嘿 moomoo-ers 们!

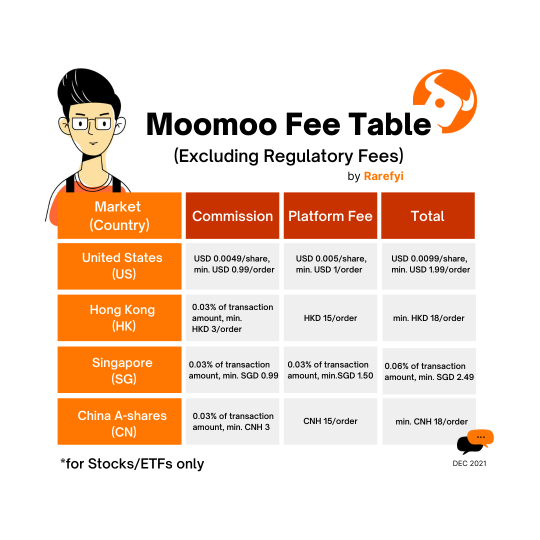

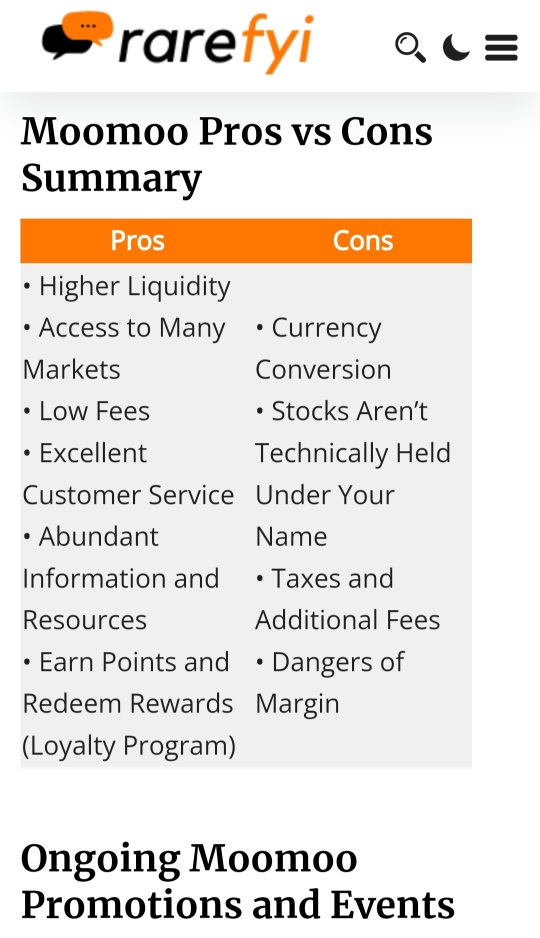

我们最近发表了一篇关于以下内容的文章 Rarefyi 关于 moomoo 的优缺点,以及对该平台的总体评价。

这基本上是你在使用moomoo应用程序进行投资时需要知道的基本知识。通过下面的链接查看完整文章!

https://rarefyi.com/investing-with-moomoo-app/

我们花了无数小时为您制作高质量的指南!希望你喜欢。![]()

与您的朋友分享文章或费用表...

我们最近发表了一篇关于以下内容的文章 Rarefyi 关于 moomoo 的优缺点,以及对该平台的总体评价。

这基本上是你在使用moomoo应用程序进行投资时需要知道的基本知识。通过下面的链接查看完整文章!

https://rarefyi.com/investing-with-moomoo-app/

我们花了无数小时为您制作高质量的指南!希望你喜欢。

与您的朋友分享文章或费用表...

已翻译

9

These days, I see many people investing in companies without even knowing what it does.

If you are a trader that analyses charts, follows momentum, or look at other technical factors, sure. But for the majority of us, investing in what we don't know will lead to disaster.

"Stick to your circle of competence" - Warren Buffett

The worst is, these people are influenced by emotions and panic sell when they see a red day.

What happens when you know what you're doing, and what you're investing in?

You won't be as affected emotionally and can make rational decisions. Since you know and believe in what you are investing in, emotions won't get the better of you when you see huge fluctuations in stock prices.

These are the basics to selecting companies:

1. Understand what the company does(your circle of competence)

2. How does the company make money and can they keep growing long term?

3. Use valuation methods such as P/E ratio, DCF, P/S ratio etc. to estimate the intrinsic value of the company

4. Is management of the company good, or ridden with scandals?

5. Are you comfortable holding this stock long term even if it goes down?

Being patient can be tough sometimes. But think about it this way - you don't have to do much once you decided on a company. If you done your research and fundamental analysis correctly, you don't have to worry about it.

It is only when something has fundamentally changed about a company that you need to evaluate it again.

Good luck!

If you are a trader that analyses charts, follows momentum, or look at other technical factors, sure. But for the majority of us, investing in what we don't know will lead to disaster.

"Stick to your circle of competence" - Warren Buffett

The worst is, these people are influenced by emotions and panic sell when they see a red day.

What happens when you know what you're doing, and what you're investing in?

You won't be as affected emotionally and can make rational decisions. Since you know and believe in what you are investing in, emotions won't get the better of you when you see huge fluctuations in stock prices.

These are the basics to selecting companies:

1. Understand what the company does(your circle of competence)

2. How does the company make money and can they keep growing long term?

3. Use valuation methods such as P/E ratio, DCF, P/S ratio etc. to estimate the intrinsic value of the company

4. Is management of the company good, or ridden with scandals?

5. Are you comfortable holding this stock long term even if it goes down?

Being patient can be tough sometimes. But think about it this way - you don't have to do much once you decided on a company. If you done your research and fundamental analysis correctly, you don't have to worry about it.

It is only when something has fundamentally changed about a company that you need to evaluate it again.

Good luck!

10

3

$苹果(AAPL.US$ The death of Steve Jobs, or the rise of competitors like Samsung. These are strong reasons to lose faith in Apple and many have chosen to abandon or worse short the stock.

Despite all the declines that the stock has faced, since the company's IPO in 1980 the stock has risen more than 670 times.

Does this not justify just how much one can earn should they have patience and understanding of the true value of Apple?

Read the full article!

https://rarefyi.com/100k-in-2-years/

Despite all the declines that the stock has faced, since the company's IPO in 1980 the stock has risen more than 670 times.

Does this not justify just how much one can earn should they have patience and understanding of the true value of Apple?

Read the full article!

https://rarefyi.com/100k-in-2-years/

1

Do you always seem to pick a stock and it suddenly plummets from there? You may think you have some curse on you picking the wrong stocks at the highest possible price.

Here's some helpful tips to choose the right stocks!

1. Understanding the Company

Do you understand what the company you're looking at is doing? Their business model? Their pros and cons? If you don't, investing in a company you don't understand can be disastrous.

2. Look at the Financials

After you've found a company that has a good business model and one that you understand, it's time to look at their financials.

You can find them with platforms such as Moomoo.

Look out for their revenue, P/E ratio, Profit Margin, and so on!

3. Invest...Long term

Once the company checks all your boxes, slowly add to your position (not all at once!). Hold it for the long term or until something fundamental about the business changes.

If you don't want to worry, do the research, analyze companies and fundamentals, I suggest buying an ETF that tracks an index. For example, tracks S&P 500, Dow Jones, and so on.

Historical data shows you'll get ~8-10% return per year passively if you invest in index funds.

Best of luck for investing!

Here's some helpful tips to choose the right stocks!

1. Understanding the Company

Do you understand what the company you're looking at is doing? Their business model? Their pros and cons? If you don't, investing in a company you don't understand can be disastrous.

2. Look at the Financials

After you've found a company that has a good business model and one that you understand, it's time to look at their financials.

You can find them with platforms such as Moomoo.

Look out for their revenue, P/E ratio, Profit Margin, and so on!

3. Invest...Long term

Once the company checks all your boxes, slowly add to your position (not all at once!). Hold it for the long term or until something fundamental about the business changes.

If you don't want to worry, do the research, analyze companies and fundamentals, I suggest buying an ETF that tracks an index. For example, tracks S&P 500, Dow Jones, and so on.

Historical data shows you'll get ~8-10% return per year passively if you invest in index funds.

Best of luck for investing!

This rule will hopefully be passed down generations to come.

Investing is NOT Gambling.

Investing requires you to find out about the company's background, financial statements, competitive moat etc. You may also invest into an index with a proven track record such as the S&P 500.

Buying into a company without even knowing what it does is a big NO.

Unless you're a trader following technicals and trends, investing requires you to buy into a company for the long term.

Trading is also not equals to investing. Moomoo and other sources provides educational content and courses for you to excel as a trader. Do not go in blind!

Hope this helps. May you be financially free!...

Investing is NOT Gambling.

Investing requires you to find out about the company's background, financial statements, competitive moat etc. You may also invest into an index with a proven track record such as the S&P 500.

Buying into a company without even knowing what it does is a big NO.

Unless you're a trader following technicals and trends, investing requires you to buy into a company for the long term.

Trading is also not equals to investing. Moomoo and other sources provides educational content and courses for you to excel as a trader. Do not go in blind!

Hope this helps. May you be financially free!...

我还记得我的第一次 $苹果(AAPL.US$IPhone是一部iPhone 5S。我必须努力学习才能取得好成绩,才能说服父母给我买这辆车。

苹果一直是占主导地位的品牌,现在仍然是。

...

苹果无可否认的竞争护城河是其品牌忠诚度。

...

给你喜欢的公司的投资小贴士

...

如果你喜欢苹果的产品,为什么不考虑拥有它呢?AAPL拥有强大的资产负债表。考虑把美元成本平均到苹果这样的蓝筹股,以获得稳定的回报。

...

当然,做你自己的事情吧。

...

购买一家你喜欢的公司将防止你在股票波动时变得过于情绪化。

...

如果你不让股票的短期波动影响你,你会成为一个更好的投资者。

...

感谢您的阅读!

...

苹果一直是占主导地位的品牌,现在仍然是。

...

苹果无可否认的竞争护城河是其品牌忠诚度。

...

给你喜欢的公司的投资小贴士

...

如果你喜欢苹果的产品,为什么不考虑拥有它呢?AAPL拥有强大的资产负债表。考虑把美元成本平均到苹果这样的蓝筹股,以获得稳定的回报。

...

当然,做你自己的事情吧。

...

购买一家你喜欢的公司将防止你在股票波动时变得过于情绪化。

...

如果你不让股票的短期波动影响你,你会成为一个更好的投资者。

...

感谢您的阅读!

...

已翻译

3

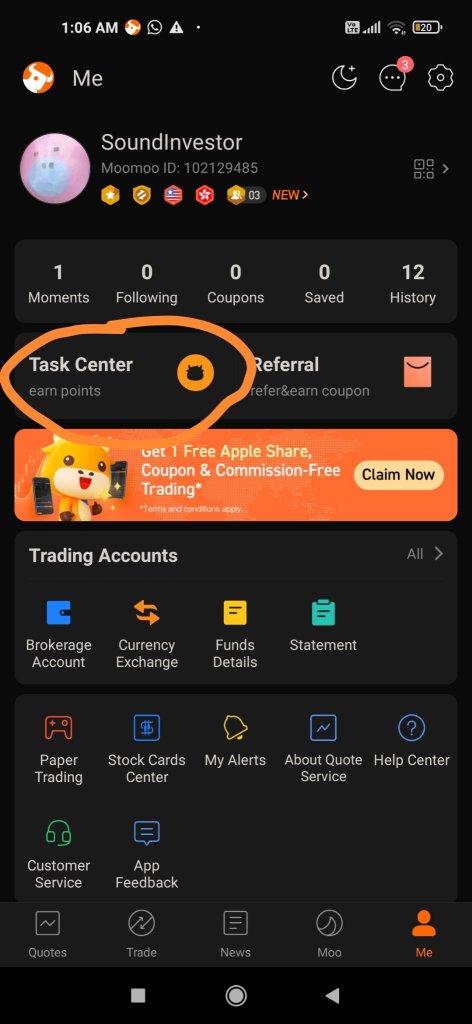

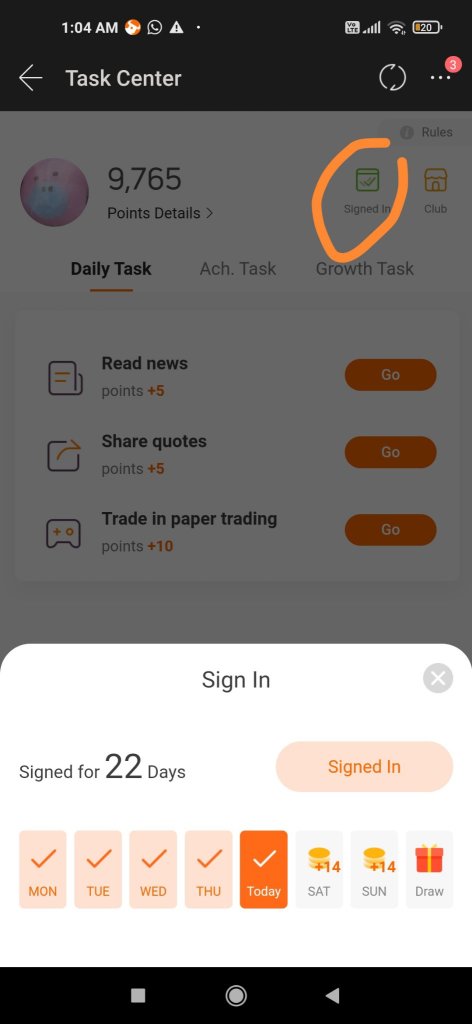

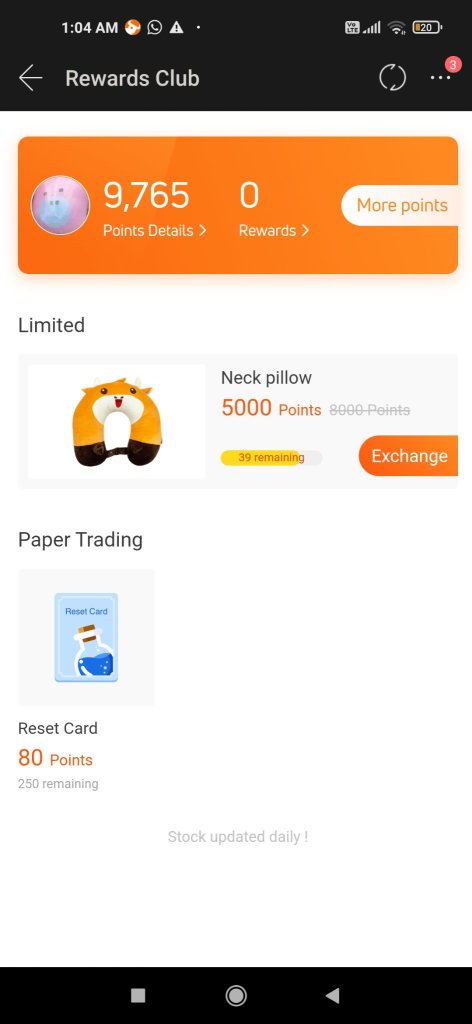

您知道访问任务中心可以累积积分吗?

点击 “登录” 以查看更多详细信息。

点击 “俱乐部” 查看可能的奖励。

我相信 Moomoo 将来会增加更多奖励。

希望将来还能增加佣金折扣、现金券或股票卡等奖励!

朋友提一下: @101891085

已经使用moomoo好几个月了,到目前为止还不错!

点击 “登录” 以查看更多详细信息。

点击 “俱乐部” 查看可能的奖励。

我相信 Moomoo 将来会增加更多奖励。

希望将来还能增加佣金折扣、现金券或股票卡等奖励!

朋友提一下: @101891085

已经使用moomoo好几个月了,到目前为止还不错!

已翻译

11

4

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)