持仓还是保持随时(包括当天,甚至下一秒)就可能卖出的风格,但是我持股持仓在大多数情况下,时间通常会超过2个月,大盘不好时亏损总市值5%...

【核心摘要:1.这些美国证券市场的知识和法规必须要知道和了解,因为涉及到缴税的问题。现在尤其是为自己做交易,必须控制税务的风险。美国是成熟法治国家,法规很细腻,为的就是防止洗钱,所以别不当回事。我以后也不会做大量的日内交易和短线交易,所以也不会每天写盘后复盘图表解析报告了。以前为金融机构工作,就只管套利交易就行,现在为自己做交易不得不照顾到税务方面的问题 。】

【核心摘要:2.为了适应税务方面的情况,将由原来的短线和波段级别的博弈性操作交易改为中长线波段级别的博弈性交易(非价值投资),具体时间将暂定为2个月(61天)以上。特此通知。】

免责声明:该文章是私人操盘日志,不是观点和个股推荐,博主是以建数理模型定量分析的短线操作风格(常规大众的基本面分析和技术面分析,看图形做交易在我看来早已落伍,失效,使用的人太多,与赌博无异,有惊喜更多的是沮丧和绝望,赌博永远是高消费。),持股持仓还是保持随时(包括当天,甚至下一秒)就可能卖出的风格,但是我持股持仓在大多数情况下,时间通常会超过2个月,大盘不好时亏损总市值5%...

+8

1

To Moon

赞了

$QuantumScape(QS.US$

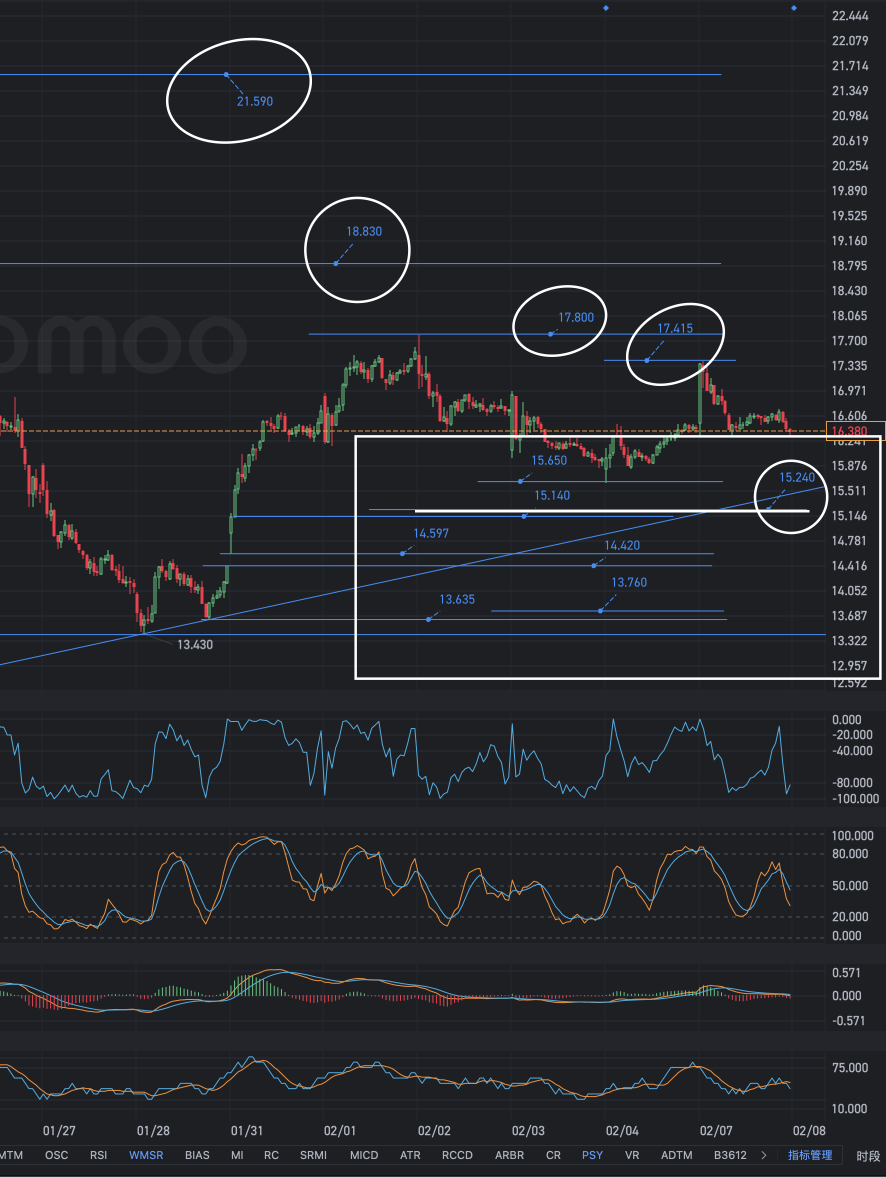

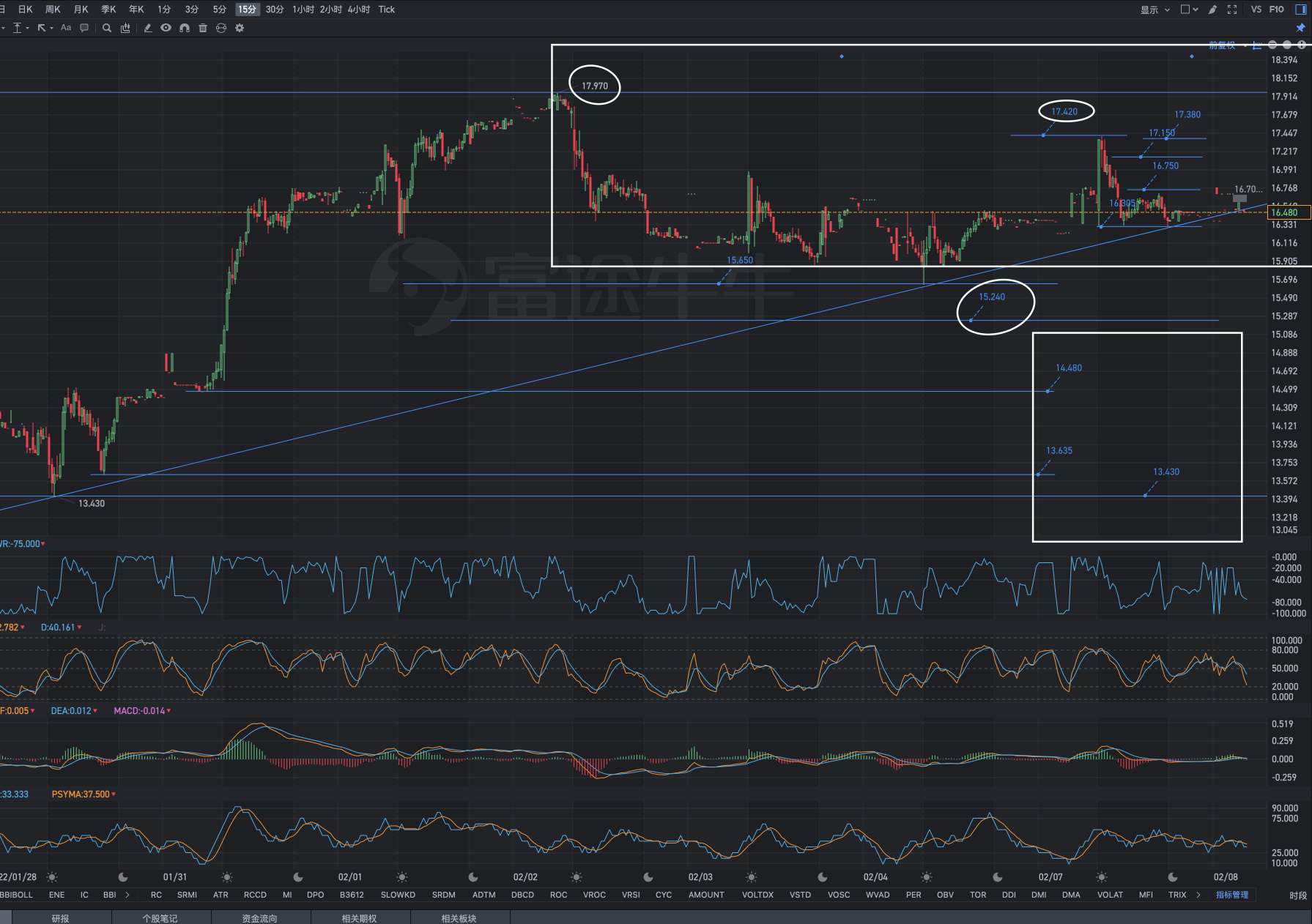

在美东时间2月16日主交易时间段收盘后公布QS财报之前,博弈性交易在15.65--15.24–14.48–13.64–13.43一带尝试建仓,不回调到这一带区域就坚决不建仓,纵然踏空也在所不惜,大盘指数上涨乏力,下跌的可能性更大,必须清楚地知道到现在为止还没有开始加息和缩表;在17.42–17.97一带以上则是需要果断抛售出去,而不是做梦。哪有卖飞和踏空之说?真要错了,随时可以再度杀入市场的。健全成熟股市可没有涨跌停板之说。15.65–17.42一带则是控盘主力实施欺骗套杀,吞噬情绪不稳的喜涨厌跌的擅长追高的头部玩家的真正可上可下的危险地带。

现实中更多的交易者在15.65–15.24–14.48–13.64–13.43一带因心生不满和愤恨、跳脚骂街而坐失建仓良机;在17.42–17.97一带以上因涨而亢奋,愿意出更大价钱追高而被套杀;在15.65–17.42一带则凭自己感觉毫无技术依据地胡乱交易买卖建仓,白白消费掉自己来之不易的交易本金。

很多事情,如果完全靠自己摸索,可能一辈子都找不到入门的路。要想出人头地,就得放下身段,踏踏...

在美东时间2月16日主交易时间段收盘后公布QS财报之前,博弈性交易在15.65--15.24–14.48–13.64–13.43一带尝试建仓,不回调到这一带区域就坚决不建仓,纵然踏空也在所不惜,大盘指数上涨乏力,下跌的可能性更大,必须清楚地知道到现在为止还没有开始加息和缩表;在17.42–17.97一带以上则是需要果断抛售出去,而不是做梦。哪有卖飞和踏空之说?真要错了,随时可以再度杀入市场的。健全成熟股市可没有涨跌停板之说。15.65–17.42一带则是控盘主力实施欺骗套杀,吞噬情绪不稳的喜涨厌跌的擅长追高的头部玩家的真正可上可下的危险地带。

现实中更多的交易者在15.65–15.24–14.48–13.64–13.43一带因心生不满和愤恨、跳脚骂街而坐失建仓良机;在17.42–17.97一带以上因涨而亢奋,愿意出更大价钱追高而被套杀;在15.65–17.42一带则凭自己感觉毫无技术依据地胡乱交易买卖建仓,白白消费掉自己来之不易的交易本金。

很多事情,如果完全靠自己摸索,可能一辈子都找不到入门的路。要想出人头地,就得放下身段,踏踏...

+2

2

To Moon

赞了

$QuantumScape(QS.US$

1.交易的绝技是,不贪婪,不恐惧,不后悔。

2.不贪婪,客观组合中庸,可持续发展。

3.不恐惧,追求有知者无畏,多做有用功,不赌博。

4.不后悔,赚认知范围内的钱,一后悔就会重回永炖机、永动机的牢笼。

5.三不原则不是口号,而是细节实务应用。

1.交易的绝技是,不贪婪,不恐惧,不后悔。

2.不贪婪,客观组合中庸,可持续发展。

3.不恐惧,追求有知者无畏,多做有用功,不赌博。

4.不后悔,赚认知范围内的钱,一后悔就会重回永炖机、永动机的牢笼。

5.三不原则不是口号,而是细节实务应用。

2

To Moon

赞了

$Biofrontera(BFRI.US$ -Biofrontera AG招募了首位患者参加评估Ameluz/bf-Rhodoled治疗痤疮的IIb期临床研究。股票支撑位为5.50美元

$QuantumScape(QS.US$ -股票接近22美元的支撑区域。如果持有,我们可能会逆转至25美元以上。

$Longeveron(LGVN.US$ -股票处于整合模式。注意突破20美元以继续走高。

$Lucid Group(LCID.US$ -正如预期的那样,股票从35美元的支撑位反弹。股票在40美元上方看起来看涨

$Galera Therapeutics(GRTX.US$ -Galera宣布在Avasopasem的3期ROMAN试验的更正顶线疗效数据中,主要终点具有统计学意义。还听说BTIG升级为买入,设定了15美元的目标股价

$QuantumScape(QS.US$ -股票接近22美元的支撑区域。如果持有,我们可能会逆转至25美元以上。

$Longeveron(LGVN.US$ -股票处于整合模式。注意突破20美元以继续走高。

$Lucid Group(LCID.US$ -正如预期的那样,股票从35美元的支撑位反弹。股票在40美元上方看起来看涨

$Galera Therapeutics(GRTX.US$ -Galera宣布在Avasopasem的3期ROMAN试验的更正顶线疗效数据中,主要终点具有统计学意义。还听说BTIG升级为买入,设定了15美元的目标股价

已翻译

14

4

To Moon

赞了

非图表承接短线交易

我不相信技术图表,因为市场心理和趋势不断变化,图表无法预测影响特定公司的外部事件。相反,我的短期交易从发现即将发生的影响股票的事件开始,例如,收益发布,新产品的发布等。例如,如果公司A发布收益,我会通过买入看涨期权或提前两周建立多头头寸,这取决于我对收益是否会超过或低于市场预期的评估。一旦收益出来,我就平仓。另一个例子是,在预期重大事件的情况下进行交易。为了说明这一点, $Astra Space(ASTR.US$将于2022年1月发射另一枚火箭。一次成功的发射可能会提振股价,如果火箭失败,反之亦然。由于我乐观地认为,他们拥有设计一次顺利发射的专业知识,我将在两周前积累他们的股票,并在知道发射结果后出售。

我不相信技术图表,因为市场心理和趋势不断变化,图表无法预测影响特定公司的外部事件。相反,我的短期交易从发现即将发生的影响股票的事件开始,例如,收益发布,新产品的发布等。例如,如果公司A发布收益,我会通过买入看涨期权或提前两周建立多头头寸,这取决于我对收益是否会超过或低于市场预期的评估。一旦收益出来,我就平仓。另一个例子是,在预期重大事件的情况下进行交易。为了说明这一点, $Astra Space(ASTR.US$将于2022年1月发射另一枚火箭。一次成功的发射可能会提振股价,如果火箭失败,反之亦然。由于我乐观地认为,他们拥有设计一次顺利发射的专业知识,我将在两周前积累他们的股票,并在知道发射结果后出售。

9

To Moon

赞了

$英伟达(NVDA.US$ $Unity Software(U.US$ $元宇宙概念(LIST2567.US$ 由于ARMS的交易,NVIDIA的股票昨天跌至280年代,但很快 “修正” 回到了300年代。看来300是一个坚实的基础。

从长远来看,人们对NVIDIA有什么看法?元界和人工智能在讨论中出现了很多问题,但我并不完全相信。

从长远来看,人们对NVIDIA有什么看法?元界和人工智能在讨论中出现了很多问题,但我并不完全相信。

已翻译

23

3

To Moon

赞了

$Palantir(PLTR.US$ has quite an interesting story. This company is often regarded as the most secretive startup in Silicon Valley. The firm started building cutting-edge software platforms for the CIA and FBI. Furthermore, the CIA and Pentagon deployed Palantir's platform in Afghanistan and Iraq. It also allegedly helped to track and locate Osama Bin Laden.

Sounds kind of cool. For retail investors, Palantir is a company investors have found a reason to jump on. This year, PLTR stock surged during the previous meme stock rally to hit $45 per share. However, like many meme stocks, Palantir has since fallen back to earth.

For many retail investors, this discount may seem intriguing. Personally, I remain neutral on PLTR stock right now. (See Analysts' Top Stocks on TipRanks)

Let's dive into the bull and bear case around this stock.

Impressive Growth Not Enough for the Market

One of the key bull theses driving interest in Palantir is the company's growth prospects moving forward. This software and analytics company has a business model at the intersection of growth and stability that many long-term investors like.

Palantir focuses on providing high-value customers (we'll discuss that more in a second) with meaningful insights via software analytics tools based on big data and AI. Thus, Palantir's success in generating market-beating revenue growth could signal that a strong, long-term cash flow machine is right around the corner.

Now, Palantir has not been consistently profitable, ever. This is a company that's continued investing heavily in its platform at the expense of profit. However, recent earnings suggest the tide may be turning on this front as well.

This past quarter, Palantir brought in $0.04 per share in earnings, meeting analyst expectations. It's earning a profit – a good sign for long-term investors looking at this stock.

However, on the top line, Palantir beat expectations, bringing in $392 million versus an estimated $385 million. That translates to 36% year-over-year growth. Certainly, not bad, particularly for a company of this size.

That said, PLTR stock sold off dramatically following this earnings report. It should be noted that investors had bid up shares prior to the report. Accordingly, it appears the market was pricing in some sort of massive beat this past quarter, which didn't materialize.

This sort of volatile price action has made Palantir a stock that's hard to intrinsically value. On the one hand, market sentiment shifts continue to provide volatile swings to the upside and the downside. With momentum driving shares all over the map, PLTR stock looks more like a trading vehicle right now than a long-term hold.

For those taking the longer view with PLTR stock, perhaps this volatility doesn't matter in the grand scheme of things. However, for those looking to hold this stock for a limited period of time, continued volatility will be something to watch with Palantir in the quarters to come.

Revenue Mix a Key Driver of Interest in Palantir

Another one of the key factors investors seem to like with Palantir is the company's client mix. Unlike many large corporations, which ultimately sell their goods to consumers or other large businesses, Palantir's focus has been on growing its revenue from government agencies.

As of the second quarter of this year, the

Revenue mix as of Q2

Having the U.S. government as the company's core client is generally seen as a good thing. The government will pay its bills and has unlimited resources to do so. However, one misstep and this whole game could be over should the government switch its software analytics provider.

It should be noted that this relationship between Palantir and the government appears to be pretty entrenched. Switching costs are likely very high at this point, and there seems to be a relatively wide moat around Palantir's core customer base. For bulls, this is a good thing.

Overall, Palantir's inability to provide profitable growth over many years has some investors worried about its pricing power with its core customer. Growth is great, but doing so profitably is important. Thus, the extent to which new contracts can be negotiated at better rates remains a key factor investors should keep an eye on.

Wall Street's Take

Turning to Wall Street, Palantir has a Moderate Sell consensus rating, based on one Buy, three Holds, and four Sells assigned in the past three months. The average Palantir price target of $23.14 implies 11.5% upside potential.

Analyst price targets range from a high of $31 per share to a low of $18 per share.

Bottom Line

The hopes for Palantir are high as a "best in breed" player in the field of data analytics, data mining, and security services. With the U.S. government as Palantir's biggest client, what could go wrong? This is a company that continues to grow its top line quickly, providing bulls with a strong investment thesis today.

However, bears seem to be vindicated in their view that this company's earnings potential remains muted. On a forward-looking price-to-earnings valuation basis, this stock is expensive. Accordingly, Palantir has work to do on its bottom line before many fundamental investors jump aboard.

Sounds kind of cool. For retail investors, Palantir is a company investors have found a reason to jump on. This year, PLTR stock surged during the previous meme stock rally to hit $45 per share. However, like many meme stocks, Palantir has since fallen back to earth.

For many retail investors, this discount may seem intriguing. Personally, I remain neutral on PLTR stock right now. (See Analysts' Top Stocks on TipRanks)

Let's dive into the bull and bear case around this stock.

Impressive Growth Not Enough for the Market

One of the key bull theses driving interest in Palantir is the company's growth prospects moving forward. This software and analytics company has a business model at the intersection of growth and stability that many long-term investors like.

Palantir focuses on providing high-value customers (we'll discuss that more in a second) with meaningful insights via software analytics tools based on big data and AI. Thus, Palantir's success in generating market-beating revenue growth could signal that a strong, long-term cash flow machine is right around the corner.

Now, Palantir has not been consistently profitable, ever. This is a company that's continued investing heavily in its platform at the expense of profit. However, recent earnings suggest the tide may be turning on this front as well.

This past quarter, Palantir brought in $0.04 per share in earnings, meeting analyst expectations. It's earning a profit – a good sign for long-term investors looking at this stock.

However, on the top line, Palantir beat expectations, bringing in $392 million versus an estimated $385 million. That translates to 36% year-over-year growth. Certainly, not bad, particularly for a company of this size.

That said, PLTR stock sold off dramatically following this earnings report. It should be noted that investors had bid up shares prior to the report. Accordingly, it appears the market was pricing in some sort of massive beat this past quarter, which didn't materialize.

This sort of volatile price action has made Palantir a stock that's hard to intrinsically value. On the one hand, market sentiment shifts continue to provide volatile swings to the upside and the downside. With momentum driving shares all over the map, PLTR stock looks more like a trading vehicle right now than a long-term hold.

For those taking the longer view with PLTR stock, perhaps this volatility doesn't matter in the grand scheme of things. However, for those looking to hold this stock for a limited period of time, continued volatility will be something to watch with Palantir in the quarters to come.

Revenue Mix a Key Driver of Interest in Palantir

Another one of the key factors investors seem to like with Palantir is the company's client mix. Unlike many large corporations, which ultimately sell their goods to consumers or other large businesses, Palantir's focus has been on growing its revenue from government agencies.

As of the second quarter of this year, the

Revenue mix as of Q2

Having the U.S. government as the company's core client is generally seen as a good thing. The government will pay its bills and has unlimited resources to do so. However, one misstep and this whole game could be over should the government switch its software analytics provider.

It should be noted that this relationship between Palantir and the government appears to be pretty entrenched. Switching costs are likely very high at this point, and there seems to be a relatively wide moat around Palantir's core customer base. For bulls, this is a good thing.

Overall, Palantir's inability to provide profitable growth over many years has some investors worried about its pricing power with its core customer. Growth is great, but doing so profitably is important. Thus, the extent to which new contracts can be negotiated at better rates remains a key factor investors should keep an eye on.

Wall Street's Take

Turning to Wall Street, Palantir has a Moderate Sell consensus rating, based on one Buy, three Holds, and four Sells assigned in the past three months. The average Palantir price target of $23.14 implies 11.5% upside potential.

Analyst price targets range from a high of $31 per share to a low of $18 per share.

Bottom Line

The hopes for Palantir are high as a "best in breed" player in the field of data analytics, data mining, and security services. With the U.S. government as Palantir's biggest client, what could go wrong? This is a company that continues to grow its top line quickly, providing bulls with a strong investment thesis today.

However, bears seem to be vindicated in their view that this company's earnings potential remains muted. On a forward-looking price-to-earnings valuation basis, this stock is expensive. Accordingly, Palantir has work to do on its bottom line before many fundamental investors jump aboard.

37

2

To Moon

赞了

嘿 mooers 只是想听听你对投资太空部门的看法。

我认识或现在的公司:Astra、Rocket-Lab、SPCE、Redwire、Ark-K

你觉得这些门票怎么样?我需要添加什么?在接下来的5-10年中,您对该行业的总体看法如何

$维珍银河(SPCE.US$ $Astra Space(ASTR.US$ $Rocket Lab(RKLB.US$

我认识或现在的公司:Astra、Rocket-Lab、SPCE、Redwire、Ark-K

你觉得这些门票怎么样?我需要添加什么?在接下来的5-10年中,您对该行业的总体看法如何

$维珍银河(SPCE.US$ $Astra Space(ASTR.US$ $Rocket Lab(RKLB.US$

已翻译

19

4

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)