Market Whales and Their Recent Bets on CELH Options

Market Whales and Their Recent Bets on CELH Options

Whales with a lot of money to spend have taken a noticeably bullish stance on Celsius Holdings.

有大量资金可以花的鲸鱼对Celsius Holdings采取了明显的看涨立场。

Looking at options history for Celsius Holdings (NASDAQ:CELH) we detected 10 trades.

查看Celsius Holdings(纳斯达克股票代码:CELH)的期权历史记录,我们发现了10笔交易。

If we consider the specifics of each trade, it is accurate to state that 50% of the investors opened trades with bullish expectations and 50% with bearish.

如果我们考虑每笔交易的具体情况,可以准确地说,有50%的投资者以看涨的预期开仓,而50%的投资者以看跌的预期开盘。

From the overall spotted trades, 3 are puts, for a total amount of $119,920 and 7, calls, for a total amount of $401,063.

在已发现的全部交易中,有3笔是看跌期权,总额为119,920美元,7笔看涨期权,总额为401,063美元。

Expected Price Movements

预期的价格走势

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $65.0 to $90.0 for Celsius Holdings over the last 3 months.

考虑到这些合约的交易量和未平仓合约,在过去的3个月中,鲸鱼似乎一直将Celsius Holdings的价格定在65.0美元至90.0美元之间。

Volume & Open Interest Trends

交易量和未平仓合约趋势

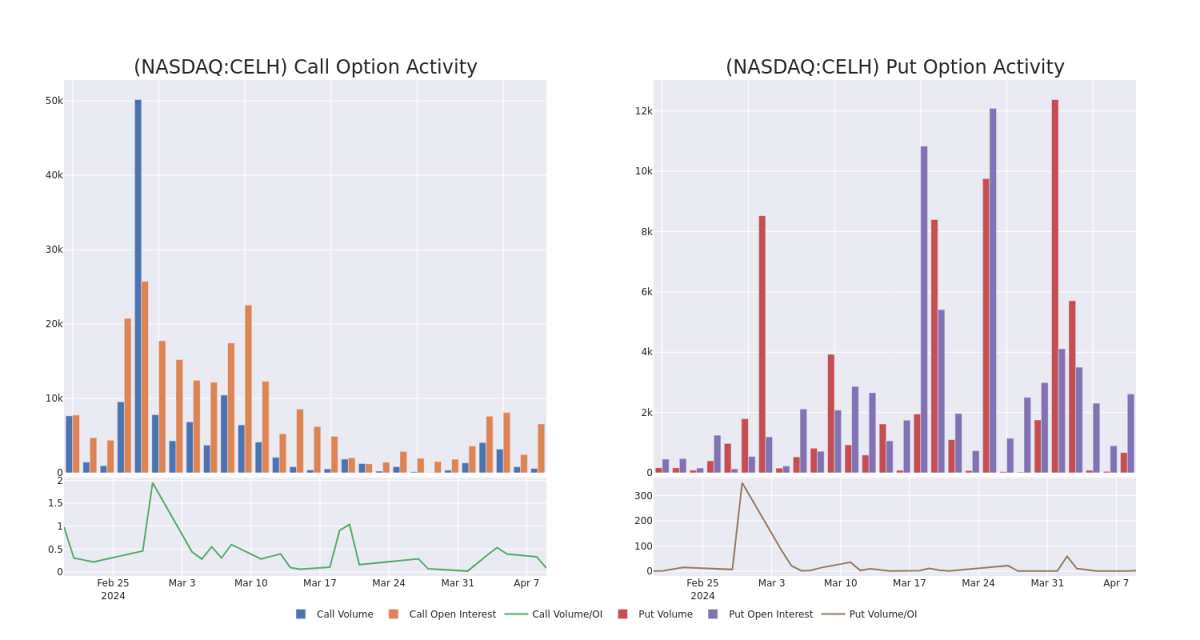

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Celsius Holdings's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Celsius Holdings's substantial trades, within a strike price spectrum from $65.0 to $90.0 over the preceding 30 days.

评估交易量和未平仓合约是期权交易的战略步骤。这些指标揭示了以特定行使价计算的摄氏控股期权的流动性和投资者对该期权的兴趣。即将发布的数据可视化了与Celsius Holdings的大量交易相关的看涨期权和未平仓合约的交易量和未平仓合约的波动,在过去30天内,行使价范围从65.0美元到90.0美元不等。

Celsius Holdings Call and Put Volume: 30-Day Overview

Celsius Holdings 看涨和看跌交易量:30 天概览

Noteworthy Options Activity:

值得注意的期权活动:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CELH | CALL | SWEEP | BULLISH | 05/17/24 | $4.6 | $4.55 | $4.6 | $90.00 | $115.0K | 2.9K | 269 |

| CELH | CALL | SWEEP | BEARISH | 05/17/24 | $4.65 | $4.5 | $4.53 | $90.00 | $113.5K | 2.9K | 269 |

| CELH | CALL | TRADE | BULLISH | 04/19/24 | $2.3 | $2.19 | $2.3 | $83.00 | $45.9K | 503 | 249 |

| CELH | CALL | TRADE | NEUTRAL | 01/17/25 | $22.05 | $21.85 | $21.96 | $75.00 | $43.9K | 665 | 2 |

| CELH | PUT | TRADE | BEARISH | 04/12/24 | $1.25 | $1.15 | $1.25 | $80.00 | $41.2K | 300 | 502 |

| 符号 | 看跌/看涨 | 交易类型 | 情绪 | Exp。日期 | 问 | 出价 | 价格 | 行使价 | 总交易价格 | 未平仓合约 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CELH | 打电话 | 扫 | 看涨 | 05/17/24 | 4.6 美元 | 4.55 美元 | 4.6 美元 | 90.00 美元 | 115.0 万美元 | 2.9K | 269 |

| CELH | 打电话 | 扫 | 粗鲁的 | 05/17/24 | 4.65 美元 | 4.5 美元 | 4.53 美元 | 90.00 美元 | 113.5 万美元 | 2.9K | 269 |

| CELH | 打电话 | 贸易 | 看涨 | 04/19/24 | 2.3 美元 | 2.19 美元 | 2.3 美元 | 83.00 美元 | 45.9 万美元 | 503 | 249 |

| CELH | 打电话 | 贸易 | 中立 | 01/17/25 | 22.05 美元 | 21.85 美元 | 21.96 美元 | 75.00 美元 | 43.9 万美元 | 665 | 2 |

| CELH | 放 | 贸易 | 粗鲁的 | 04/12/24 | 1.25 美元 | 1.15 美元 | 1.25 美元 | 80.00 美元 | 41.2 万美元 | 300 | 502 |

About Celsius Holdings

关于 Celsius Holdings

Celsius Holdings plays in the energy drink subsegment of the global nonalcoholic beverage market, with 96% of revenue concentrated in North America. Celsius' products contain natural ingredients and a metabolism-enhancing formulation, appealing to fitness and active lifestyle enthusiasts. The firm's portfolio includes its namesake Celsius Originals beverages (including those that are naturally caffeinated with stevia), Celsius Essentials line (containing aminos), and Celsius On-the-Go powder packets. Celsius focuses its time on branding and innovation, while it utilizes third parties for the manufacturing, packaging, and distribution of its products. In 2022, Celsius forged a 20-year distribution agreement with PepsiCo, which holds an 8.5% stake in the business.

Celsius Holdings涉足全球非酒精饮料市场的能量饮料细分市场,96%的收入集中在北美。Celsius 的产品含有天然成分和增强新陈代谢的配方,吸引了健身和积极生活方式爱好者。该公司的产品组合包括与Celsius Originals同名的饮料(包括含有甜叶菊的天然咖啡因饮料)、Celsius Essentials系列(含有氨基酸)和随身携带的摄氏粉包。Celsius将时间集中在品牌和创新上,同时利用第三方进行产品的制造、包装和分销。2022年,摄氏与百事可乐签订了为期20年的分销协议,百事可乐持有该业务8.5%的股份。

Where Is Celsius Holdings Standing Right Now?

Celsius Holdings 现在处于什么位置?

- With a trading volume of 1,020,582, the price of CELH is up by 0.44%, reaching $84.17.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 28 days from now.

- CELH的交易量为1,020,582美元,上涨了0.44%,达到84.17美元。

- 当前的RSI值表明,该股目前在超买和超卖之间处于中立状态。

- 下一份收益报告定于28天后发布。

Expert Opinions on Celsius Holdings

关于 Celsius Holdings 的专家意见

4 market experts have recently issued ratings for this stock, with a consensus target price of $95.0.

4位市场专家最近发布了该股的评级,共识目标价为95.0美元。

- Maintaining their stance, an analyst from Stifel continues to hold a Buy rating for Celsius Holdings, targeting a price of $95.

- An analyst from Roth MKM has decided to maintain their Buy rating on Celsius Holdings, which currently sits at a price target of $105.

- An analyst from Jefferies has decided to maintain their Buy rating on Celsius Holdings, which currently sits at a price target of $105.

- Maintaining their stance, an analyst from Morgan Stanley continues to hold a Equal-Weight rating for Celsius Holdings, targeting a price of $75.

- Stifel的一位分析师保持立场,继续维持Celsius Holdings的买入评级,目标价格为95美元。

- 罗斯MKM的一位分析师已决定维持对Celsius Holdings的买入评级,该评级目前的目标股价为105美元。

- 杰富瑞集团的一位分析师已决定维持对Celsius Holdings的买入评级,该评级目前的目标股价为105美元。

- 摩根士丹利的一位分析师坚持其立场,继续对Celsius Holdings维持同等权重评级,目标股价为75美元。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

与仅交易股票相比,期权是一种风险更高的资产,但它们具有更高的获利潜力。严肃的期权交易者通过每天自我教育、扩大交易规模、关注多个指标以及密切关注市场来管理这种风险。