The Market Doesn't Like What It Sees From CEA Industries Inc.'s (NASDAQ:CEAD) Revenues Yet As Shares Tumble 33%

The Market Doesn't Like What It Sees From CEA Industries Inc.'s (NASDAQ:CEAD) Revenues Yet As Shares Tumble 33%

CEA Industries Inc. (NASDAQ:CEAD) shareholders won't be pleased to see that the share price has had a very rough month, dropping 33% and undoing the prior period's positive performance. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 43% in that time.

CEA工业公司纳斯达克(Sequoia Capital:CEAD)股东将不会高兴地看到,该公司股价经历了非常艰难的一个月,下跌了33%,抹去了前一季度的积极表现。过去30天的下跌为股东们艰难的一年画上了句号,股价在此期间下跌了43%。

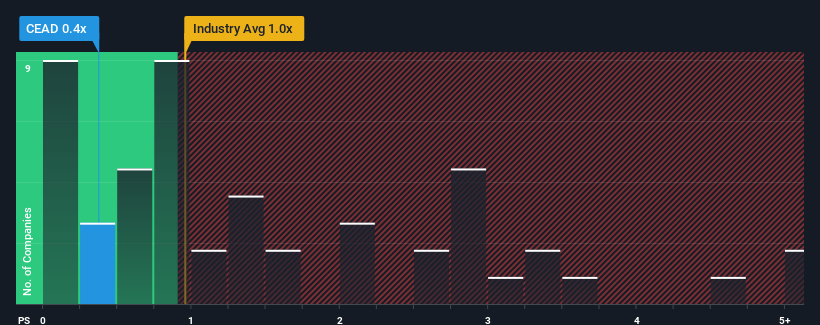

Following the heavy fall in price, CEA Industries' price-to-sales (or "P/S") ratio of 0.4x might make it look like a buy right now compared to the Building industry in the United States, where around half of the companies have P/S ratios above 1x and even P/S above 3x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

随着价格的大幅下跌,东航实业0.4倍的市售比(即P/S)可能会让它看起来像是买入,而在美国,大约一半的公司的P/S比超过1倍,甚至P/S高于3倍的情况也很常见。然而,P/S可能是有原因的,需要进一步调查才能确定是否合理。

See our latest analysis for CEA Industries

查看我们对CEA行业的最新分析

What Does CEA Industries' Recent Performance Look Like?

东航实业近期的表现如何?

CEA Industries has been doing a decent job lately as it's been growing revenue at a reasonable pace. It might be that many expect the respectable revenue performance to degrade, which has repressed the P/S. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

CEA Industries最近一直在做一份不错的工作,因为它一直在以合理的速度增长收入。这可能是因为许多人预计其可观的营收表现将会下滑,这抑制了市盈率。如果你喜欢这家公司,你可能会希望情况并非如此,这样你就可以在它不受青睐的时候买入一些股票。

Is There Any Revenue Growth Forecasted For CEA Industries?

CEA Industries有没有收入增长的预测?

The only time you'd be truly comfortable seeing a P/S as low as CEA Industries' is when the company's growth is on track to lag the industry.

只有当东航的增长速度落后于行业时,你才会真正放心地看到东航的市盈率如此之低。

Taking a look back first, we see that the company managed to grow revenues by a handy 6.5% last year. However, this wasn't enough as the latest three year period has seen an unpleasant 3.7% overall drop in revenue. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

首先回顾一下,我们看到该公司去年的收入轻松增长了6.5%。然而,这还不够,因为最近三年的总收入下降了3.7%,令人不快。因此,股东们会对中期营收增长率感到悲观。

Comparing that to the industry, which is predicted to deliver 3.7% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

相比之下,该行业预计将在未来12个月实现3.7%的增长,根据最近的中期营收结果,该公司的下滑势头令人警醒。

In light of this, it's understandable that CEA Industries' P/S would sit below the majority of other companies. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

有鉴于此,东航的P/S会排在大多数其他公司的后面,这是可以理解的。尽管如此,不能保证P/S已经触底,营收出现了逆转。如果该公司不改善其营收增长,市盈率S有可能跌至更低的水平。

What We Can Learn From CEA Industries' P/S?

我们可以从东航实业的P/S那里学到什么?

CEA Industries' P/S has taken a dip along with its share price. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

东航实业的市盈率/S与其股价一起下跌。有人认为,在某些行业中,市销率是衡量价值的次要指标,但它可能是一个强大的商业信心指标。

As we suspected, our examination of CEA Industries revealed its shrinking revenue over the medium-term is contributing to its low P/S, given the industry is set to grow. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises either. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

正如我们怀疑的那样,我们对东航实业的调查显示,鉴于该行业将会增长,该公司中期收入的萎缩是导致其低市盈率的原因之一。目前,股东们正在接受S的低市盈率,因为他们承认,未来的收入可能也不会带来任何惊喜。除非近期的中期状况有所改善,否则将继续在这些水平附近形成股价障碍。

Plus, you should also learn about these 2 warning signs we've spotted with CEA Industries.

另外,你还应该了解这些我们在CEA工业公司发现了2个警告信号。

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

重要的是确保你寻找的是一家伟大的公司,而不仅仅是你遇到的第一个想法。因此,如果不断增长的盈利能力符合你对一家伟大公司的看法,不妨看看这一点免费近期收益增长强劲(市盈率较低)的有趣公司名单。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有什么反馈吗?担心内容吗? 保持联系直接与我们联系。或者,也可以给编辑组发电子邮件,地址是implywallst.com。

本文由Simply Wall St.撰写,具有概括性。我们仅使用不偏不倚的方法提供基于历史数据和分析师预测的评论,我们的文章并不打算作为财务建议。它不构成买卖任何股票的建议,也没有考虑你的目标或你的财务状况。我们的目标是为您带来由基本面数据驱动的长期重点分析。请注意,我们的分析可能不会将最新的对价格敏感的公司公告或定性材料考虑在内。Simply Wall St.对上述任何一只股票都没有持仓。