Household Products Stocks Q4 Highlights: Central Garden & Pet (NASDAQ:CENT)

As the craze of earnings season draws to a close, here's a look back at some of the most exciting (and some less so) results from Q4. Today we are looking at the household products stocks, starting with Central Garden & Pet (NASDAQ:CENT).

Household products stocks are generally stable investments, as many of the industry's products are essential for a comfortable and functional living space. Recently, there's been a growing emphasis on eco-friendly and sustainable offerings, reflecting the evolving consumer preferences for environmentally conscious options. These trends can be double-edged swords that benefit companies who innovate quickly to take advantage of them and hurt companies that don't invest enough to meet consumers where they want to be with regards to trends.

The 10 household products stocks we track reported a strong Q4; on average, revenues beat analyst consensus estimates by 2.3% Inflation (despite slowing) has investors prioritizing near-term cash flows, but household products stocks held their ground better than others, with the share prices up 4.3% on average since the previous earnings results.

Central Garden & Pet (NASDAQ:CENT)

Enhancing the lives of both pets and homeowners, Central Garden & Pet (NASDAQGS:CENT) is a leading producer and distributor of essential products for pet care, lawn and garden maintenance, and pest control.

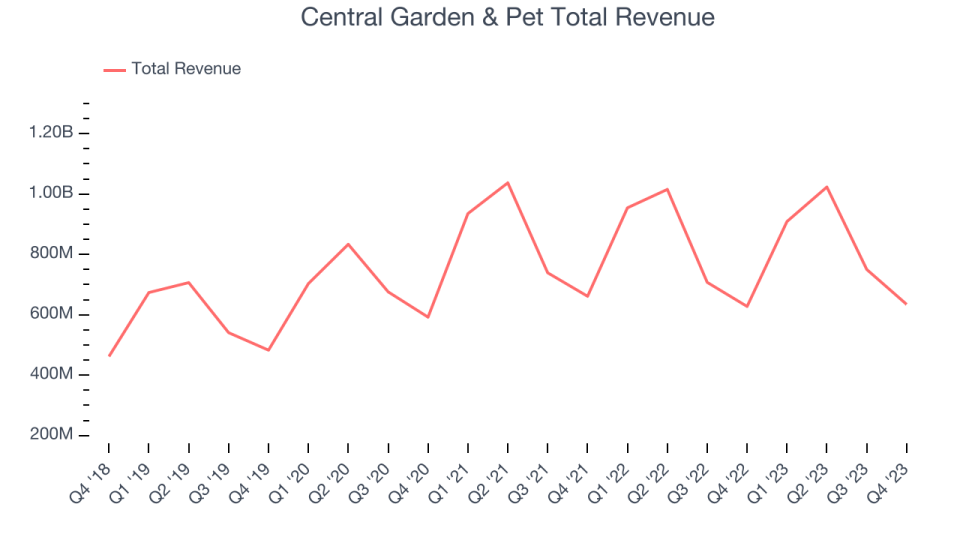

Central Garden & Pet reported revenues of $634.5 million, up 1.1% year on year, topping analyst expectations by 2.8%. It was a very strong quarter for the company, with an impressive beat of analysts' earnings estimates.

“The fiscal year is off to a solid start as we successfully navigated the challenging external environment. We delivered earnings per share of $0.01 as a result of improved gross margin and early season shipments,” said Beth Springer, Interim CEO of Central Garden & Pet.

The stock is up 13.3% since the results and currently trades at $42.56.

Is now the time to buy Central Garden & Pet? Access our full analysis of the earnings results here, it's free.

Best Q4: Clorox (NYSE:CLX)

Founded in 1913 with bleach as the sole product offering, Clorox (NYSE:CLX) today is a consumer products giant whose product portfolio spans everything from bleach to skincare to salad dressing to kitty litter.

Clorox reported revenues of $1.99 billion, up 16% year on year, outperforming analyst expectations by 10.3%. It was an incredible quarter for the company, with an impressive beat of analysts' earnings estimates, although some large one-time charges that were added back to arrive at the EPS (non-GAAP) figure likely made it difficult for Wall Street to model and project. In addition, its revenue and gross margin outperformed Wall Street's estimates.

Clorox delivered the biggest analyst estimates beat and fastest revenue growth among its peers. The stock is up 1.5% since the results and currently trades at $150.25.

Is now the time to buy Clorox? Access our full analysis of the earnings results here, it's free.

Weakest Q4: Kimberly-Clark (NYSE:KMB)

Originally founded as a Wisconsin paper mill in 1872, Kimberly-Clark (NYSE:KMB) is now a household products powerhouse known for personal care and tissue products.

Kimberly-Clark reported revenues of $4.97 billion, flat year on year, falling short of analyst expectations by 0.5%. It was a weak quarter for the company, with a miss of analysts' operating margin and EPS estimates due to $170 million of currency headwinds from its developing markets experiencing hyperinflation.

Kimberly-Clark had the weakest performance against analyst estimates in the group. The stock is up 0.7% since the results and currently trades at $125.74.

Read our full analysis of Kimberly-Clark's results here.

Energizer (NYSE:ENR)

Masterminds behind the viral Energizer Bunny mascot, Energizer (NYSE:ENR) is one of the world's largest manufacturers of batteries.

Energizer reported revenues of $716.6 million, down 6.3% year on year, in line with analyst expectations. It was a mixed quarter for the company, with a narrow miss of analysts' revenue andd EPS estimates. While next quarter's EPS outlook was below expectations, full year EPS guidance was in line.

The stock is down 9.5% since the results and currently trades at $28.11.

Read our full, actionable report on Energizer here, it's free.

Reynolds (NASDAQ:REYN)

Best known for its aluminum foil, Reynolds (NASDAQ:REYN) is a household products company whose products focus on food storage, cooking, and waste.

Reynolds reported revenues of $1.01 billion, down 7.5% year on year, in line with analyst expectations. It was a solid quarter for the company, with optimistic earnings guidance for the next quarter and full year.

Reynolds had the slowest revenue growth among its peers. The stock is up 1.9% since the results and currently trades at $28.36.

Read our full, actionable report on Reynolds here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.