Snope

留下了心情

$SPDR 标普500指数ETF(SPY.US$ $标普500指数(.SPX.US$ Just early last week, when most market participants were convinced that we were on the brink of a market correction, I highlighted to members of my community the power of excess liquidity. The Bubble of Liquidity demonstrated itself again this week when the markets surprised many investors by having one of the biggest rallies in months, delivering solid gains. The S&P index closed last week up 1.8%, its best week since last July. The Nasdaq was up by 2.2%, and the Russell small-cap index was up by 1.5%.

Weakness in equities continues to be quickly met with investors looking to "buy the dip." In a strong bull market like today, stocks can surprise to the upside at any time.

I have been urging our investors not to try trading this market as the risk of missing large rallies is high. Personally, I have been fully invested in the past several months and suggest that our members remain fully invested. Selling or reducing positions has been the wrong move. Furthermore, if you attempt to trade this market, it would result in significant missed opportunities when the markets recover quickly.

Weakness in equities continues to be quickly met with investors looking to "buy the dip." In a strong bull market like today, stocks can surprise to the upside at any time.

I have been urging our investors not to try trading this market as the risk of missing large rallies is high. Personally, I have been fully invested in the past several months and suggest that our members remain fully invested. Selling or reducing positions has been the wrong move. Furthermore, if you attempt to trade this market, it would result in significant missed opportunities when the markets recover quickly.

8

Snope

赞了

根据最新数据,美国CPI环比为0.4%,年贴现率也在5%左右。这表明,通货膨胀源于先前的价格上涨,并承受着相当大的边际压力。一方面,高价格反映了经济联系不畅的现象,另一方面,它们也意味着美国的需求正在继续复苏。

10月份的CPI涨幅可能创下近30年来的新高。11月,尽管美联储有缩减债券的预期,但这只是为了缩小债券购买规模。无论释放水的阀门有多小,它也会释放水。对大宗期货的影响不会在短期内得到反映。总体而言,美国通货膨胀率的下降仍需要一段时间。

$道琼斯指数(.DJI.US$

$SPDR 标普500指数ETF(SPY.US$

10月份的CPI涨幅可能创下近30年来的新高。11月,尽管美联储有缩减债券的预期,但这只是为了缩小债券购买规模。无论释放水的阀门有多小,它也会释放水。对大宗期货的影响不会在短期内得到反映。总体而言,美国通货膨胀率的下降仍需要一段时间。

$道琼斯指数(.DJI.US$

$SPDR 标普500指数ETF(SPY.US$

已翻译

2

1

Snope

赞了

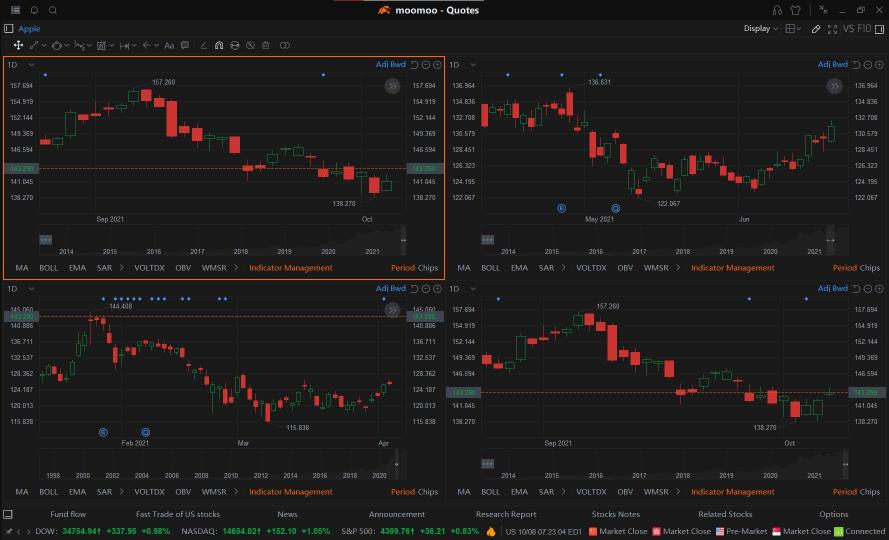

$苹果(AAPL.US$ If you feel the urge to buy Apple stock please read this, you may find it useful, at least I believe it will save your time in trading!

In the above charts, you can see the last 4 apple corrections, in the past trading year!

As you can clearly see, Apple's correction is usually followed by a sideways (consolidation) pattern.

With a little more focus you can find out these sideways last for 3-4 weeks and the range of the consolidation pattern could be 50% of the correction before it!

Holding stocks in sideway patterns could be torturous for active traders!

I am pretty much sure you have experienced this phenomenon many times!

By evaluating the behavior of any stock you can find some none random patterns, If you could not find it, leave it alone and look for other opportunities! there are always many out there if you know how to looking for them!

A few lessons from him Simons:

“We search through historical data looking for anomalous patterns that we would not expect to occur at random.”

"Efficient market theory is correct in that there are no gross inefficiencies. But we look at anomalies that may be small in size and brief in time. We make our forecast. Then, shortly thereafter, we re-evaluate the situation and revise our forecast and our portfolio. We do this all day long. We're always in and out and out and in. So we're dependent on activity to make money."

Trend = (inefficient market) Good for trading.

Sideways: (efficient market) not good for trading.

George Soros saying: “ Chuck Prince famously said we have to dance until the music stops. Actually, the music had stopped already when he said that.”

I will patiently wait for the music to start dancing with it.

In the above charts, you can see the last 4 apple corrections, in the past trading year!

As you can clearly see, Apple's correction is usually followed by a sideways (consolidation) pattern.

With a little more focus you can find out these sideways last for 3-4 weeks and the range of the consolidation pattern could be 50% of the correction before it!

Holding stocks in sideway patterns could be torturous for active traders!

I am pretty much sure you have experienced this phenomenon many times!

By evaluating the behavior of any stock you can find some none random patterns, If you could not find it, leave it alone and look for other opportunities! there are always many out there if you know how to looking for them!

A few lessons from him Simons:

“We search through historical data looking for anomalous patterns that we would not expect to occur at random.”

"Efficient market theory is correct in that there are no gross inefficiencies. But we look at anomalies that may be small in size and brief in time. We make our forecast. Then, shortly thereafter, we re-evaluate the situation and revise our forecast and our portfolio. We do this all day long. We're always in and out and out and in. So we're dependent on activity to make money."

Trend = (inefficient market) Good for trading.

Sideways: (efficient market) not good for trading.

George Soros saying: “ Chuck Prince famously said we have to dance until the music stops. Actually, the music had stopped already when he said that.”

I will patiently wait for the music to start dancing with it.

3

3

Snope

赞了

$苹果(AAPL.US$

$蔚来(NIO.US$

$花旗集团(C.US$

几个月的投资经验,学到很多投资知识,不断地看Moo课程,也不停的看Moo社区的评论,曾经因为错过好时机买入而伤心,高点没有卖出而生气,觉得投资太难了,为什么只要是我入手的股票就跌📉,我一旦卖去它又起🆙,瞬间崩溃,觉得自信心跌入谷底,但是投资可以把我变得更强大,内心素质,承受能力,耐心都在慢慢成长变强,主动学习观察研究,让错误的决定变得更少,投资更谨慎。

把伤心哭泣和流不出的眼泪变成动力,加油!💪🏻💪🏻💪🏻

$蔚来(NIO.US$

$花旗集团(C.US$

几个月的投资经验,学到很多投资知识,不断地看Moo课程,也不停的看Moo社区的评论,曾经因为错过好时机买入而伤心,高点没有卖出而生气,觉得投资太难了,为什么只要是我入手的股票就跌📉,我一旦卖去它又起🆙,瞬间崩溃,觉得自信心跌入谷底,但是投资可以把我变得更强大,内心素质,承受能力,耐心都在慢慢成长变强,主动学习观察研究,让错误的决定变得更少,投资更谨慎。

把伤心哭泣和流不出的眼泪变成动力,加油!💪🏻💪🏻💪🏻

5

12

Snope

赞了

$SPDR 标普500指数ETF(SPY.US$

At this stage of the game, there are genuinely too many things to list that would back up the idea of an impending drop in the market.

Instead of eating, sleeping breathing FUD and living in the fear based, scarcity mindset and focusing on how “the market is going to crash” I encourage everyone to see the clearance buffet we are about to have in front of us.

We are about to have an opportunity for generational wealth transfer style profit making. Many missed the ultimate BTFD moment (COVID) but I believe we’re in for a mini round 2. The bigger the dip, the bigger the rip and I’m being a bit facetious here but I mean it.

If you’re gonna rob a bank, are you gonna plan how to do it ahead of time, or just walk in? You know the phrase get away with murder? Well, the people who get away with it are the people who plan it and not the ones who do it impulsively in the moment!

So get ready for the murder of the market that brings a traditional Christmas pump. If you're uncomfortable trading chop, spend this time:

1. Charting High Time Frame on Fundamentally Sound Tickers

2. Setting Alerts at Buy Zones

3. Waiting

Spend this time making all of the money you can OUTSIDE of the market so when opportunity presents itself (massive fear and a drop) to be bought you have the opportunity to do so.

At this stage of the game, there are genuinely too many things to list that would back up the idea of an impending drop in the market.

Instead of eating, sleeping breathing FUD and living in the fear based, scarcity mindset and focusing on how “the market is going to crash” I encourage everyone to see the clearance buffet we are about to have in front of us.

We are about to have an opportunity for generational wealth transfer style profit making. Many missed the ultimate BTFD moment (COVID) but I believe we’re in for a mini round 2. The bigger the dip, the bigger the rip and I’m being a bit facetious here but I mean it.

If you’re gonna rob a bank, are you gonna plan how to do it ahead of time, or just walk in? You know the phrase get away with murder? Well, the people who get away with it are the people who plan it and not the ones who do it impulsively in the moment!

So get ready for the murder of the market that brings a traditional Christmas pump. If you're uncomfortable trading chop, spend this time:

1. Charting High Time Frame on Fundamentally Sound Tickers

2. Setting Alerts at Buy Zones

3. Waiting

Spend this time making all of the money you can OUTSIDE of the market so when opportunity presents itself (massive fear and a drop) to be bought you have the opportunity to do so.

4

1

Snope

赞了

$美国超微公司(AMD.US$ 交易者和投资者好!让我们来看看 AMD 今天的表现如何!

自我们上次分析以来,正如我们所想的那样,106美元在保持价格方面做得很好,但是,当我们本周终于突破这一阻力时,由于昨天的抛售,AMD大幅下跌。

现在,我们看到我们有了一些反应,这是不错的,但是在1小时图中我们还没有接近任何明显的支撑位,因此情况仍然有点复杂。在日线图中,我们有更多线索:

看来100美元的区域确实是对AMD的不错支撑,而且它是一个相当具有象征意义的价格,因为它是一个四舍五入的数字。如果交易量持续增加,看涨反应可能会给我们带来另一个买入信号,并巩固100美元作为AMD的下限。

今天这是一个良好的开端,但我们必须等待更多的确认。如果你喜欢这篇文章,记得关注我,随时了解我的每日更新,请在你离开之前支持这个想法!

祝你有美好的一天!

自我们上次分析以来,正如我们所想的那样,106美元在保持价格方面做得很好,但是,当我们本周终于突破这一阻力时,由于昨天的抛售,AMD大幅下跌。

现在,我们看到我们有了一些反应,这是不错的,但是在1小时图中我们还没有接近任何明显的支撑位,因此情况仍然有点复杂。在日线图中,我们有更多线索:

看来100美元的区域确实是对AMD的不错支撑,而且它是一个相当具有象征意义的价格,因为它是一个四舍五入的数字。如果交易量持续增加,看涨反应可能会给我们带来另一个买入信号,并巩固100美元作为AMD的下限。

今天这是一个良好的开端,但我们必须等待更多的确认。如果你喜欢这篇文章,记得关注我,随时了解我的每日更新,请在你离开之前支持这个想法!

祝你有美好的一天!

已翻译

6

Snope

赞了

$SPDR 标普500指数ETF(SPY.US$

After some charting fun I made a few observations

~During the past dividends, there has been a big pullback which coincided with the previous 5% drop and this 6% drop. This could be a bearish indicator for future SPY contracts to keep in mind. Dividends = puts

~The previous resistance became the long term support ever since April. This, if SPY ever does break this resistance line without coming back, there are two gaps to fill which would be great Price targets (414.50-416) and (401.30-402.70)

~Using fractal recurrence, we can see that we may see a rise to probably around 449 before we see our next major pullback. The last 5% drop that followed a double bottom that we are seeing now followed this pattern, and seeing as to how this is a very similar fractal ...Lord have mercy.

~Also keep in mind that the RSI is overbought rn and has also started curling up. Every time it has done this it is usually followed by going overbought.

After some charting fun I made a few observations

~During the past dividends, there has been a big pullback which coincided with the previous 5% drop and this 6% drop. This could be a bearish indicator for future SPY contracts to keep in mind. Dividends = puts

~The previous resistance became the long term support ever since April. This, if SPY ever does break this resistance line without coming back, there are two gaps to fill which would be great Price targets (414.50-416) and (401.30-402.70)

~Using fractal recurrence, we can see that we may see a rise to probably around 449 before we see our next major pullback. The last 5% drop that followed a double bottom that we are seeing now followed this pattern, and seeing as to how this is a very similar fractal ...Lord have mercy.

~Also keep in mind that the RSI is overbought rn and has also started curling up. Every time it has done this it is usually followed by going overbought.

2

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)