Henan Qingshuiyuan TechnologyLtd (SZSE:300437) Will Be Hoping To Turn Its Returns On Capital Around

Henan Qingshuiyuan TechnologyLtd (SZSE:300437) Will Be Hoping To Turn Its Returns On Capital Around

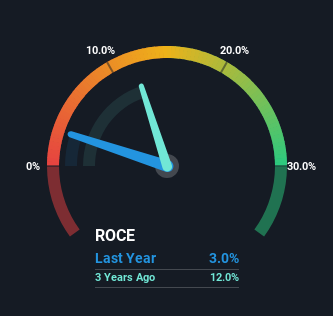

When it comes to investing, there are some useful financial metrics that can warn us when a business is potentially in trouble. Businesses in decline often have two underlying trends, firstly, a declining return on capital employed (ROCE) and a declining base of capital employed. This indicates the company is producing less profit from its investments and its total assets are decreasing. And from a first read, things don't look too good at Henan Qingshuiyuan TechnologyLtd (SZSE:300437), so let's see why.

谈到投资,有一些有用的财务指标可以在企业潜在陷入困境时警告我们。衰退中的企业通常有两个潜在趋势,第一,衰退退货论资本充足率(ROCE)与衰退基地已动用资本的比例。这表明该公司从投资中产生的利润正在减少,其总资产正在减少。从第一眼看,事情看起来并不太好河南清水源科技有限公司(SZSE:300437),让我们看看为什么。

Return On Capital Employed (ROCE): What Is It?

资本回报率(ROCE):它是什么?

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. The formula for this calculation on Henan Qingshuiyuan TechnologyLtd is:

如果您不确定,只需澄清一下,ROCE是一种评估公司投资于其业务的资本获得多少税前收入(按百分比计算)的指标。河南清水源科技有限公司的这一计算公式为:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

已动用资本回报率=息税前收益(EBIT)?(总资产-流动负债)

0.03 = CN¥56m ÷ (CN¥2.9b - CN¥1.1b) (Based on the trailing twelve months to March 2023).

0.03=CN元5600万?(CN元29亿元-CN元11亿元)(根据截至2023年3月的往绩12个月计算)。

Thus, Henan Qingshuiyuan TechnologyLtd has an ROCE of 3.0%. Ultimately, that's a low return and it under-performs the Chemicals industry average of 7.1%.

因此,河南清水源科技有限公司的净资产收益率为3.0%。归根结底,这是一个较低的回报率,表现低于7.1%的化工行业平均水平。

See our latest analysis for Henan Qingshuiyuan TechnologyLtd

查看我们对河南清水源科技有限公司的最新分析

While the past is not representative of the future, it can be helpful to know how a company has performed historically, which is why we have this chart above. If you're interested in investigating Henan Qingshuiyuan TechnologyLtd's past further, check out this free graph of past earnings, revenue and cash flow.

虽然过去并不代表未来,但了解一家公司历史上的表现是有帮助的,这就是为什么我们有上面的图表。如果你有兴趣进一步调查河南清水源科技有限公司的过去,请查看以下内容免费过去收益、收入和现金流的图表。

What Does the ROCE Trend For Henan Qingshuiyuan TechnologyLtd Tell Us?

河南清水源科技有限公司的ROCE趋势告诉我们什么?

There is reason to be cautious about Henan Qingshuiyuan TechnologyLtd, given the returns are trending downwards. About five years ago, returns on capital were 12%, however they're now substantially lower than that as we saw above. And on the capital employed front, the business is utilizing roughly the same amount of capital as it was back then. This combination can be indicative of a mature business that still has areas to deploy capital, but the returns received aren't as high due potentially to new competition or smaller margins. So because these trends aren't typically conducive to creating a multi-bagger, we wouldn't hold our breath on Henan Qingshuiyuan TechnologyLtd becoming one if things continue as they have.

考虑到回报呈下降趋势,对河南清水源科技有限公司持谨慎态度是有理由的。大约五年前,资本回报率为12%,但现在大大低于我们上面看到的水平。在已动用资本方面,该公司利用的资本与当时大致相同。这一组合可能表明,一家成熟的企业仍有需要配置资本的领域,但由于潜在的新竞争或利润率较低,获得的回报并不那么高。因此,由于这些趋势通常不利于创建多个袋子,如果事情继续下去,我们不会屏息于河南清水源科技有限公司的合并。

In Conclusion...

总之..。

All in all, the lower returns from the same amount of capital employed aren't exactly signs of a compounding machine. Despite the concerning underlying trends, the stock has actually gained 10.0% over the last five years, so it might be that the investors are expecting the trends to reverse. Either way, we aren't huge fans of the current trends and so with that we think you might find better investments elsewhere.

总而言之,同样数额的资本回报率较低,并不完全是复利机器的迹象。尽管存在令人担忧的潜在趋势,但该股在过去五年中实际上上涨了10.0%,因此投资者可能预计趋势会逆转。无论哪种方式,我们都不是当前趋势的狂热粉丝,因此我们认为你可能会在其他地方找到更好的投资。

One more thing: We've identified 2 warning signs with Henan Qingshuiyuan TechnologyLtd (at least 1 which can't be ignored) , and understanding these would certainly be useful.

还有一件事:我们已经确定了2个警告标志与河南清水源科技有限公司(至少1家不能忽视)的合作,了解这些肯定会有所帮助。

While Henan Qingshuiyuan TechnologyLtd isn't earning the highest return, check out this free list of companies that are earning high returns on equity with solid balance sheets.

虽然河南清水源科技有限公司并没有获得最高的回报,但看看这个免费资产负债表稳健、股本回报率高的公司名单。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有什么反馈吗?担心内容吗? 保持联系直接与我们联系。或者,也可以给编辑组发电子邮件,地址是implywallst.com。

本文由Simply Wall St.撰写,具有概括性。我们仅使用不偏不倚的方法提供基于历史数据和分析师预测的评论,我们的文章并不打算作为财务建议。它不构成买卖任何股票的建议,也没有考虑你的目标或你的财务状况。我们的目标是为您带来由基本面数据驱动的长期重点分析。请注意,我们的分析可能不会将最新的对价格敏感的公司公告或定性材料考虑在内。Simply Wall St.对上述任何一只股票都没有持仓。