Smart Money Is Betting Big In PBR Options

Smart Money Is Betting Big In PBR Options

Benzinga's options scanner has just identified more than 8 option transactions on Petrobras Brasileiro (NYSE:PBR), with a cumulative value of $722,544. Concurrently, our algorithms picked up 4 puts, worth a total of 573,172.

Benzinga的期权扫描仪刚刚在巴西石油公司(纽约证券交易所代码:PBR)上发现了超过8笔期权交易,累计价值为722,544美元。同时,我们的算法获得了 4 个看跌期权,总价值为 573,172。

What's The Price Target?

目标价格是多少?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $12.0 to $17.0 for Petrobras Brasileiro during the past quarter.

分析这些合约的交易量和未平仓合约,看来大型企业一直在关注巴西石油公司在过去一个季度的价格范围从12.0美元到17.0美元不等。

Volume & Open Interest Trends

交易量和未平仓合约趋势

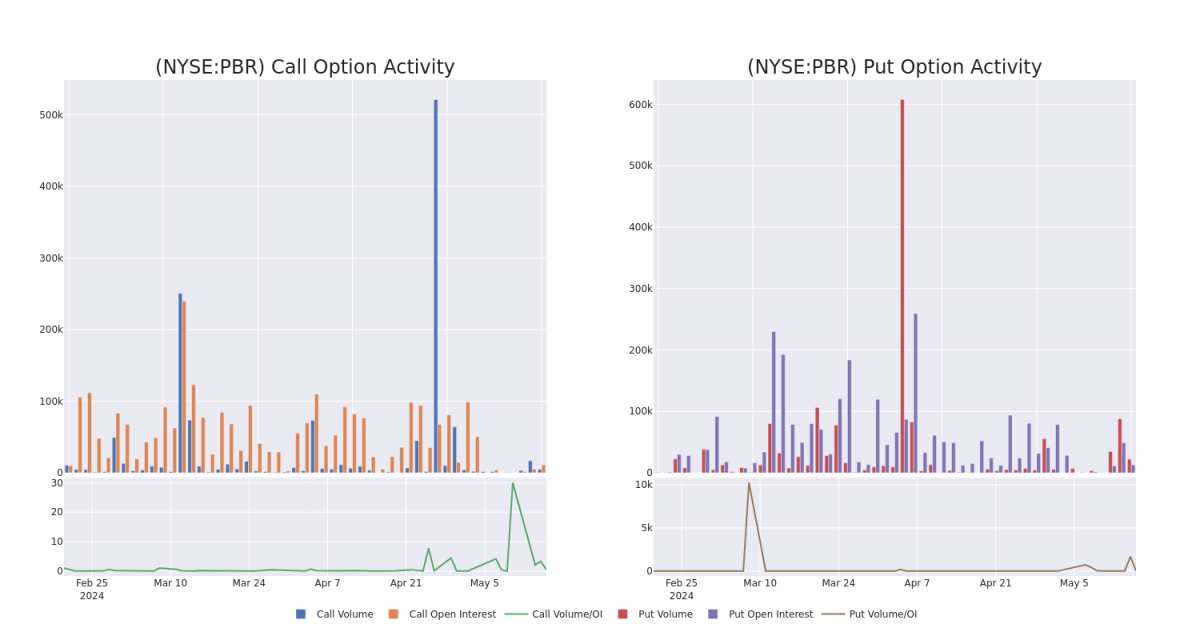

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Petrobras Brasileiro's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Petrobras Brasileiro's significant trades, within a strike price range of $12.0 to $17.0, over the past month.

检查交易量和未平仓合约为股票研究提供了至关重要的见解。这些信息是衡量巴西石油公司在特定行使价下期权的流动性和利息水平的关键。下面,我们将简要介绍过去一个月巴西石油公司重大交易的看涨期权和未平仓合约的趋势,行使价区间为12.0美元至17.0美元。

Petrobras Brasileiro Option Activity Analysis: Last 30 Days

巴西石油公司期权活动分析:过去 30 天

Significant Options Trades Detected:

检测到的重要期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PBR | PUT | TRADE | BULLISH | 07/19/24 | $0.33 | $0.32 | $0.3 | $14.00 | $300.0K | 9.7K | 10.2K |

| PBR | PUT | TRADE | BULLISH | 06/21/24 | $0.2 | $0.19 | $0.17 | $14.00 | $170.0K | 556 | 10.0K |

| PBR | CALL | SWEEP | BULLISH | 01/16/26 | $2.85 | $2.8 | $2.85 | $13.00 | $79.2K | 2.9K | 280 |

| PBR | PUT | TRADE | BULLISH | 06/21/24 | $1.3 | $1.17 | $1.18 | $16.00 | $77.1K | 2.6K | 685 |

| PBR | CALL | TRADE | BEARISH | 07/19/24 | $0.36 | $0.34 | $0.34 | $16.00 | $47.3K | 8.1K | 2.6K |

| 符号 | 看跌/看涨 | 交易类型 | 情绪 | Exp。日期 | 问 | 出价 | 价格 | 行使价 | 总交易价格 | 未平仓合约 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PBR | 放 | 贸易 | 看涨 | 07/19/24 | 0.33 美元 | 0.32 美元 | 0.3 美元 | 14.00 美元 | 300.0 万美元 | 9.7K | 10.2K |

| PBR | 放 | 贸易 | 看涨 | 06/21/24 | 0.2 美元 | 0.19 美元 | 0.17 美元 | 14.00 美元 | 170.0K | 556 | 10.0K |

| PBR | 打电话 | 扫 | 看涨 | 01/16/26 | 2.85 美元 | 2.8 美元 | 2.85 美元 | 13.00 美元 | 79.2 万美元 | 2.9K | 280 |

| PBR | 放 | 贸易 | 看涨 | 06/21/24 | 1.3 美元 | 1.17 | 1.18 | 16.00 美元 | 77.1 万美元 | 2.6K | 685 |

| PBR | 打电话 | 贸易 | 粗鲁的 | 07/19/24 | 0.36 美元 | 0.34 美元 | 0.34 美元 | 16.00 美元 | 47.3 万美元 | 8.1K | 2.6K |

About Petrobras Brasileiro

关于巴西石油公司

Petrobras is a Brazil-based integrated energy company controlled by the Brazilian government. The company focuses on exploration and production of oil and gas in Brazilian offshore fields. Production in 2023 was 2.8 million barrels of oil equivalent a day (80% oil production), and reserves stood at 10.9 billion boe (85% oil). At end-2023, Petrobras operated 10 refineries in Brazil with capacity of 1.8 million barrels a day and distributes refined products and natural gas throughout Brazil.

巴西石油公司是一家总部位于巴西的综合能源公司,由巴西政府控制。该公司专注于在巴西海上油田勘探和生产石油和天然气。2023年的产量为每天280万桶石油当量(80%的石油产量),储量为109亿桶桶石油当量(85%的石油)。2023年底,巴西石油公司在巴西运营10家炼油厂,日产能为180万桶,并在巴西各地分销成品油和天然气。

After a thorough review of the options trading surrounding Petrobras Brasileiro, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

在对围绕巴西石油公司的期权交易进行了全面审查之后,我们将对该公司进行更详细的审查。这包括评估其当前的市场状况和表现。

Present Market Standing of Petrobras Brasileiro

巴西石油公司目前的市场地位

- Trading volume stands at 15,697,327, with PBR's price down by -0.06%, positioned at $15.55.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 77 days.

- 交易量为15,697,327美元,PBR的价格下跌了-0.06%,为15.55美元。

- RSI指标显示,该股目前在超买和超卖之间处于中立状态。

- 预计将在77天后公布财报。

Expert Opinions on Petrobras Brasileiro

关于巴西石油公司的专家意见

In the last month, 1 experts released ratings on this stock with an average target price of $17.7.

上个月,1位专家发布了该股的评级,平均目标价为17.7美元。

- In a cautious move, an analyst from Jefferies downgraded its rating to Hold, setting a price target of $17.

- 杰富瑞集团的一位分析师谨慎地将其评级下调至持有,将目标股价定为17美元。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Petrobras Brasileiro with Benzinga Pro for real-time alerts.

交易期权涉及更大的风险,但也提供了更高利润的潜力。精明的交易者通过持续的教育、战略贸易调整、利用各种指标以及随时关注市场动态来降低这些风险。使用Benzinga Pro获取实时提醒,随时了解巴西石油公司的最新期权交易。