“减半”发生后比特币价格小幅下挫,其影响在很大程度上已被市场提前消化。受“减半”影响最大的是比特币矿商,摩根大通预计,“减半”将令行业收入腰斩,引发新一轮行业整合和矿企倒闭潮。

刚刚,比特币完成了历史上的第四次“减半”。

根据分析网站mempool.space和Blockchain.com的数据,“减半”于纽约时间周五晚上8:10生效。

所谓“减半”,就是矿工通过挖矿获得的奖励减半。每当比特币区块链产生21万个区块时,比特币区块奖励都会减半。加上本次,比特币自2009年诞生以来已经进行了四次“减半”。

消息传出后,比特币价格小幅走低,现在63550美元/枚附近波动。

本次减半的结果是,矿工每天通过验证交易生产的比特币数量从900个减少到450个,矿工获得的奖励从6.25个比特币减少到3.125个。

“减半”=新一轮牛市的开端?

此前比特币的支持者预计,“减半”将成为最新牛市的积极催化剂,理由是在需求上升(来自比特币现货ETF)的同时,“减半”进一步减少了比特币的供应。

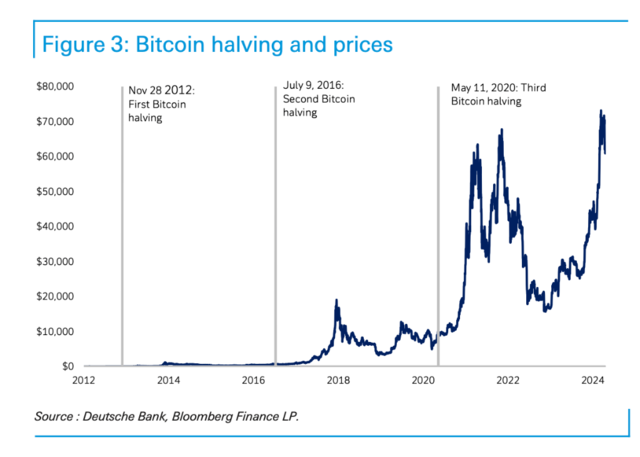

历史上,比特币减半事件前后的价格变动引起了广泛关注。在2012年、2016年和2020年的减半事件前30天,比特币价格分别上涨了5%、13%和27%。此外,减半事件也推动了比特币地址数量的增长,尤其是在减半后的150天内,新创建的比特币地址数量分别增长了83%、101%和11%。

然而,尽管在过去的“减半”事件后比特币价格曾飙升至创纪录水平,包括摩根大通和德意志银行的分析师在内的市场观察人士此前预测,这次“减半”的影响在很大程度上已被市场提前消化。

摩根大通分析师Nikolaos Panigirtzoglou周四表示,他预计比特币短期内会承压,理由是市场过度买入,且价格较比特币相对黄金(考虑波动性调整后)的水平仍然偏高。他还提到,加密项目融资低迷。

摩根大通分析师Nikolaos Panigirtzoglou周四表示,他预计比特币短期内会承压,理由是市场过度买入,且价格较比特币相对黄金(考虑波动性调整后)的水平仍然偏高。他还提到,加密项目融资低迷。

德银分析师看法相近。该行分析师Marion Laboure周四在报告中称:“市场已经在一定程度上消化了比特币‘减半’的影响。考虑到比特币算法的特性,此次减半在很大程度上已被市场预期。我们预计,减半后比特币价格不会大幅上扬。”

新加坡数字资产交易所AsiaNext首席执行官Kok Kee Chong表示:“正如预期的那样,‘减半’已经完全反映在价格中,因此价格变动有限。现在,业界将拭目以待,看看在持续的机构兴趣下,未来几周是否会出现反弹。”

从机制上看,“减半”本身不应该在短期内影响比特币价格,但许多投资者根据比特币在之前几次减半后的表现,预计未来几个月将出现大幅上涨。在2012年、2016年和2020年的减半之后,比特币价格从减半当日的价格到周期峰值分别上涨了约93倍、30倍和8倍。

值得注意的是,每次比特币经历“减半”后,新开采的比特币数量对整个比特币供应量的影响(即稀释效应)都在减弱。比如,第一次“减半"后,新开采的比特币数量相当于减半时全部流通比特币的50%,对总供应量影响很大。但在第四次“减半”后,新开采的比特币数量将只占当前总供应量的3.3%,对总供应量的影响大大减弱。

收入腰斩?“减半”的最大受害者出现了?

相较于比特币本身,本次“减半”对矿商的影响更大。

减半前夕,比特币矿商走势跌宕,比如Riot Platforms周五收盘下跌约41%,但2023年曾暴涨356%。今年以来,比特币多数矿商股价跌幅达两位数,这与2023年300%至600%的涨幅形成鲜明对比。

摩根大通分析师Reginald Smith近日在一份投资者报告中指出:

“在其他条件不变的情况下,‘减半’将令行业收入腰斩,引发新一轮行业整合和矿企倒闭潮。但与此同时,‘减半’有望理顺网络算力和行业资本支出,最终将利好留存的矿企。”

比特币旷工的收入主要有两大来源:挖矿奖励以及交易费用。“减半”直接影响了矿工的挖矿奖励,然而,矿工的运营成本,如电费、设备费用等,并不会因为减半而降低。

这就意味着,如果比特币价格和交易费没有大幅上涨,以抵消奖励“减半”的影响,许多矿工可能会面临盈利困难。

伯恩斯坦分析师Gautam Chhugani表示:

“在比特币ETF缺位的情况下,市场迄今将矿业股视为比特币的代理人。减半将进一步分化矿企:低成本、规模化、整合型的赢家,将从众多中小矿企中脱颖而出,后者或在减半后陷入不利境地。”