Behind the Scenes of T-Mobile US's Latest Options Trends

Behind the Scenes of T-Mobile US's Latest Options Trends

Whales with a lot of money to spend have taken a noticeably bearish stance on T-Mobile US.

有很多钱可以花的鲸鱼对美国T-Mobile采取了明显的看跌立场。

Looking at options history for T-Mobile US (NASDAQ:TMUS) we detected 8 trades.

查看美国T-Mobile(纳斯达克股票代码:TMUS)的期权历史记录,我们发现了8笔交易。

If we consider the specifics of each trade, it is accurate to state that 12% of the investors opened trades with bullish expectations and 62% with bearish.

如果我们考虑每笔交易的具体情况,可以准确地说,12%的投资者以看涨的预期开启交易,62%的投资者持看跌预期。

From the overall spotted trades, 2 are puts, for a total amount of $499,820 and 6, calls, for a total amount of $685,504.

在已发现的全部交易中,有2笔是看跌期权,总额为499,820美元,6笔看涨期权,总额为685,504美元。

Expected Price Movements

预期的价格走势

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $150.0 to $190.0 for T-Mobile US during the past quarter.

分析这些合约的交易量和未平仓合约,看来大型企业一直在关注美国T-Mobile在过去一个季度的价格范围从150.0美元到190.0美元不等。

Insights into Volume & Open Interest

对交易量和未平仓合约的见解

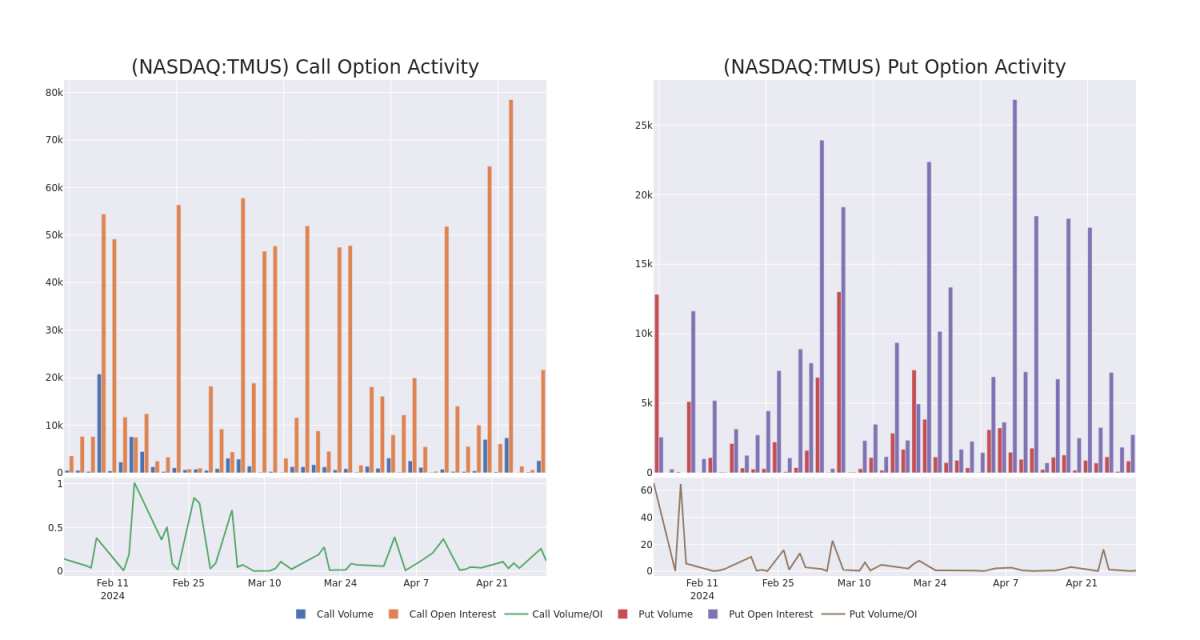

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in T-Mobile US's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to T-Mobile US's substantial trades, within a strike price spectrum from $150.0 to $190.0 over the preceding 30 days.

评估交易量和未平仓合约是期权交易的战略步骤。这些指标揭示了美国T-Mobile期权在指定行使价下的流动性和投资者对它们的兴趣。即将发布的数据可视化了与美国T-Mobile大量交易相关的看涨期权和看跌期权的交易量和未平仓合约的波动,在过去30天内,行使价范围从150.0美元到190.0美元不等。

T-Mobile US Option Activity Analysis: Last 30 Days

T-Mobile 美国期权活动分析:过去 30 天

Significant Options Trades Detected:

检测到的重要期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| TMUS | PUT | TRADE | NEUTRAL | 06/20/25 | $5.8 | $5.2 | $5.5 | $150.00 | $467.5K | 2.2K | 850 |

| TMUS | CALL | TRADE | BULLISH | 06/20/25 | $6.95 | $5.3 | $6.5 | $190.00 | $364.0K | 1.5K | 560 |

| TMUS | CALL | SWEEP | BEARISH | 05/17/24 | $2.77 | $2.71 | $2.71 | $165.00 | $157.7K | 14.4K | 1.1K |

| TMUS | CALL | SWEEP | NEUTRAL | 01/17/25 | $3.0 | $2.73 | $2.98 | $190.00 | $61.5K | 2.6K | 408 |

| TMUS | CALL | SWEEP | BEARISH | 05/17/24 | $2.83 | $2.78 | $2.78 | $165.00 | $48.1K | 14.4K | 186 |

| 符号 | 看跌/看涨 | 交易类型 | 情绪 | Exp。日期 | 问 | 出价 | 价格 | 行使价 | 总交易价格 | 未平仓合约 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| TMUS | 放 | 贸易 | 中立 | 06/20/25 | 5.8 美元 | 5.2 美元 | 5.5 美元 | 150.00 美元 | 467.5 万美元 | 2.2K | 850 |

| TMUS | 打电话 | 贸易 | 看涨 | 06/20/25 | 6.95 美元 | 5.3 美元 | 6.5 美元 | 190.00 美元 | 364.0 万美元 | 1.5K | 560 |

| TMUS | 打电话 | 扫 | 粗鲁的 | 05/17/24 | 2.77 美元 | 2.71 美元 | 2.71 美元 | 165.00 美元 | 157.7 万美元 | 14.4K | 1.1K |

| TMUS | 打电话 | 扫 | 中立 | 01/17/25 | 3.0 美元 | 2.73 美元 | 2.98 美元 | 190.00 美元 | 61.5 万美元 | 2.6K | 408 |

| TMUS | 打电话 | 扫 | 粗鲁的 | 05/17/24 | 2.83 美元 | 2.78 美元 | 2.78 美元 | 165.00 美元 | 48.1 万美元 | 14.4K | 186 |

About T-Mobile US

关于美国 T-Mobile

Deutsche Telekom merged its T-Mobile USA unit with prepaid specialist MetroPCS in 2013, and that firm merged with Sprint in 2020, creating the second-largest wireless carrier in the U.S. T-Mobile now serves 76 million postpaid and 22 million prepaid phone customers, equal to around 30% of the U.S. retail wireless market. The firm entered the fixed-wireless broadband market aggressively in 2021 and now serves nearly 5 million residential and business customers. In addition, T-Mobile provides wholesale services to resellers.

德国电信于2013年将其美国T-Mobile分公司与预付费专业公司MetroPCS合并,该公司于2020年与Sprint合并,创建了美国第二大无线运营商。T-Mobile现在为7600万后付费和2200万预付费电话客户提供服务,相当于美国零售无线市场的30%左右。该公司在2021年积极进入固定无线宽带市场,目前为近500万住宅和商业客户提供服务。此外,T-Mobile向经销商提供批发服务。

Following our analysis of the options activities associated with T-Mobile US, we pivot to a closer look at the company's own performance.

在分析了与美国T-Mobile相关的期权活动之后,我们将转向仔细研究公司自身的表现。

Where Is T-Mobile US Standing Right Now?

美国T-Mobile现在处于什么位置?

- Currently trading with a volume of 1,400,217, the TMUS's price is up by 1.13%, now at $166.02.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 85 days.

- TMUS目前的交易量为1,400,217美元,价格上涨了1.13%,目前为166.02美元。

- RSI读数表明,该股目前可能接近超买。

- 预计财报将在85天后发布。

Professional Analyst Ratings for T-Mobile US

美国T-Mobile的专业分析师评级

Over the past month, 4 industry analysts have shared their insights on this stock, proposing an average target price of $191.25.

在过去的一个月中,4位行业分析师分享了他们对该股的见解,提出平均目标价为191.25美元。

- An analyst from TD Cowen persists with their Buy rating on T-Mobile US, maintaining a target price of $202.

- Consistent in their evaluation, an analyst from RBC Capital keeps a Outperform rating on T-Mobile US with a target price of $188.

- Consistent in their evaluation, an analyst from Keybanc keeps a Overweight rating on T-Mobile US with a target price of $185.

- Maintaining their stance, an analyst from Oppenheimer continues to hold a Outperform rating for T-Mobile US, targeting a price of $190.

- 道明考恩的一位分析师坚持对美国T-Mobile的买入评级,维持202美元的目标价。

- 加拿大皇家银行资本的一位分析师在评估中保持对美国T-Mobile跑赢大盘的评级,目标价为188美元。

- 根据他们的评估,Keybanc的一位分析师维持美国T-Mobile的增持评级,目标价为185美元。

- 奥本海默的一位分析师坚持其立场,继续维持美国T-Mobile跑赢大盘的评级,目标价格为190美元。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest T-Mobile US options trades with real-time alerts from Benzinga Pro.

期权交易具有更高的风险和潜在的回报。精明的交易者通过不断自我教育、调整策略、监控多个指标以及密切关注市场走势来管理这些风险。借助Benzinga Pro的实时提醒,随时了解最新的美国T-Mobile期权交易。