Intuit Unusual Options Activity For May 16

Intuit Unusual Options Activity For May 16

Deep-pocketed investors have adopted a bearish approach towards Intuit (NASDAQ:INTU), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in INTU usually suggests something big is about to happen.

财力雄厚的投资者对Intuit(纳斯达克股票代码:INTU)采取了看跌的态度,这是市场参与者不容忽视的。我们对本辛加公开期权记录的追踪今天揭示了这一重大举措。这些投资者的身份仍然未知,但是INTU的如此实质性的举动通常表明大事即将发生。

We gleaned this information from our observations today when Benzinga's options scanner highlighted 8 extraordinary options activities for Intuit. This level of activity is out of the ordinary.

我们今天从观察中收集了这些信息,当时Benzinga的期权扫描仪重点介绍了Intuit的8项非同寻常的期权活动。这种活动水平与众不同。

The general mood among these heavyweight investors is divided, with 12% leaning bullish and 75% bearish. Among these notable options, 2 are puts, totaling $56,030, and 6 are calls, amounting to $291,835.

这些重量级投资者的总体情绪存在分歧,12%的人倾向于看涨,75%的人看跌。在这些值得注意的期权中,有两个是看跌期权,总额为56,030美元,6个是看涨期权,总额为291,835美元。

Expected Price Movements

预期的价格走势

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $470.0 to $800.0 for Intuit over the recent three months.

根据交易活动,看来主要投资者的目标是在最近三个月中将Intuit的价格范围从470.0美元扩大到800.0美元。

Volume & Open Interest Trends

交易量和未平仓合约趋势

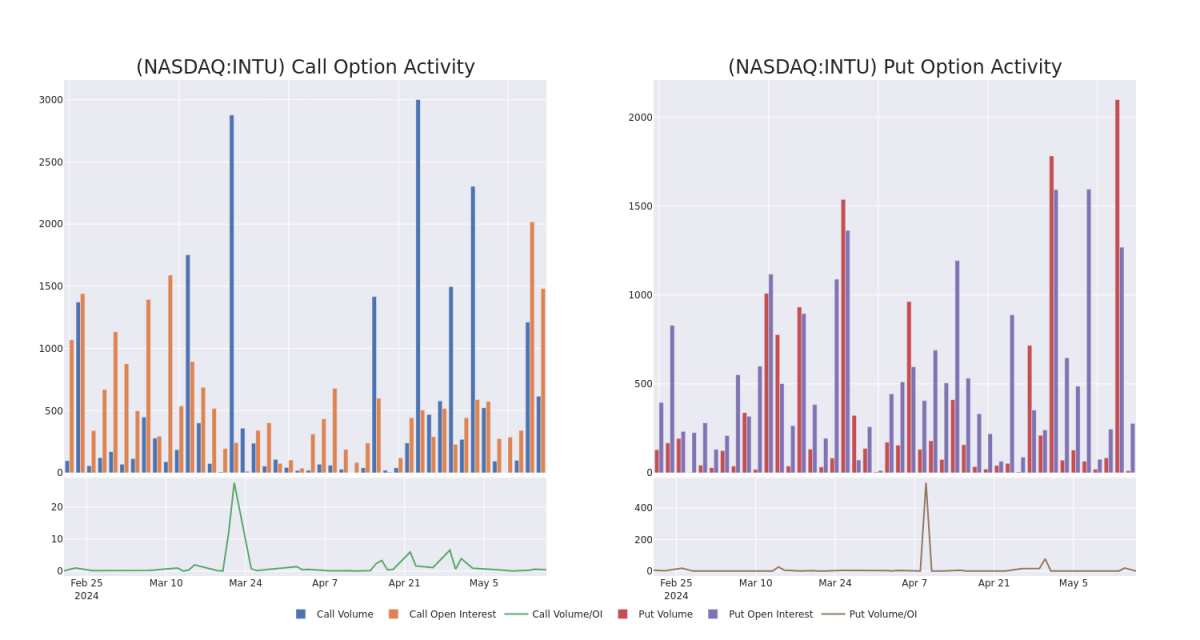

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Intuit's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Intuit's substantial trades, within a strike price spectrum from $470.0 to $800.0 over the preceding 30 days.

评估交易量和未平仓合约是期权交易的战略步骤。这些指标揭示了特定行使价下Intuit期权的流动性和投资者对Intuit期权的兴趣。即将发布的数据可视化了与Intuit的大量交易相关的看涨期权和看跌期权的交易量和未平仓合约的波动,在过去30天内,行使价范围从470.0美元到800.0美元不等。

Intuit Call and Put Volume: 30-Day Overview

Intuit 看涨和看跌交易量:30 天概述

Biggest Options Spotted:

发现的最大选择:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| INTU | CALL | SWEEP | BEARISH | 06/21/24 | $10.3 | $9.9 | $9.65 | $700.00 | $56.1K | 445 | 274 |

| INTU | CALL | TRADE | BEARISH | 06/21/24 | $23.6 | $23.3 | $23.3 | $660.00 | $55.9K | 348 | 25 |

| INTU | CALL | TRADE | BEARISH | 12/20/24 | $67.9 | $66.5 | $66.5 | $660.00 | $53.2K | 76 | 8 |

| INTU | CALL | SWEEP | BEARISH | 12/19/25 | $66.0 | $64.1 | $64.1 | $800.00 | $51.2K | 1 | 13 |

| INTU | CALL | SWEEP | NEUTRAL | 05/17/24 | $7.2 | $6.5 | $6.43 | $650.00 | $38.2K | 578 | 294 |

| 符号 | 看跌/看涨 | 交易类型 | 情绪 | Exp。日期 | 问 | 出价 | 价格 | 行使价 | 总交易价格 | 未平仓合约 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| INTU | 打电话 | 扫 | 粗鲁的 | 06/21/24 | 10.3 美元 | 9.9 美元 | 9.65 美元 | 700.00 美元 | 56.1 万美元 | 445 | 274 |

| INTU | 打电话 | 贸易 | 粗鲁的 | 06/21/24 | 23.6 美元 | 23.3 美元 | 23.3 美元 | 660.00 美元 | 55.9 万美元 | 348 | 25 |

| INTU | 打电话 | 贸易 | 粗鲁的 | 12/20/24 | 67.9 美元 | 66.5 美元 | 66.5 美元 | 660.00 美元 | 53.2 万美元 | 76 | 8 |

| INTU | 打电话 | 扫 | 粗鲁的 | 12/19/25 | 66.0 美元 | 64.1 美元 | 64.1 美元 | 800.00 美元 | 51.2 万美元 | 1 | 13 |

| INTU | 打电话 | 扫 | 中立 | 05/17/24 | 7.2 美元 | 6.5 美元 | 6.43 美元 | 650.00 美元 | 38.2 万美元 | 578 | 294 |

About Intuit

关于 Intuit

Intuit is a provider of small-business accounting software (QuickBooks), personal tax solutions (TurboTax), and professional tax offerings (Lacerte). Founded in the mid-1980s, Intuit controls the majority of U.S. market share for small-business accounting and do-it-yourself tax-filing software.

Intuit是小型企业会计软件(QuickBooks)、个人税务解决方案(TurboTax)和专业税收服务(Lacerte)的提供商。Intuit 成立于 20 世纪 80 年代中期,控制着美国小型企业会计和自己动手报税软件的大部分市场份额。

Following our analysis of the options activities associated with Intuit, we pivot to a closer look at the company's own performance.

在分析了与Intuit相关的期权活动之后,我们将转向仔细研究公司自身的表现。

Present Market Standing of Intuit

Intuit 目前的市场地位

- Trading volume stands at 448,202, with INTU's price down by -0.15%, positioned at $654.17.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 7 days.

- 交易量为448,202美元,其中INTU的价格下跌了-0.15%,为654.17美元。

- RSI指标显示该股可能接近超买。

- 预计将在7天后公布财报。

Expert Opinions on Intuit

关于 Intuit 的专家意见

In the last month, 1 experts released ratings on this stock with an average target price of $740.0.

上个月,1位专家发布了该股的评级,平均目标价为740.0美元。

- An analyst from Morgan Stanley has decided to maintain their Overweight rating on Intuit, which currently sits at a price target of $740.

- 摩根士丹利的一位分析师决定维持对Intuit的增持评级,目前的目标股价为740美元。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Intuit with Benzinga Pro for real-time alerts.

交易期权涉及更大的风险,但也提供了获得更高利润的可能性。精明的交易者通过持续的教育、战略交易调整、利用各种指标以及随时关注市场动态来降低这些风险。使用Benzinga Pro了解Intuit的最新期权交易情况,获取实时提醒。