Direxion Retail Bull ETF Rallies As GameStop Traders Look For Diversification To Play The Stock's Surge

Direxion Retail Bull ETF Rallies As GameStop Traders Look For Diversification To Play The Stock's Surge

Direxion Daily Retail Bull 3X Shares (NYSE:RETL) was surging about 10% on Monday, partly driven by massive bullish momentum in GameStop Corporation (NYSE:GME) stock –the latter which was skyrocketing about 65% after Keith Gill resurfaced on social media.

周一,Direxion每日零售牛市3X股票(纽约证券交易所代码:RETL)飙升了约10%,部分原因是GameStop公司(纽约证券交易所代码:GME)股票的巨大看涨势头,后者在基思·吉尔在社交媒体上再次露面后飙升了约65%。

Traders and investors may be choosing to take a position in RETL, which holds a 1.2% weighting of GameStop, as well as multiple other retail stocks, to take advantage of GameStop's upward trajectory but with diversification.

交易者和投资者可能会选择持有GameStop权重1.2%的RETL以及其他多只零售股票,以利用GameStop的上升轨迹,但要实现多元化。

RETL is a triple-leveraged fund that is designed to outperform the S&P Retail Select Industry Index 300%. The ETF tracks many stocks popular with retail traders, with Amazon.com, Inc (NASDAQ:AMZN), Target Corp (NYSE:TGT) and Walmart, Inc (NYSE:WMT) making up 3.07% of its holdings.

RETL是一种三杠杆基金,旨在跑赢标普零售精选行业指数300%。该ETF追踪了许多深受零售交易者欢迎的股票,其中亚马逊公司(纳斯达克股票代码:AMZN)、塔吉特公司(纽约证券交易所代码:TGT)和沃尔玛公司(纽约证券交易所代码:WMT)占其持股量的3.07%。

Trending: 'Republicans Smell Blood In The Water:' Uniswap CEO Warns Democrats Of 'Swing States Level Miscalculation' On Crypto

趋势:“共和党人闻到了水中有血的味道:” Uniswap 首席执行官警告民主党人在加密问题上出现 “摇摆州级别的错误估计”

It should be noted that leveraged ETFs are meant to be used as a trading vehicle by experienced traders, as opposed to a long-term investment. Leveraged ETFs should never be used by an investor with a buy-and-hold strategy or those who have low-risk appetites.

值得注意的是,杠杆ETF旨在被经验丰富的交易者用作交易工具,而不是长期投资。杠杆ETF不应由采用买入并持有策略的投资者或具有低风险偏好的投资者使用。

Want direct analysis? Find me in the BZ Pro lounge! Click here for a free trial.

想要直接分析?在 BZ Pro 休息室找我!点击此处免费试用。

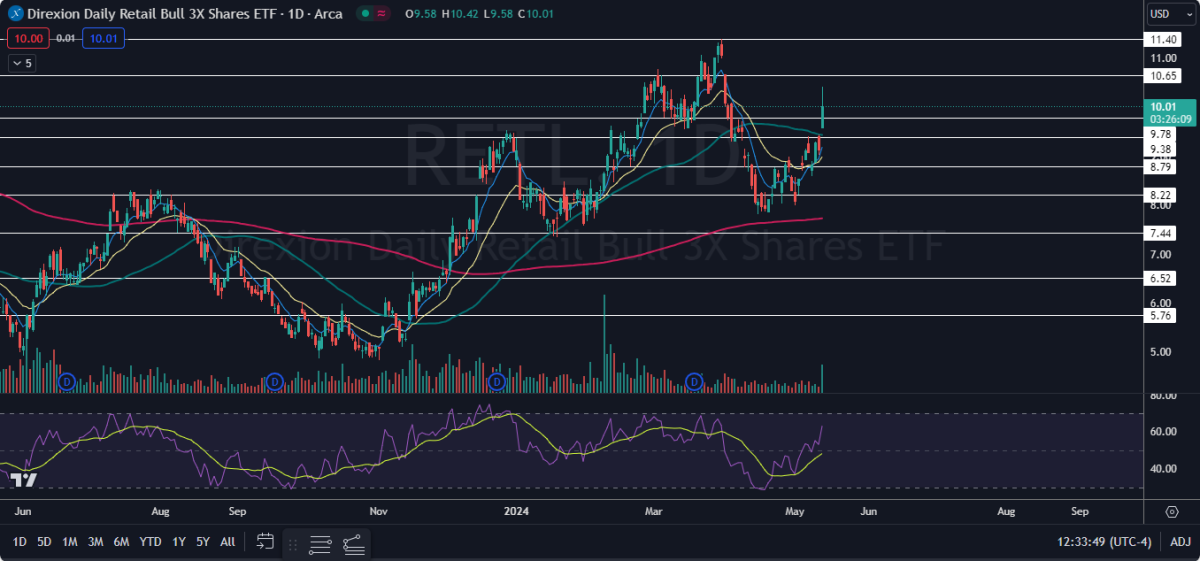

The RETL Chart: RETL gapped up above the 50-day simple moving average on Monday before topping out at $10.42, where the ETF began to pull back slightly. RETL's surge also caused the eight-day exponential moving average (EMA) to move higher above the 21-day EMA, which is bullish.

RETL图表:周一,RETL跳空至50天简单移动平均线上方,然后达到10.42美元,ETF开始小幅回落。RETL的飙升还导致八天指数移动平均线(EMA)上方走高,高于看涨的21天均线。

- The upward movement confirmed the uptrend, which RETL has been trading in since April 16, remains intact. The most recent confirmed higher high within the uptrend was formed on May 7 at $9.40 and the most recent higher low was printed at the $8.59 mark the following day.

- If RETL closes Monday's trading session under the $10 level, the ETF will print a shooting star candlestick, which could indicate the local top has occurred and RETL will fall on Tuesday. If the ETF closes the trading day near its high-of-day, it will print a bullish kicker candlestick, which could indicate higher prices are on the horizon.

- The move higher on Monday was taking place on higher-than-average volume, which indicates a high level of interest in the ETF. If RETL continues to trek north without sideways consolidation, the ETF will enter into overbought territory, which could signal at least a temporary pullback is in the cards.

- RETL has resistance above at $10.65 and at $11.40 and support below at $9.78 and at $9.38.

- 上涨趋势证实了自4月16日以来RETL一直处于交易中的上升趋势保持不变。上升趋势中最近确认的更高高点于5月7日形成,为9.40美元,最近的较高低点于第二天创下8.59美元大关。

- 如果RETL周一的交易时段收盘价低于10美元,则ETF将打印流星烛台,这可能表明本地顶部已经出现,RETL将在周二下跌。如果ETF在交易日收盘时接近当日高点,它将打印出看涨的K线图,这可能表明价格即将上涨。

- 周一的上涨是由于交易量高于平均水平,这表明人们对ETF的兴趣很高。如果RETL在没有横盘整的情况下继续向北行进,则ETF将进入超买区域,这可能表明至少会出现暂时的回调。

- RETL的阻力位在10.65美元和11.40美元上方,支撑位在9.78美元和9.38美元下方。