Market Hits Highs, Equities Decline Thursday | Market Story

Market Hits Highs, Equities Decline Thursday | Market Story

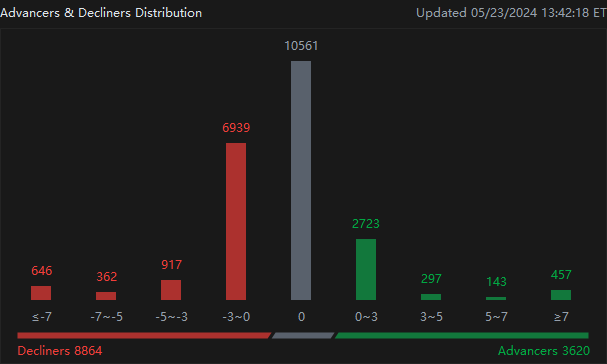

As a general recap, the market was overall declining despite some records. Shortly after 3:15 PM EST, the $S&P 500 Index traded down 0.74%. The $Dow Jones Industrial Average fell about 1.53%, and the $Nasdaq Composite Index fell 0.39%. By direction, 10,000 equities declined while 3,000 climbed Thursday.

总的来说,尽管有一些记录,但市场整体下跌。美国东部标准时间下午 3:15 过后不久, 美元标准普尔500指数 交易价格下跌了0.74%。这个 $道琼斯工业平均指数 下跌了约1.53%,而且 $纳斯达克综合指数 下跌了0.39%。从方向来看,10,000只股票下跌,而周四上涨了3,000只。

Thursday, investors gauged S&P PMI numbers that came in generally higher with 50.9 in manufacturing, 54.4 in Composite, and 54.8 in Services. Initial jobless claims came in lower than last week, at 215k.

周四,投资者估计,标准普尔采购经理人指数普遍走高,制造业为50.9,综合指数为54.4,服务业为54.8。首次申请失业救济人数低于上周,为21.5万。

In the most recent meeting minutes released Wednesday, many FOMC members commented on their uncertainty about when rates should come down. Several participants said they were willing to raise rates further.

在周三发布的最新会议纪要中,许多联邦公开市场委员会成员评论了他们对何时降息的不确定性。 几位参与者表示,他们愿意进一步提高利率。

The committee, during their April 30-May 1 meeting, found that uncertainty came from the possibility that "high interest rates may have smaller effects than in the pas." Participants said interest rates would stay put unless inflation numbers were clearly at 2%, or the labor market clearly weakens. Members said they would be willing to raise rates if "risks to inflation materialize in a way that such an action became appropriate."

该委员会在4月30日至5月1日的会议上发现,不确定性源于 “高利率的影响可能比过去小” 的可能性。与会者表示,除非通货膨胀率明显为2%,或者劳动力市场明显疲软,否则利率将保持不变。成员们表示,如果 “通货膨胀风险以适当的方式出现”,他们愿意提高利率。

This week investors will also watch numerous Fed speeches. Federal Reserve Governor Christopher Waller said on Tuesday that if economic data continues to weaken over the next three to five months, the central bank might consider lowering interest rates by the end of 2024.

本周投资者还将观看美联储的许多讲话。美联储理事克里斯托弗·沃勒周二表示,如果经济数据在未来三到五个月内继续疲软,央行可能会考虑在2024年底之前降低利率。

Monday Morning, Fed Vice Chair Jefferson said the economy is growing at a solid pace, and its too early to tell if the current disinflation slowdown will last longer. Cleveland Fed President Loretta Mester on Monday suggested she was thinking about backing away from her prior expectation of three cuts this year.

周一上午,美联储副主席杰斐逊表示,经济正在稳步增长,现在判断当前的反通货膨胀放缓是否会持续更长的时间还为时过早。克利夫兰联储主席洛雷塔·梅斯特周一表示,她正在考虑放弃先前对今年三次削减的预期。

Last week, Wednesday CPI numbers for April came in right at expectations. Prices advanced 3.4%, and core prices advanced 3.6% in April compared to a year ago, and 0.3% month over month.

上周,周三的4月份消费者价格指数数据符合预期。与去年同期相比,4月份价格上涨了3.4%,核心价格上涨了3.6%,同比上涨了0.3%。

The $U.S. 2-Year Treasury Notes Yield (US2Y.BD)$ was 4.93, and the $U.S. 10-Year Treasury Notes Yield (US10Y.BD)$ 4.47.

这个 $美国2年期国债收益率 (US2Y.BD)$ 是 4.93,而且 $美国10年期国债收益率 (US10Y.BD)$ 4.47。

Mooers, what are you watching today? Comment below and I may feature your comment tomorrow!

摩尔们,你今天在看什么?请在下面发表评论,我明天可能会发表您的评论!

Disclaimer: This presentation is for informational and educational use only and is not a recommendation or endorsement of any particular investment or investment strategy. Indexes are unmanaged and cannot be directly invested in. Past performance is no indication of future results. Investing involves risk and the potential to lose principal. Investment information provided in this content is general in nature, strictly for illustrative purposes, and may not be appropriate for all investors. It is provided without respect to individual investors’ financial sophistication, financial situation, investment objectives, investing time horizon, or risk tolerance. You should consider the appropriateness of this information regarding your relevant personal circumstances before making any investment decisions. Past investment performance does not indicate or guarantee future success. Returns will vary, and all investments carry risks, including loss of principal. Moomoo makes no representation or warranty regarding its adequacy, completeness, accuracy, or timeliness for any purpose of the above content. See thislinkfor more information.

免责声明:本演示文稿仅供参考和教育之用,不是对任何特定投资或投资策略的推荐或认可。指数不受管理,不能直接投资。过去的表现并不代表未来的业绩。投资涉及风险和损失本金的可能性。本内容中提供的投资信息本质上是一般性的,仅用于说明目的,可能不适合所有投资者。其提供时不考虑个人投资者的财务复杂程度、财务状况、投资目标、投资时间范围或风险承受能力。在做出任何投资决定之前,您应考虑这些信息与您的相关个人情况相关的适当性。过去的投资表现并不表明或保证未来的成功。回报会有所不同,所有投资都有风险,包括本金损失。对于上述内容的任何目的,Moomoo 对其充分性、完整性、准确性或及时性不作任何陈述或保证。看看这个链接了解更多信息。