Deere Options Trading: A Deep Dive Into Market Sentiment

Deere Options Trading: A Deep Dive Into Market Sentiment

Financial giants have made a conspicuous bullish move on Deere. Our analysis of options history for Deere (NYSE:DE) revealed 14 unusual trades.

金融巨头对迪尔采取了明显的看涨举动。我们对迪尔(纽约证券交易所代码:DE)期权历史的分析显示了14笔不寻常的交易。

Delving into the details, we found 57% of traders were bullish, while 35% showed bearish tendencies. Out of all the trades we spotted, 10 were puts, with a value of $480,204, and 4 were calls, valued at $421,964.

深入研究细节,我们发现57%的交易者看涨,而35%的交易者表现出看跌的趋势。在我们发现的所有交易中,有10笔是看跌期权,价值480,204美元,4笔是看涨期权,价值421,964美元。

Predicted Price Range

预测的价格区间

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $200.0 to $420.0 for Deere over the recent three months.

根据交易活动,看来重要投资者的目标是在最近三个月中将迪尔的价格范围从200.0美元扩大到420.0美元。

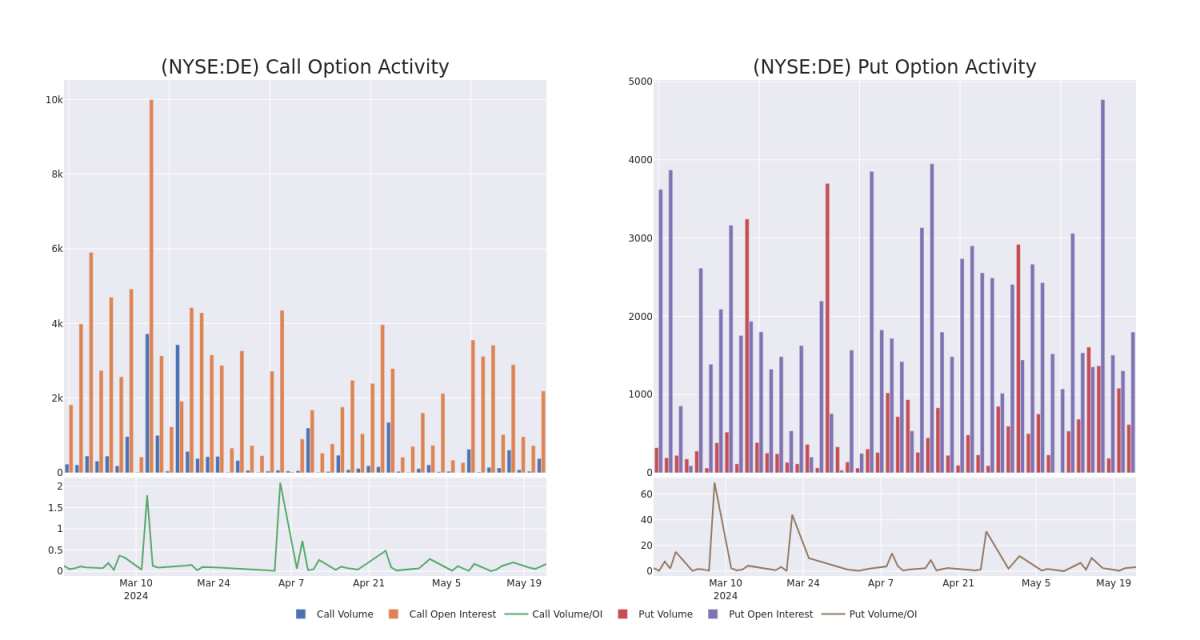

Volume & Open Interest Development

交易量和未平仓合约的发展

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Deere's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Deere's whale trades within a strike price range from $200.0 to $420.0 in the last 30 days.

交易期权时,查看交易量和未平仓合约是一个强有力的举动。这些数据可以帮助您跟踪迪尔期权在给定行使价下的流动性和利息。下面,我们可以观察到过去30天内所有迪尔鲸鱼交易的看涨期权和看跌期权交易量和未平仓合约的变化,行使价在200美元至420.0美元之间。

Deere 30-Day Option Volume & Interest Snapshot

迪尔30天期权交易量和利息快照

Largest Options Trades Observed:

观察到的最大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DE | CALL | TRADE | NEUTRAL | 06/21/24 | $186.95 | $179.0 | $182.97 | $200.00 | $274.4K | 46 | 15 |

| DE | PUT | SWEEP | BULLISH | 06/21/24 | $41.95 | $36.7 | $38.46 | $420.00 | $96.0K | 151 | 21 |

| DE | PUT | SWEEP | BULLISH | 09/20/24 | $12.55 | $12.5 | $12.5 | $370.00 | $85.0K | 503 | 2 |

| DE | CALL | SWEEP | BEARISH | 06/21/24 | $2.65 | $2.57 | $2.57 | $400.00 | $62.1K | 1.9K | 311 |

| DE | CALL | SWEEP | BULLISH | 07/19/24 | $13.3 | $12.9 | $13.3 | $380.00 | $59.8K | 21 | 50 |

| 符号 | 看跌/看涨 | 交易类型 | 情绪 | Exp。日期 | 问 | 出价 | 价格 | 行使价 | 总交易价格 | 未平仓合约 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DE | 打电话 | 贸易 | 中立 | 06/21/24 | 186.95 美元 | 179.0 美元 | 182.97 美元 | 200.00 美元 | 274.4 万美元 | 46 | 15 |

| DE | 放 | 扫 | 看涨 | 06/21/24 | 41.95 美元 | 36.7 美元 | 38.46 美元 | 420.00 美元 | 96.0 万美元 | 151 | 21 |

| DE | 放 | 扫 | 看涨 | 09/20/24 | 12.55 美元 | 12.5 美元 | 12.5 美元 | 370.00 美元 | 85.0 万美元 | 503 | 2 |

| DE | 打电话 | 扫 | 粗鲁的 | 06/21/24 | 2.65 美元 | 2.57 美元 | 2.57 美元 | 400.00 美元 | 62.1 万美元 | 1.9K | 311 |

| DE | 打电话 | 扫 | 看涨 | 07/19/24 | 13.3 美元 | 12.9 美元 | 13.3 美元 | 380.00 美元 | 59.8 万美元 | 21 | 50 |

About Deere

关于迪尔

Deere is the world's leading manufacturer of agricultural equipment, producing some of the most recognizable machines in the heavy machinery industry. The company is divided into four reportable segments: production and precision agriculture, small agriculture and turf, construction and forestry, and John Deere Capital. Its products are available through an extensive dealer network, which includes over 2,000 dealer locations in North America and approximately 3,700 locations globally. John Deere Capital provides retail financing for machinery to its customers, in addition to wholesale financing for dealers, which increases the likelihood of Deere product sales.

迪尔是世界领先的农业设备制造商,生产重型机械行业中一些最知名的机器。该公司分为四个可报告的部门:生产和精准农业、小型农业和草坪、建筑和林业以及约翰迪尔资本。其产品可通过广泛的经销商网络获得,该网络包括北美的2,000多个经销商地点和全球约3,700个分支机构。约翰迪尔资本向其客户提供机械零售融资,此外还为经销商提供批发融资,这增加了迪尔产品销售的可能性。

Having examined the options trading patterns of Deere, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

在研究了迪尔的期权交易模式之后,我们的注意力现在直接转向了该公司。这种转变使我们能够深入研究其目前的市场地位和表现

Present Market Standing of Deere

迪尔目前的市场地位

- Currently trading with a volume of 756,871, the DE's price is down by -0.98%, now at $382.22.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 85 days.

- 德国目前的交易量为756,871美元,价格下跌了-0.98%,目前为382.22美元。

- RSI读数表明,该股目前在超买和超卖之间处于中立状态。

- 预计财报将在85天后发布。

Expert Opinions on Deere

关于迪尔的专家意见

5 market experts have recently issued ratings for this stock, with a consensus target price of $429.2.

5位市场专家最近发布了该股的评级,共识目标价为429.2美元。

- Consistent in their evaluation, an analyst from Oppenheimer keeps a Outperform rating on Deere with a target price of $465.

- Consistent in their evaluation, an analyst from TD Cowen keeps a Hold rating on Deere with a target price of $390.

- An analyst from Oppenheimer has decided to maintain their Outperform rating on Deere, which currently sits at a price target of $456.

- An analyst from Stifel has decided to maintain their Buy rating on Deere, which currently sits at a price target of $450.

- Maintaining their stance, an analyst from JP Morgan continues to hold a Neutral rating for Deere, targeting a price of $385.

- 奥本海默的一位分析师在评估中保持了对迪尔跑赢大盘的评级,目标价为465美元。

- 道明考恩的一位分析师在评估中保持对迪尔的持有评级,目标价为390美元。

- 奥本海默的一位分析师已决定维持对迪尔跑赢大盘的评级,目前的目标股价为456美元。

- Stifel的一位分析师已决定维持对迪尔的买入评级,目前的目标股价为450美元。

- 摩根大通的一位分析师保持立场,继续对迪尔维持中性评级,目标价格为385美元。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Deere with Benzinga Pro for real-time alerts.

交易期权涉及更大的风险,但也提供了更高利润的潜力。精明的交易者通过持续的教育、战略贸易调整、利用各种指标以及随时关注市场动态来降低这些风险。使用Benzinga Pro了解迪尔的最新期权交易,以获取实时提醒。