Investors Give Future FinTech Group Inc. (NASDAQ:FTFT) Shares A 29% Hiding

Investors Give Future FinTech Group Inc. (NASDAQ:FTFT) Shares A 29% Hiding

Unfortunately for some shareholders, the Future FinTech Group Inc. (NASDAQ:FTFT) share price has dived 29% in the last thirty days, prolonging recent pain. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 65% loss during that time.

不幸的是,对于一些股东来说,未来金融科技集团公司(纳斯达克股票代码:FTFT)的股价在过去三十天内下跌了29%,延续了最近的痛苦。对于股东来说,最近的下跌结束了灾难性的十二个月,在此期间,他们的亏损为65%。

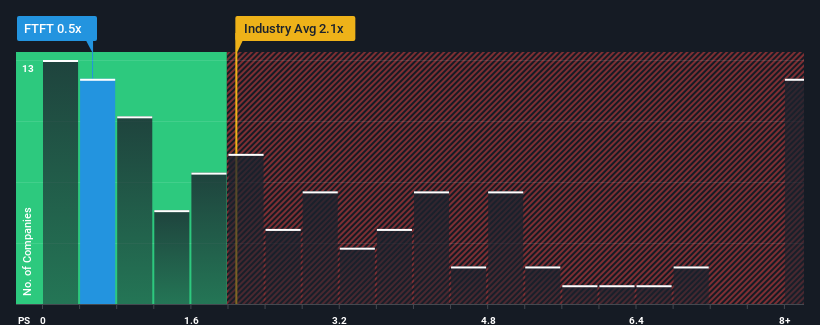

After such a large drop in price, Future FinTech Group may be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.5x, since almost half of all companies in the Diversified Financial industry in the United States have P/S ratios greater than 2.1x and even P/S higher than 5x are not unusual. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

在价格大幅下跌之后,Future Fintech Group目前可能会发出看涨信号,其市盈率(或 “市盈率”)为0.5倍,因为美国多元化金融行业几乎有一半的市盈率超过2.1倍,甚至市盈率高于5倍也并不罕见。但是,市盈率低可能是有原因的,需要进一步调查才能确定其是否合理。

See our latest analysis for Future FinTech Group

查看我们对未来金融科技集团的最新分析

NasdaqCM:FTFT Price to Sales Ratio vs Industry November 14th 2023

纳斯达克CM:FTFT 市销比率与行业对比 2023 年 11 月 14 日

What Does Future FinTech Group's Recent Performance Look Like?

未来金融科技集团最近的表现如何?

As an illustration, revenue has deteriorated at Future FinTech Group over the last year, which is not ideal at all. Perhaps the market believes the recent revenue performance isn't good enough to keep up the industry, causing the P/S ratio to suffer. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

举例来说,在过去的一年中,未来金融科技集团的收入有所下降,这根本不理想。也许市场认为最近的收入表现不足以维持该行业的发展,从而导致市盈率受到影响。但是,如果最终没有发生这种情况,那么现有股东可能会对股价的未来走向感到乐观。

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Future FinTech Group's earnings, revenue and cash flow.

我们没有分析师的预测,但您可以查看我们关于Future Fintech Group收益、收入和现金流的免费报告,了解最近的趋势如何为公司未来做好准备。

How Is Future FinTech Group's Revenue Growth Trending?

未来金融科技集团的收入增长趋势如何?

In order to justify its P/S ratio, Future FinTech Group would need to produce sluggish growth that's trailing the industry.

为了证明其市盈率是合理的,Future Fintech Group需要实现落后于该行业的缓慢增长。

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 42%. The latest three year period has seen an incredible overall rise in revenue, a stark contrast to the last 12 months. Accordingly, shareholders will be pleased, but also have some serious questions to ponder about the last 12 months.

首先回顾一下,该公司去年的收入增长并不令人兴奋,因为它公布了令人失望的42%的下降。最近三年的收入总体增长令人难以置信,与过去的12个月形成鲜明对比。因此,股东会感到高兴,但对于过去的12个月,也有一些严肃的问题需要思考。

This is in contrast to the rest of the industry, which is expected to grow by 5.9% over the next year, materially lower than the company's recent medium-term annualised growth rates.

这与该行业的其他部门形成鲜明对比,该行业预计明年将增长5.9%,大大低于该公司最近的中期年化增长率。

With this in mind, we find it intriguing that Future FinTech Group's P/S isn't as high compared to that of its industry peers. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

考虑到这一点,我们发现有趣的是,Future FinTech Group的市盈率与行业同行相比没有那么高。显然,一些股东认为最近的表现已经超出了极限,并且一直在接受大幅降低的销售价格。

What We Can Learn From Future FinTech Group's P/S?

我们可以从未来金融科技集团的市盈率中学到什么?

Future FinTech Group's P/S has taken a dip along with its share price. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

未来金融科技集团的市盈率与股价一起下跌。尽管市售比率不应该成为决定你是否买入股票的决定性因素,但它是衡量收入预期的有力晴雨表。

We're very surprised to see Future FinTech Group currently trading on a much lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. When we see robust revenue growth that outpaces the industry, we presume that there are notable underlying risks to the company's future performance, which is exerting downward pressure on the P/S ratio. It appears many are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

我们非常惊讶地看到,Future Fintech Group目前的市盈率远低于预期,因为其最近的三年增长高于整个行业的预期。当我们看到强劲的收入增长超过行业时,我们认为公司的未来业绩存在明显的潜在风险,这给市盈率带来了下行压力。看来许多人确实在预测收入不稳定,因为最近的这些中期条件的持续存在通常会提振股价。

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Future FinTech Group, and understanding these should be part of your investment process.

始终有必要考虑永远存在的投资风险幽灵。我们已经向Future Fintech Group发现了两个警告信号,了解这些信号应该成为您投资过程的一部分。

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

当然,具有良好收益增长历史的盈利公司通常是更安全的选择。因此,您可能希望看到这些免费收集的市盈率合理且收益增长强劲的其他公司。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有反馈吗?对内容感到担忧吗?请直接联系我们。或者,也可以发送电子邮件至编辑团队 (at) simplywallst.com。

Simply Wall St的这篇文章本质上是笼统的。我们仅使用公正的方法根据历史数据和分析师的预测提供评论,我们的文章无意作为财务建议。它不构成买入或卖出任何股票的建议,也没有考虑到您的目标或财务状况。我们的目标是为您提供由基本数据驱动的长期重点分析。请注意,我们的分析可能不考虑最新的价格敏感型公司公告或定性材料。简而言之,华尔街没有持有任何上述股票的头寸。