一季度,交易服务收入暴增327%至443.6亿美元,赶超在线营销板块成为拼多多最大的收入来源。

时隔三个月,拼多多再次拿出了一份亮眼的季度业绩:一季度营收增长131%,净利润同比暴增202%,交易服务收入暴增327%至443.6亿美元,赶超在线营销业务成为拼多多最大的收入来源。

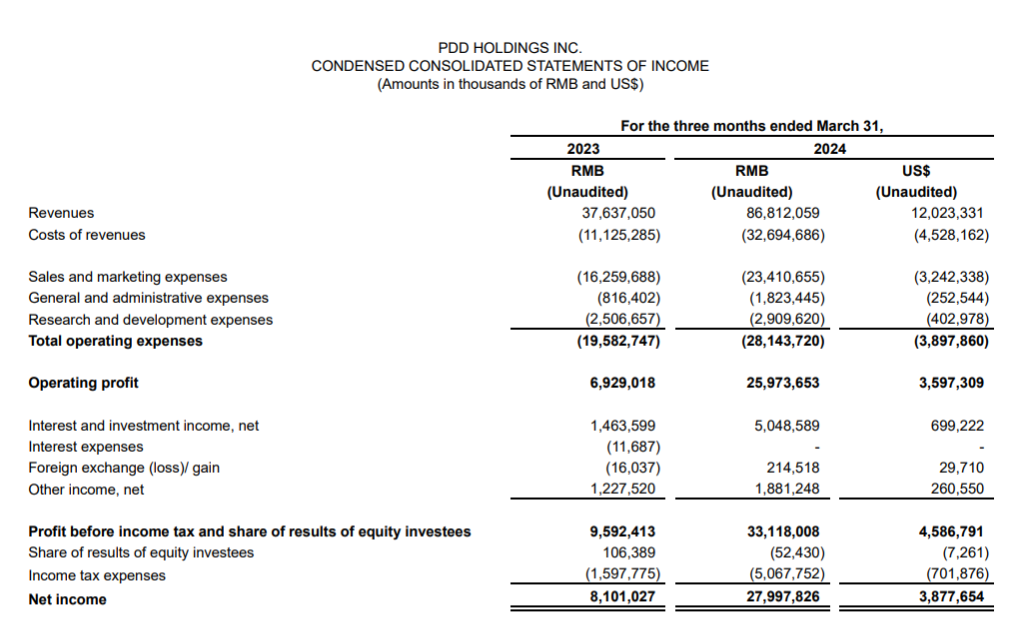

5月22日周三,拼多多公布2024年第一季度财报。结果显示,拼多多一季度营收同比增长131%至868.1亿元人民币,超过市场预期的768.6亿元;经营利润同比增长275%至259.7亿元,归属于普通股股东的净利润为280.0亿元同比增长246%;非GAAP调整后净利润同比增长202%至306.0亿元人民币,大幅超过预期的155.3亿元人民币。

拼多多一季度稀释后每ADS收益为18.96元,2023年同期为5.55元,增幅在两倍左右,非GAAP稀释每ADS收益为20.72元,而2023年同期为6.92元。此外,拼多多一季度经营活动产生的净现金为210.7亿元,而2023年同期为13.4亿元,主要是由于净利润的增加。

财报公布后,拼多多美股盘前股价跌幅扩大至8%,但随后迅速收复失地,现涨6.1%。

“在第一季度,我们持续投资于高质量发展战略的关键领域,”拼多多控股财务副总裁刘珺表示,“我们更加重视创造长期价值,而非专注于短期业绩,并将继续致力于加大对未来的投资力度。”

交易服务成为营收支柱

拼多多方面称,收入增长主要是受益于在线营销服务和交易服务收入的增加。其中,交易服务收入暴增327%至443.6亿美元,赶超在线营销业务成为拼多多最大的收入来源。一季度:

在线营销服务及其他收入为424.6亿元,同比增长56%。

交易服务收入为443.6亿元,同比增长327%。

成本增长两倍

随着营收大幅增长,拼多多一季度总成本同比增长194%至326.9亿元。

拼多多方面称,成本增长主要来自履约费用、支付处理费用、维护成本和呼叫中心费用的增加。具体来看,一季度:

总运营费用为281.4亿元,同比增长44%,主要是因为销售和营销费用增加;

销售和营销费用为人民币234.1亿元,同比增长44%,主要是因为促销和广告活动支出增加;

一般及行政费用为人民币18.2亿元,同比增长123%,主要是因为员工相关成本增加;

研发支出29.1亿元人民币,预估33.1亿元人民币,2023年同期为25.1亿元。