REIT Watch - S-Reits Continue to Expand Through DPU-accretive Acquisitions

REIT Watch - S-Reits Continue to Expand Through DPU-accretive Acquisitions

The combined market value of the Singapore Reits and property trusts (S-Reits) sector has grown at a compound annual rate of 6 per cent over the 10 years to end-2023. As expected, and given the challenging macroeconomic environment since the pandemic, not every year saw growth.

在截至2023年底的10年中,新加坡房地产信托基金和房地产信托(S-Reits)行业的总市值以6%的复合年增长率增长。正如预期的那样,鉴于自疫情以来宏观经济环境充满挑战,并非每年都出现增长。

Nevertheless, S-Reits are still expanding their portfolios as we see Reit managers announce proposed acquisitions and developments in the year thus far.

尽管如此,S-Reits仍在扩大其投资组合,因为我们看到房地产投资信托基金经理宣布了今年迄今为止的拟议收购和发展。

The latest was announced by Frasers Logistics & Commercial Trust (FLCT) with the proposed acquisition of 89.9 per cent interest in a logistics and industrial (L&I) portfolio of four properties in Germany. The stake will be purchased from its sponsor, Frasers Property, at an agreed property purchase price of 129.5 million euros (S$188.6 million), which is at a discount of 5.3 per cent and 1.1 per cent to the appraised value by Colliers and CBRE, respectively. The properties are fully occupied and leased to tenants, which include multinational corporations such as Schenker, Dachser and Hermes Germany, which are existing tenants within FLCT's portfolio.

弗雷泽物流与商业信托基金(FLCT)宣布了最新消息,提议收购德国四处物业的物流和工业(L&I)投资组合中89.9%的权益。该股份将以1.295亿欧元(1.886亿新元)的商定房地产购买价格从其赞助商弗雷泽地产手中收购,与高力证券和世邦魏理仕的估值相比分别折扣5.3%和1.1%。这些房产已全部入住并出租给租户,其中包括信可、达瑟和德国爱马仕等跨国公司,这些公司是FLCT投资组合中的现有租户。

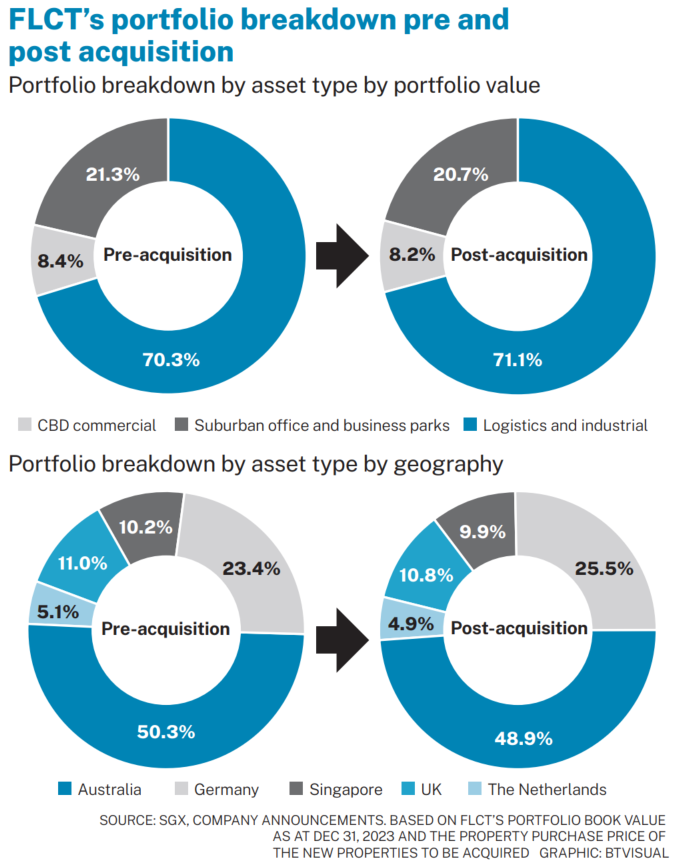

Post acquisition, the proportion of L&I assets in FLCT's portfolio will increase from 70.3 to 71.1 per cent, and the number of L&I assets in Germany will increase to 33, representing over a quarter of FLCT's total portfolio value. The German logistics sector is noted to have maintained its resilience with close to record low vacancy rates, and a slowdown in new developments resulting in limited supply in key logistics hotspots which drove rents up by 12 per cent in 2023.

收购后,FLCT投资组合中杠杆和反向资产的比例将从70.3%增加到71.1%,德国的杠杆和反向资产数量将增加到33个,占FLCT投资组合总价值的四分之一以上。值得注意的是,德国物流业保持了弹性,空置率接近历史新低,新开发项目放缓导致主要物流热点供应有限,导致2023年租金上涨了12%。

Earlier this month, Digital Core Reit (DCReit) proposed to increase its stake in a German data centre by 24.9 per cent for a purchase consideration of 117 million euros. The acquisition will take its stake in the Frankfurt facility to 49.9 per cent and is expected to be about 3.2 per cent accretive to its distribution per unit (DPU).

本月早些时候,数字核心房地产投资信托基金(DCreit)提议将其在德国数据中心的股份增加24.9%,收购对价为1.17亿欧元。此次收购将使其在法兰克福工厂的股份达到49.9%,预计其单位分配(DPU)将增加约3.2%。

DCReit notes that the acquisition will improve overall portfolio credit quality by increasing the total annualised rent contribution from investment grade customers from 78 to 87 per cent pro forma. It will also improve its geographic diversification of the portfolio and will reduce the total annualised rent contribution from North America from 82 to 71 per cent pro forma.

DCreit指出,此次收购将通过将投资级客户的年化租金缴纳总额从78%提高到87%,从而改善整体投资组合信贷质量。它还将改善其投资组合的地域多元化,并将北美的年化租金缴纳总额从预计的82%减少到71%。

Last month also saw two proposed acquisitions by Mapletree Logistics Trust (MLT) and CapitaLand India Trust (Clint).

上个月,丰树物流信托基金(MLT)和凯德置地印度信托(Clint)也提出了两项收购提议。

MLT announced the proposed acquisitions of three logistics properties – one in Malaysia and two in Vietnam – for a total acquisition cost of about S$234 million. MLT notes that the acquisitions will deepen its network connectivity in these growth markets and position the trust to capitalise on favourable demand drivers for logistics space. The acquisitions will increase MLT's exposure in Malaysia and Vietnam from 24 to 27 assets and gross floor area will increase by 20.6 and 21 per cent respectively.

MLT宣布拟收购三处物流物业——一处在马来西亚,两处在越南——总收购成本约为2.34亿新元。MLT指出,这些收购将深化其在这些成长型市场中的网络连接,并使该信托基金能够利用物流空间的有利需求驱动力。这些收购将使MLT在马来西亚和越南的资产敞口从24项增加到27项,总建筑面积将分别增加20.6%和21%。

Clint announced that it has entered into a forward purchase agreement with Casa Grande Group to acquire three industrial facilities in Chennai, India. The total purchase price is estimated to be 2,680 million rupees (S$43.3 million) and as part of the agreement, Clint will provide funding in three phases and subsequently acquire the facilities upon the completion of each phase.

克林特宣布已与Casa Grande集团签订远期收购协议,收购印度钦奈的三个工业设施。总收购价格估计为26.8亿卢比(合4,330万新元),作为协议的一部分,克林特将分三个阶段提供资金,随后在每个阶段完成后收购设施。

Clint notes that the acquisition will further diversify its portfolio and grow its industrial presence in Chennai, which is developing into an important hub for electronics component manufacturers in South India. With the proposed acquisition, the floor area of Clint's industrial, logistics and data centre asset classes as a percentage of its committed pipeline will increase approximately from 12 to 14 per cent.

克林特指出,此次收购将进一步分散其投资组合,扩大其在钦奈的工业影响力,钦奈正在发展成为印度南部电子元件制造商的重要中心。通过拟议的收购,克林特的工业、物流和数据中心资产类别的占地面积占其承诺管道的百分比将从约12%增加到14%。

Source: SGX Research S-Reits & Property Trusts Chartbook.

资料来源:新加坡证券交易所研究公司房地产投资信托基金和房地产信托基金图表手册。

REIT Watch is a weekly column on The Business Times, read the original version.

房地产投资信托基金观察是《商业时报》的每周专栏文章,阅读原始版本。

Enjoying this read?

喜欢这本书吗?

- Subscribe now to the SGX My Gateway newsletter for a compilation of latest market news, sector performances, new product release updates, and research reports on SGX-listed companies.

- Stay up-to-date with our SGX Invest Telegram channel.

- 立即订阅新加坡交易所 My Gateway 时事通讯,了解最新的市场新闻、行业表现、新产品发布更新以及新加坡交易所上市公司的研究报告。

- 关注我们的 SGX Invest Telegram 频道的最新动态。