A Look At The Fair Value Of Intchains Group Limited (NASDAQ:ICG)

A Look At The Fair Value Of Intchains Group Limited (NASDAQ:ICG)

Key Insights

关键见解

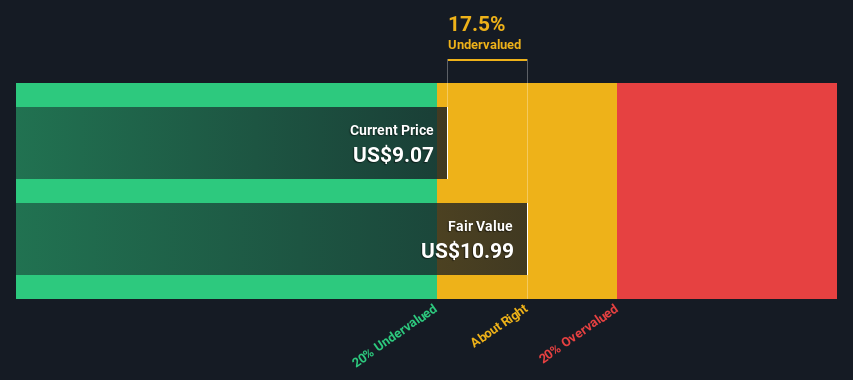

- The projected fair value for Intchains Group is US$10.99 based on 2 Stage Free Cash Flow to Equity

- Current share price of US$9.07 suggests Intchains Group is potentially trading close to its fair value

- The average premium for Intchains Group's competitorsis currently 68%

- 根据两阶段股权自由现金流,Intchains集团的预计公允价值为10.99美元

- 目前9.07美元的股价表明Intchains集团的交易价格可能接近其公允价值

- 目前,Intchains集团竞争对手的平均溢价为68%

How far off is Intchains Group Limited (NASDAQ:ICG) from its intrinsic value? Using the most recent financial data, we'll take a look at whether the stock is fairly priced by estimating the company's future cash flows and discounting them to their present value. We will use the Discounted Cash Flow (DCF) model on this occasion. Believe it or not, it's not too difficult to follow, as you'll see from our example!

Intchains集团有限公司(纳斯达克股票代码:ICG)距离其内在价值有多远?使用最新的财务数据,我们将通过估算公司未来的现金流并将其折扣为现值来研究股票的定价是否公平。在这种情况下,我们将使用折扣现金流(DCF)模型。信不信由你,这并不难理解,正如你将从我们的例子中看到的那样!

Remember though, that there are many ways to estimate a company's value, and a DCF is just one method. Anyone interested in learning a bit more about intrinsic value should have a read of the Simply Wall St analysis model.

但请记住,估算公司价值的方法有很多,而差价合约只是一种方法。任何有兴趣进一步了解内在价值的人都应该读一读 Simply Wall St 分析模型。

See our latest analysis for Intchains Group

查看我们对Intchains集团的最新分析

The Method

该方法

We're using the 2-stage growth model, which simply means we take in account two stages of company's growth. In the initial period the company may have a higher growth rate and the second stage is usually assumed to have a stable growth rate. To begin with, we have to get estimates of the next ten years of cash flows. Seeing as no analyst estimates of free cash flow are available to us, we have extrapolate the previous free cash flow (FCF) from the company's last reported value. We assume companies with shrinking free cash flow will slow their rate of shrinkage, and that companies with growing free cash flow will see their growth rate slow, over this period. We do this to reflect that growth tends to slow more in the early years than it does in later years.

我们使用的是两阶段增长模型,这只是意味着我们考虑了公司增长的两个阶段。在初始阶段,公司的增长率可能更高,而第二阶段通常被认为具有稳定的增长率。首先,我们必须估算出未来十年的现金流。鉴于我们没有分析师对自由现金流的估计,我们从公司上次公布的价值中推断了之前的自由现金流(FCF)。我们假设自由现金流萎缩的公司将减缓其萎缩速度,而自由现金流不断增长的公司在此期间的增长率将放缓。我们这样做是为了反映早期增长的放缓幅度往往比后来的几年更大。

A DCF is all about the idea that a dollar in the future is less valuable than a dollar today, so we need to discount the sum of these future cash flows to arrive at a present value estimate:

差价合约完全是关于未来一美元的价值低于今天一美元的想法,因此我们需要对这些未来现金流的总和进行折现才能得出现值估计:

10-year free cash flow (FCF) forecast

10 年自由现金流 (FCF) 预测

| 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | |

| Levered FCF (CN¥, Millions) | CN¥310.6m | CN¥337.8m | CN¥360.8m | CN¥380.4m | CN¥397.4m | CN¥412.5m | CN¥426.2m | CN¥438.9m | CN¥451.1m | CN¥462.8m |

| Growth Rate Estimate Source | Est @ 11.58% | Est @ 8.78% | Est @ 6.81% | Est @ 5.43% | Est @ 4.47% | Est @ 3.79% | Est @ 3.32% | Est @ 2.99% | Est @ 2.76% | Est @ 2.60% |

| Present Value (CN¥, Millions) Discounted @ 10.0% | CN¥282 | CN¥279 | CN¥271 | CN¥260 | CN¥247 | CN¥233 | CN¥219 | CN¥205 | CN¥191 | CN¥178 |

| 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | |

| 杠杆FCF(人民币,百万) | 3.106 亿元人民币 | 3.378 亿元人民币 | 3.608 亿元人民币 | 380.4 万元人民币 | 3.974 亿元人民币 | 412.5 亿人民币 | 426.2 亿元人民币 | 4.389 亿元人民币 | 4.51亿元人民币 | 4.628亿元人民币 |

| 增长率估算来源 | 美国东部标准时间 @ 11.58% | 美国东部标准时间 @ 8.78% | Est @ 6.81% | Est @ 5.43% | Est @ 4.47% | Est @ 3.79% | Est @ 3.32% | Est @ 2.99% | Est @ 2.76% | Est @ 2.60% |

| 现值(人民币,百万元)折扣 @ 10.0% | CN¥282 | CN¥279 | CN¥271 | CN¥260 | CN¥247 | CN¥233 | CN¥219 | CN¥205 | CN¥191 | CN¥178 |

("Est" = FCF growth rate estimated by Simply Wall St)

Present Value of 10-year Cash Flow (PVCF) = CN¥2.4b

(“Est” = Simply Wall St估计的FCF增长率)

10 年期现金流 (PVCF) 的现值 = 24亿元人民币

After calculating the present value of future cash flows in the initial 10-year period, we need to calculate the Terminal Value, which accounts for all future cash flows beyond the first stage. The Gordon Growth formula is used to calculate Terminal Value at a future annual growth rate equal to the 5-year average of the 10-year government bond yield of 2.2%. We discount the terminal cash flows to today's value at a cost of equity of 10.0%.

在计算了最初10年期内未来现金流的现值之后,我们需要计算终值,该终值涵盖了第一阶段以后的所有未来现金流。戈登增长公式用于计算终值,其未来年增长率等于10年期国债收益率2.2%的5年平均水平。我们将终端现金流折现为今天的价值,权益成本为10.0%。

Terminal Value (TV)= FCF2033 × (1 + g) ÷ (r – g) = CN¥463m× (1 + 2.2%) ÷ (10.0%– 2.2%) = CN¥6.1b

终端价值 (TV) = FCF2033 × (1 + g) ÷ (r — g) = 4.63亿元人民币× (1 + 2.2%) ÷ (10.0% — 2.2%) = 61亿人民币

Present Value of Terminal Value (PVTV)= TV / (1 + r)10= CN¥6.1b÷ ( 1 + 10.0%)10= CN¥2.3b

终端价值的现值 (PVTV) = 电视/ (1 + r)10= CN¥6.1b÷ (1 + 10.0%)10= 2.3亿元人民币

The total value, or equity value, is then the sum of the present value of the future cash flows, which in this case is CN¥4.7b. In the final step we divide the equity value by the number of shares outstanding. Compared to the current share price of US$9.1, the company appears about fair value at a 18% discount to where the stock price trades currently. Remember though, that this is just an approximate valuation, and like any complex formula - garbage in, garbage out.

因此,总价值或权益价值是未来现金流现值的总和,在本例中为47亿元人民币。在最后一步中,我们将股票价值除以已发行股票的数量。与目前的9.1美元股价相比,该公司的公允价值似乎比目前的股价折扣了18%。但请记住,这只是一个近似的估值,就像任何复杂的公式一样,垃圾进出。

The Assumptions

假设

We would point out that the most important inputs to a discounted cash flow are the discount rate and of course the actual cash flows. You don't have to agree with these inputs, I recommend redoing the calculations yourself and playing with them. The DCF also does not consider the possible cyclicality of an industry, or a company's future capital requirements, so it does not give a full picture of a company's potential performance. Given that we are looking at Intchains Group as potential shareholders, the cost of equity is used as the discount rate, rather than the cost of capital (or weighted average cost of capital, WACC) which accounts for debt. In this calculation we've used 10.0%, which is based on a levered beta of 1.282. Beta is a measure of a stock's volatility, compared to the market as a whole. We get our beta from the industry average beta of globally comparable companies, with an imposed limit between 0.8 and 2.0, which is a reasonable range for a stable business.

我们要指出的是,贴现现金流的最重要投入是贴现率,当然还有实际的现金流。你不必同意这些输入,我建议你自己重做计算然后试一试。DCF也没有考虑一个行业可能的周期性,也没有考虑公司未来的资本需求,因此它没有全面反映公司的潜在表现。鉴于我们将Intchains集团视为潜在股东,因此使用权益成本作为贴现率,而不是构成债务的资本成本(或加权平均资本成本,WACC)。在此计算中,我们使用了10.0%,这是基于1.282的杠杆测试版。Beta是衡量股票与整个市场相比波动性的指标。我们的测试版来自全球可比公司的行业平均贝塔值,设定在0.8到2.0之间,这是一个稳定的业务的合理范围。

Looking Ahead:

展望未来:

Although the valuation of a company is important, it shouldn't be the only metric you look at when researching a company. It's not possible to obtain a foolproof valuation with a DCF model. Instead the best use for a DCF model is to test certain assumptions and theories to see if they would lead to the company being undervalued or overvalued. For example, changes in the company's cost of equity or the risk free rate can significantly impact the valuation. For Intchains Group, we've put together three important aspects you should explore:

尽管公司的估值很重要,但它不应该是你在研究公司时唯一考虑的指标。使用DCF模型不可能获得万无一失的估值。相反,DCF模型的最佳用途是测试某些假设和理论,看看它们是否会导致公司被低估或高估。例如,公司权益成本或无风险利率的变化会对估值产生重大影响。对于Intchains集团,我们汇总了你应该探索的三个重要方面:

- Risks: Every company has them, and we've spotted 1 warning sign for Intchains Group you should know about.

- Other High Quality Alternatives: Do you like a good all-rounder? Explore our interactive list of high quality stocks to get an idea of what else is out there you may be missing!

- Other Environmentally-Friendly Companies: Concerned about the environment and think consumers will buy eco-friendly products more and more? Browse through our interactive list of companies that are thinking about a greener future to discover some stocks you may not have thought of!

- 风险:每家公司都有风险,我们发现了一个你应该知道的Intchains集团警告信号。

- 其他高质量的替代品:你喜欢一个优秀的全能选手吗?浏览我们的高品质股票互动清单,了解您可能还会错过什么!

- 其他环保公司:担心环境并认为消费者会越来越多地购买环保产品?浏览我们正在考虑更绿色未来的公司的互动名单,发现一些你可能没有想到的股票!

PS. The Simply Wall St app conducts a discounted cash flow valuation for every stock on the NASDAQCM every day. If you want to find the calculation for other stocks just search here.

PS。Simply Wall St应用程序每天对纳斯达克证券交易所的每只股票进行折扣现金流估值。如果您想找到其他股票的计算方法,请在此处搜索。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有反馈吗?对内容感到担忧?直接联系我们。 或者,给编辑团队 (at) simplywallst.com 发送电子邮件。

Simply Wall St的这篇文章本质上是笼统的。我们仅使用公正的方法根据历史数据和分析师的预测提供评论,我们的文章无意作为财务建议。它不构成买入或卖出任何股票的建议,也没有考虑到您的目标或财务状况。我们的目标是为您提供由基本数据驱动的长期重点分析。请注意,我们的分析可能不考虑最新的价格敏感型公司公告或定性材料。简而言之,华尔街没有持有任何上述股票的头寸。