Some Confidence Is Lacking In China Silver Technology Holdings Limited (HKG:515) As Shares Slide 25%

Some Confidence Is Lacking In China Silver Technology Holdings Limited (HKG:515) As Shares Slide 25%

The China Silver Technology Holdings Limited (HKG:515) share price has fared very poorly over the last month, falling by a substantial 25%. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 56% loss during that time.

这个中国银色科技控股有限公司(HKG:515)过去一个月,股价表现非常糟糕,大幅下跌了25%。最近的下跌为股东们灾难性的12个月画上了句号,在此期间,他们坐拥56%的损失。

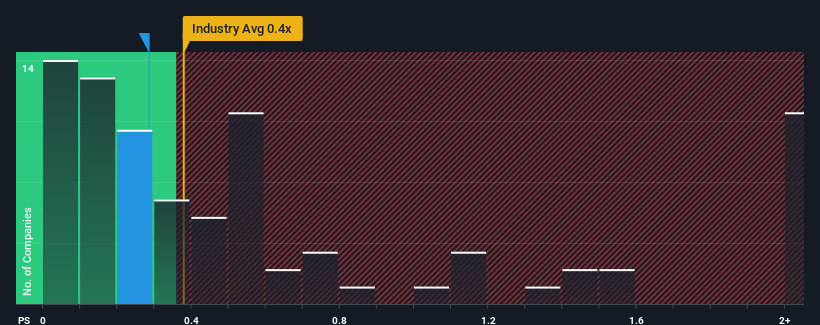

Although its price has dipped substantially, there still wouldn't be many who think China Silver Technology Holdings' price-to-sales (or "P/S") ratio of 0.3x is worth a mention when the median P/S in Hong Kong's Electronic industry is similar at about 0.4x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

虽然其价格大幅下跌,但在香港电子行业的P/S中值约为0.4倍的情况下,仍不会有很多人认为中国银色科技控股的0.3倍的市售比(P/S)值得一提。尽管如此,在没有解释的情况下简单地忽视市盈率S是不明智的,因为投资者可能会忽视一个独特的机会或代价高昂的错误。

View our latest analysis for China Silver Technology Holdings

查看我们对中国银色科技控股的最新分析

What Does China Silver Technology Holdings' P/S Mean For Shareholders?

中国银色科技控股P/S对股东意味着什么?

For instance, China Silver Technology Holdings' receding revenue in recent times would have to be some food for thought. One possibility is that the P/S is moderate because investors think the company might still do enough to be in line with the broader industry in the near future. If not, then existing shareholders may be a little nervous about the viability of the share price.

例如,中国银色科技控股公司近期营收下滑,这肯定是值得深思的。一种可能性是,S的市盈率是温和的,因为投资者认为,该公司在不久的将来可能仍会采取足够的措施,与更广泛的行业保持一致。如果不是,那么现有股东可能会对股价的生存能力感到有点紧张。

How Is China Silver Technology Holdings' Revenue Growth Trending?

中国银色科技控股的营收增长趋势如何?

In order to justify its P/S ratio, China Silver Technology Holdings would need to produce growth that's similar to the industry.

为了证明其市盈率与S的比率是合理的,中国银色科技控股有限公司需要实现与该行业类似的增长。

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 44%. As a result, revenue from three years ago have also fallen 26% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

首先回顾一下,该公司去年的收入增长并不令人兴奋,因为它公布了令人失望的44%的下降。因此,三年前的营收总体上也下降了26%。因此,公平地说,最近的收入增长对公司来说是不可取的。

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 29% shows it's an unpleasant look.

将这一中期收入轨迹与整个行业一年内增长29%的预测进行比较,可以看出这是一个令人不快的前景。

With this information, we find it concerning that China Silver Technology Holdings is trading at a fairly similar P/S compared to the industry. Apparently many investors in the company are way less bearish than recent times would indicate and aren't willing to let go of their stock right now. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh on the share price eventually.

有了这些信息,我们发现,与行业相比,中国银色科技控股的市盈率与S相当。显然,该公司的许多投资者并不像最近的情况所显示的那样悲观,他们现在不愿抛售自己的股票。只有最大胆的人才会认为这些价格是可持续的,因为最近收入趋势的延续最终可能会拖累股价。

The Bottom Line On China Silver Technology Holdings' P/S

中国银色科技控股P/S的底线

China Silver Technology Holdings' plummeting stock price has brought its P/S back to a similar region as the rest of the industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

中国银色科技控股公司股价暴跌,使其市盈率与S的市盈率回到了与业内其他公司类似的地区。一般来说,我们倾向于将市销率的使用限制在确定市场对公司整体健康状况的看法上。

Our look at China Silver Technology Holdings revealed its shrinking revenues over the medium-term haven't impacted the P/S as much as we anticipated, given the industry is set to grow. Even though it matches the industry, we're uncomfortable with the current P/S ratio, as this dismal revenue performance is unlikely to support a more positive sentiment for long. If recent medium-term revenue trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

我们对中国银色科技控股有限公司的调查显示,考虑到该行业的增长,该公司中期收入的缩水对市盈率/S指数的影响并不像我们预期的那么大。尽管它与行业相符,但我们对当前的市盈率/S比率感到不安,因为这种惨淡的营收表现不太可能长期支持更积极的情绪。如果近期的中期营收趋势持续下去,将使股东的投资面临风险,潜在投资者面临支付不必要溢价的危险。

Plus, you should also learn about these 2 warning signs we've spotted with China Silver Technology Holdings.

另外,你还应该了解这些我们发现中国银色科技控股公司的两个警告信号。

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

如果强大的盈利公司激起了你的想象力,那么你就会想要看看这个。免费市盈率较低(但已证明它们可以增加收益)的有趣公司名单。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有什么反馈吗?担心内容吗? 保持联系直接与我们联系。或者,也可以给编辑组发电子邮件,地址是implywallst.com。

本文由Simply Wall St.撰写,具有概括性。我们仅使用不偏不倚的方法提供基于历史数据和分析师预测的评论,我们的文章并不打算作为财务建议。它不构成买卖任何股票的建议,也没有考虑你的目标或你的财务状况。我们的目标是为您带来由基本面数据驱动的长期重点分析。请注意,我们的分析可能不会将最新的对价格敏感的公司公告或定性材料考虑在内。Simply Wall St.对上述任何一只股票都没有持仓。