Unpacking the Latest Options Trading Trends in Celsius Holdings

Unpacking the Latest Options Trading Trends in Celsius Holdings

Financial giants have made a conspicuous bullish move on Celsius Holdings. Our analysis of options history for Celsius Holdings (NASDAQ:CELH) revealed 15 unusual trades.

金融巨头对Celsius Holdings采取了明显的看涨举动。我们对Celsius Holdings(纳斯达克股票代码:CELH)的期权历史分析显示了15笔不寻常的交易。

Delving into the details, we found 40% of traders were bullish, while 40% showed bearish tendencies. Out of all the trades we spotted, 3 were puts, with a value of $168,026, and 12 were calls, valued at $552,956.

深入研究细节,我们发现40%的交易者看涨,而40%的交易者表现出看跌的趋势。在我们发现的所有交易中,有3笔是看跌期权,价值为168,026美元,12笔是看涨期权,价值为552,956美元。

Predicted Price Range

预测的价格区间

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $60.0 to $105.0 for Celsius Holdings over the last 3 months.

考虑到这些合约的交易量和未平仓合约,在过去的3个月中,鲸鱼似乎一直将Celsius Holdings的价格定在60.0美元至105.0美元之间。

Analyzing Volume & Open Interest

分析交易量和未平仓合约

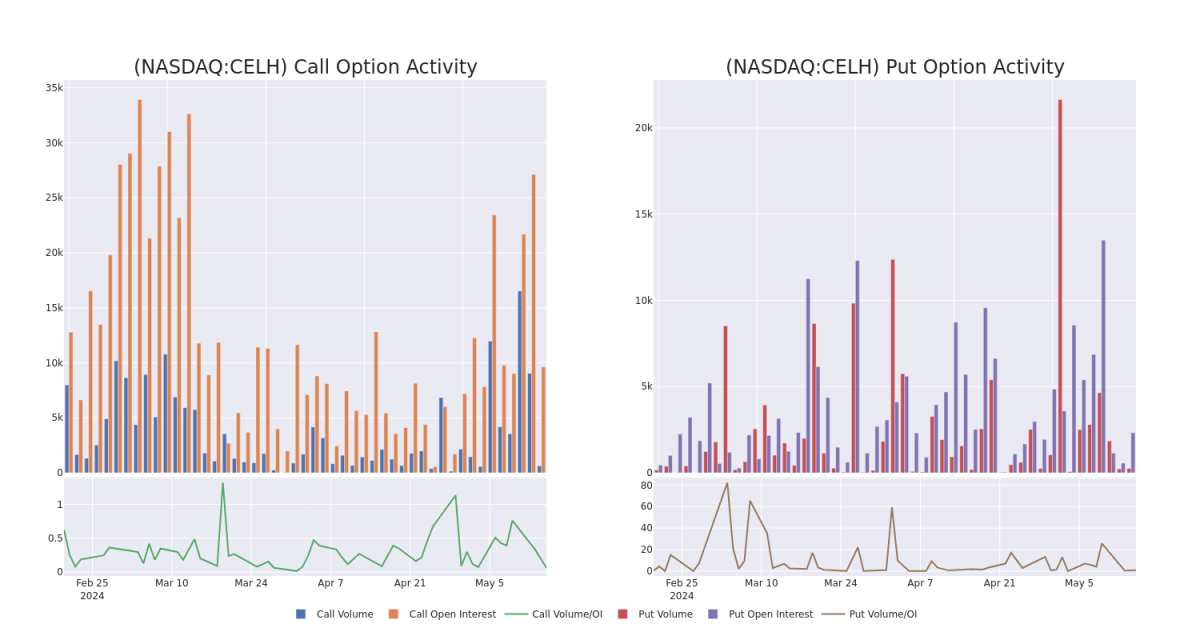

In terms of liquidity and interest, the mean open interest for Celsius Holdings options trades today is 919.46 with a total volume of 883.00.

就流动性和利息而言,今天Celsius Holdings期权交易的平均未平仓合约为919.46,总交易量为883.00。

In the following chart, we are able to follow the development of volume and open interest of call and put options for Celsius Holdings's big money trades within a strike price range of $60.0 to $105.0 over the last 30 days.

在下图中,我们可以跟踪过去30天在60.0美元至105.0美元行使价区间内的Celsius Holdings大额资金交易的看涨和看跌期权交易量和未平仓合约的变化。

Celsius Holdings Option Activity Analysis: Last 30 Days

Celsius Holdings 期权活动分析:过去 30 天

Significant Options Trades Detected:

检测到的重要期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CELH | PUT | SWEEP | BULLISH | 01/17/25 | $17.7 | $17.65 | $17.65 | $96.67 | $88.2K | 111 | 50 |

| CELH | CALL | TRADE | BULLISH | 07/19/24 | $13.6 | $13.45 | $13.55 | $85.00 | $67.7K | 2.3K | 88 |

| CELH | CALL | SWEEP | BEARISH | 07/19/24 | $13.6 | $13.4 | $13.46 | $85.00 | $67.3K | 2.3K | 140 |

| CELH | CALL | TRADE | BULLISH | 01/16/26 | $40.5 | $40.25 | $40.5 | $70.00 | $56.7K | 569 | 24 |

| CELH | PUT | SWEEP | BEARISH | 06/21/24 | $3.85 | $3.75 | $3.84 | $90.00 | $53.7K | 399 | 176 |

| 符号 | 看跌/看涨 | 交易类型 | 情绪 | Exp。日期 | 问 | 出价 | 价格 | 行使价 | 总交易价格 | 未平仓合约 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CELH | 放 | 扫 | 看涨 | 01/17/25 | 17.7 美元 | 17.65 美元 | 17.65 美元 | 96.67 美元 | 88.2 万美元 | 111 | 50 |

| CELH | 打电话 | 贸易 | 看涨 | 07/19/24 | 13.6 美元 | 13.45 美元 | 13.55 美元 | 85.00 美元 | 67.7 万美元 | 2.3K | 88 |

| CELH | 打电话 | 扫 | 粗鲁的 | 07/19/24 | 13.6 美元 | 13.4 美元 | 13.46 美元 | 85.00 美元 | 67.3 万美元 | 2.3K | 140 |

| CELH | 打电话 | 贸易 | 看涨 | 01/16/26 | 40.5 美元 | 40.25 美元 | 40.5 美元 | 70.00 美元 | 56.7 万美元 | 569 | 24 |

| CELH | 放 | 扫 | 粗鲁的 | 06/21/24 | 3.85 美元 | 3.75 美元 | 3.84 美元 | 90.00 美元 | 53.7 万美元 | 399 | 176 |

About Celsius Holdings

关于 Celsius Holdings

Celsius Holdings plays in the energy drink subsegment of the global nonalcoholic beverage market, with 96% of revenue concentrated in North America. Celsius' products contain natural ingredients and a metabolism-enhancing formulation, appealing to fitness and active lifestyle enthusiasts. The firm's portfolio includes its namesake Celsius Originals beverages (including those that are naturally caffeinated with stevia), Celsius Essentials line (containing aminos), and Celsius On-the-Go powder packets. Celsius focuses its time on branding and innovation, while it utilizes third parties for the manufacturing, packaging, and distribution of its products. In 2022, Celsius forged a 20-year distribution agreement with PepsiCo, which holds an 8.5% stake in the business.

Celsius Holdings涉足全球非酒精饮料市场的能量饮料细分市场,96%的收入集中在北美。Celsius 的产品含有天然成分和增强新陈代谢的配方,吸引了健身和积极生活方式爱好者。该公司的产品组合包括与Celsius Originals同名的饮料(包括含有甜叶菊的天然咖啡因饮料)、Celsius Essentials系列(含有氨基酸)和随身携带的摄氏粉包。Celsius将时间集中在品牌和创新上,同时利用第三方进行产品的制造、包装和分销。2022年,摄氏与百事可乐签订了为期20年的分销协议,百事可乐持有该业务8.5%的股份。

Having examined the options trading patterns of Celsius Holdings, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

在研究了Celsius Holdings的期权交易模式之后,我们现在的注意力直接转向了该公司。这种转变使我们能够深入研究其目前的市场地位和表现

Celsius Holdings's Current Market Status

摄氏控股的当前市场状况

- Currently trading with a volume of 2,263,701, the CELH's price is up by 2.07%, now at $93.44.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 83 days.

- CELH目前的交易量为2,263,701美元,价格上涨了2.07%,目前为93.44美元。

- RSI读数表明该股目前可能处于超买状态。

- 预计财报将在83天后发布。

Professional Analyst Ratings for Celsius Holdings

Celsius Holdings的专业分析师评级

A total of 4 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $90.5.

在过去的30天中,共有4位专业分析师对该股发表了看法,将平均目标股价定为90.5美元。

- An analyst from Stifel persists with their Buy rating on Celsius Holdings, maintaining a target price of $85.

- An analyst from Wedbush has decided to maintain their Outperform rating on Celsius Holdings, which currently sits at a price target of $85.

- Reflecting concerns, an analyst from Wedbush lowers its rating to Outperform with a new price target of $100.

- Consistent in their evaluation, an analyst from UBS keeps a Buy rating on Celsius Holdings with a target price of $92.

- Stifel的一位分析师坚持对Celsius Holdings的买入评级,将目标价维持在85美元。

- Wedbush的一位分析师已决定维持对Celsius Holdings的跑赢大盘评级,该评级目前的目标股价为85美元。

- 出于担忧,Wedbush的一位分析师将其评级下调至跑赢大盘,新的目标股价为100美元。

- 瑞银的一位分析师在评估中保持对Celsius Holdings的买入评级,目标价为92美元。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Celsius Holdings options trades with real-time alerts from Benzinga Pro.

期权交易具有更高的风险和潜在的回报。精明的交易者通过不断自我教育、调整策略、监控多个指标以及密切关注市场走势来管理这些风险。借助Benzinga Pro的实时提醒,随时了解最新的Celsius Holdings期权交易。