We Think The Compensation For Amerant Bancorp Inc.'s (NYSE:AMTB) CEO Looks About Right

We Think The Compensation For Amerant Bancorp Inc.'s (NYSE:AMTB) CEO Looks About Right

Key Insights

关键见解

- Amerant Bancorp to hold its Annual General Meeting on 8th of May

- CEO Jerry Plush's total compensation includes salary of US$90.0k

- The total compensation is similar to the average for the industry

- Amerant Bancorp's EPS grew by 44% over the past three years while total shareholder return over the past three years was 12%

- Amerant Bancorp将于5月8日举行年度股东大会

- 首席执行官杰里·普洛什的总薪酬包括90.0万美元的工资

- 总薪酬与该行业的平均水平相似

- Amerant Bancorp的每股收益在过去三年中增长了44%,而过去三年的股东总回报率为12%

CEO Jerry Plush has done a decent job of delivering relatively good performance at Amerant Bancorp Inc. (NYSE:AMTB) recently. This is something shareholders will keep in mind as they cast their votes on company resolutions such as executive remuneration in the upcoming AGM on 8th of May. We present our case of why we think CEO compensation looks fair.

首席执行官杰里·普拉斯最近在Amerant Bancorp Inc.(纽约证券交易所代码:AMTB)在实现相对不错的业绩方面做得不错。这是股东在即将于5月8日举行的股东周年大会上对公司决议(例如高管薪酬)进行投票时要记住的事情。我们举例说明了为什么我们认为首席执行官的薪酬看起来很公平。

How Does Total Compensation For Jerry Plush Compare With Other Companies In The Industry?

与业内其他公司相比,Jerry Plush的总薪酬如何?

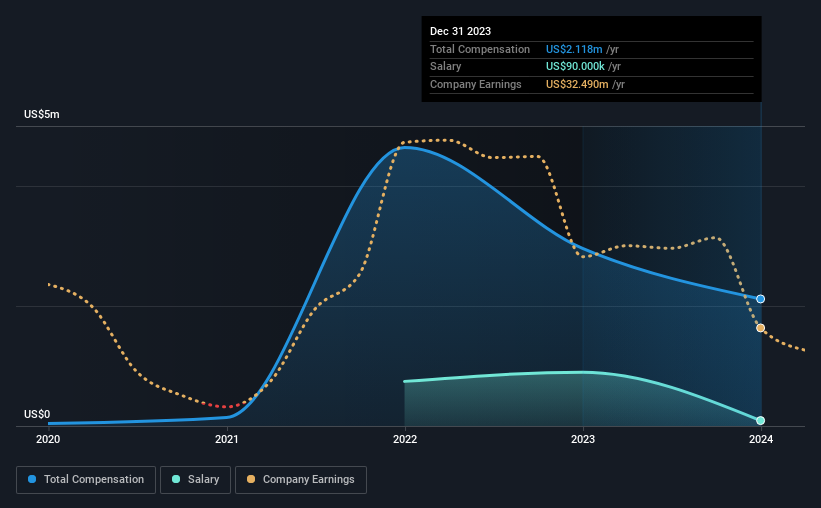

Our data indicates that Amerant Bancorp Inc. has a market capitalization of US$727m, and total annual CEO compensation was reported as US$2.1m for the year to December 2023. Notably, that's a decrease of 28% over the year before. We think total compensation is more important but our data shows that the CEO salary is lower, at US$90k.

我们的数据显示,Amerant Bancorp Inc.的市值为7.27亿美元,截至2023年12月的一年中,首席执行官的年薪酬总额报告为210万美元。值得注意的是,这比上年下降了28%。我们认为总薪酬更为重要,但我们的数据显示,首席执行官的薪水较低,为9万美元。

In comparison with other companies in the American Banks industry with market capitalizations ranging from US$400m to US$1.6b, the reported median CEO total compensation was US$1.9m. This suggests that Amerant Bancorp remunerates its CEO largely in line with the industry average. Moreover, Jerry Plush also holds US$4.2m worth of Amerant Bancorp stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

与市值在4亿美元至16亿美元之间的美国银行行业其他公司相比,报告的首席执行官总薪酬中位数为190万美元。这表明Amerant Bancorp的首席执行官薪酬基本符合行业平均水平。此外,杰里·普洛什还直接以自己的名义持有价值420万美元的Amerant Bancorp股票,这向我们表明他们在该公司拥有大量个人股份。

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | US$90k | US$895k | 4% |

| Other | US$2.0m | US$2.1m | 96% |

| Total Compensation | US$2.1m | US$3.0m | 100% |

| 组件 | 2023 | 2022 | 比例 (2023) |

| 工资 | 90 万美元 | 895万美元 | 4% |

| 其他 | 200 万美元 | 2.1 万美元 | 96% |

| 总薪酬 | 2.1 万美元 | 300 万美元 | 100% |

On an industry level, around 45% of total compensation represents salary and 55% is other remuneration. Interestingly, the company has chosen to go down an unconventional route in that it pays a smaller salary to Jerry Plush as compared to non-salary compensation over the one-year period examined. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

在行业层面上,总薪酬中约有45%代表工资,55%是其他薪酬。有趣的是,该公司选择走一条非常规的路线,因为在审查的一年期内,与非工资薪酬相比,它向杰里·普拉斯支付的工资要少。如果非工资薪酬在总薪酬中占主导地位,则表明高管的薪水与公司业绩息息相关。

Amerant Bancorp Inc.'s Growth

Amerant Bancorp Inc. 's 增长

Amerant Bancorp Inc.'s earnings per share (EPS) grew 44% per year over the last three years. In the last year, its revenue is up 3.1%.

Amerant Bancorp Inc. '在过去三年中,每股收益(EPS)每年增长44%。去年,其收入增长了3.1%。

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's also good to see modest revenue growth, suggesting the underlying business is healthy. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

总体而言,这对股东来说是一个积极的结果,表明公司近年来有所改善。收入温和增长也是件好事,这表明基础业务良好。展望未来,您可能需要查看这份关于分析师对公司未来收益预测的免费可视化报告。

Has Amerant Bancorp Inc. Been A Good Investment?

Amerant Bancorp Inc. 是一项不错的投资吗?

Amerant Bancorp Inc. has served shareholders reasonably well, with a total return of 12% over three years. But they probably wouldn't be so happy as to think the CEO should be paid more than is normal, for companies around this size.

Amerant Bancorp Inc.为股东提供了相当不错的服务,三年来的总回报率为12%。但是,对于这种规模的公司,他们可能不会很高兴地认为首席执行官的薪水应该超过正常水平。

To Conclude...

总而言之...

Amerant Bancorp primarily uses non-salary benefits to reward its CEO. Given that the company's overall performance has been reasonable, the CEO remuneration policy might not be shareholders' central point of focus in the upcoming AGM. However, we still think that any proposed increase in CEO compensation will be examined closely to make sure the compensation is appropriate and linked to performance.

Amerant Bancorp主要使用非薪金福利来奖励其首席执行官。鉴于公司的整体表现合理,首席执行官薪酬政策可能不是即将举行的股东周年大会的重点。但是,我们仍然认为,将仔细审查任何增加首席执行官薪酬的提议,以确保薪酬适当且与业绩挂钩。

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. That's why we did some digging and identified 4 warning signs for Amerant Bancorp that you should be aware of before investing.

首席执行官薪酬是你关注的关键方面,但投资者也需要睁大眼睛关注与业务绩效相关的其他问题。这就是为什么我们进行了一些挖掘并确定了Amerant Bancorp的4个警告信号,在投资之前你应该注意这些信号。

Important note: Amerant Bancorp is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

重要提示:Amerant Bancorp是一只令人兴奋的股票,但我们知道投资者可能正在寻找未支配的资产负债表和丰厚的回报。你可能会在这份投资回报率高、负债低的有趣公司清单中找到更好的东西。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有反馈吗?对内容感到担忧?直接联系我们。 或者,给编辑团队 (at) simplywallst.com 发送电子邮件。

Simply Wall St的这篇文章本质上是笼统的。我们仅使用公正的方法根据历史数据和分析师的预测提供评论,我们的文章无意作为财务建议。它不构成买入或卖出任何股票的建议,也没有考虑到您的目标或财务状况。我们的目标是为您提供由基本数据驱动的长期重点分析。请注意,我们的分析可能不考虑最新的价格敏感型公司公告或定性材料。简而言之,华尔街没有持有任何上述股票的头寸。