Futong Technology Development Holdings Limited's (HKG:465) 28% Share Price Plunge Could Signal Some Risk

Futong Technology Development Holdings Limited's (HKG:465) 28% Share Price Plunge Could Signal Some Risk

Futong Technology Development Holdings Limited (HKG:465) shares have had a horrible month, losing 28% after a relatively good period beforehand. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 40% share price drop.

富通科技发展控股有限公司(HKG: 465)的股价经历了一个糟糕的月份,在经历了相对不错的时期之后,股价下跌了28%。在过去十二个月中已经持股的股东没有获得回报,反而坐视股价下跌了40%。

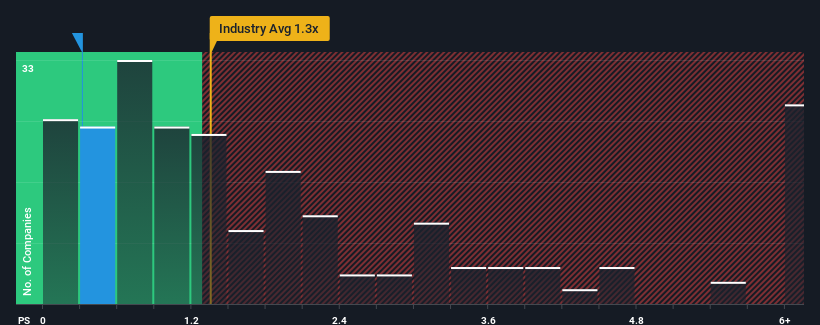

Even after such a large drop in price, you could still be forgiven for feeling indifferent about Futong Technology Development Holdings' P/S ratio of 0.3x, since the median price-to-sales (or "P/S") ratio for the Tech industry in Hong Kong is also close to 0.5x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

即使在价格大幅下跌之后,你对富通科技开发控股0.3倍的市销率漠不关心还是可以原谅的,因为香港科技行业的中位数市销率(或 “市盈率”)也接近0.5倍。但是,不加解释地忽略市销率是不明智的,因为投资者可能会忽视一个明显的机会或一个代价高昂的错误。

View our latest analysis for Futong Technology Development Holdings

查看我们对富通科技开发控股的最新分析

SEHK:465 Price to Sales Ratio vs Industry January 8th 2024

SEHK: 465 2024 年 1 月 8 日与行业的股价销售比率

What Does Futong Technology Development Holdings' P/S Mean For Shareholders?

富通科技开发控股的市销率对股东意味着什么?

As an illustration, revenue has deteriorated at Futong Technology Development Holdings over the last year, which is not ideal at all. It might be that many expect the company to put the disappointing revenue performance behind them over the coming period, which has kept the P/S from falling. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

举例来说,富通科技开发控股公司的收入在过去一年中有所下降,这根本不理想。许多人可能预计,该公司将在未来一段时间内将令人失望的收入表现抛在脑后,这阻止了市销售率的下降。如果你喜欢这家公司,你至少希望情况确实如此,这样你就有可能在它不太受青睐的情况下买入一些股票。

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Futong Technology Development Holdings' earnings, revenue and cash flow.

我们没有分析师的预测,但您可以查看我们关于富通科技开发控股收益、收入和现金流的免费报告,了解最近的趋势如何为公司未来做好准备。

Is There Some Revenue Growth Forecasted For Futong Technology Development Holdings?

富通科技开发控股公司的收入预计会增长吗?

The only time you'd be comfortable seeing a P/S like Futong Technology Development Holdings' is when the company's growth is tracking the industry closely.

你唯一能放心地看到像富通科技开发控股公司这样的市销率的时候是公司的增长密切关注行业的时候。

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 47%. This means it has also seen a slide in revenue over the longer-term as revenue is down 76% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

首先回顾一下,该公司去年的收入增长并不令人兴奋,因为它公布了令人失望的47%的跌幅。这意味着从长远来看,其收入也出现了下滑,因为在过去三年中,总收入下降了76%。因此,股东会对中期收入增长率感到悲观。

Comparing that to the industry, which is predicted to deliver 13% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

相比之下,该行业预计将在未来12个月内实现13%的增长,根据最近的中期收入业绩,该公司的下滑势头令人震惊。

With this information, we find it concerning that Futong Technology Development Holdings is trading at a fairly similar P/S compared to the industry. Apparently many investors in the company are way less bearish than recent times would indicate and aren't willing to let go of their stock right now. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

根据这些信息,我们发现富通科技开发控股的市销售率与该行业相似。显然,该公司的许多投资者并不像最近所表明的那样看跌,他们现在不愿意放弃股票。如果市销率降至更符合近期负增长率的水平,现有股东很有可能为未来的失望做好准备。

What We Can Learn From Futong Technology Development Holdings' P/S?

我们可以从富通科技开发控股公司的市销率中学到什么?

Following Futong Technology Development Holdings' share price tumble, its P/S is just clinging on to the industry median P/S. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

继富通科技开发控股公司股价暴跌之后,其市销率仅保持在行业中位数的市销率上。通常,在做出投资决策时,我们谨慎行事,不要过多地解读市售比率,尽管这可以揭示其他市场参与者对公司的看法。

The fact that Futong Technology Development Holdings currently trades at a P/S on par with the rest of the industry is surprising to us since its recent revenues have been in decline over the medium-term, all while the industry is set to grow. When we see revenue heading backwards in the context of growing industry forecasts, it'd make sense to expect a possible share price decline on the horizon, sending the moderate P/S lower. Unless the recent medium-term conditions improve markedly, investors will have a hard time accepting the share price as fair value.

富通科技开发控股公司目前的市销率与该行业其他公司持平,这一事实令我们感到惊讶,因为其最近的收入在中期内一直在下降,而该行业仍将增长。在行业预测不断增长的背景下,当我们看到收入倒退时,预计股价可能会下跌,从而使温和的市销率走低是有道理的。除非最近的中期状况明显改善,否则投资者将很难接受股价作为公允价值。

We don't want to rain on the parade too much, but we did also find 3 warning signs for Futong Technology Development Holdings (2 can't be ignored!) that you need to be mindful of.

我们不想在游行队伍中下太多雨,但我们也确实为富通科技开发控股找到了3个警告标志(2个不容忽视!)你需要注意的。

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

如果你喜欢强势的公司盈利,那么你需要免费查看这份以低市盈率进行交易(但已证明可以增加收益)的有趣公司名单。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有反馈吗?对内容感到担忧吗?请直接联系我们。或者,也可以发送电子邮件至编辑团队 (at) simplywallst.com。

Simply Wall St 的这篇文章本质上是笼统的。我们仅使用公正的方法提供基于历史数据和分析师预测的评论,我们的文章并非旨在提供财务建议。它不构成买入或卖出任何股票的建议,也没有考虑到您的目标或财务状况。我们的目标是为您提供由基本数据驱动的长期重点分析。请注意,我们的分析可能不会考虑最新的价格敏感型公司公告或定性材料。华尔街只是没有持有上述任何股票的头寸。