Spotlight on Altria Group: Analyzing the Surge in Options Activity

Spotlight on Altria Group: Analyzing the Surge in Options Activity

Whales with a lot of money to spend have taken a noticeably bullish stance on Altria Group.

有大量资金可以花的鲸鱼对奥驰亚集团采取了明显的看涨立场。

Looking at options history for Altria Group (NYSE:MO) we detected 9 trades.

查看奥驰亚集团(纽约证券交易所代码:MO)的期权历史记录,我们发现了9笔交易。

If we consider the specifics of each trade, it is accurate to state that 55% of the investors opened trades with bullish expectations and 44% with bearish.

如果我们考虑每笔交易的具体情况,可以准确地说,55%的投资者以看涨的预期开仓,44%的投资者以看跌的预期开盘。

From the overall spotted trades, 5 are puts, for a total amount of $243,310 and 4, calls, for a total amount of $931,365.

在已发现的全部交易中,有5笔是看跌期权,总额为243,310美元,4笔看涨期权,总额为931,365美元。

What's The Price Target?

目标价格是多少?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $27.5 to $50.0 for Altria Group during the past quarter.

分析这些合约的交易量和未平仓合约,看来大型企业一直在关注奥驰亚集团在过去一个季度的价格范围从27.5美元到50.0美元不等。

Analyzing Volume & Open Interest

分析交易量和未平仓合约

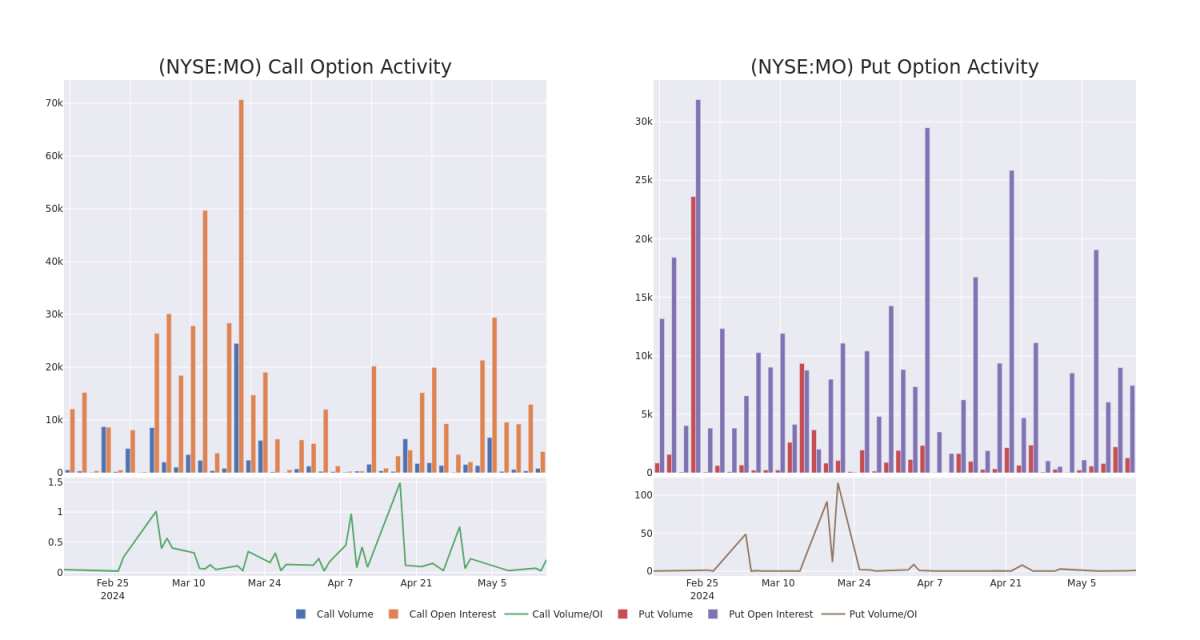

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Altria Group's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Altria Group's significant trades, within a strike price range of $27.5 to $50.0, over the past month.

检查交易量和未平仓合约为股票研究提供了至关重要的见解。这些信息是衡量奥驰亚集团期权在特定行使价下的流动性和利息水平的关键。下面,我们简要介绍了过去一个月奥驰亚集团重大交易的看涨期权和未平仓合约的趋势,行使价区间为27.5美元至50.0美元。

Altria Group 30-Day Option Volume & Interest Snapshot

奥驰亚集团30天期权交易量和利息快照

Largest Options Trades Observed:

观察到的最大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MO | CALL | TRADE | BULLISH | 06/21/24 | $18.4 | $18.35 | $18.4 | $27.50 | $828.0K | 250 | 450 |

| MO | PUT | TRADE | BEARISH | 06/20/25 | $1.25 | $1.16 | $1.22 | $37.50 | $80.5K | 1.2K | 688 |

| MO | PUT | TRADE | BULLISH | 09/20/24 | $1.75 | $1.71 | $1.72 | $45.00 | $68.8K | 2.6K | 410 |

| MO | CALL | TRADE | BULLISH | 06/20/25 | $1.25 | $1.05 | $1.25 | $50.00 | $41.2K | 3.3K | 343 |

| MO | PUT | SWEEP | BEARISH | 01/16/26 | $6.3 | $6.25 | $6.3 | $47.50 | $35.9K | 627 | 57 |

| 符号 | 看跌/看涨 | 交易类型 | 情绪 | Exp。日期 | 问 | 出价 | 价格 | 行使价 | 总交易价格 | 未平仓合约 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MO | 打电话 | 贸易 | 看涨 | 06/21/24 | 18.4 美元 | 18.35 美元 | 18.4 美元 | 27.50 美元 | 828.0 万美元 | 250 | 450 |

| MO | 放 | 贸易 | 粗鲁的 | 06/20/25 | 1.25 美元 | 1.16 美元 | 1.22 | 37.50 | 80.5 万美元 | 1.2K | 688 |

| MO | 放 | 贸易 | 看涨 | 09/20/24 | 1.75 美元 | 1.71 美元 | 1.72 美元 | 45.00 美元 | 68.8 万美元 | 2.6K | 410 |

| MO | 打电话 | 贸易 | 看涨 | 06/20/25 | 1.25 美元 | 1.05 美元 | 1.25 美元 | 50.00 美元 | 41.2 万美元 | 3.3K | 343 |

| MO | 放 | 扫 | 粗鲁的 | 01/16/26 | 6.3 美元 | 6.25 美元 | 6.3 美元 | 47.50 美元 | 35.9 万美元 | 627 | 57 |

About Altria Group

关于奥驰亚集团

Altria comprises Philip Morris USA, us Smokeless Tobacco, John Middleton, Horizon Innovations and Helix Innovations. It holds an 8% interest in the world's largest brewer, Anheuser-Busch InBev. Through its tobacco subsidiaries, Altria holds the leading position in cigarettes and smokeless tobacco in the United States and the number-two spot in machine-made cigars. The company's Marlboro brand is the leading cigarette brand in the us with a 42% annual share in 2022. Altria holds a 42% stake in cannabis manufacturer Cronos, acquired Njoy Holdings in 2023, and recently exited its strategic investment in Juul Labs. It operates a joint venture with Japan Tobacco in the heated tobacco category.

奥驰亚包括美国菲利普·莫里斯、美国无烟烟草公司、约翰·米德尔顿、地平线创新和Helix Innovations。它持有全球最大的啤酒生产商安海斯-布希英博8%的权益。通过其烟草子公司,奥驰亚在美国香烟和无烟烟草领域处于领先地位,在机制雪茄中排名第二。该公司的万宝路品牌是美国领先的卷烟品牌,2022年的年份额为42%。奥驰亚持有大麻制造商克罗诺斯42%的股份,于2023年收购了Njoy Holdings,最近退出了对Juul Labs的战略投资。它与日本烟草公司经营加热烟草类别的合资企业。

Having examined the options trading patterns of Altria Group, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

在研究了奥驰亚集团的期权交易模式之后,我们的注意力现在直接转向了该公司。这种转变使我们能够深入研究其目前的市场地位和表现

Altria Group's Current Market Status

奥驰亚集团的当前市场状况

- With a trading volume of 3,514,892, the price of MO is up by 0.81%, reaching $45.87.

- Current RSI values indicate that the stock is may be overbought.

- Next earnings report is scheduled for 76 days from now.

- MO的交易量为3514,892美元,价格上涨了0.81%,达到45.87美元。

- 当前的RSI值表明该股可能已被超买。

- 下一份收益报告定于76天后发布。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Altria Group options trades with real-time alerts from Benzinga Pro.

期权交易具有更高的风险和潜在的回报。精明的交易者通过不断自我教育、调整策略、监控多个指标以及密切关注市场走势来管理这些风险。借助Benzinga Pro的实时提醒,随时了解奥驰亚集团的最新期权交易。

From the overall spotted trades, 5 are puts, for a total amount of $243,310 and 4, calls, for a total amount of $931,365.

From the overall spotted trades, 5 are puts, for a total amount of $243,310 and 4, calls, for a total amount of $931,365.