Market Participants Recognise Enviro-Hub Holdings Ltd.'s (SGX:L23) Earnings Pushing Shares 29% Higher

Market Participants Recognise Enviro-Hub Holdings Ltd.'s (SGX:L23) Earnings Pushing Shares 29% Higher

Enviro-Hub Holdings Ltd. (SGX:L23) shareholders have had their patience rewarded with a 29% share price jump in the last month. But not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 21% in the last twelve months.

Enviro-Hub 控股有限公司 (SGX: L23) 股东的耐心得到了回报,股价在上个月上涨了29%。但是,并非所有股东都会感到欢欣鼓舞,因为在过去的十二个月中,股价仍下跌了令人失望的21%。

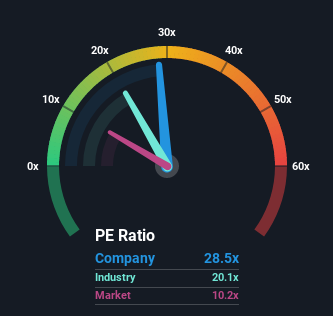

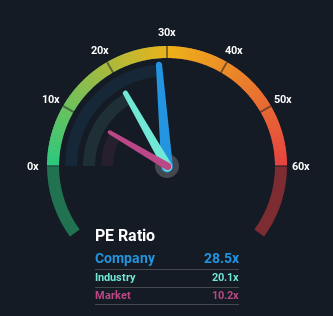

Since its price has surged higher, given close to half the companies in Singapore have price-to-earnings ratios (or "P/E's") below 10x, you may consider Enviro-Hub Holdings as a stock to avoid entirely with its 28.5x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

由于其价格飙升,鉴于新加坡近一半的公司的市盈率(或 “市盈率”)低于10倍,因此您可以将Enviro-Hub Holdings视为一只值得完全避开的股票,其市盈率为28.5倍。但是,仅按面值来看待市盈率是不明智的,因为可能有人解释为什么市盈率如此之高。

With earnings growth that's exceedingly strong of late, Enviro-Hub Holdings has been doing very well. The P/E is probably high because investors think this strong earnings growth will be enough to outperform the broader market in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

由于最近收益增长异常强劲,Enviro-Hub Holdings一直表现良好。市盈率可能很高,因为投资者认为这种强劲的收益增长足以在不久的将来跑赢整个市场。你真的希望如此,否则你会无缘无故地付出相当高的代价。

See our latest analysis for Enviro-Hub Holdings

查看我们对 Enviro-Hub Holdings 的最新分析

What Are Growth Metrics Telling Us About The High P/E?

关于高市盈率,增长指标告诉我们什么?

In order to justify its P/E ratio, Enviro-Hub Holdings would need to produce outstanding growth well in excess of the market.

为了证明其市盈率是合理的,Enviro-Hub Holdings需要实现远远超过市场的显著增长。

Taking a look back first, we see that the company grew earnings per share by an impressive 106% last year. EPS has also lifted 28% in aggregate from three years ago, mostly thanks to the last 12 months of growth. Accordingly, shareholders would have probably been satisfied with the medium-term rates of earnings growth.

先回头看,我们发现该公司去年的每股收益增长了令人印象深刻的106%。每股收益总额也比三年前增长了28%,这主要归功于过去12个月的增长。因此,股东可能会对中期收益增长率感到满意。

In contrast to the company, the rest of the market is expected to decline by 1.1% over the next year, which puts the company's recent medium-term positive growth rates in a good light for now.

与该公司形成鲜明对比的是,其他市场预计将在明年下降1.1%,这使该公司最近的中期正增长率目前处于良好状态。

With this information, we can see why Enviro-Hub Holdings is trading at a high P/E compared to the market. Investors are willing to pay more for a stock they hope will buck the trend of the broader market going backwards. Nonetheless, with most other businesses facing an uphill battle, staying on its current earnings path is no certainty.

有了这些信息,我们可以明白为什么Enviro-Hub Holdings的市盈率与市场相比居高不下。投资者愿意为他们希望逆转大盘倒退趋势的股票支付更多费用。尽管如此,由于大多数其他企业都面临着艰苦的战斗,保持目前的盈利道路尚不确定。

The Key Takeaway

关键要点

The strong share price surge has got Enviro-Hub Holdings' P/E rushing to great heights as well. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

股价的强劲上涨也使Enviro-Hub Holdings的市盈率飙升至高点。仅使用市盈率来确定是否应该出售股票是不明智的,但它可以作为公司未来前景的实用指南。

We've established that Enviro-Hub Holdings maintains its high P/E on the strength of its recentthree-year growth beating forecasts for a struggling market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. We still remain cautious about the company's ability to stay its recent course and swim against the current of the broader market turmoil. Although, if the company's relative performance doesn't change it will continue to provide strong support to the share price.

我们已经确定,正如预期的那样,Enviro-Hub Holdings保持了较高的市盈率,这要归因于其最近三年的增长超过了对陷入困境的市场的预期。在现阶段,投资者认为,收益恶化的可能性还不足以证明降低市盈率是合理的。我们仍然谨慎地看待该公司能否坚持最近的方针,逆势而上,应对更广泛的市场动荡。但是,如果公司的相对表现不变,它将继续为股价提供强有力的支撑。

And what about other risks? Every company has them, and we've spotted 3 warning signs for Enviro-Hub Holdings (of which 1 is significant!) you should know about.

那其他风险呢?每家公司都有它们,我们已经发现了 Enviro-Hub Holdings 有 3 个警告 (其中 1 很重要!)你应该知道。

If P/E ratios interest you, you may wish to see this free collection of other companies that have grown earnings strongly and trade on P/E's below 20x.

如果你对市盈率感兴趣,你可能希望看到这个 免费的 其他盈利增长强劲且市盈率低于20倍的公司的集合。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有反馈吗?对内容感到担忧? 取得联系 直接和我们联系。 或者,给编辑团队 (at) simplywallst.com 发送电子邮件。

Simply Wall St 的这篇文章本质上是一般性的。 我们仅使用不偏不倚的方法根据历史数据和分析师预测提供评论,我们的文章并非旨在提供财务建议。 它不构成买入或卖出任何股票的建议,也没有考虑您的目标或财务状况。我们的目标是为您提供由基本面数据驱动的长期重点分析。请注意,我们的分析可能未将最新的价格敏感型公司公告或定性材料考虑在内。简而言之,华尔街对上述任何股票都没有头寸。