melkee

评论了

新能源与新趋势

近年来,各国倡导低碳计划,以避免破坏环境。

你支持低碳生活吗?

随着投资者越来越具有环保意识, 绿色投资呈增长趋势.

你有没有考虑过 购买低碳ETF是为了保护地球?

![]()

![]()

![]() 参加交易测验 并获得奖品!

参加交易测验 并获得奖品!

从学习开始”什么是交易所买卖基金?“然后判断它是否真的对你的港口有好处...

近年来,各国倡导低碳计划,以避免破坏环境。

你支持低碳生活吗?

随着投资者越来越具有环保意识, 绿色投资呈增长趋势.

你有没有考虑过 购买低碳ETF是为了保护地球?

从学习开始”什么是交易所买卖基金?“然后判断它是否真的对你的港口有好处...

已翻译

95

988

melkee

赞了

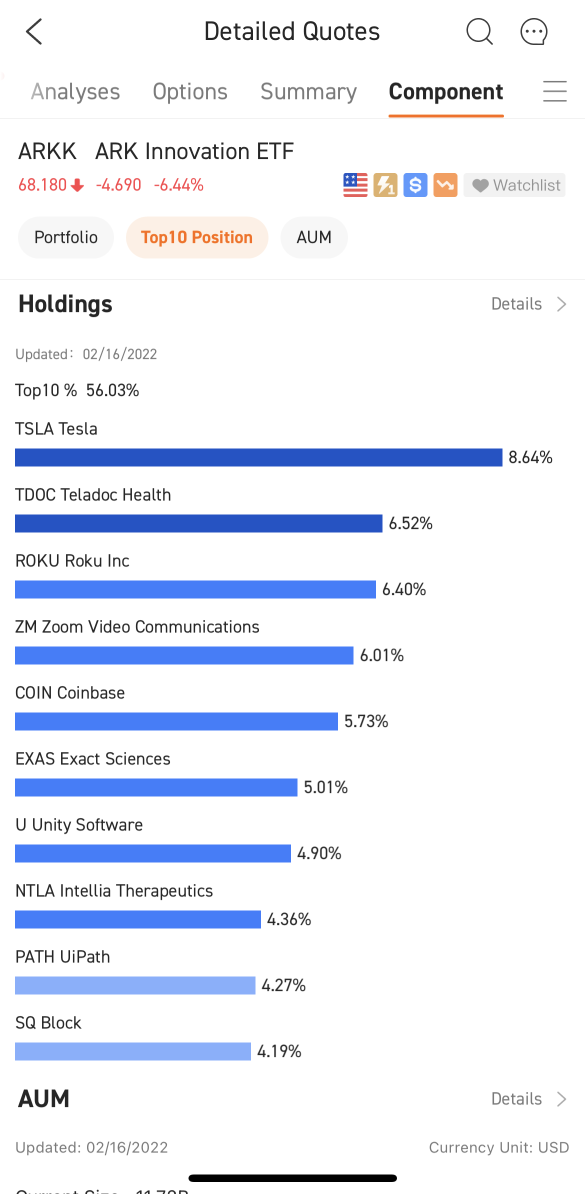

1。沃伦·巴菲特:久经考验的大师

你可能已经看到了下面的图表,这与沃伦·巴菲特的伯克希尔·哈撒韦公司的回报和凯茜·伍德的方舟创新ETF的回报形成了鲜明的对比。

是的,在2021年你不会相信,但现在是真的。ARK ETF曾经是散户投资者最追捧的ETF。

伍德和巴菲特的投资风格截然不同。但是在过去的两年中,他们的投资者得到了回报...

你可能已经看到了下面的图表,这与沃伦·巴菲特的伯克希尔·哈撒韦公司的回报和凯茜·伍德的方舟创新ETF的回报形成了鲜明的对比。

是的,在2021年你不会相信,但现在是真的。ARK ETF曾经是散户投资者最追捧的ETF。

伍德和巴菲特的投资风格截然不同。但是在过去的两年中,他们的投资者得到了回报...

已翻译

+3

145

28

melkee

赞了

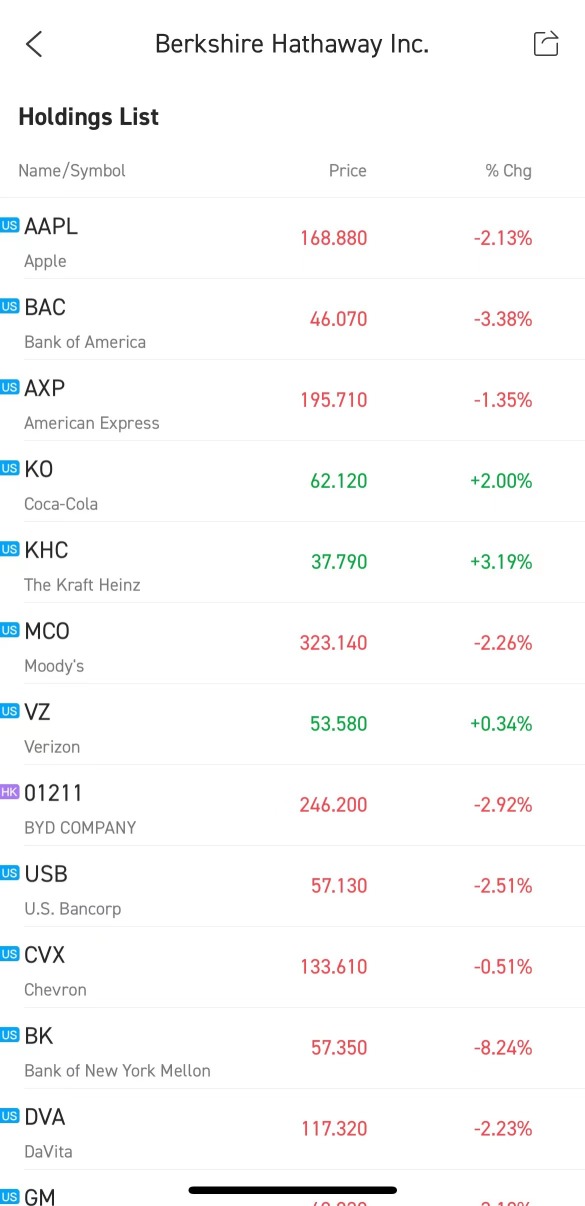

Time flies! You have completed another journey of Co-Wise: What habits help you become a better trader. Thank you all for your participation!![]() In this topic, most mooers mentioned FOMO emotions, panics, and mistakes. When newbies first got in the market, they followed blindly, not knowing what they were doing, and made losses due to succumbing to emotions.

In this topic, most mooers mentioned FOMO emotions, panics, and mistakes. When newbies first got in the market, they followed blindly, not knowing what they were doing, and made losses due to succumbing to emotions.![]()

Will you get sucked into a BULL/FOMO trap when the market plunges? We must learn to stop emotions from getting in the way and take the upper hand in our decision-making.![]() Successful tradings arise from constant practicing and establishing trading rules. Once your trading plan is created, you should be patient and keep plugging away. It would be best to grasp mistakes and be pragmatic to accept them and move on. Let's cultivate good habits to yield consistent results.

Successful tradings arise from constant practicing and establishing trading rules. Once your trading plan is created, you should be patient and keep plugging away. It would be best to grasp mistakes and be pragmatic to accept them and move on. Let's cultivate good habits to yield consistent results.

![]()

![]()

![]() Now, it's time for the winning list of this topic. Let's enjoy the highlight moments together! Congratulation to all the mooers winning $福特汽车(F.US$ and $ContextLogic(WISH.US$ stocks!

Now, it's time for the winning list of this topic. Let's enjoy the highlight moments together! Congratulation to all the mooers winning $福特汽车(F.US$ and $ContextLogic(WISH.US$ stocks!

*The rewards will be distributed to winners within 15 working days—the ranking sortes in alphabetical order.

Part Ⅰ: High-Quality Post Collection

@Dadacai Habits To Becoming A Better Trader

One of the key successful habits is to form a trading plan. As Benjamin Franklin rightly said, if you fail to plan, you are planning to fail. Don’t give in to the fear of missing out (FOMO). With practice and perseverance, we can all become successful traders!

@iSpyderTrader Building Good Trading Habits

DO NOT try to copy someone else's idea as that works for them. You need to get insight about it and try it on your own. Practice makes perfect. Do your due diligence (research, articles, news, etc.) Trade with a positive attitude. Don't be greedy and take profits.

@JP GO Set a rule that suitable your lifestyle

Trading have to link with lifestyle and set up a rule of it. More importantly is following it as a habit. I start from small amounts to test that if my thoughts/rule works for me and make some adjustments. I only allow myself to use 3 quarters, leave a last option for myself and I won't fear while look at the red numbers.

@mooboo Habits that made me a better trader

For my value investing, I do a certain amount of due diligence before starting a position in any stock. I fight the urge every time I panic. Emotions are your biggest enemy in the stock market. Lastly, manage your risk well.

@TraderPeter Be mechanical!

The risk and the size are highly correlated. Ask Why first. Knowing the why helps me to make quick decision without second guess myself. Only trade something that is liquid enough. Take profit early and often and let time cure the pain.

@bullrider21Nothing is foolproof

Always do your homework before you buy a stock. Don't speculate. Don't buy on rumours. Find out the support and resistance levels to determine your buying and selling prices. You must be disciplined. Don't be too greedy.

@Ganar PocoGood habits will make you a consistent winner

Trading Psychology is a mental aspect of trading. It involves things like how to control your emotions, eg FOMO. After you have control your emotions & learned the importance of Risk Management. The next important aspect that will give an edge in trading is Strategy.

@Moo Top My 117 days experiences

I am still figuring out what is my plan in investing and trading after 117 days in Moomoo. However, the following are what I gather from my experiences: Investment or Trading. Have an exit plan if trading. Value or Growth or Meme stocks. Trading is not everything. Have a life.

@Zann56 Overcoming emotions

Human emotions (Fear and greed) are inevitably involved when it comes to investing. I have made losses in the past due to succumbing to my emotions. To avoid such mistakes, I have learnt to adopt 3 strategies now. Invest in what I strongly believe in. Dollar Cost Averaging. Diversification.

@甜心0121 My Habits

For me personally, I hold on to these 4 habits to ensure consistency in my trading. Set goals. Manage risks. Research, research and research. Limit time and get a life.

![]() For more engaging posts, please click Co-Wise: What habits help you become a better trader? to check. Don't forget to leave your comments and tell mooers what you've learned!

For more engaging posts, please click Co-Wise: What habits help you become a better trader? to check. Don't forget to leave your comments and tell mooers what you've learned!![]()

Part Ⅱ: Voting on the “Mentor Moo” Title

It's time for voting! Let's vote for the candidates to see who will win the "Mentor Moo" title. Whose post do you think is the best? Your vote means a lot to them!

Emotions and responsibilities could cloud your thinking. Deduction and objectivity could lead you to impulsive and irrational decision-making, resulting in more losses. It is not valid to trade based on feelings or rumors. Analysis and research should be trading fundamentals. Emotional trading may bring back some earnings, but rational trading is how you survive for a long time. Enhance your lifestyle with trading and follow the rules as a habit. Practice makes perfect.![]()

Disclaimer: All investment involves risk. Neither Futu Inc, nor Futu SG, nor moomoo endorses any particular investment strategy. You should carefully consider your investment goals and objectives when deciding on an investment strategy. Past performance is no guarantee of future results.

Will you get sucked into a BULL/FOMO trap when the market plunges? We must learn to stop emotions from getting in the way and take the upper hand in our decision-making.

*The rewards will be distributed to winners within 15 working days—the ranking sortes in alphabetical order.

Part Ⅰ: High-Quality Post Collection

@Dadacai Habits To Becoming A Better Trader

One of the key successful habits is to form a trading plan. As Benjamin Franklin rightly said, if you fail to plan, you are planning to fail. Don’t give in to the fear of missing out (FOMO). With practice and perseverance, we can all become successful traders!

@iSpyderTrader Building Good Trading Habits

DO NOT try to copy someone else's idea as that works for them. You need to get insight about it and try it on your own. Practice makes perfect. Do your due diligence (research, articles, news, etc.) Trade with a positive attitude. Don't be greedy and take profits.

@JP GO Set a rule that suitable your lifestyle

Trading have to link with lifestyle and set up a rule of it. More importantly is following it as a habit. I start from small amounts to test that if my thoughts/rule works for me and make some adjustments. I only allow myself to use 3 quarters, leave a last option for myself and I won't fear while look at the red numbers.

@mooboo Habits that made me a better trader

For my value investing, I do a certain amount of due diligence before starting a position in any stock. I fight the urge every time I panic. Emotions are your biggest enemy in the stock market. Lastly, manage your risk well.

@TraderPeter Be mechanical!

The risk and the size are highly correlated. Ask Why first. Knowing the why helps me to make quick decision without second guess myself. Only trade something that is liquid enough. Take profit early and often and let time cure the pain.

@bullrider21Nothing is foolproof

Always do your homework before you buy a stock. Don't speculate. Don't buy on rumours. Find out the support and resistance levels to determine your buying and selling prices. You must be disciplined. Don't be too greedy.

@Ganar PocoGood habits will make you a consistent winner

Trading Psychology is a mental aspect of trading. It involves things like how to control your emotions, eg FOMO. After you have control your emotions & learned the importance of Risk Management. The next important aspect that will give an edge in trading is Strategy.

@Moo Top My 117 days experiences

I am still figuring out what is my plan in investing and trading after 117 days in Moomoo. However, the following are what I gather from my experiences: Investment or Trading. Have an exit plan if trading. Value or Growth or Meme stocks. Trading is not everything. Have a life.

@Zann56 Overcoming emotions

Human emotions (Fear and greed) are inevitably involved when it comes to investing. I have made losses in the past due to succumbing to my emotions. To avoid such mistakes, I have learnt to adopt 3 strategies now. Invest in what I strongly believe in. Dollar Cost Averaging. Diversification.

@甜心0121 My Habits

For me personally, I hold on to these 4 habits to ensure consistency in my trading. Set goals. Manage risks. Research, research and research. Limit time and get a life.

Part Ⅱ: Voting on the “Mentor Moo” Title

It's time for voting! Let's vote for the candidates to see who will win the "Mentor Moo" title. Whose post do you think is the best? Your vote means a lot to them!

Emotions and responsibilities could cloud your thinking. Deduction and objectivity could lead you to impulsive and irrational decision-making, resulting in more losses. It is not valid to trade based on feelings or rumors. Analysis and research should be trading fundamentals. Emotional trading may bring back some earnings, but rational trading is how you survive for a long time. Enhance your lifestyle with trading and follow the rules as a habit. Practice makes perfect.

Disclaimer: All investment involves risk. Neither Futu Inc, nor Futu SG, nor moomoo endorses any particular investment strategy. You should carefully consider your investment goals and objectives when deciding on an investment strategy. Past performance is no guarantee of future results.

长图

长图 72

29

melkee

赞了

$美国超微公司(AMD.US$ $Cloudflare(NET.US$ So I asked this question a few months ago and I got some very interesting responses, a lot of AMD, Cloudfare, and things of that nature. All in all people's picks performed very well much to my surprise and I would like to see what everyone likes for the next 10 years, particularly, stocks that have the most upside potential due to an industry being revolutionized or a company you believe is severely undervalued.

24

melkee

赞了

Terrific investment opportunities are everywhere if you'd just open your eyes👀 (and our moomoo app)! Find your perfect match![]() using our stock screener, a must-have among traders and investors alike. Be it finding stocks with strong upside momentum or finding hot stocks during earnings season, you get to sift through thousands of stocks and find those that best meet your criteria.

using our stock screener, a must-have among traders and investors alike. Be it finding stocks with strong upside momentum or finding hot stocks during earnings season, you get to sift through thousands of stocks and find those that best meet your criteria.

Find out why it pays to be picky

Connect, follow and have a conversation with us.

Facebook | Instagram

Find out why it pays to be picky

Connect, follow and have a conversation with us.

Facebook | Instagram

127

33

melkee

赞了

作为投资者,我们有多种投资选择。股息股票通常是历史悠久的公司,在向股东分配收益方面有着良好的历史。股息投资是一种在新加坡投资的流行方式。

什么是股息投资?

股息投资是购买支付股息的股票以从投资中获得稳定的收入来源的做法。股息是公司在获得利润或盈余时支付的利润的比例。绝大多数新加坡公司都通过分红按季度发放股息。例如,房地产投资信托基金是一种众所周知的支付股息的公司。

什么是房地产投资信托基金?

对于以稳定收入来源为目标的投资者来说,房地产投资信托基金(REIT)是最受欢迎的选择之一。房地产投资信托基金是一家拥有、经营或资助创收房地产的企业,它可以为投资专业管理的房地产资产提供投资机会,并在证券交易所上市和交易。

新加坡是亚洲大型房地产投资信托中心。到目前为止,目前有43家房地产投资信托和房地产商业信托在新加坡交易所上市,总市值超过1100亿美元,约占新加坡总额的12%。以下数字表明,从不同维度来看,新加坡房地产投资信托基金正在蓬勃发展。

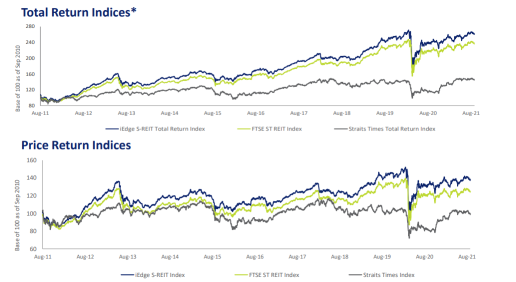

从历史模式来看,房地产投资信托基金的回报稳步增长,从2011年到2021年,增长率增长了三倍,如图1所示。

图 1:三年平均年化总回报率为 13.4%

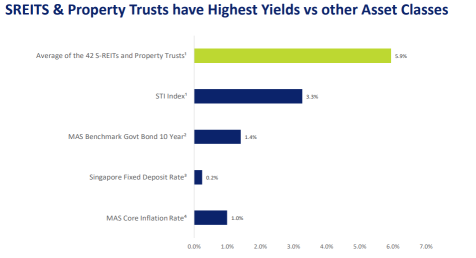

图2显示,2021年S-REITS和房地产信托的平均回报率为5.9%,高于其他资产类别。

图 2:S-REITs和房地产信托与其他资产类别的对比

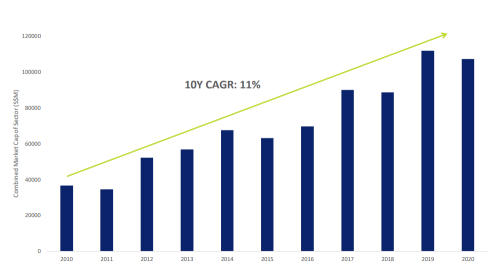

自2010年以来,新加坡交易所的房地产投资信托和房地产信托的10年复合年增长率相当可观,为11%,如图3所示。

图 3:新加坡交易所的房地产投资信托基金和房地产信托:十年内复合年增长率为 11%

如何评估股息股票?

如前所述,股息股票通常是具有良好盈利历史的老牌公司。以下三个参数可以帮助您区分股票。

股息收益率

股息收益率是公司每年支付的股息,与股价有关。房地产投资信托基金(REIT)支付的股息通常高于平均水平。HighertheDividend收益率越好。此外,股息的增长应与公司的长期收益一致。

支付比率

派息率是指支付的股息占公司总收益的百分比。高派息率,明显超过100%,可能会引发人们对股票长期可持续性的质疑。相比之下,低派息率可能表明一家公司正在将其大部分收益再投资以扩大业务。换句话说,无论派息率是高还是低,投资者都应该认真对待派息率。

股息历史

长期股息支付记录最好的公司通常多年来一直保持稳定的派息率。公司的股息分配是否在持续增加?公司向股东支付股息多久了?

如何进行股息投资?

(1)以高股息收益率为目标

短期投资者可以专注于增长缓慢的老牌公司,这些公司现金流巨大,可以支付可观的股息。

(2)选择高股息增长

长期投资者应集中精力购买激增但支付的股息低于平均水平的公司的股票。短期内回报率可能看起来很小,但随着公司的扩张,股息收益率应该会稳步提高。

为了评估特定股票的潜力,投资者可以从包含各种图表的报告中查看其过去的表现。以下WLMIY(丰益国际有限公司)的条形图根据其历史预测了股息增长。假设年度股息增长率为 $丰益国际(F34.SG$ 为15.73%,丰益的股息每4.7年翻一番。

关于股息投资的几点注意事项

任何公司的股息都不是固定的,可以随时调整。

成熟的大公司通常提供增长率适中的股息。

假设投资者只关注股息丰厚的公司。在这种情况下,他们可能会错过尚未开始支付股息或支付少量股息的快速增长的公司。

富途限时活动

如果投资者在2021年11月5日至2021年11月16日的认购期内(包括两个日期)至少认购了4,000新加坡元的大华银行亚太区绿色房地产投资信托基金ETF,并且在认购截止日期之前没有撤回认购,则将获得价值18.8新加坡元的现金优惠券,用于在moomoo 上进行交易。

立即进入>>

免责声明:

Moomoo 是由 Moomoo Inc. 提供的交易平台。在新加坡,moomoo 上的资本市场产品和服务由富途新加坡私人有限公司提供。Ltd. 受新加坡金融管理局(MAS)监管。

该内容仅用于教育和信息用途。所使用的信息和数据仅用于说明目的。此处的任何内容均不得视为购买或出售证券、期货或其他投资产品的要约、招标或推荐。它没有考虑到您的投资目标、财务状况或特定需求。所有信息和数据(如果有)仅供参考,不应将过去的表现视为未来业绩的指标。这并不能保证未来的结果。股票、期权、交易所买卖基金和其他工具的投资存在风险,包括可能损失投资金额。投资的价值可能会波动,因此,客户可能会损失其投资的价值。使用保证金账户进行交易时,客户的损失可能超过其原始投资。有关任何投资的适用性,请咨询您的财务顾问。

什么是股息投资?

股息投资是购买支付股息的股票以从投资中获得稳定的收入来源的做法。股息是公司在获得利润或盈余时支付的利润的比例。绝大多数新加坡公司都通过分红按季度发放股息。例如,房地产投资信托基金是一种众所周知的支付股息的公司。

什么是房地产投资信托基金?

对于以稳定收入来源为目标的投资者来说,房地产投资信托基金(REIT)是最受欢迎的选择之一。房地产投资信托基金是一家拥有、经营或资助创收房地产的企业,它可以为投资专业管理的房地产资产提供投资机会,并在证券交易所上市和交易。

新加坡是亚洲大型房地产投资信托中心。到目前为止,目前有43家房地产投资信托和房地产商业信托在新加坡交易所上市,总市值超过1100亿美元,约占新加坡总额的12%。以下数字表明,从不同维度来看,新加坡房地产投资信托基金正在蓬勃发展。

从历史模式来看,房地产投资信托基金的回报稳步增长,从2011年到2021年,增长率增长了三倍,如图1所示。

图 1:三年平均年化总回报率为 13.4%

图2显示,2021年S-REITS和房地产信托的平均回报率为5.9%,高于其他资产类别。

图 2:S-REITs和房地产信托与其他资产类别的对比

自2010年以来,新加坡交易所的房地产投资信托和房地产信托的10年复合年增长率相当可观,为11%,如图3所示。

图 3:新加坡交易所的房地产投资信托基金和房地产信托:十年内复合年增长率为 11%

如何评估股息股票?

如前所述,股息股票通常是具有良好盈利历史的老牌公司。以下三个参数可以帮助您区分股票。

股息收益率

股息收益率是公司每年支付的股息,与股价有关。房地产投资信托基金(REIT)支付的股息通常高于平均水平。HighertheDividend收益率越好。此外,股息的增长应与公司的长期收益一致。

支付比率

派息率是指支付的股息占公司总收益的百分比。高派息率,明显超过100%,可能会引发人们对股票长期可持续性的质疑。相比之下,低派息率可能表明一家公司正在将其大部分收益再投资以扩大业务。换句话说,无论派息率是高还是低,投资者都应该认真对待派息率。

股息历史

长期股息支付记录最好的公司通常多年来一直保持稳定的派息率。公司的股息分配是否在持续增加?公司向股东支付股息多久了?

如何进行股息投资?

(1)以高股息收益率为目标

短期投资者可以专注于增长缓慢的老牌公司,这些公司现金流巨大,可以支付可观的股息。

(2)选择高股息增长

长期投资者应集中精力购买激增但支付的股息低于平均水平的公司的股票。短期内回报率可能看起来很小,但随着公司的扩张,股息收益率应该会稳步提高。

为了评估特定股票的潜力,投资者可以从包含各种图表的报告中查看其过去的表现。以下WLMIY(丰益国际有限公司)的条形图根据其历史预测了股息增长。假设年度股息增长率为 $丰益国际(F34.SG$ 为15.73%,丰益的股息每4.7年翻一番。

关于股息投资的几点注意事项

任何公司的股息都不是固定的,可以随时调整。

成熟的大公司通常提供增长率适中的股息。

假设投资者只关注股息丰厚的公司。在这种情况下,他们可能会错过尚未开始支付股息或支付少量股息的快速增长的公司。

富途限时活动

如果投资者在2021年11月5日至2021年11月16日的认购期内(包括两个日期)至少认购了4,000新加坡元的大华银行亚太区绿色房地产投资信托基金ETF,并且在认购截止日期之前没有撤回认购,则将获得价值18.8新加坡元的现金优惠券,用于在moomoo 上进行交易。

立即进入>>

免责声明:

Moomoo 是由 Moomoo Inc. 提供的交易平台。在新加坡,moomoo 上的资本市场产品和服务由富途新加坡私人有限公司提供。Ltd. 受新加坡金融管理局(MAS)监管。

该内容仅用于教育和信息用途。所使用的信息和数据仅用于说明目的。此处的任何内容均不得视为购买或出售证券、期货或其他投资产品的要约、招标或推荐。它没有考虑到您的投资目标、财务状况或特定需求。所有信息和数据(如果有)仅供参考,不应将过去的表现视为未来业绩的指标。这并不能保证未来的结果。股票、期权、交易所买卖基金和其他工具的投资存在风险,包括可能损失投资金额。投资的价值可能会波动,因此,客户可能会损失其投资的价值。使用保证金账户进行交易时,客户的损失可能超过其原始投资。有关任何投资的适用性,请咨询您的财务顾问。

已翻译

+1

167

8

melkee

赞了

Hey mooers ![]()

![]()

![]() , today let's learn how to identify stock market trends using moving averages to help add context, support decision making, and complement other forms of analysis.

, today let's learn how to identify stock market trends using moving averages to help add context, support decision making, and complement other forms of analysis. ![]()

![]()

![]()

Technical analysis of stocks borrows from the law of inertia to understand and describe the relationships between a stock price, buying and selling of the stock, and its motion. In describing motion, investors borrow another physics term, "momentum," which, as in physics, is the quantity of motion. The "forces" acting on a stock are buying and selling. And the "motion" of a stock is usually called a trend.![]()

![]()

![]()

Trends can form in three directions: up, down, or sideways. These trends, or ways of describing a stock's motion, are among the technical analysis basics.

Let's take Apple's chart as an example![]()

![]()

![]() :

:

Trend Analysis for Investors

As opposed to traders, investors typically hold investments for long periods of time — months or several years. So when it comes to applying trend analysis to investing, it's important to use a chart and time frame that aligns with investing.![]()

![]()

![]()

Here's how these two moving averages can help identify trends. When the 5-day moving average is greater than the 20-day moving average, the AAPL is in an uptrend. When the 5-day is less than the 20-day moving average, the AAPL is in a downtrend.![]()

![]()

![]()

The idea is to maximize profits when the AAPL is in an uptrend. But when the AAPL is in a downtrend, the idea is to limit losses.

Identifying trends using technical analysis is not an exact science; it has flaws, and it's not a standalone investing strategy. But technical analysis basics such as trend analysis can help add context, support your decision making, and complement other forms of analysis like fundamental, macroeconomic, and psychological.![]()

![]()

![]()

Technical analysis of stocks borrows from the law of inertia to understand and describe the relationships between a stock price, buying and selling of the stock, and its motion. In describing motion, investors borrow another physics term, "momentum," which, as in physics, is the quantity of motion. The "forces" acting on a stock are buying and selling. And the "motion" of a stock is usually called a trend.

Trends can form in three directions: up, down, or sideways. These trends, or ways of describing a stock's motion, are among the technical analysis basics.

Let's take Apple's chart as an example

Trend Analysis for Investors

As opposed to traders, investors typically hold investments for long periods of time — months or several years. So when it comes to applying trend analysis to investing, it's important to use a chart and time frame that aligns with investing.

Here's how these two moving averages can help identify trends. When the 5-day moving average is greater than the 20-day moving average, the AAPL is in an uptrend. When the 5-day is less than the 20-day moving average, the AAPL is in a downtrend.

The idea is to maximize profits when the AAPL is in an uptrend. But when the AAPL is in a downtrend, the idea is to limit losses.

Identifying trends using technical analysis is not an exact science; it has flaws, and it's not a standalone investing strategy. But technical analysis basics such as trend analysis can help add context, support your decision making, and complement other forms of analysis like fundamental, macroeconomic, and psychological.

94

14

melkee

赞了

在我们上一次活动中,moomoo获得了成千上万投资者的许多点赞和认可,尤其是那些还不熟悉该应用程序的投资者。

为了为每位moomoo投资者建立无缝的交易体验,我们整理了一份指南,涵盖了您在使用moomoo时可能遇到的几乎所有问题。![]() 从开户到资金结算,我们的目标是解决您投资旅程中的每一个问题!

从开户到资金结算,我们的目标是解决您投资旅程中的每一个问题!

moomoo 课程:

...

为了为每位moomoo投资者建立无缝的交易体验,我们整理了一份指南,涵盖了您在使用moomoo时可能遇到的几乎所有问题。

moomoo 课程:

...

已翻译

![[更新] Moomoo 课程目录:在投资之前找到所需的一切](https://ussnsimg.moomoo.com/16203792656495-77777015-web-555d65f83d449d48.jpg/thumb)

![[更新] Moomoo 课程目录:在投资之前找到所需的一切](https://ussnsimg.moomoo.com/moo-1620381448-77777015-iPhone-1-org.jpg/thumb)

![[更新] Moomoo 课程目录:在投资之前找到所需的一切](https://ussnsimg.moomoo.com/16203787721155-77777015-web-62b96ce14928333f.png/thumb)

+2

355

110

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)

melkee : 1. B

2. C

3. A

4. B

5. A

6. D