Increasing Performance and Stable Payouts: Loews Benefits Investors With Growing Earnings

Increasing Performance and Stable Payouts: Loews Benefits Investors With Growing Earnings

On March 05, 2024, Loews (NYSE:L) will distribute a dividend payout of $0.06 per share, equating to an annualized dividend yield of 0.34%. Shareholders who owned the stock before the ex-dividend date on February 20, 2024 will receive this payout.

2024 年 3 月 5 日 Loews(纽约证券交易所代码:L) 将分配每股0.06美元的股息,相当于0.34%的年化股息收益率。在2024年2月20日除息日之前拥有该股票的股东将获得这笔款项。

Loews Recent Dividend Payouts

Loews 最近的股息支付

| Ex-Date | Payments per year | Dividend | Yield | Announced | Record | Payable |

|---|---|---|---|---|---|---|

| 2024-02-20 | 4$0.06 | 0.34% | 2024-02-06 | 2024-02-21 | 2024-03-05 | |

| 2023-11-21 | 4$0.06 | 0.38% | 2023-11-07 | 2023-11-22 | 2023-12-05 | |

| 2023-08-15 | 4$0.06 | 0.4% | 2023-08-01 | 2023-08-16 | 2023-08-29 | |

| 2023-05-23 | 4$0.06 | 0.43% | 2023-05-09 | 2023-05-24 | 2023-06-06 | |

| 2023-02-21 | 4$0.06 | 0.41% | 2023-02-07 | 2023-02-22 | 2023-03-07 | |

| 2022-11-22 | 4$0.06 | 0.45% | 2022-11-08 | 2022-11-23 | 2022-12-06 | |

| 2022-08-16 | 4$0.06 | 0.45% | 2022-08-02 | 2022-08-17 | 2022-08-30 | |

| 2022-05-24 | 4$0.06 | 0.4% | 2022-05-10 | 2022-05-25 | 2022-06-07 | |

| 2022-02-22 | 4$0.06 | 0.41% | 2022-02-08 | 2022-02-23 | 2022-03-08 | |

| 2021-11-23 | 4$0.06 | 0.43% | 2021-11-09 | 2021-11-24 | 2021-12-07 | |

| 2021-08-17 | 4$0.06 | 0.47% | 2021-08-03 | 2021-08-18 | 2021-08-31 | |

| 2021-05-25 | 4$0.06 | 0.43% | 2021-05-11 | 2021-05-26 | 2021-06-08 |

| 过期日期 | 每年付款 | 分红 | 收益率 | 已宣布 | 记录 | 应付款 |

|---|---|---|---|---|---|---|

| 2024-02-20 | 40.06 | 0.34% | 2024-02-06 | 2024-02-21 | 2024-03-05 | |

| 2023-11-21 | 40.06 | 0.38% | 2023-11-07 | 2023-11-22 | 2023-12-05 | |

| 2023-08-15 | 40.06 | 0.4% | 2023-08-01 | 2023-08-16 | 2023-08-29 | |

| 2023-05-23 | 40.06 | 0.43% | 2023-05-09 | 2023-05-24 | 2023-06-06 | |

| 2023-02-21 | 40.06 | 0.41% | 2023-02-07 | 2023-02-22 | 2023-03-07 | |

| 2022-11-22 | 40.06 | 0.45% | 2022-11-08 | 2022-11-23 | 2022-12-06 | |

| 2022-08-16 | 40.06 | 0.45% | 2022-08-02 | 2022-08-17 | 2022-08-30 | |

| 2022-05-24 | 40.06 | 0.4% | 2022-05-10 | 2022-05-25 | 2022-06-07 | |

| 2022-02-22 | 40.06 | 0.41% | 2022-02-08 | 2022-02-23 | 2022-03-08 | |

| 2021-11-23 | 40.06 | 0.43% | 2021-11-09 | 2021-11-24 | 2021-12-07 | |

| 2021-08-17 | 40.06 | 0.47% | 2021-08-03 | 2021-08-18 | 2021-08-31 | |

| 2021-05-25 | 40.06 | 0.43% | 2021-05-11 | 2021-05-26 | 2021-06-08 |

In terms of dividend yield, Loews finds itself in the middle ground among its industry peers, while CNA Financial (NYSE:CNA) takes the lead with the highest annualized dividend yield at 4.06%.

在股息收益率方面,洛斯发现自己在业内同行中处于中间地带,而 CNA 金融(纽约证券交易所代码:CNA) 位居榜首,年化股息收益率最高,为4.06%。

Analyzing Loews Financial Health

分析 Loews 的财务状况

Companies that pay out steady cash dividends are attractive to income-seeking investors, and companies that are financially healthy tend to maintain their dividend payout schedule. For this reason, investors can find it insightful to see if a company has been increasing or decreasing their dividend payout schedule and if their earnings are growing.

支付稳定现金分红的公司对寻求收入的投资者具有吸引力,而财务状况良好的公司往往会维持其股息支付时间表。出于这个原因,投资者可以深入了解一家公司是增加还是减少了股息支付时间表,以及他们的收益是否在增长。

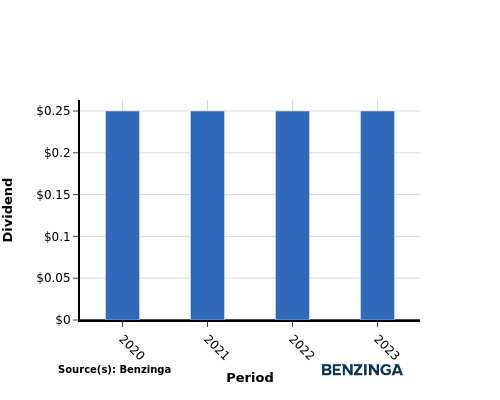

YoY Growth in Dividend Per Share

每股股息同比增长

As you can see, from 2020 to 2023, investors observed a stable dividend per share of $0.25 throughout this period. This indicates a consistent dividend policy maintained by the company, providing stability to shareholders. Investors can rely on the company's consistent dividend payout to generate a steady income stream.

如您所见,从2020年到2023年,投资者在此期间观察到稳定的每股股息为0.25美元。这表明公司维持了一贯的股息政策,为股东提供了稳定性。投资者可以依靠公司持续的股息支付来产生稳定的收入来源。

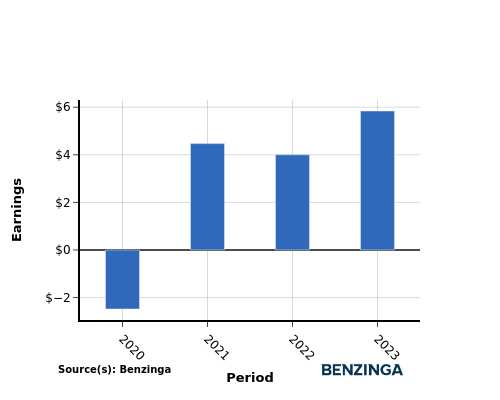

YoY Earnings Growth For Loews

Loews的同比收益增长

The earnings chart above shows that from 2020 to 2023, Loews has experienced an increase in their earnings from $-2.48 per share to $5.84 per share. This positive earnings trend is promising for income-seeking investors as it suggests that the company has more potential to increase its cash dividend payout if the trend continues.

上面的收益图表显示,从2020年到2023年,洛伊斯的收益从每股-2.48美元增长到每股5.84美元。这种积极的收益趋势对寻求收入的投资者来说是有希望的,因为这表明如果这种趋势持续下去,该公司更有可能增加现金股息支出。

Recap

回顾

This article provides an in-depth analysis of Loews's recent dividend distribution and the impact it has on shareholders. The company is currently distributing a dividend of $0.06 per share, resulting in an annualized dividend yield of 0.34%.

本文深入分析了洛伊斯最近的股息分配及其对股东的影响。该公司目前分配每股0.06美元的股息,年化股息收益率为0.34%。

In terms of dividend yield, Loews finds itself in the middle ground among its industry peers, while CNA Financial takes the lead with the highest annualized dividend yield at 4.06%.

在股息收益率方面,洛伊斯发现自己在业内同行中处于中间地带,而CNA Financial则以最高的年化股息收益率领先,为4.06%。

Despite no adjustment in the dividend per share over the period of 2020 to 2023, the consistent growth in earnings per share for Loews indicates a sound financial status, which could enable the company to continue sharing profits with its investors.

尽管在2020年至2023年期间没有调整每股股息,但洛伊斯每股收益的持续增长表明财务状况良好,这可能使公司能够继续与投资者分享利润。

It is advisable for investors to monitor the company's performance in the coming quarters to stay in the loop about any adjustments in financials or dividend disbursements.

建议投资者监控公司在未来几个季度的业绩,以随时了解财务状况或股息支付的任何调整。

[Track real-time stock fluctuations for Loews on Benzinga.](Loews (NYSE: L))

[追踪本辛加上洛伊斯的实时股票波动。] (洛伊斯(纽约证券交易所代码:L))

This article was generated by Benzinga's automated content engine and reviewed by an editor.

本文由Benzinga的自动内容引擎生成,并由编辑审阅。