Investors Don't See Light At End Of CStone Pharmaceuticals' (HKG:2616) Tunnel

Investors Don't See Light At End Of CStone Pharmaceuticals' (HKG:2616) Tunnel

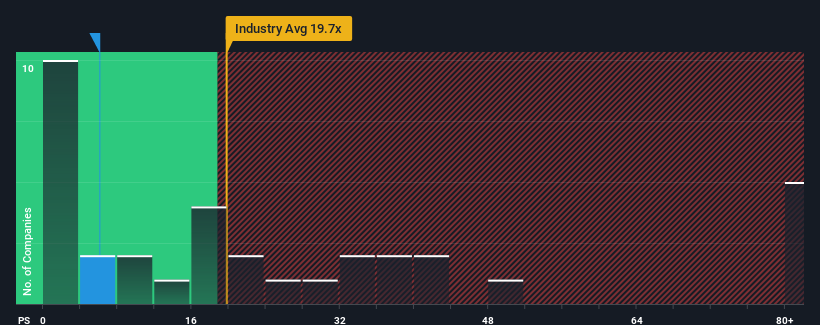

CStone Pharmaceuticals' (HKG:2616) price-to-sales (or "P/S") ratio of 6.1x might make it look like a strong buy right now compared to the Biotechs industry in Hong Kong, where around half of the companies have P/S ratios above 19.7x and even P/S above 38x are quite common. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

cStone Pharmicals (HKG: 2616) 6.1倍的市售比(或 “市盈率”)与香港的生物科技行业相比,现在可能看起来像是一个强劲的买盘。在香港,大约有一半的公司的市盈率超过19.7倍,甚至市盈率超过38倍也很常见。但是,P/S可能相当低是有原因的,需要进一步调查以确定其是否合理。

Check out our latest analysis for CStone Pharmaceuticals

查看我们对cStone Pharmicals的最新分析

How CStone Pharmaceuticals Has Been Performing

cStone 制药的表现如何

Recent times haven't been great for CStone Pharmaceuticals as its revenue has been rising slower than most other companies. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

对于cStone Pharmicals来说,最近的情况并不乐观,因为其收入增长速度低于大多数其他公司。也许市场预计当前收入增长不佳的趋势将继续下去,这抑制了市盈率。如果你还喜欢这家公司,你会希望收入不会变得更糟,也希望你能在股票失宠的时候买入一些股票。

What Are Revenue Growth Metrics Telling Us About The Low P/S?

关于低市盈率,收入增长指标告诉我们什么?

The only time you'd be truly comfortable seeing a P/S as depressed as CStone Pharmaceuticals' is when the company's growth is on track to lag the industry decidedly.

看到像cStone Pharmaceuticals这样萧条的市盈率只有在公司的增长有望明显落后于行业时,你才会真正感到满意。

If we review the last year of revenue growth, the company posted a terrific increase of 98%. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

如果我们回顾一下去年的收入增长,该公司公布了98%的惊人增长。但是,最近三年的总体表现并不那么好,因为它根本没有带来任何增长。因此,在我们看来,在此期间,该公司在收入增长方面的结果好坏参半。

Shifting to the future, estimates from the four analysts covering the company suggest revenue should grow by 51% per annum over the next three years. That's shaping up to be materially lower than the 108% per year growth forecast for the broader industry.

展望未来,报道该公司的四位分析师的估计表明,未来三年收入将每年增长51%。这将大大低于整个行业每年108%的增长预期。

With this in consideration, its clear as to why CStone Pharmaceuticals' P/S is falling short industry peers. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

考虑到这一点,cStone Pharmaceuticals的市盈率为何低于行业同行就显而易见了。显然,许多股东不愿意坚持下去,而该公司则可能将目光投向不那么繁荣的未来。

The Final Word

最后一句话

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

通常,在做出投资决策时,我们会告诫不要过多地考虑价格与销售比率,尽管这可以充分揭示其他市场参与者对公司的看法。

We've established that CStone Pharmaceuticals maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. The company will need a change of fortune to justify the P/S rising higher in the future.

我们已经确定,cStone Pharmicals维持其低市盈率,原因是其预测的增长低于整个行业,正如预期的那样。在现阶段,投资者认为收入改善的可能性不足以证明提高市盈率是合理的。该公司需要改变命运来证明未来市盈率上涨是合理的。

Before you take the next step, you should know about the 2 warning signs for CStone Pharmaceuticals that we have uncovered.

在你采取下一步之前,你应该知道 cStone 制药有 2 个警告信号 我们已经发现了。

If you're unsure about the strength of CStone Pharmaceuticals' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

如果你是 不确定cStone Pharmicals的业务实力,为什么不浏览我们的互动股票清单,为你可能错过的其他一些公司提供坚实的商业基本面。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有反馈吗?对内容感到担忧? 取得联系 直接和我们联系。 或者,给编辑团队 (at) simplywallst.com 发送电子邮件。

Simply Wall St 的这篇文章本质上是一般性的。 我们仅使用公正的方法提供基于历史数据和分析师预测的评论,我们的文章无意提供财务建议。 它不构成买入或卖出任何股票的建议,也没有考虑您的目标或财务状况。我们的目标是为您提供由基本面数据驱动的长期重点分析。请注意,我们的分析可能未将最新的价格敏感型公司公告或定性材料考虑在内。简而言之,华尔街对上述任何股票都没有头寸。