Earnings Preview: Analysts expect Shopify's revenue to increase 45.59%

Earnings Preview: Analysts expect Shopify's revenue to increase 45.59%

$Shopify Inc(SHOP.US)$ announces its next round of earnings this Wednesday, July 28. Here is everything that matters.

$Shopify Inc(SHOP.US)$该公司将于7月28日(星期三)公布下一轮财报。以下是所有重要的事情。

Net Income, Earnings, And Earnings Per Share

净收入、收益和每股收益

Earnings and especially earnings per share (EPS) are useful measures of a company's profitability. Total earnings, which is also referred to as net income, equals total revenue minus total expenses. EPS equals to net income divided by the number of shares outstanding.

收益,特别是每股收益(EPS)是衡量一家公司盈利能力的有用指标。总收入,也被称为净收入,等于总收入减去总支出。每股收益等于净利润除以流通股数量。

Earnings And Revenue

收入和收入

Wall Street expects EPS of $0.96 and sales around $1.04 billion. Shopify reported a per-share profit of $1.05 when it published results during the same quarter last year. Sales in that period totaled $714.34 million.

华尔街预计每股收益为0.96美元,销售额约为10.4亿美元。Shopify在去年同期公布财报时公布的每股利润为1.05美元。这一时期的销售额总计7.1434亿美元。

What Are Analyst Estimates And Earnings Surprises, And Why Do They Matter?

分析师的预期和收益惊喜是什么?为什么它们很重要?

Wall Street analysts who study this company will publish analyst estimates of revenue and EPS. The averages of all analyst EPS and revenue estimates are called the "consensus estimates"; these consensus estimates can have a significant effect on a company's performance during an earnings release. When a company posts earnings or revenue above or below a consensus estimate, it has posted an "earnings surprise", which can really move a stock depending on the difference between actual and estimated values.

研究这家公司的华尔街分析师将公布分析师对收入和每股收益的估计。所有分析师每股收益和营收预估的平均值被称为“共识预估”;这些共识预估可能会对公司在收益发布期间的业绩产生重大影响。当一家公司公布高于或低于普遍预期的收益或收入时,它就发布了“收益惊喜”,这真的可以根据实际价值和估计价值之间的差异来影响一只股票。

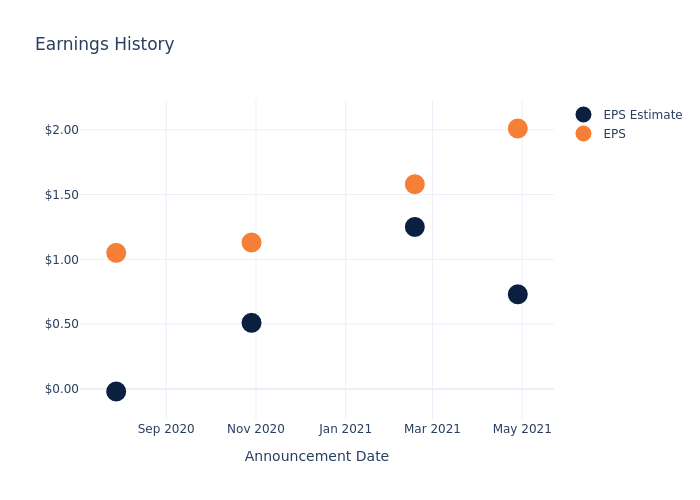

The Wall Street consensus estimate for earnings would represent a 8.57% decrease for the company. Revenue would be have grown 45.59% from the same quarter last year. The company's reported EPS has stacked up against analyst estimates in the past like this:

华尔街对收益的普遍预期意味着该公司将下降8.57%。营收将比去年同期增长45.59%。该公司报告的每股收益(EPS)过去一直与分析师的预期相提并论,如下所示:

| Quarter | Q1 2021 | Q4 2020 | Q3 2020 | Q2 2020 |

|---|---|---|---|---|

| EPS Estimate | 0.73 | 1.25 | 0.51 | -0.02 |

| EPS Actual | 2.01 | 1.58 | 1.13 | 1.05 |

| Revenue Estimate | 865.48 M | 910.22 M | 653.22 M | 505.08 M |

| Revenue Actual | 988.65 M | 977.74 M | 767.40 M | 714.34 M |

| 季度 | Q1 2021 | Q4 2020 | Q3 2020 | Q2 2020 |

|---|---|---|---|---|

| 每股收益预估 | 0.73 | 1.25 | 0.51 | -0.02 |

| 实际每股收益 | 2.01 | 1.58 | 1.13 | 1.05 |

| 收入预估 | 865.48 M | 910.22 M | 653.22 M | 505.08 M |

| 实际收入 | 988.65 M | 977.74 M | 767.40 M | 714.34 M |

Stock Performance

股票表现

Shares of Shopify were trading at $1582.28 as of July 26. Over the last 52-week period, shares are up 50.64%. Given that these returns are generally positive, long-term shareholders are probably satisfied going into this earnings release.

截至7月26日,Shopify的股价为1582.28美元。在过去52周的时间里,股价上涨了50.64%。考虑到这些回报总体上是积极的,长期股东可能会对此次收益发布感到满意。