Seven Things You Need to Know About the Australian Property Market

Seven Things You Need to Know About the Australian Property Market

Dr Shane Oliver, Head of Investment Strategy & Chief Economist at AMP, discusses the property market.

AMP投资策略主管兼首席经济学家谢恩·奥利弗博士讨论了房地产市场。

Key points

关键点

- The Australian housing market remains far more complicated than optimists and doomsters portray it to be.

- Australian housing is expensive and highly indebted; but it's very diverse; mortgage arrears remain low; interest rates still matter; but it's been chronically undersupplied for years; forecasting home prices is very hard; and housing has similar long-term investment returns to shares.

- The surge in immigration is estimated to push the housing shortfall to around 200,000 dwellings this financial year.

- Price gains are expected to be around 5% this year with high rates dragging but the supply shortfall supporting prices. The risks are finely balanced.

- 澳大利亚的房地产市场仍然比乐观主义者和末日主义者所描绘的要复杂得多。

- 澳大利亚的住房价格昂贵且负债累累;但它非常多样化;抵押贷款拖欠额仍然很低;利率仍然很重要;但多年来长期供应不足;很难预测房价;住房具有与股票相似的长期投资回报。

- 据估计,移民的激增将使本财政年度的住房短缺增加到约20万套住房。

- 预计今年价格将上涨约5%,高利率拖累,但供应短缺支撑了价格。风险是微妙平衡的。

Introduction

导言

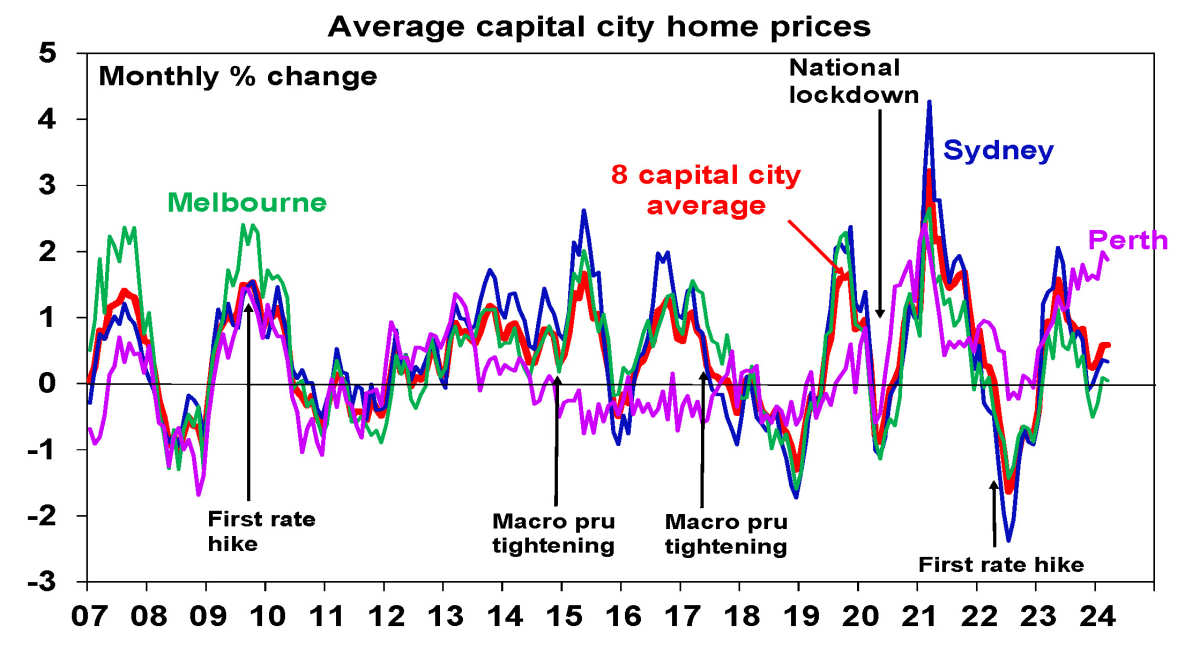

The Australian housing market has started the year on a solid note with national home prices up 1.6% over the first three months according to CoreLogic. We had thought the drag of high mortgage rates would get the upper hand again but the supply shortfall is continuing to dominate.

根据CoreLogic的数据,澳大利亚房地产市场今年年初表现良好,全国房价在前三个月上涨了1.6%。我们曾以为高抵押贷款利率的拖累将再次占上风,但供应短缺仍然占主导地位。

Source: CoreLogic, AMP

资料来源:CoreLogic、AMP

Extreme property views

极致的房产景观

While most economists sit in the middle, there are basically two extreme views amongst "property experts". Some real estate spruikers still wheel out the old "property will double every seven years" line. But property doomsters say it's hugely overvalued and overindebted and so a crash is inevitable. The trouble with the former is that it implies the already high ratio of home prices to incomes will double over the next 12 years! The trouble with the doomsters is that they've been saying that for decades. The reality is that it's far more complicated than the extremes portray it. Here's seven stylised "facts" regarding Australian property.

虽然大多数经济学家处于中间位置,但 “房地产专家” 基本上有两种极端观点。一些房地产狂热者仍在推行旧的 “房地产每七年翻一番” 的路线。但是房地产界人士说,它的估值被严重高估了,负债过高,因此暴跌是不可避免的。前者的问题在于,这意味着本已很高的房价收入比率将在未来12年内翻一番!末日之徒的麻烦在于,他们已经这样说了几十年。现实情况是,它比极端情况所描绘的要复杂得多。以下是有关澳大利亚房地产的七个风格化的 “事实”。

First – it's very expensive

首先,它非常昂贵

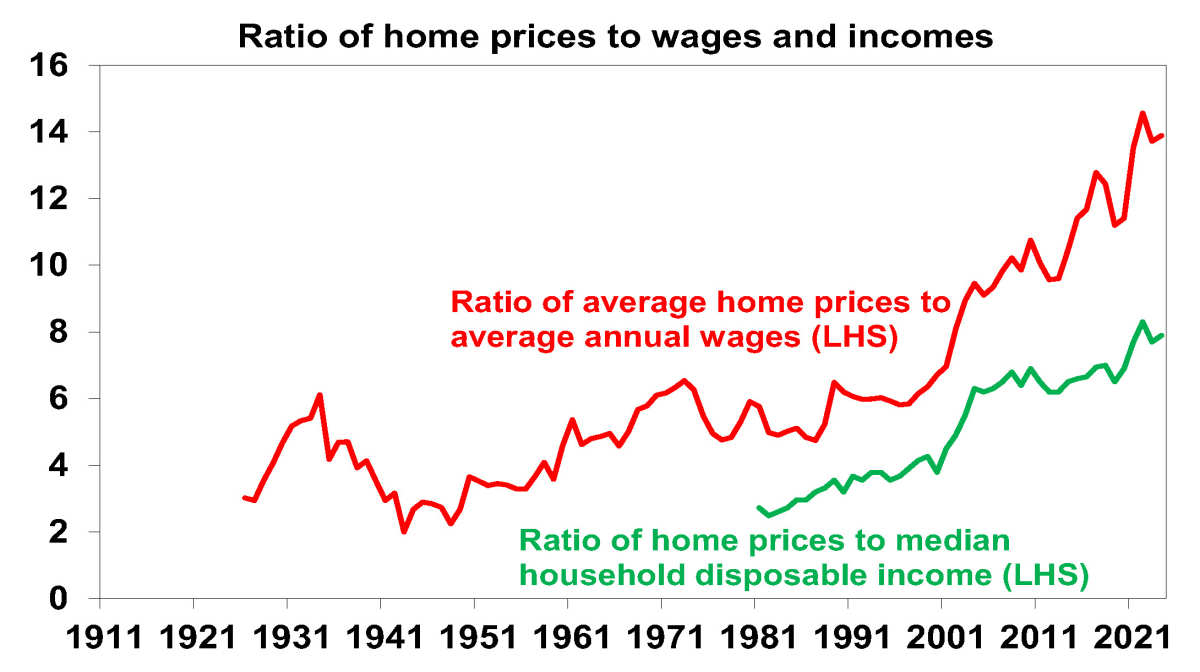

This has been the case since the early 2000s but it's been getting worse:

自2000年代初以来,情况一直如此,但情况越来越糟:

- House price to income ratios have doubled since the year 2000.

- 自2000年以来,房价收入比率翻了一番。

Source: ABS, CoreLogic, AMP

来源:ABS、CoreLogic、AMP

- The years taken to save a 20% deposit for an average full time wage earner have doubled from 5 years 30 years ago to 10 years now.

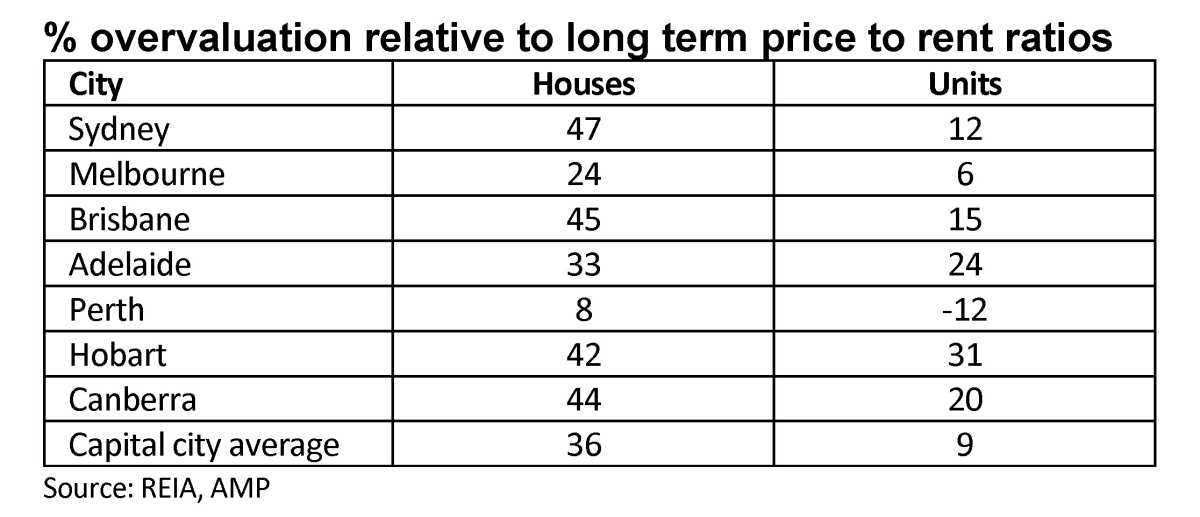

- A measure of house price valuation based on the ratio of home prices to rents (a bit like a PE for shares) adjusted for inflation shows house prices around 36% above their long-term average price to rent ratio.

- It's also expensive in global comparisons, eg, the 2023 Demographia Housing Affordability Survey shows the median multiple of house prices to income at 8.2 times versus around 5 in the US and UK.

- 从30年前的5年到现在的10年,平均全职工资收入者存入20%的存款所需的年限翻了一番。

- 根据经通货膨胀调整的房价与租金的比率(有点像股票的私募股权)来衡量房价估值的指标显示,房价比长期平均租金比率高出约36%。

- 在全球比较中,它也很昂贵,例如,2023年Demographia住房负担能力调查显示,房价与收入的倍数中位数为8.2倍,而美国和英国的平均倍数约为5倍。

The expensive nature of Australian property and the high level of household debt that goes with it leaves the economy vulnerable should high interest rates or unemployment make it harder to service loans and is leading to rising wealth (and intergenerational) inequality.

如果高利率或失业率使贷款更难偿还并导致财富(和代际)不平等加剧,那么澳大利亚房地产的昂贵性质以及随之而来的高额家庭债务会使经济变得脆弱。

Second – it's also very diverse

其次-它也非常多样化

While it's common to refer to "the Australian property market", in reality there is significant divergence between localities. This has been been seen recently with rapid relative price growth in Adelaide, Brisbane and Perth. See the first chart for Perth. This divergence partly reflects a combination of better housing affordability (with prices in Adelaide, Brisbane and Perth playing catchup after lagging pre-pandemic) and relative population growth (with Brisbane and Perth benefitting from interstate migration).

尽管提到 “澳大利亚房地产市场” 很常见,但实际上,不同地区之间存在巨大差异。最近,阿德莱德、布里斯班和珀斯的价格相对快速上涨就体现了这一点。参见珀斯的第一张图表。这种差异在一定程度上反映了住房负担能力的改善(阿德莱德、布里斯班和珀斯的房价在疫情前滞后后之后迎头赶上)和相对人口增长(布里斯班和珀斯受益于州际移民)的结合。

The divergence is reflected in measures of valuation. For example, the next table shows the percentage difference between price to annual rent ratios adjusted for inflation relative to their average since 1983. On this basis while houses are 36% overvalued, units are only 9% over valued. And Perth stands out as the least overvalued market in terms of houses and is actually undervalued (by 12%) in terms of units.

这种差异反映在估值衡量标准中。例如,下表显示了经通货膨胀调整后的价格与年租金比率相对于1983年以来平均水平的百分比差异。在此基础上,虽然房屋被高估了36%,但单位的估值仅高出9%。就房屋而言,珀斯是最不被高估的市场,实际上,按单位计算,珀斯的估值被低估了(12%)。

Third – mortgage arrears remain low (for now at least)

第三 — 抵押贷款拖欠额仍然很低(至少目前是这样)

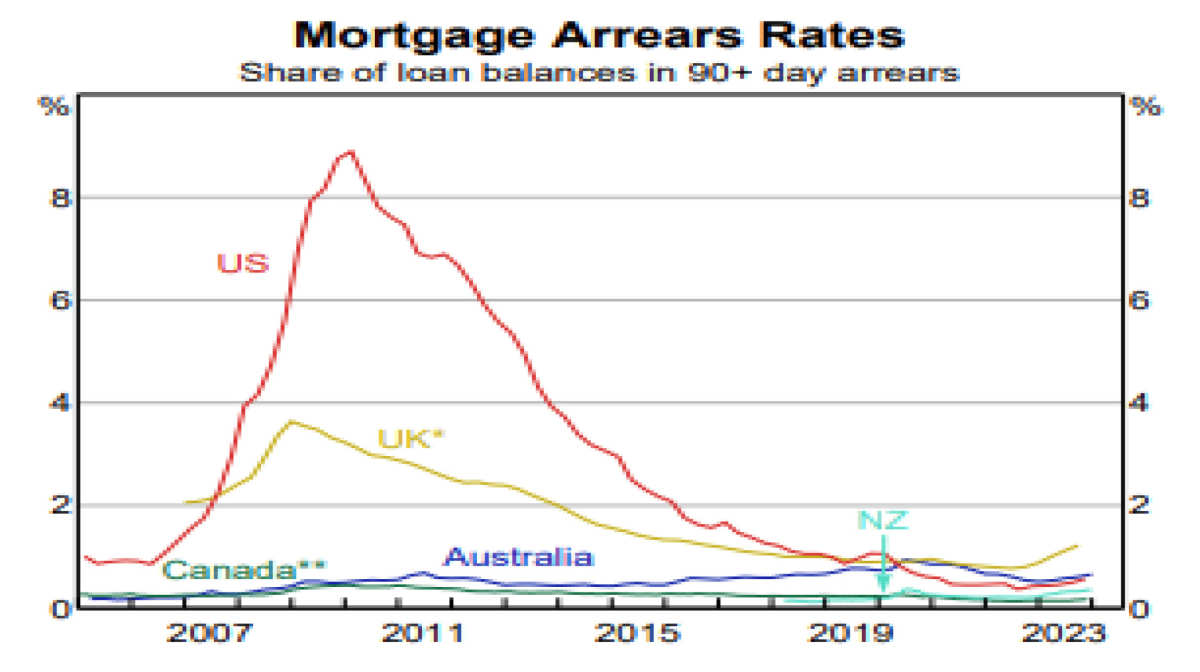

Headlines of excessive mortgage stress have been common for over a decade now. There is no denying housing affordability is poor, household debt is high and some households are suffering significant mortgage stress with the two or three fold increase in mortgage rates. But despite this mortgage arrears rates remain remarkably low as indicated in this chart from the RBA's Financial Stability Review published last month.

十多年来,抵押贷款压力过大的头条新闻已经司空见惯。不可否认的是,住房负担能力差,家庭债务居高不下,抵押贷款利率增长了两到三倍,一些家庭承受着巨大的抵押贷款压力。但是,尽管如此,正如澳大利亚央行上个月发布的《金融稳定报告》中的这张图表所示,抵押贷款拖欠利率仍然非常低。

Source: RBA Financial Stability Review, March 2024

来源:澳大利亚央行金融稳定报告,2024年3月

The low level of arrears partly reflects strong lending standards in Australia combined with the strong jobs market and a high level of savings buffers coming out of the pandemic. That said, arrears are starting to pick up and the risks will rise as buffers run down, scope to cut discretionary spending is exhausted and if the labour market deteriorates significantly.

较低的欠款水平在一定程度上反映了澳大利亚强劲的贷款标准,以及强劲的就业市场和疫情带来的高水平储蓄缓冲。尽管如此,拖欠款项已开始增加,随着缓冲区的减少,削减全权支出的空间已用尽以及劳动力市场严重恶化,风险将上升。

Fourth – interest rates still matter

第四 — 利率仍然很重要

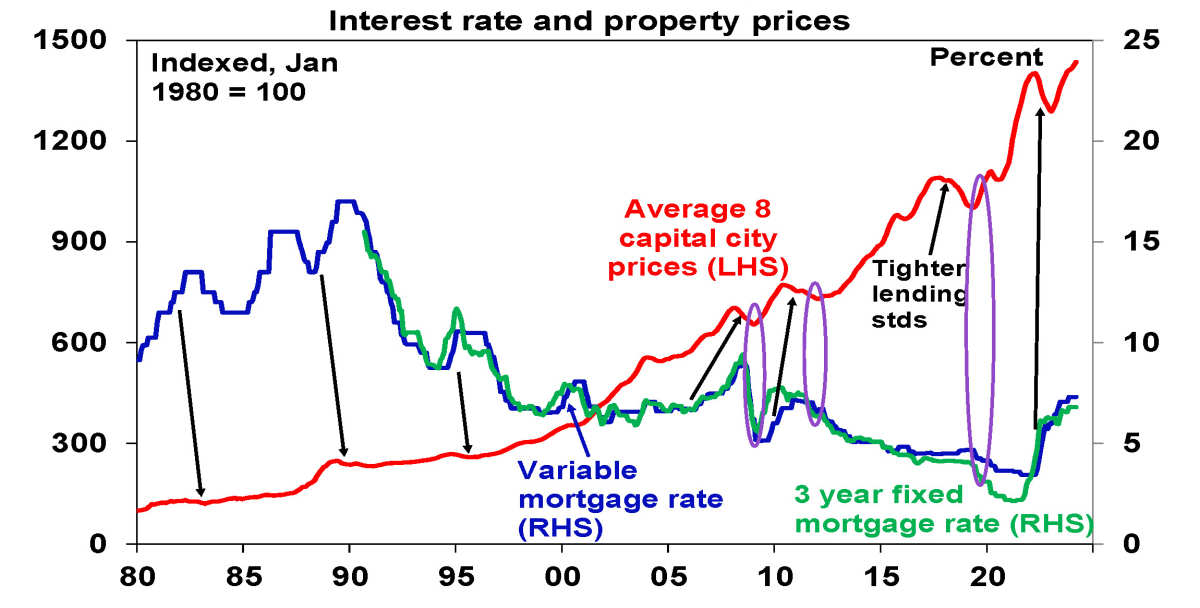

The long sweep of history shows interest rates matter a lot to the property market. The downtrend in mortgage rates since the late 1980s underpinned the surge in property prices over the same period as it enabled buyers to borrow more relative to their incomes. And rate hikes have been associated with cyclical price falls (black arrows in the next chart) with rate cuts usually needed for upswings (see the purple ovals).

漫长的历史表明,利率对房地产市场非常重要。自1980年代末以来,抵押贷款利率的下降趋势支撑了同期房地产价格的飙升,因为它使买家能够借到更多相对于收入的贷款。加息与周期性价格下跌有关(下图中的黑色箭头),而上涨通常需要降息(见紫色椭圆形)。

Source: CoreLogic, RBA, AMP

资料来源:CoreLogic、澳大利亚央行、AMP

But of course, the impact of interest rates can be swamped by other factors at times, as has been the case over the last year.

但是,当然,利率的影响有时会被其他因素所淹没,就像去年一样。

Fifth – it's chronically undersupplied

第五 — 它长期供不应求

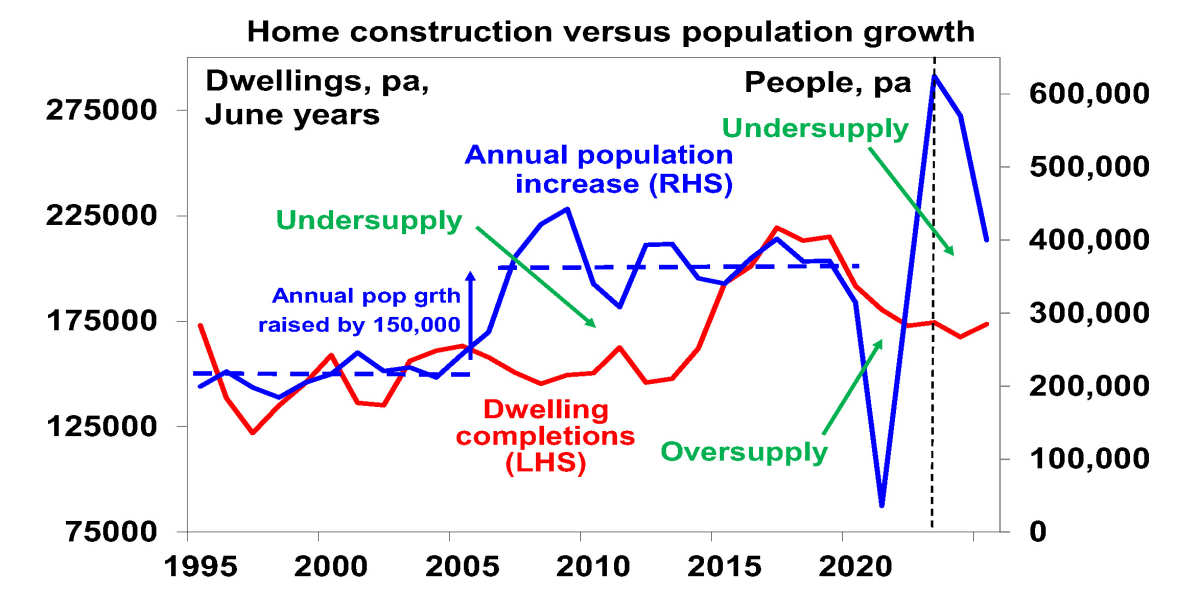

This has been the case since the mid-2000s when immigration levels, and hence population growth, surged and the supply of new homes did not keep up. The pandemic's freeze on immigration provided a brief relief but this was offset by a fall in the number of people per household and the problem has worsened with reopening leading to record immigration levels (of 548,800 people over the year to September resulting in population growth of nearly 660,000). This has pushed underlying housing demand to around 250,000 dwellings pa at a time when home completions are around 170,000 dwellings a year. So, the shortfall of homes is getting worse (and likely to reach 200,000 dwellings by June) and this explains the surprising strength in home prices over the last year.

自2000年代中期以来,情况一直如此,当时移民人数激增,从而导致人口增长,新房的供应跟不上。疫情对移民的冻结提供了短暂的缓解,但这被每户家庭人数的下降所抵消,而且随着重新开放导致移民人数创历史新高(截至9月的一年中,移民人数为548,800人,导致人口增长近66万人),问题进一步恶化。这已将潜在住房需求推高至每年约25万套住房,而房屋竣工量约为每年17万套住房。因此,房屋短缺越来越严重(到6月可能达到20万套住房),这解释了去年房价出人意料地强劲的原因。

The next chart assumes some slowing in immigration levels, but data up to January suggests it remains around record levels. Given home building capacity constraints and the desire to reduce the existing housing shortfall, immigration levels really need to be cut back to around 200,000 a year.

下图假设移民人数有所放缓,但截至1月份的数据表明移民人数仍在创纪录的水平附近。鉴于房屋建筑能力的限制以及减少现有住房短缺的愿望,确实需要将移民人数减少到每年20万左右。

Source: ABS, AMP

资料来源:ABS、AMP

Sixth – forecasting swings in home prices is hard

第六 — 预测房价的波动很难

Failed property crash calls have been a dime a dozen over the last two decades and forecasting property swings has been hard. For example, RBA Governor Michele Bullock noted last month that "I wouldn't like to predict housing prices...every time we tried...we seem to get it wrong..." So be humble and sceptical when it comes to house prices forecasts.

在过去的二十年中,失败的房地产崩溃电话一直很普遍,预测房地产波动一直很困难。例如,澳洲联储行长米歇尔·布洛克上个月指出:“我不想预测房价... 每次尝试... 我们似乎都弄错了...”因此,在房价预测方面要保持谦虚和怀疑。

Finally – it has similar long term returns to shares

最后,它具有相似的长期股票回报率

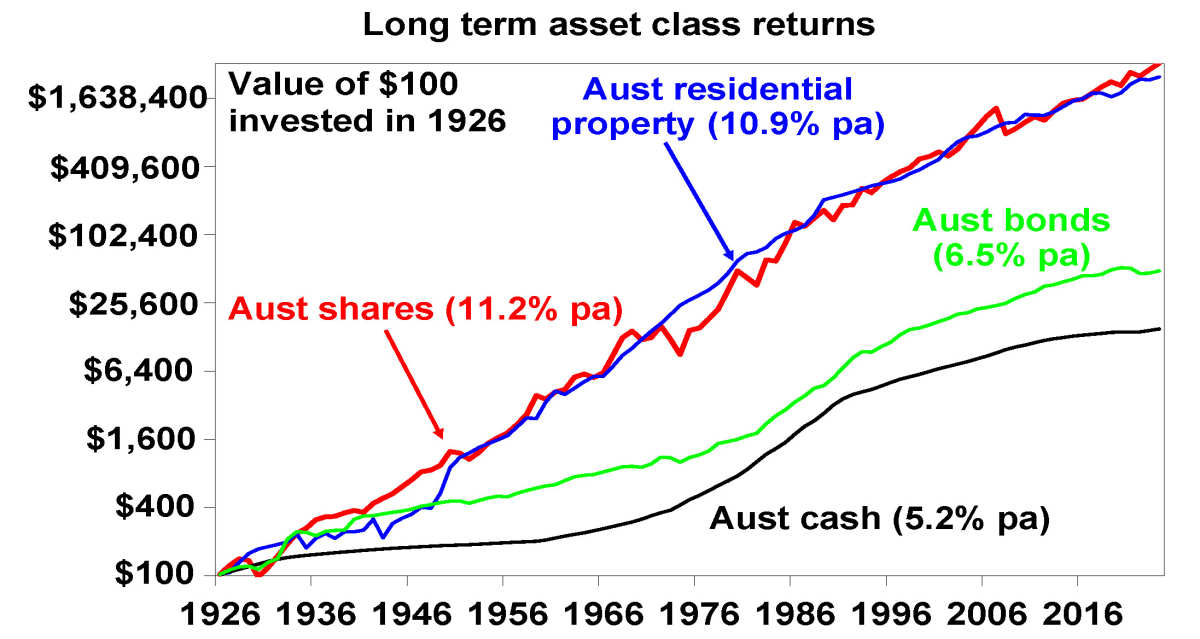

This can be seen in the next chart which shows the value of $100 invested in 1926 in Australian cash, bonds, shares and residential property with interest, dividends and rent (after costs) reinvested along the way. Over the period both shares and property return around 11% pa. Property's low correlation with shares, lower volatility but lower liquidity makes it a good portfolio diversifier. So, there is clearly a role for it in investors' portfolios.

这可以在下一张图表中看出,该图表显示了1926年投资于澳大利亚现金、债券、股票和住宅物业的100美元的价值,在此过程中利息、股息和租金(扣除成本后)进行了再投资。在此期间,股票和房地产的年回报率均约为11%。房地产与股票的低相关性,较低的波动性但较低的流动性使其成为良好的投资组合分散工具。因此,它在投资者的投资组合中显然可以发挥作用。

Source: ASX, ABS, REIA, AMP

资料来源:澳大利亚证券交易所、澳大利亚证券交易所、澳大利亚证券交易所、澳大利亚证券交易所

Where to now?

现在去哪里?

As we noted earlier forecasting property prices is fraught. Particularly now with the opposing forces of a major chronic supply shortfall and high mortgage rates. Our base case is now for 5% or so home price growth this year, down from 8% last year, as still high interest rates constrain demand and along with higher unemployment lead to some increase in distressed listings. However, the supply shortfall should provide support and rate cuts are expected to boost price growth later this year. Delays to rate cuts and a sharp rise in unemployment would signal downside risks whereas the supply shortfall points to upside risk. The key for savvy investors, given the pressure from high interest rates relative to still low rental yields making most property investments cash flow negative, is to look for properties offering decent rental yields.

正如我们之前指出的那样,房地产价格的预测令人担忧。尤其是在目前存在严重的长期供应短缺和高抵押贷款利率的对立势力的情况下。我们目前的基本理由是今年房价增长5%左右,低于去年的8%,这是因为高利率仍然限制了需求,加上失业率的上升导致不良房源有所增加。但是,供应短缺应提供支撑,预计降息将提振今年晚些时候的价格增长。延迟降息和失业率急剧上升将预示着下行风险,而供应短缺则表明上行风险。鉴于高利率带来的压力,相对于仍然较低的租金收益率使大多数房地产投资的现金流为负数,精明的投资者来说,关键是寻找租金收益率不错的房产。

Ends

结束

Important note: While every care has been taken in the preparation of this document, neither National Mutual Funds Management Ltd (ABN 32 006 787 720, AFSL 234652) (NMFM), AMP Limited ABN 49 079 354 519 nor any other member of the AMP Group (AMP) makes any representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor's objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor's objectives, financial situation and needs. This document is solely for the use of the party to whom it is provided. This document is not intended for distribution or use in any jurisdiction where it would be contrary to applicable laws, regulations or directives and does not constitute a recommendation, offer, solicitation or invitation to invest.

重要提示:尽管在编写本文件时已采取一切谨慎措施,但国家共同基金管理有限公司(ABN 32 006 787 720,AFSL 234652)(NMFM)、AMP Limited ABN 49 079 354 519和AMP集团(AMP)的任何其他成员均未对其中任何声明(包括但不限于任何预测)的准确性或完整性作出任何陈述或保证。过去的表现不是未来表现的可靠指标。编写本文件的目的是提供一般信息,没有考虑到任何特定投资者的目标、财务状况或需求。在做出任何投资决定之前,投资者应考虑本文件中信息的适当性,并根据投资者的目标、财务状况和需求寻求专业建议。本文件仅供向其提供的一方使用。本文件不用于在违反适用法律、法规或指令的任何司法管辖区分发或使用,也不构成建议、要约、招标或投资邀请。