This Is What Whales Are Betting On Coca-Cola

This Is What Whales Are Betting On Coca-Cola

Benzinga's options scanner has just identified more than 8 option transactions on Coca-Cola (NYSE:KO), with a cumulative value of $1,125,070. Concurrently, our algorithms picked up 2 puts, worth a total of 143,011.

Benzinga的期权扫描仪刚刚在可口可乐(纽约证券交易所代码:KO)上发现了超过8笔期权交易,累计价值为1,125,070美元。同时,我们的算法获得了 2 个看跌期权,总价值为 143,011。

What's The Price Target?

目标价格是多少?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $62.5 to $70.0 for Coca-Cola during the past quarter.

分析这些合约的交易量和未平仓合约,大型企业似乎一直在关注可口可乐在过去一个季度的价格范围从62.5美元到70.0美元不等。

Volume & Open Interest Trends

交易量和未平仓合约趋势

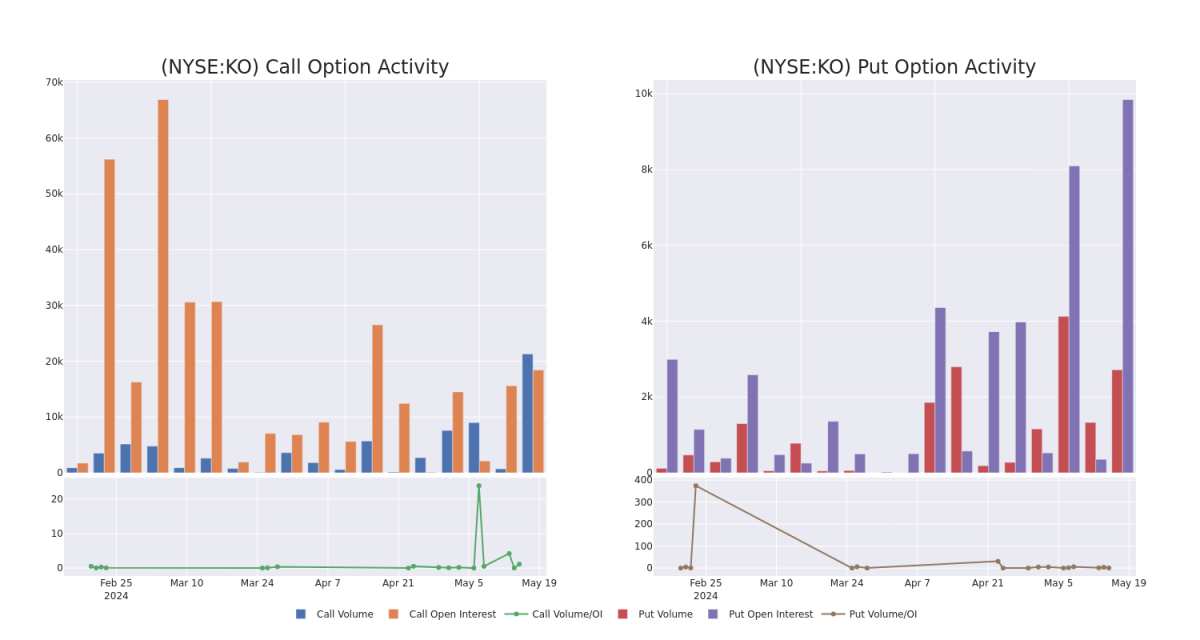

In today's trading context, the average open interest for options of Coca-Cola stands at 7064.75, with a total volume reaching 24,022.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Coca-Cola, situated within the strike price corridor from $62.5 to $70.0, throughout the last 30 days.

在今天的交易背景下,可口可乐期权的平均未平仓合约为7064.75,总交易量达到24,022.00。随附的图表描绘了过去30天中可口可乐高价值交易的看涨和看跌期权交易量以及未平仓合约的变化,行使价走势从62.5美元到70.0美元不等。

Coca-Cola Option Volume And Open Interest Over Last 30 Days

过去30天的可口可乐期权交易量和未平仓合约

Significant Options Trades Detected:

检测到的重要期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| KO | CALL | TRADE | BULLISH | 06/20/25 | $1.67 | $1.62 | $1.66 | $70.00 | $531.2K | 12.7K | 4.8K |

| KO | CALL | TRADE | BULLISH | 06/20/25 | $1.69 | $1.62 | $1.68 | $70.00 | $210.0K | 12.7K | 1.2K |

| KO | CALL | TRADE | BULLISH | 06/20/25 | $1.71 | $1.58 | $1.72 | $70.00 | $163.4K | 12.7K | 4.8K |

| KO | PUT | SWEEP | BEARISH | 06/21/24 | $0.62 | $0.6 | $0.62 | $62.50 | $104.8K | 7.5K | 2.1K |

| KO | CALL | TRADE | BULLISH | 06/20/25 | $1.72 | $1.58 | $1.72 | $70.00 | $68.8K | 12.7K | 5.2K |

| 符号 | 看跌/看涨 | 交易类型 | 情绪 | Exp。日期 | 问 | 出价 | 价格 | 行使价 | 总交易价格 | 未平仓合约 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| KO | 打电话 | 贸易 | 看涨 | 06/20/25 | 1.67 美元 | 1.62 | 1.66 美元 | 70.00 美元 | 531.2 万美元 | 12.7K | 4.8K |

| KO | 打电话 | 贸易 | 看涨 | 06/20/25 | 1.69 美元 | 1.62 | 1.68 美元 | 70.00 美元 | 210.0 万美元 | 12.7K | 1.2K |

| KO | 打电话 | 贸易 | 看涨 | 06/20/25 | 1.71 美元 | 1.58 美元 | 1.72 美元 | 70.00 美元 | 163.4 万美元 | 12.7K | 4.8K |

| KO | 放 | 扫 | 粗鲁的 | 06/21/24 | 0.62 美元 | 0.6 美元 | 0.62 美元 | 62.50 美元 | 104.8 万美元 | 7.5K | 2.1K |

| KO | 打电话 | 贸易 | 看涨 | 06/20/25 | 1.72 美元 | 1.58 美元 | 1.72 美元 | 70.00 美元 | 68.8 万美元 | 12.7K | 5.2K |

About Coca-Cola

关于可口可乐

Founded in 1886, Atlanta-headquartered Coca-Cola is the world's largest nonalcoholic beverage company, with a strong portfolio of 200 brands covering key categories including carbonated soft drinks, water, sports, energy, juice, and coffee. Together with bottlers and distribution partners, the company sells finished beverage products bearing Coca-Cola and licensed brands through retailers and food-service locations in more than 200 countries and regions globally. Coca-Cola generates around two thirds of its total revenues overseas, with a significant portion from emerging economies in Latin America and Asia-Pacific.

总部位于亚特兰大的可口可乐成立于1886年,是全球最大的无酒精饮料公司,拥有由200个品牌组成的强大产品组合,涵盖碳酸软饮料、水、运动、能量、果汁和咖啡等关键类别。该公司与装瓶商和分销合作伙伴一起,通过全球200多个国家和地区的零售商和餐饮服务网点销售含有可口可乐和特许品牌的成品饮料产品。可口可乐总收入的三分之二左右来自海外,其中很大一部分来自拉丁美洲和亚太地区的新兴经济体。

Having examined the options trading patterns of Coca-Cola, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

在研究了可口可乐的期权交易模式之后,我们的注意力现在直接转向了该公司。这种转变使我们能够深入研究其目前的市场地位和表现

Where Is Coca-Cola Standing Right Now?

可口可乐现在处于什么位置?

- Trading volume stands at 4,920,220, with KO's price up by 0.11%, positioned at $63.17.

- RSI indicators show the stock to be may be overbought.

- Earnings announcement expected in 70 days.

- 交易量为4,920,220美元,KO的价格上涨了0.11%,为63.17美元。

- RSI指标显示该股可能已超买。

- 预计将在70天后公布财报。

Expert Opinions on Coca-Cola

关于可口可乐的专家意见

5 market experts have recently issued ratings for this stock, with a consensus target price of $68.8.

5位市场专家最近发布了该股的评级,共识目标价为68.8美元。

- An analyst from JP Morgan persists with their Overweight rating on Coca-Cola, maintaining a target price of $68.

- Consistent in their evaluation, an analyst from Evercore ISI Group keeps a Outperform rating on Coca-Cola with a target price of $70.

- An analyst from JP Morgan persists with their Overweight rating on Coca-Cola, maintaining a target price of $65.

- Maintaining their stance, an analyst from UBS continues to hold a Buy rating for Coca-Cola, targeting a price of $72.

- Consistent in their evaluation, an analyst from Barclays keeps a Overweight rating on Coca-Cola with a target price of $69.

- 摩根大通的一位分析师坚持对可口可乐的增持评级,维持68美元的目标价。

- Evercore ISI集团的一位分析师在评估中保持了对可口可乐跑赢大盘的评级,目标价为70美元。

- 摩根大通的一位分析师坚持对可口可乐的增持评级,维持65美元的目标价。

- 瑞银的一位分析师保持立场,继续维持可口可乐的买入评级,目标价格为72美元。

- 巴克莱银行的一位分析师在评估中保持了对可口可乐的增持评级,目标价为69美元。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Coca-Cola with Benzinga Pro for real-time alerts.

交易期权涉及更大的风险,但也提供了更高利润的潜力。精明的交易者通过持续的教育、战略贸易调整、利用各种指标以及随时关注市场动态来降低这些风险。使用Benzinga Pro了解可口可乐的最新期权交易,以获取实时警报。