Varex Imaging's Earnings: A Preview

Varex Imaging's Earnings: A Preview

Varex Imaging (NASDAQ:VREX) is set to give its latest quarterly earnings report on Tuesday, 2024-02-06. Here's what investors need to know before the announcement.

万睿视影业(纳斯达克股票代码:VREX)定于2024-02-06星期二发布其最新的季度收益报告。以下是投资者在宣布之前需要了解的内容。

Analysts estimate that Varex Imaging will report an earnings per share (EPS) of $0.11.

分析师估计,万睿视影像将公布的每股收益(EPS)为0.11美元。

Varex Imaging bulls will hope to hear the company announce they've not only beaten that estimate, but also to provide positive guidance, or forecasted growth, for the next quarter.

万睿视影像多头希望听到该公司宣布他们不仅超过了这一预期,而且还为下一季度提供积极的指导或预期的增长。

New investors should note that it is sometimes not an earnings beat or miss that most affects the price of a stock, but the guidance (or forecast).

新投资者应注意,有时对股票价格影响最大的不是收益超过或失败,而是指导方针(或预测)。

Historical Earnings Performance

历史收益表现

Last quarter the company beat EPS by $0.10, which was followed by a 0.82% drop in the share price the next day.

上个季度,该公司每股收益高出0.10美元,随后第二天股价下跌0.82%。

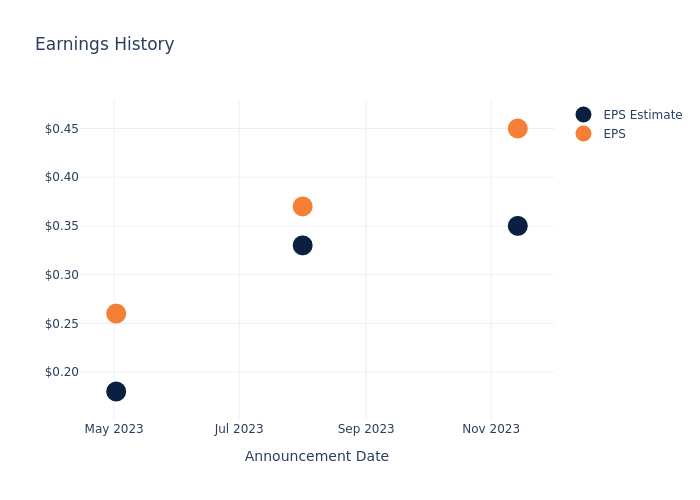

Here's a look at Varex Imaging's past performance and the resulting price change:

以下是万睿视影像过去的表现以及由此产生的价格变化:

| Quarter | Q4 2023 | Q3 2023 | Q2 2023 | Q1 2023 |

|---|---|---|---|---|

| EPS Estimate | 0.35 | 0.33 | 0.18 | 0.20 |

| EPS Actual | 0.45 | 0.37 | 0.26 | 0.21 |

| Price Change % | -0.82% | -2.61% | 19.46% | -12.47% |

| 季度 | 2023 年第四季度 | 2023 年第三季度 | 2023 年第二季度 | 2023年第一季度 |

|---|---|---|---|---|

| 每股收益估算 | 0.35 | 0.33 | 0.18 | 0.20 |

| 实际每股收益 | 0.45 | 0.37 | 0.26 | 0.21 |

| 价格变动% | -0.82% | -2.61% | 19.46% | -12.47% |

Stock Performance

股票表现

Shares of Varex Imaging were trading at $19.19 as of February 02. Over the last 52-week period, shares are up 1.47%. Given that these returns are generally positive, long-term shareholders should be satisfied going into this earnings release.

截至2月2日,万睿视影像的股票交易价格为19.19美元。在过去的52周中,股价上涨了1.47%。鉴于这些回报率普遍为正数,长期股东应该对本财报感到满意。

To track all earnings releases for Varex Imaging visit their earnings calendar on our site.

要追踪万睿视影业发布的所有财报,请访问我们网站上的财报日历。

This article was generated by Benzinga's automated content engine and reviewed by an editor.

本文由Benzinga的自动内容引擎生成,并由编辑审阅。