A Closer Look at Upstart Hldgs's Options Market Dynamics

A Closer Look at Upstart Hldgs's Options Market Dynamics

Investors with significant funds have taken a bullish position in Upstart Hldgs (NASDAQ:UPST), a development that retail traders should be aware of.

拥有大量资金的投资者对Upstart Hldgs(纳斯达克股票代码:UPST)持看涨立场,零售交易者应该注意这一事态发展。

This was brought to our attention today through our monitoring of publicly accessible options data at Benzinga. The exact nature of these investors remains a mystery, but such a major move in UPST usually indicates foreknowledge of upcoming events.

今天,通过对本辛加可公开访问的期权数据的监控,这引起了我们的注意。这些投资者的确切性质仍然是个谜,但是UPST的如此重大举动通常表明对即将发生的事件的预感。

Today, Benzinga's options scanner identified 8 options transactions for Upstart Hldgs. This is an unusual occurrence. The sentiment among these large-scale traders is mixed, with 75% being bullish and 12% bearish. Of all the options we discovered, 7 are puts, valued at $903,590, and there was a single call, worth $27,302.

今天,Benzinga的期权扫描仪发现了Upstart Hldgs的8笔期权交易。这是一种不寻常的事件。这些大型交易者的情绪喜忧参半,75%看涨,12%看跌。在我们发现的所有期权中,有7个是看跌期权,价值903,590美元,还有一个看涨期权,价值27,302美元。

Expected Price Movements

预期的价格走势

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $22.5 to $35.0 for Upstart Hldgs over the last 3 months.

考虑到这些合约的交易量和未平仓合约,在过去的3个月中,鲸鱼似乎一直将Upstart Hldgs的价格定在22.5美元至35.0美元之间。

Analyzing Volume & Open Interest

分析交易量和未平仓合约

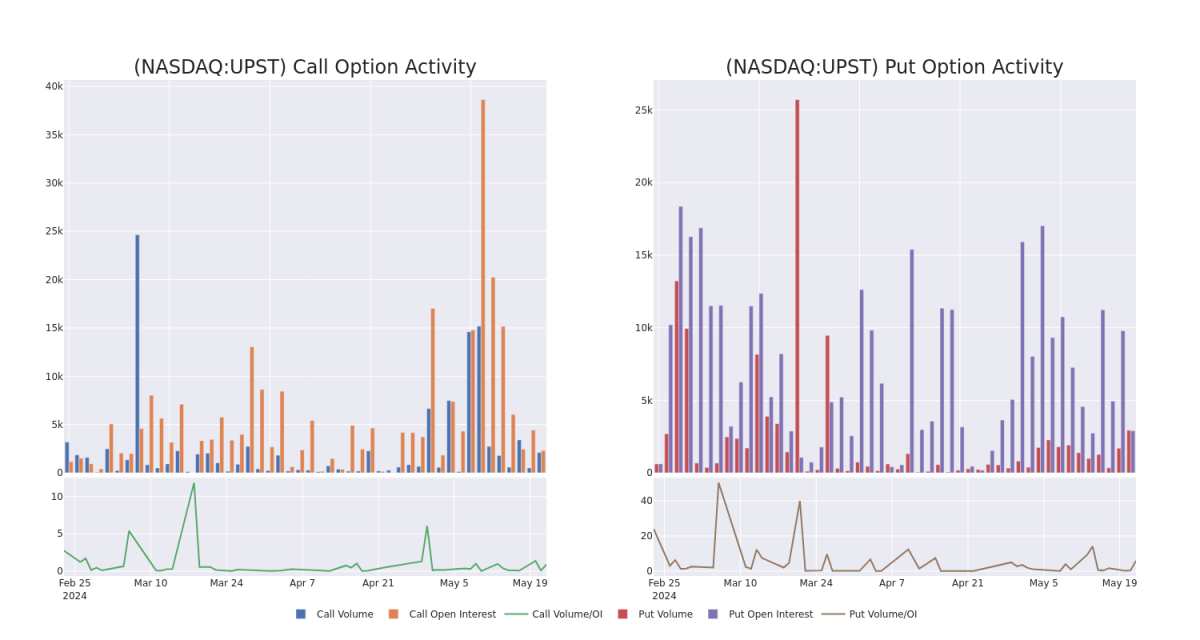

In terms of liquidity and interest, the mean open interest for Upstart Hldgs options trades today is 868.33 with a total volume of 5,027.00.

就流动性和利息而言,今天Upstart Hldgs期权交易的平均未平仓合约为868.33份,总交易量为5,027.00。

In the following chart, we are able to follow the development of volume and open interest of call and put options for Upstart Hldgs's big money trades within a strike price range of $22.5 to $35.0 over the last 30 days.

在下图中,我们可以跟踪过去30天Upstart Hldgs在22.5美元至35.0美元的行使价区间内进行大额资金交易的看涨期权和未平仓合约的变化。

Upstart Hldgs 30-Day Option Volume & Interest Snapshot

Upstart Hldgs 30 天期权交易量和利息快照

Noteworthy Options Activity:

值得注意的期权活动:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| UPST | PUT | TRADE | BULLISH | 09/20/24 | $2.98 | $2.94 | $2.9 | $22.50 | $580.0K | 472 | 2.0K |

| UPST | PUT | SWEEP | BULLISH | 12/20/24 | $7.45 | $7.4 | $7.4 | $27.50 | $99.1K | 1.2K | 134 |

| UPST | PUT | SWEEP | BULLISH | 10/18/24 | $12.0 | $11.75 | $11.8 | $35.00 | $66.0K | 105 | 69 |

| UPST | PUT | SWEEP | NEUTRAL | 12/20/24 | $7.5 | $7.45 | $7.5 | $27.50 | $51.0K | 1.2K | 202 |

| UPST | PUT | TRADE | BULLISH | 05/24/24 | $4.35 | $4.2 | $4.2 | $29.50 | $42.0K | 638 | 150 |

| 符号 | 看跌/看涨 | 交易类型 | 情绪 | Exp。日期 | 问 | 出价 | 价格 | 行使价 | 总交易价格 | 未平仓合约 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 精神失调 | 放 | 贸易 | 看涨 | 09/20/24 | 2.98 美元 | 2.94 美元 | 2.9 美元 | 22.50 | 580.0 万美元 | 472 | 2.0K |

| 精神失调 | 放 | 扫 | 看涨 | 12/20/24 | 7.45 美元 | 7.4 美元 | 7.4 美元 | 27.50 美元 | 99.1K | 1.2K | 134 |

| 精神失调 | 放 | 扫 | 看涨 | 10/18/24 | 12.0 美元 | 11.75 美元 | 11.8 美元 | 35.00 美元 | 66.0 万美元 | 105 | 69 |

| 精神失调 | 放 | 扫 | 中立 | 12/20/24 | 7.5 美元 | 7.45 美元 | 7.5 美元 | 27.50 美元 | 51.0 万美元 | 1.2K | 202 |

| 精神失调 | 放 | 贸易 | 看涨 | 05/24/24 | 4.35 美元 | 4.2 美元 | 4.2 美元 | 29.50 美元 | 42.0 万美元 | 638 | 150 |

About Upstart Hldgs

关于 Upstart Hldgs

Upstart Holdings Inc provides credit services. The company provides a proprietary, cloud-based, artificial intelligence lending platform. The platform aggregates consumer demand for loans and connects it to the network of Upstart AI-enabled bank partners. Upstart's platform includes personal loans, automotive retail and refinance loans, home equity lines of credit and small dollar loans.

Upstart Holdings Inc提供信贷服务。该公司提供专有的、基于云的人工智能贷款平台。该平台汇总了消费者的贷款需求,并将其连接到支持Upstart AI的银行合作伙伴网络。Upstart的平台包括个人贷款、汽车零售和再融资贷款、房屋净值信贷额度和小额贷款。

In light of the recent options history for Upstart Hldgs, it's now appropriate to focus on the company itself. We aim to explore its current performance.

鉴于Upstart Hldgs最近的期权历史,现在应该将重点放在公司本身上。我们的目标是探索其目前的表现。

Upstart Hldgs's Current Market Status

Upstart Hldgs的当前市场状况

- With a trading volume of 1,977,035, the price of UPST is down by -0.4%, reaching $24.6.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 76 days from now.

- UPST的交易量为1,977,035美元,下跌了-0.4%,至24.6美元。

- 当前的RSI值表明该股可能已接近超买。

- 下一份收益报告定于76天后发布。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

与仅交易股票相比,期权是一种风险更高的资产,但它们具有更高的获利潜力。严肃的期权交易者通过每天自我教育、扩大交易规模、关注多个指标以及密切关注市场来管理这种风险。