102272386

留下了心情

亲爱的摩尔们,

中国新年快乐!

无论你和谁在一起,无论你在哪里,moomoo都祝你新的一年充满好运、幸福、成就和繁荣。

moomoo 感谢你一直以来的陪伴。我们希望在您的投资旅程中陪伴您走得更远!

我们再次祝愿您和您的家人春节快乐、健康、繁荣!

moomoo 战队

中国新年快乐!

无论你和谁在一起,无论你在哪里,moomoo都祝你新的一年充满好运、幸福、成就和繁荣。

moomoo 感谢你一直以来的陪伴。我们希望在您的投资旅程中陪伴您走得更远!

我们再次祝愿您和您的家人春节快乐、健康、繁荣!

moomoo 战队

已翻译

131

51

102272386

留下了心情

嘿 mooer们,

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

我们祝你:

一个充满爱、幸福和繁荣的欢乐圣诞节!![]()

来自 moomoo 新闻组成员 Wave Melody Linear Chloe Zoe Mia Jimmy Danilo Ander Julianna Eli

我们祝你:

一个充满爱、幸福和繁荣的欢乐圣诞节!

来自 moomoo 新闻组成员 Wave Melody Linear Chloe Zoe Mia Jimmy Danilo Ander Julianna Eli

已翻译

307

205

102272386

评论了

Warren Buffett is known for being a legendary investor. He is known as a proponent of value investing, and for decrying the rampant speculation and gambling by self-proclaimed "investors" ![]()

![]()

![]() .

.

However, did you know that Warren Buffett used to speculate using derivatives such as stock options and commodity futures?![]()

![]()

![]()

Warren Buffett purchased his first investment, Cities Services Preferred, at 11 years of age, buying three shares for $114.75. He sold these for a profit of $1.75 relatively soon after the acquisition. His next adventure in the market came in 1949. Buffett started using technical analysis to earn quick profits from the market on top of his other activities. This was mostly speculative trading.![]()

![]()

![]()

He was hooked on share trading at this time. He tried all sorts of ways to make share trading work, from chart patterns to numerical patterns and 'odd-lot stock trading,' whatever that was. We can tell from this that Buffett had been speculating."

—— Glen Arnold's book, "The Deals of Warren Buffett, Volume 1: The First $100m,"

In the late seventies, he bought a few stocks for his own account. He was a bit more of a swinger with his personal money. For instance, in the case of Teledyne, Buffett invested in options — a strategy with a higher chance of either failing or making a killing. According to one associate, he also bought copper futures — an outright speculation.

—— "Buffett: The Making of an American Capitalist, Chapter 12" by Roger Lowenstein

Technical analysis remains popular among investors. Research indicates up to 40 per cent of foreign exchange traders see technical analysis as important for predicting price action over short time horizons. About one-third of equity fund managers utilise technical analysis, according to a major 2012 survey.![]()

![]()

![]()

If I were on a desert island and allowed just one investment tool, it would be the chart.”

—— Bolton said

Mooers, what do you think of technical analysis for stock investment?![]()

![]()

![]()

However, did you know that Warren Buffett used to speculate using derivatives such as stock options and commodity futures?

Warren Buffett purchased his first investment, Cities Services Preferred, at 11 years of age, buying three shares for $114.75. He sold these for a profit of $1.75 relatively soon after the acquisition. His next adventure in the market came in 1949. Buffett started using technical analysis to earn quick profits from the market on top of his other activities. This was mostly speculative trading.

He was hooked on share trading at this time. He tried all sorts of ways to make share trading work, from chart patterns to numerical patterns and 'odd-lot stock trading,' whatever that was. We can tell from this that Buffett had been speculating."

—— Glen Arnold's book, "The Deals of Warren Buffett, Volume 1: The First $100m,"

In the late seventies, he bought a few stocks for his own account. He was a bit more of a swinger with his personal money. For instance, in the case of Teledyne, Buffett invested in options — a strategy with a higher chance of either failing or making a killing. According to one associate, he also bought copper futures — an outright speculation.

—— "Buffett: The Making of an American Capitalist, Chapter 12" by Roger Lowenstein

Technical analysis remains popular among investors. Research indicates up to 40 per cent of foreign exchange traders see technical analysis as important for predicting price action over short time horizons. About one-third of equity fund managers utilise technical analysis, according to a major 2012 survey.

If I were on a desert island and allowed just one investment tool, it would be the chart.”

—— Bolton said

Mooers, what do you think of technical analysis for stock investment?

68

13

102272386

赞了

埃隆·马斯克是世界上最富有的人,他现在的身价与比尔·盖茨和沃伦·巴菲特的总和一样多!太疯狂了!![]()

![]()

![]() 他的净资产超过2300亿美元,相当于约87.6万辆法拉利488,或2.5亿部iPhone或625亿台巨无霸!!

他的净资产超过2300亿美元,相当于约87.6万辆法拉利488,或2.5亿部iPhone或625亿台巨无霸!!![]()

![]()

![]()

另外,他想让贝索斯知道自己排名第一。哈哈...![]()

![]()

![]()

马斯克今年的财富增加了超过600亿美元,这要归功于他的强劲表现 $特斯拉(TSLA.US$ 以及SpaceX最近的一次股票出售,该公司的估值为1000亿美元。![]()

![]()

他在管理公司和进行投资方面非常成功。我相信他是最好的企业家和投资者!甚至比尔·盖茨和他的 $微软(MSFT.US$ 还有巴菲特和他的 $伯克希尔-A(BRK.A.US$ 无法比拟!![]()

![]()

![]()

如果你不同意,请告诉我你最喜欢的首席执行官和他的公司!

奖励来电!评论赢取奖励!

我和Moomoo新闻组一起举办活动一个月!我每天都会发布讨论,Moomoo新闻团队将为活动提供奖励积分!我们将在每个工作日选出前 2 个 “喜欢” 和前 3 个 “有见地” 的评论以及每个周末前 10 名 “喜欢” 和前 10 名 “有见地” 的评论作为赢家。

欲了解更多详情,请单击 这里。

关注我加入最新的讨论!

另外,他想让贝索斯知道自己排名第一。哈哈...

马斯克今年的财富增加了超过600亿美元,这要归功于他的强劲表现 $特斯拉(TSLA.US$ 以及SpaceX最近的一次股票出售,该公司的估值为1000亿美元。

他在管理公司和进行投资方面非常成功。我相信他是最好的企业家和投资者!甚至比尔·盖茨和他的 $微软(MSFT.US$ 还有巴菲特和他的 $伯克希尔-A(BRK.A.US$ 无法比拟!

如果你不同意,请告诉我你最喜欢的首席执行官和他的公司!

奖励来电!评论赢取奖励!

我和Moomoo新闻组一起举办活动一个月!我每天都会发布讨论,Moomoo新闻团队将为活动提供奖励积分!我们将在每个工作日选出前 2 个 “喜欢” 和前 3 个 “有见地” 的评论以及每个周末前 10 名 “喜欢” 和前 10 名 “有见地” 的评论作为赢家。

欲了解更多详情,请单击 这里。

关注我加入最新的讨论!

已翻译

![[奖励电话] 埃隆·马斯克是最伟大的首席执行官和投资者!](https://ussnsimg.moomoo.com/4563251728169564083.png/thumb)

![[奖励电话] 埃隆·马斯克是最伟大的首席执行官和投资者!](https://ussnsimg.moomoo.com/5417315979179241507.jpg/thumb)

120

107

102272386

赞了

专栏 推销新闻

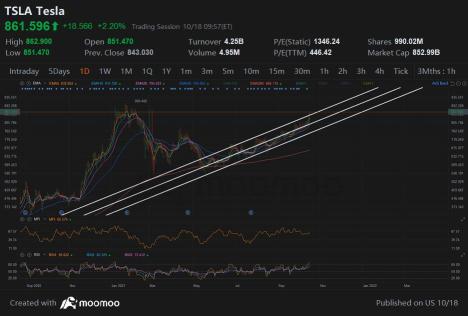

$特斯拉(TSLA.US$ 根据TSLA的收益,本次有两种情景。

1。TSLA击败了分析师,在上个季度表现非常出色,但是随着过去几周供应链和中国出现重大中断,进入第四季度,人们可以开始对不太多的数字进行定价,并借此机会推销这一消息。

2。TSLA的表现不如预期,低于分析师的预期,表现也不如预期,随后将在WED上公布抛售,+还将对供应链进行研究和预测,直至第四季度的未来收益。

在技术层面上,我们还有两个选项,正在进行中。

1。该楔形中有一点虚假的出现,它具有坚实的基础和上涨趋势,并将继续向下移动,有效地突破并走出该楔形。

2。TSLA 位于一个突出显示的频道中,而在最上面则是向通道线的底部反弹。

MFI和RSI存在看跌分歧,目前RSI在所有时间范围内均处于超买状态。

伙计们就是这样

1。TSLA击败了分析师,在上个季度表现非常出色,但是随着过去几周供应链和中国出现重大中断,进入第四季度,人们可以开始对不太多的数字进行定价,并借此机会推销这一消息。

2。TSLA的表现不如预期,低于分析师的预期,表现也不如预期,随后将在WED上公布抛售,+还将对供应链进行研究和预测,直至第四季度的未来收益。

在技术层面上,我们还有两个选项,正在进行中。

1。该楔形中有一点虚假的出现,它具有坚实的基础和上涨趋势,并将继续向下移动,有效地突破并走出该楔形。

2。TSLA 位于一个突出显示的频道中,而在最上面则是向通道线的底部反弹。

MFI和RSI存在看跌分歧,目前RSI在所有时间范围内均处于超买状态。

伙计们就是这样

已翻译

4

$新加坡交易所(S68.SG$ today market not so good, any chance to raise up again?

1

1

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)