Energizer's (ENR) Auto Care Unit Strong, Battery Category Soft

Energizer Holdings Inc. ENR is advancing strategic initiatives for sustainable growth and enhancing profitability. The company is deeply engaged in consumer engagement strategies to boost brand loyalty and market share without sidelining margin improvement. Energizer's Auto Care Segment has been doing well in particular, helping the company battle softness in the battery category.

The abovementioned strategies include targeted pricing and promotional tactics designed to reinforce category health and drive brand growth, all while maintaining a disciplined approach. The ongoing Project Momentum initiative, which focuses on cost-saving measures and operational efficiencies, thereby contributing to margin expansion and long-term value creation, is significant part of these efforts.

ENR’s commitment to sustainable performance is evident through its strategic agility in navigating market challenges. This approach has led to a notable improvement in margins, with the adjusted gross margin reaching 39.5% in the first quarter of fiscal 2024, marking a 50-basis-point improvement year over year, attributed to the successful execution of Project Momentum.

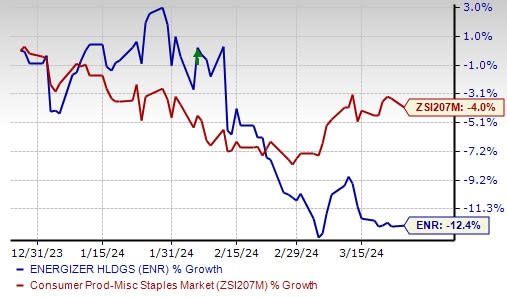

Image Source: Zacks Investment Research

Auto Care Segment Strong

The Auto Care segment stands as a pivotal growth driver for Energizer, with revenues increasing 5.7% to $98.8 million in the fiscal first quarter from the previous year. This growth is powered by innovative product offerings, effective marketing and strategic distribution channels, allowing Energizer to diversify its revenue streams and enhance its competitive edge in the automotive aftermarket.

Moreover, the segment's remarkable growth in double digits within international markets highlights Energizer's solid international presence and strategic operations. Moving forward, the company is in an excellent position to seize growth prospects in the Auto Care segment, using its knowledge, brand reputation and customer confidence to fuel ongoing success and generate value.

Debt Reduction Strategy Bodes Well

On the financial front, Energizer has adopted a comprehensive debt reduction strategy to strengthen its financial standing and boost shareholder value. This strategy has yielded significant debt reduction, with $78 million paid down in the fiscal first quarter, followed by an additional $58 million of long-term debt repayment.

Energizer's ability to generate strong cash flow, exceeding 21% of net sales in the fiscal first quarter, supports its disciplined debt repayment approach, enabling the allocation of resources toward debt reduction, while maintaining liquidity for strategic investments.

Soft Battery Category

Despite the positive aspects of Energizer, the battery category saw a downturn in both global category volume and value, each falling in the low-single digits in the fiscal first quarter. This decline has been attributed to the ongoing repercussions of international price hikes and the effects of the energy crisis in Europe, which have led to reduced category volumes and values.

Additionally, the company pointed out a persistently weaker performance in non-tracked channels, likely affecting battery segment sales. As a result, revenues from the Batteries & Lights segment fell 8% year over year to $617.8 million, with organic sales dipping 9.1%.

This Zacks Rank #3 (Hold) company’s shares have lost 12.4% in the past three months compared with the industry’s decline of 4%.

However, the strategic vision positions Energizer as a dynamic player capable of navigating market challenges and seizing growth opportunities.

Key Consumer Staple Picks

Post Holdings POST is a consumer-packaged goods holding company. It currently sports a Zacks Rank #1 (Strong Buy). POST has a trailing four-quarter average earnings surprise of 52.2%. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Post Holdings’ current fiscal-year sales and earnings suggests growth of 15.2% and 3.4%, respectively, from the year-ago reported figures.

Celsius Holdings CELH, which offers functional drinks and liquid supplements, currently carries a Zacks Rank #2 (Buy). CELH has a trailing four-quarter earnings surprise of 67.4%, on average.

The Zacks Consensus Estimate for Celsius Holdings’ current financial-year sales and earnings suggests growth of 41.6% each from the year-ago reported numbers.

Vital Farms VITL offers a range of produced pasture-raised foods. It currently carries a Zacks Rank #2. VITL has a trailing four-quarter earnings surprise of 155.4%, on average.

The Zacks Consensus Estimate for Vital Farms’ current financial-year sales and earnings suggests growth of 18.6% and 35.6%, respectively, from the year-ago reported figures.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Energizer Holdings, Inc. (ENR) : Free Stock Analysis Report

Post Holdings, Inc. (POST) : Free Stock Analysis Report

Celsius Holdings Inc. (CELH) : Free Stock Analysis Report

Vital Farms, Inc. (VITL) : Free Stock Analysis Report