After Recent Decline, MercadoLibre Presents an Opportunity

After releasing disappointing fourth-quarter earnings results in February, MercadoLibre Inc.'s (NASDAQ:MELI) share price had dropped by more than 21% to around $1,500 at the time of writing. Despite the recent plunge, the company has been a great stock for its shareholders, delivering a compounded annual growth rate of 33% over the past 10years.

My analysis indicates the stock now appears to be quite undervalued.

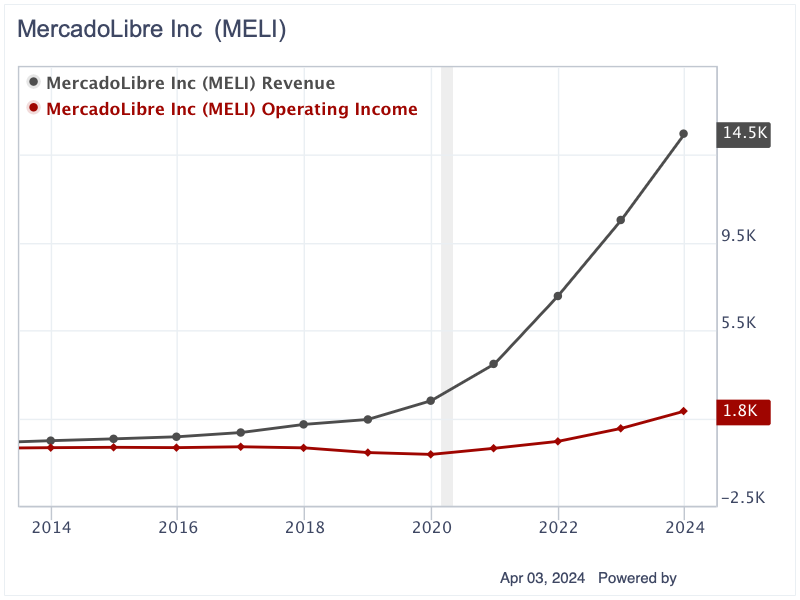

Growing revenue and fluctuating operating income

Considered the Amazon (NASDAQ:AMZN) of Latin America, MercadoLibre is the largest online commerce ecosystem in 18 countries, including Brazil, Argentina, Mexico, Venezuela and Ecuador. The company has two main revenue streams: Commerce and Fintech. The Commerce revenue is derived from marketplace fees, shipping fees, ad sales fees, classifieds fees and fees from other ancillary businesses. Fintech revenue is generated from commissions based on the payment volume in the Marketplace platform, interest, cash advances, insurtech fees and cash withdrawal fees. Around $8.20 billion, or 56.70% of the total 2023 revenue, was generated from Commerce, while the Fintech revenue was $6.27 billion, representing 43.30% of total sales.

MercadoLibre's business has experienced rapid growth over the past decade. In 2013, the company had 25.30 million unique users, including 5.10 million unique sellers and 20.20 million unique buyers. In 2023, the number of unique active users surged by 8.60 times to 218 million.

Along with the growing number of unique active users, the company has managed to grow its revenue every single year, increasing from $472.60 million in 2013 to nearly $14.50 billion in 2023. On the other hand, its operating income fluctuated in the range of $144.87 million to $195 million between 2013 and 2017. In the subsequent two years, its operating income dropped to losses of $69.50 million and $153.16 million. The losses generated in 2018 and 2019 were mainly due to the increase in sales and marketing expenses relating to bad debt expenses of the credit business in Brazil, buyer protection program expenses and branding initiatives. However, MercadoLibre's operating income has bounced back strongly to reach an all-time high of $1.82 billion in 2023.

Looking to the future, MercadoLibre has strong growth prospects. According to Atlantico's Latin America Digital Transformation Report, the internet penetration rate in Latin America was 78% in 2023, surpassing China's rate at 74% and India's at only 49%. The penetration rates in the company's three biggest markets, including Brazil, Mexico and Argentina, are extremely high at 84%, 77% and 87%, respectively. Building on its leading e-commerce platform, MercadoLibre can continue to expand its fintech businesses, which include payment platform MercadoPago and the lending solution MercadoCredito, which gives loans to consumers and merchants. The growth of its fintech solutions are expected to be propelled by the fact that 70% of Latin America's population, amounting to 122 million people, remains underbanked.

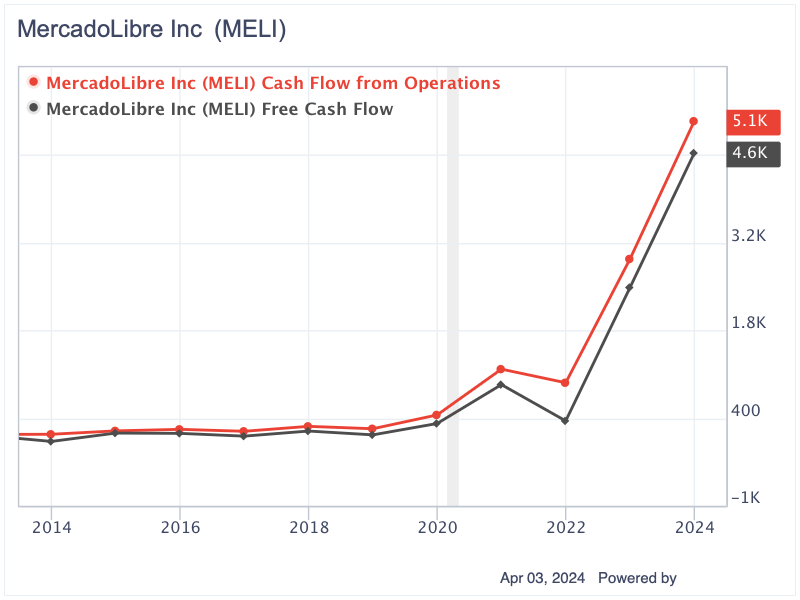

Strong cash flow generation

MercadoLibre has been a consistent positive cash flow generator. Although its operating cash flow and free cash flow have been fluctuating widely over the past decade, they are on a rising trend. Its operating cash flow increased from $142.50 million in 2013 to $5.14 billion in 2023, while free cash flow rose from $28.30 million to $4.63 billion over the same period. In the past two years, the cash flow generation has taken off significantly, driven by the increase in profitability, payables and accrued expenses as well as a sharp rise in payables related to credit and debit card transactions.

Solid balance sheet with net cash position

MercadoLibre has a strong balance sheet. At the end of 2023, its total shareholders' equity was recorded at $3 billion, with cash reserves and short-term investments, including overnight bank deposits, amounting to $7.33 billion. The company's total debt, including loans payable and operating leases, stood at $5.33 billion. Consequently, MercadoLibre had a net cash position of $2 billion. Given this robust net cash position alongside an operating cash flow of $5.14 billion, it is clear MercadoLibre faces no significant challenges in meeting its debt and lease obligations.

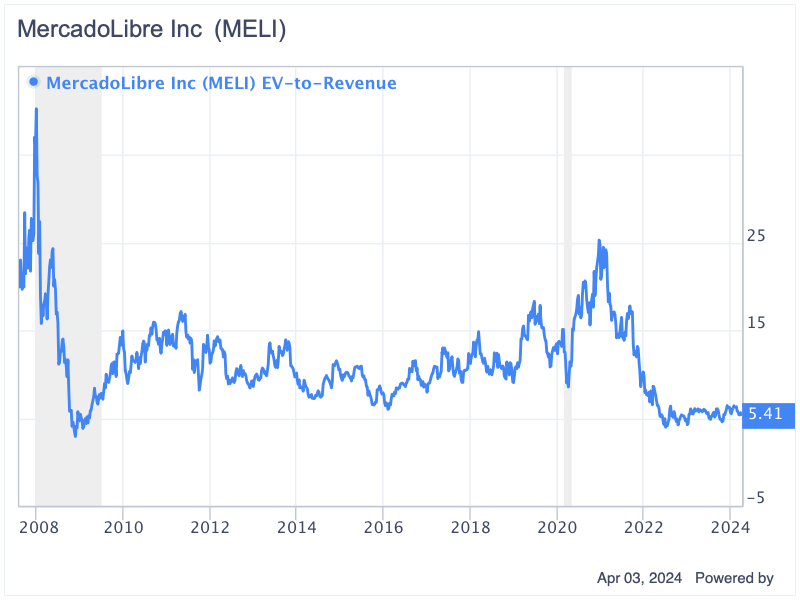

Potential upside

Since 2007, the company's enterprise value-to-revenue ratio has exhibited significant volatility. After reaching a peak of 40.26 at the end of 2007, the company's revenue multiple drastically fell to 2.92 during the global recession in 2008, only to rebound shortly thereafter. In the period of 2009 to 2021, its sales valuation has oscillated within a broad range of 8 to 25.30. Currently, MercadoLibre is valued at only 5.40 times its revenue, which is nearly 50% below its 17-year average sales multiple of 11.40.

In 2025, MercadoLibre is expected to generate around $21.65 billion in sales. If we expect a 15% operating margin, which is lower than its 17-year average operating margin of 18%, its operating profit will be $3.25 billion.

Since 2007, the company's earnings yield has fluctuated between -1.25% and 8.25%, averaging at 2% during this period. With an expected earnings yield of 2%, equivalent to 50 times its operating income, MercadoLibre's valuation is projected to reach $162.5 billion by 2025.

Applying an 8% discount rate, the company's enterprise value is estimated to be $139.30 billion. After adding $2 billion in net cash, the equity value should be $141.30 billion. Given 51 million shares outstanding, each share would be worth $2,770 per share, 85% higher than the current price.

Conclusion

MercadoLibre has delivered robust performance over the past decade, characterized by consistent revenue growth, a strong balance sheet and significant cash flow generation. Its dominant position in the Latin American e-commerce and fintech sectors creates a high barrier to entry for potential competitors.

According to my analysis, MercadoLibre offers a staggering potential upside of 85%, presenting a great opportunity for long-term growth investors.

This article first appeared on GuruFocus.