Cow coming Home

参与了投票

目前,mooer们只能设立股票定投来投资于所有基金类型和单位信托,而付款通常是通过moomoo通用账户或他们的银行账户进行现金买入。 ![]()

Thus, aside from the precise NAV price (*1), using money from 401(k), CPF, and SRS (*2), and allowing RSP for stocks and ETFs (*3), $富途控股 (FUTU.US)$ 可能考虑允许mooer们选择moomoo ...

Thus, aside from the precise NAV price (*1), using money from 401(k), CPF, and SRS (*2), and allowing RSP for stocks and ETFs (*3), $富途控股 (FUTU.US)$ 可能考虑允许mooer们选择moomoo ...

已翻译

11

2

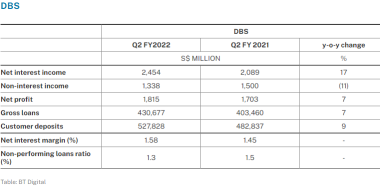

This year the trio of DBS, UOB and OCBC have contributed more than 25% of the average daily turnover of the Singapore stock market, while averaging a 3% YTD total return following the 25% average total return in 2021. Institutions have also been net sellers of the trio in the 2022 YTD, following on from net buying in 2021.

1. DBS

DBS beats forecasts with Q2 earnings up 7%, boosted by interest rate hikes.

2. UOB

United Overseas Bank (UOB) has reported a net pr...

1. DBS

DBS beats forecasts with Q2 earnings up 7%, boosted by interest rate hikes.

2. UOB

United Overseas Bank (UOB) has reported a net pr...

11

3

Cow coming Home

参与了投票

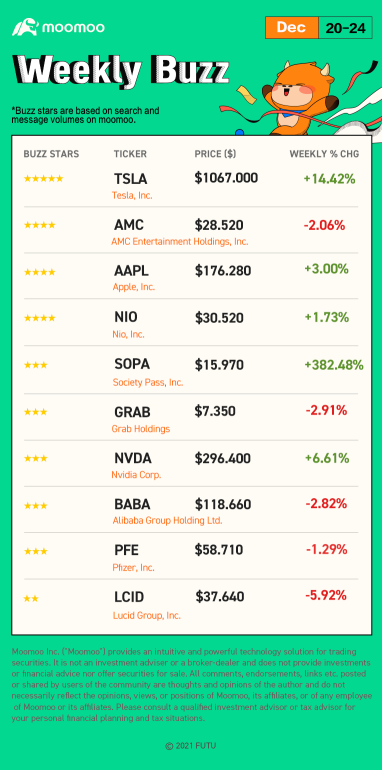

上周(截至2022年9月16日)的股票热度榜如下::

在本帖结尾,您有机会赢得积分!

星期一快乐 mooer们!你的圣诞节过得怎么样?欢迎回来! 每周热点在moomoo平台上,我们根据上周的搜索量和留言量,审查所选热门股票的新闻、表现和社区情绪!(排除纳米市值股票。)

第一部分:做出你的选择

第Ⅱ部分:热门股票列表与mooer们的评论

每个主要指数都有所变动 上涨,R...

在本帖结尾,您有机会赢得积分!

星期一快乐 mooer们!你的圣诞节过得怎么样?欢迎回来! 每周热点在moomoo平台上,我们根据上周的搜索量和留言量,审查所选热门股票的新闻、表现和社区情绪!(排除纳米市值股票。)

第一部分:做出你的选择

第Ⅱ部分:热门股票列表与mooer们的评论

每个主要指数都有所变动 上涨,R...

已翻译

+12

77

86

Cow coming Home

评论了

For this post, let's take short-term trading as intra-day trading that last from seconds to minutues. It's commonly termed as scalp, intrad-day swing trading. I'll use scalp here.

Why Scalp?

-- If you have a positive expectancy strategy, how do you make more $ from the strategy? One way is to generate more trades, the more the merrier! Why do casinos give you "free" goodies (cheap rooms, meal, drinks, etc)? To attract as many people to play (ie. trades) in the casino as possible! The more trades, the more they make; it's a number game.

-- Since scalping is so short-term, there is no need to trade many different instruments/symbols. No need to scan the thousands of stocks, options, etc. Save all those time scanning. looking at many charts, company fundamentals . Just focus on trading that 1 symbol. More productive use of your time, right?

-- No over-night risk. After you finish scalping, go sleep without fear of any nasty surprises when you wake up the next day. No position in the market = no market risk.

What to Scalp?

Must choose a instrument that has sufficient movement, daily range & liquidity. That movement should translate to good profit, ROI. So what do I scalp? My favorite is the emini index futures, specifically, symbol ES which is the S&P500 index futures. 1 tick (minimum price move) is 0.25 points for ES, & has a value of US$12.50 per contract (all dollar value is USD). You can get fee for a round-turn trade/contract of about $4 from discount broker. So, with just 1 tick profit, not only cover fee, just got profit (12.50-4.00) For example, On 7 Dec (Thur), during RTH (regular trading hours, meaning when the US stock market is open), the ES has a range of 50 points with 1.4 million contracts traded (very liquid). 50 pts translate to US$2,500/contract. Intra-day margin/contract about $500. 2500/500=500% ROI ! This is the power of a leverage product, which the ES is.

How to Scalp?

Trade mainly technically, although high impact news could move price. So must have good technical skills. Like other types of trading, the 3M of trading is important. Method, Mind, & Money Management.

I'll stop here for now; don't even know whether ppl will read it. If u did, thanks for time.

Have a great day!

Why Scalp?

-- If you have a positive expectancy strategy, how do you make more $ from the strategy? One way is to generate more trades, the more the merrier! Why do casinos give you "free" goodies (cheap rooms, meal, drinks, etc)? To attract as many people to play (ie. trades) in the casino as possible! The more trades, the more they make; it's a number game.

-- Since scalping is so short-term, there is no need to trade many different instruments/symbols. No need to scan the thousands of stocks, options, etc. Save all those time scanning. looking at many charts, company fundamentals . Just focus on trading that 1 symbol. More productive use of your time, right?

-- No over-night risk. After you finish scalping, go sleep without fear of any nasty surprises when you wake up the next day. No position in the market = no market risk.

What to Scalp?

Must choose a instrument that has sufficient movement, daily range & liquidity. That movement should translate to good profit, ROI. So what do I scalp? My favorite is the emini index futures, specifically, symbol ES which is the S&P500 index futures. 1 tick (minimum price move) is 0.25 points for ES, & has a value of US$12.50 per contract (all dollar value is USD). You can get fee for a round-turn trade/contract of about $4 from discount broker. So, with just 1 tick profit, not only cover fee, just got profit (12.50-4.00) For example, On 7 Dec (Thur), during RTH (regular trading hours, meaning when the US stock market is open), the ES has a range of 50 points with 1.4 million contracts traded (very liquid). 50 pts translate to US$2,500/contract. Intra-day margin/contract about $500. 2500/500=500% ROI ! This is the power of a leverage product, which the ES is.

How to Scalp?

Trade mainly technically, although high impact news could move price. So must have good technical skills. Like other types of trading, the 3M of trading is important. Method, Mind, & Money Management.

I'll stop here for now; don't even know whether ppl will read it. If u did, thanks for time.

Have a great day!

23

4

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)