102340190

赞了

Brazilian digital bank Nubank recently lifted the veil off its filing for an initial public offering in the United States. The company plans to dual list on the B3 Brazil under the symbol "NUBR33."

Morgan Stanley, Goldman Sachs, Citi, Nu Invest, Allen & Company, HSBC, and UBS Investment Bank are the joint bookrunners on the deal.

Business Overview

Nu Holdings, founded in 2013, is a Brazilian digital bank backed by billionaire Warren Buffett’s Berkshire Hathaway.

It is seeking a valuation of as much as $50.6 billion in its initial public offering, making it one of Latin America’s biggest companies.

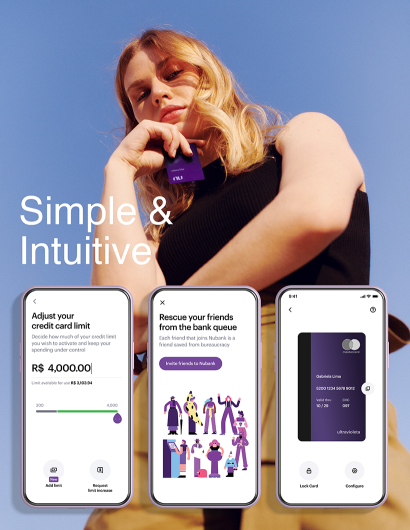

NuBank is one of the world’s largest digital banking platforms (based on number of customers) and the latest of several fast-growing financial services companies - often serving customers overlooked by banks - grabbing investors' attention.

As of September 30, 2021, It had 48.1 million customers,across Brazil, Mexico and Colombia, including approximately 28% of the population of Brazil aged 15 and above.

According to a ranking by CBInsights, Nubank is the 7th most valuable unicorn worldwide, behind fintechs Stripe, Klarna and Revolut.

It is listed in 2021 by TIME as one of the 100 Most Influential Companies in the world and by CNBC as one of the Top 50 Disruptors in the world.

Financial Performance

In the nine month periods ended September 30, 2021, it reported total revenue of US$1,062.1 million, an increase of 98.7% compared to US$534.6 million for the nine month periods ended September 30, 2020.

Though it has incurred a US$99.1 million loss for the nine months ended September 30, 2021, and a US$171.5 million, US$92.5 million and US$28.6 million loss for the years ended December 31, 2020, 2019 and 2018, respectively, it has grown the customer base and revenue at high annual growth rates.

As of September 30, 2021, it had 48.1 million customers, which represents an increase of almost 9x from 5.2 million as of September 30, 2018 (or a compounded annual growth rate, or “CAGR,” of 110%.

Click to view the prospectus

$Nu Holdings(NU.US$

Morgan Stanley, Goldman Sachs, Citi, Nu Invest, Allen & Company, HSBC, and UBS Investment Bank are the joint bookrunners on the deal.

Business Overview

Nu Holdings, founded in 2013, is a Brazilian digital bank backed by billionaire Warren Buffett’s Berkshire Hathaway.

It is seeking a valuation of as much as $50.6 billion in its initial public offering, making it one of Latin America’s biggest companies.

NuBank is one of the world’s largest digital banking platforms (based on number of customers) and the latest of several fast-growing financial services companies - often serving customers overlooked by banks - grabbing investors' attention.

As of September 30, 2021, It had 48.1 million customers,across Brazil, Mexico and Colombia, including approximately 28% of the population of Brazil aged 15 and above.

According to a ranking by CBInsights, Nubank is the 7th most valuable unicorn worldwide, behind fintechs Stripe, Klarna and Revolut.

It is listed in 2021 by TIME as one of the 100 Most Influential Companies in the world and by CNBC as one of the Top 50 Disruptors in the world.

Financial Performance

In the nine month periods ended September 30, 2021, it reported total revenue of US$1,062.1 million, an increase of 98.7% compared to US$534.6 million for the nine month periods ended September 30, 2020.

Though it has incurred a US$99.1 million loss for the nine months ended September 30, 2021, and a US$171.5 million, US$92.5 million and US$28.6 million loss for the years ended December 31, 2020, 2019 and 2018, respectively, it has grown the customer base and revenue at high annual growth rates.

As of September 30, 2021, it had 48.1 million customers, which represents an increase of almost 9x from 5.2 million as of September 30, 2018 (or a compounded annual growth rate, or “CAGR,” of 110%.

Click to view the prospectus

$Nu Holdings(NU.US$

+2

19

6

102340190

赞了

$苹果(AAPL.US$ 这个讨论区中有很多人都在谈论对抛售股票感到遗憾。当我觉得一只股票表现非常不错时,我经常会做出一个策略,但可能要么对我的投资组合来说百分比过高——要么——我觉得股票的估值可能远远高于估值,我只会卖出自己拥有的一部分股票(可能是 25%、50%、75% 等)。然后,如果股票真的(再次)上涨,我仍然会获得丰厚的回报,并且可以避免害怕错过机会。或者,如果它丢了,我的损失就不会那么大。

这不是一个罕见的策略,但只是想提醒一些人!我今天用 AAPL 做了这个。我想我可能卖掉了大约 10% 的股份。

这不是一个罕见的策略,但只是想提醒一些人!我今天用 AAPL 做了这个。我想我可能卖掉了大约 10% 的股份。

已翻译

74

10

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)